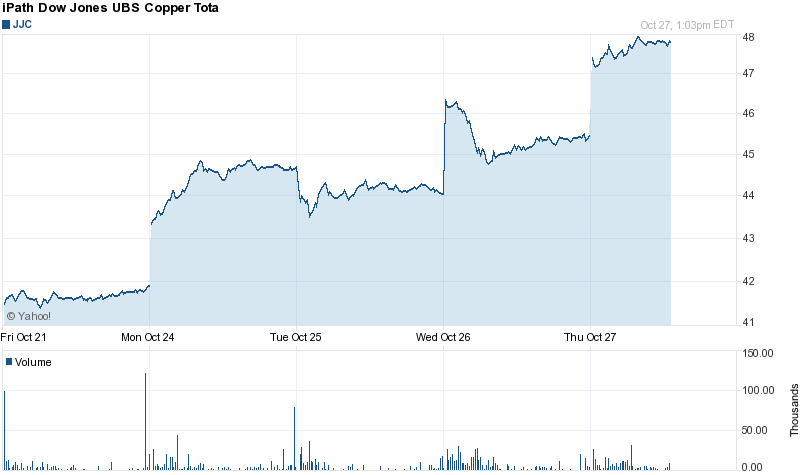

Copper is +15% for the week.

Comments »Today’s 3D Heat Map

The Bulls Have Seasonality on Their Side In November

Today’s Early Winners

No. Ticker % Change

1 VDSI 21.66

2 MSHL 21.37

3 EVC 18.67

4 CTXS 16.99

5 EVR 16.67

6 AKAM 16.32

7 LOGI 16.20

8 PEIX 15.97

9 BDC 15.84

10 PMTC 15.83

11 ATRC 15.80

12 QUIK 15.65

13 NLST 15.60

14 KAI 14.75

15 CEVA 14.51

16 PDC 14.42

17 SWI 14.39

18 HOGS 14.35

19 CVGI 14.12

20 APKT 13.91

21 COG 13.88

22 FRO 13.85

23 IGLD 13.75

24 DB 13.71

25 TBI 13.62

26 CRR 13.56

27 AMP 13.49

28 SVN 13.32

29 EQU 13.21

30 HEV 13.20

31 ING 13.05

32 LOGM 13.02

33 ACAT 12.93

34 BYI 12.50

35 ENMD 12.35

36 ACH 12.27

37 NVLS 12.04

38 CENX 11.68

39 BCS 11.61

40 SFUN 11.57

41 CS 11.54

42 SNV 11.43

43 CETV 11.11

44 SHP 10.95

45 VIT 10.89

46 SYUT 10.58

47 SSRX 10.32

48 NCI 10.26

49 LAZ 10.17

50 GIII 9.81

Pending Home Sales Drop 4.6% vs Consensus of Unch

Upgrades and Downgrades This Morning

Upgrades

URBN – Urban Outfitters upgraded to Buy from Neutral at Citigroup

APKT – Acme Packet added to buy list at Deutsche Bank

CSCO – Cisco Systems upgraded to Buy from Neutral at UBS

MOS – Mosaic initiated with Sector Performs at RBC Capital

POT – Potash initiated with Sector Performs at RBC Capital

AGU – Agrium initiated with an Outperform at RBC Capital

TJX – TJX target raised to $70 from $60 at Stifel Nicolaus

HSP – Hospira upgraded to Buy from Neutral at BofA/Merrill

OC – Owens Corning upgraded to Buy at Stifel Nicolaus

CETV – Central European Media upgraded to Buy from Neutral at BofA/Merrill

NSC – Norfolk Southern target raised to $88 from $85 at Stifel Nicolaus

Downgrades

BAC – Bank of America downgraded to Equalweight at Morgan Stanley

V – Visa downgraded to Mkt Perform at FBR Capital

PNRA – Panera Bread downgraded to Neutral from Buy at Sterne Agee

PNR – Pentair downgraded to Neutral from Buy at Suntrust

CNP – CenterPoint downgraded to Neutral from Outperform at Macquarie

CVH – Coventry Health Care downgraded to Market Perform from Outperform at Bernstein

MWV – MeadWestvaco downgraded to Underperform from Outperform at BMO Capital

NEWP – Newport target lowered to $21 from $25 at Stifel Nicolaus

EAT – Brinker downgraded to Underperform from Neutral at Sterne Agee

ANN – AnnTaylor removed from Top Picks Live list at Citigroup

HCC – HCC Insurance downgraded to Market Perform from Outperform at Keefe Bruyette

POR – Portland Gen Elec downgraded to Neutral from Outperform at Macquarie

LHCG – LHC Group downgraded to Neutral from Buy at Suntrust

UBSI – United Bankshares downgraded to Hold at Stifel Nicolaus

ARX – Aeroflex downgraded to Neutral from Overweight at JP Morgan

BTU – Peabody Energy target lowered to $50 from $65 at Stifel Nicolaus

HS – Healthspring downgraded to Hold from Buy at Jefferies

PUK – Prudential Plc initiated with a Hold at Jefferies

PX – Praxair downgraded to Underperform from Buy at BofA/Merrill

DPS – Dr Pepper Snapple downgraded to Underweight from Equal Weight at Morgan Stanley

TMO – Thermo Fisher downgraded to Neutral from Buy at Lazard

FIO – Fusion-io downgraded to Hold at Stifel Nicolaus

Comments »Gapping Up and Down This Morning

Gapping up

The entire world;

NVLS +3.3%, CDNS +3.3%, HBC +3.2%, LLNW +5.2%, OTEX +5.2%, SFSF +5%, BAC +4.7%, EXXI +4.7%,

CMRE +4.3%, MS +4%, NSC +3.9%, STD +3.6%, ISIL +2.7%, DB +14.7%, AKAM +12.7%, PEIX +11.8%, ING +7.8%,

FRO +7.7%, BCS +7.6%, UBS +6.6%, DCTH +6.5%, CS +6.1%,AIXG +6%, IDCC +5.9%, RBS +5.5%, SKX +5.4%,

Gapping down

bearish portfolios

V -2.2%, LSI -2%, VALE -0.7%, LOGM -4.8%, AGNC -3.5%, GPRE -3.2%, CA -2.4%, SYMC 2.3%, ESIO 15.7%,

AXTI -15.5%, HGR -15.4%, MDR -14.6%, TQNT -13.5%, ACOM -9.2%,

SFLY -7.8%, BMC 7.4%, FOE 7.3%, EQIX -5.3%,

Comments »In Play and On the Wires

Q3 GDP: Prior 1.3%, Market Expects 2.3%, Actual 2.5%…Initial Claims: Prior 403k, Market Expects 402k, Actual 404k

U.S. Banks and The Fed Spar Over Bank Liquidity Requirements

World Markets Celebrate a Triple Play Plan

Europe says they have struck a concrete plan to recapitalize banks, make Greece take a haircut, and leverage the ESFS fund by 4 or 5 times….

Comments »FLASH: European Futures Sharply Higher

FLASH: FUTURES SOAR ON EFSF ANNOUNCEMENT

S&P futs are up 13.6 and Asian markets are up 1%+ on the EFSF announcement.

Comments »Today’s Biggest Winners and Losers

No. Ticker % Change Market Cap

1 QCOR 20.11 2,070,000,000

2 MTW 16.99 1,140,000,000

3 PNRA 14.71 3,460,000,000

4 FSLR 13.64 3,730,000,000

5 FFIV 13.15 7,170,000,000

6 ALR 13.02 1,820,000,000

7 ULTI 12.54 1,340,000,000

8 ESRX 12.24 18,780,000,000

9 MDP 11.69 1,120,000,000

10 BIIB 10.99 25,920,000,000

11 ONXX 10.88 2,290,000,000

12 ITRI 10.79 1,320,000,000

13 SLAB 9.89 1,610,000,000

14 VLO 9.66 12,500,000,000

15 MHS 8.73 18,100,000,000

16 AVX 8.65 2,180,000,000

17 XCO 8.54 2,460,000,000

18 NJ 7.51 11,140,000,000

19 MIM 7.19 1,370,000,000

20 ARW 7.02 3,810,000,000

21 HAR 6.79 2,930,000,000

22 SSRI 6.04 1,450,000,000

23 MCK 5.95 18,750,000,000

24 GTLS 5.48 1,560,000,000

25 PCS 5.38 3,290,000,000

26 RHI 5.24 3,660,000,000

27 FMER 5.18 1,440,000,000

28 RFMD 5.07 1,990,000,000

29 SLM 5.06 6,290,000,000

30 CHE 5.05 1,140,000,000

31 ATI 5.05 4,280,000,000

32 TEX 4.97 1,520,000,000

33 AIXG 4.94 1,390,000,000

34 MOLX 4.76 4,090,000,000

35 CNO 4.60 1,410,000,000

36 TSS 4.60 3,600,000,000

37 OC 4.59 3,070,000,000

38 MWW 4.50 1,060,000,000

39 ACAS 4.40 2,490,000,000

40 GEN 4.32 2,150,000,000

41 BA 4.31 47,220,000,000

42 IAG 4.02 7,550,000,000

43 CIG 3.79 10,450,000,000

44 NSU 3.73 1,010,000,000

45 LFC 3.72 65,290,000,000

46 ENDP 3.71 3,270,000,000

47 CRR 3.64 2,660,000,000

48 ADVS 3.64 1,360,000,000

49 AUQ 3.63 1,670,000,000

50 CQP 3.62 2,470,000,000

—————————————–

No. Ticker % Change Market Cap

1 HGSI -21.76 2,430,000,000

2 DV -17.49 3,150,000,000

3 RSH -12.40 1,330,000,000

4 MASI -12.05 1,340,000,000

5 AMZN -11.34 103,110,000,000

6 BMS -10.48 3,260,000,000

7 GMCR -10.12 9,910,000,000

8 TMO -9.26 20,330,000,000

9 S -9.07 8,080,000,000

10 CHRW -8.40 12,380,000,000

11 JNY -7.76 1,030,000,000

12 TRN -7.61 2,200,000,000

13 YOKU -7.18 2,380,000,000

14 BIN -7.13 2,780,000,000

15 SINA -6.16 5,820,000,000

16 VSI -5.76 1,140,000,000

17 RIMM -5.52 11,600,000,000

18 HTLD -5.46 1,280,000,000

19 F -5.31 47,230,000,000

20 ESI -5.08 1,770,000,000

21 AVY -5.06 2,780,000,000

22 HCC -5.01 3,270,000,000

23 OPEN -4.47 1,210,000,000

24 VECO -4.25 1,050,000,000

25 OMI -4.24 1,970,000,000

26 POL -4.14 1,030,000,000

27 STRA -3.96 1,040,000,000

28 ARE -3.92 4,260,000,000

29 ACOM -3.85 1,090,000,000

30 LMT -3.75 26,290,000,000

31 FTNT -3.73 3,290,000,000

32 AGN -3.73 26,530,000,000

33 BCR -3.67 7,600,000,000

34 HCBK -3.65 2,980,000,000

35 PPO -3.64 2,300,000,000

36 SFLY -3.47 1,650,000,000

37 AUY -3.41 11,570,000,000

38 WAG -3.37 30,470,000,000

39 ADP -3.25 25,500,000,000

40 UAN -3.24 1,830,000,000

41 PCLN -3.14 25,140,000,000

42 BKI -3.14 1,120,000,000

43 SAVE -3.13 1,090,000,000

44 DPS -3.10 8,540,000,000

45 CYOU -3.07 1,560,000,000

46 RENN -3.02 2,340,000,000

47 VRTX -3.00 9,020,000,000

48 WAT -2.93 7,210,000,000

49 QLIK -2.89 2,270,000,000

50 MAKO -2.87 1,590,000,000

3D HeatMap

Upgrades and Downgrades This Morning

Upgrades

NFLX – Netflix upgraded to Buy at Hudson Square Research

SGY – Stone Energy initiated with a Buy at Global Hunter Securities

REGN – Regeneron Pharms upgraded to Outperform from Market Perform at Leerink Swann

CP – Canadian Pacific downgraded to Underweight from Neutral at JP Morgan

VAL – Valspar upgraded to Buy from Neutral at Citigroup

CSGP – CoStar Group resumed with a Buy at Needham

ALB – Albemarle upgraded to Neutral from Underperform at BofA/Merrill

AMTD – TD Ameritrade upgraded to Buy from Outperform at Credit Agricole

NOK – Nokia initiated with a Outperform at Northland Securities

Downgrades

SM – SM Energy initiated with an Overweight at Barclays

FSLR – First Solar downgraded to Hold from Buy at Jefferies

BTU – Peabody Energy target lowered to $50 at Brean Murray

POL – PolyOne downgraded to Market Perform from Outperform at Wells Fargo

DTE – DTE Energy downgraded to Equal Weight from Overweight at Barclays

CHRW – C.H. Robinson downgraded to Neutral from Buy at BofA/Merrill

ALV – Autoliv downgraded to Hold from Buy at Keybanc

HGSI – Human Genome downgraded to Hold from Buy at Brean Murray

YOKU – Youku.com downgraded to Neutral from Positive at Susquehanna

HCN – Health Care REIT initiated with an Overweight at Barclays

YGE – Yingli Green Energy downgraded to Neutral at Collins Stewart

FFIV – F5 Networks target raised to $100 from $92 at Stifel Nicolaus

CE – Celanese downgraded to Neutral from Buy at Citigroup

MET – MetLife downgraded to Neutral from Overweight at Atlantic Equities

SDRL – Seadrill Ltd downgraded to Equal Weight at Johnson Rice

DGX – Quest Diagnostics downgraded to Neutral from Outperform at Macquarie

MG – Mistras Group downgraded to Hold at KeyBanc Capital Mkts

DV – DeVry downgraded to Neutral from Overweight at JP Morgan

NUS – Nu Skin target raised to $51 from $46 at Stifel Nicolaus

RSH – RadioShack downgraded to Neutral from Buy at Goldman

NYT – New York Times downgraded to Neutral from Buy at Citigroup

AMZN – Amazon.com target lowered to $265 from $280 at Stifel Nicolaus

FIRE – Sourcefire downgraded to Neutral from Buy at Citigroup

ING – ING Group downgraded to Underperform from Neutral Exane BNP Paribas

Comments »Gapping up and Down This Morning

Gapping up

BBL +1.3%, MAR +1.2%, BCS +1%, MCK +4%, DVAX +3.9%, LIFE +3.9%, ESRX +3.3%, DB +1.9%, UBS +1.8%,

SLV +1.4%, ACGL +1.4%, QCOR +13.4%, PNRA +10.2%, FFIV +8%, VLO +6.7%, SXL +5.3%, MTW +5.2%, ANH +3.9%

VAL +1.6%, MAR +1.2%, SDRL +1.9%, TOT +1.1%, CHK +1.1%, E +1%, AG +2.1%, FCX +1.8%, BBL +1.3%,

SLW +0.9%, BHP +0.4%, GLD +0.2%,

Gapping down

BRCM -4.9%, RSH -4.4%, MET -4.2%, CENX -3.9%, TJX -3.7%, DWA -1.7%, HGSI -13.6%, AMZN -11%,

DV -8.9%, MASI -6%, FTI -5.2%,

Comments »