Gorilla glass prices are horrible now and for the foreseeable future.

Comments »Boeing’s Profits Jump 20%

United Technologies Sees Profits Grow by 11%

US Airway’s Profits Fall on Higher Fuel Costs

WellPoint’s Profits Fall 39%

Roche is Said to be Launching a $5.7 Billion Hostile Bid for Illumina

UniCredit Will Buy $3 Billion Worth of Tier 1 & 2 Bonds to Boost Capital Reserves

SAP Forecasts 11% Growth This Year

Ericsson and Novartis Post Earnings Below Estimates Helping to Weaken European Markets

Norfolk Southern Beats on The Bottom Line and Misses on Revenues

CA Technologies Pops in A.H. on Better Than Expected Earnings

WOW: Apple Reports $46.55 Billion vs Consensus of $38.9 Billion…Profits Per Share of $13.87 vs Consensus of $10.10

FLASH: APPLE CRUSHES EARNINGS

Apple prelim $13.87 vs $10.08 Capital IQ Consensus Estimate; revs $46.33 bln vs $39.04 bln Capital IQ Consensus Estimate

Apple sees Q2 EPS of ~$8.50 vs $8.00 Capital IQ Consensus Estimate; sees revs ~$32.5 bln vs $31.94 bln Capital IQ Consensus Estimate (420.41 -7.00)

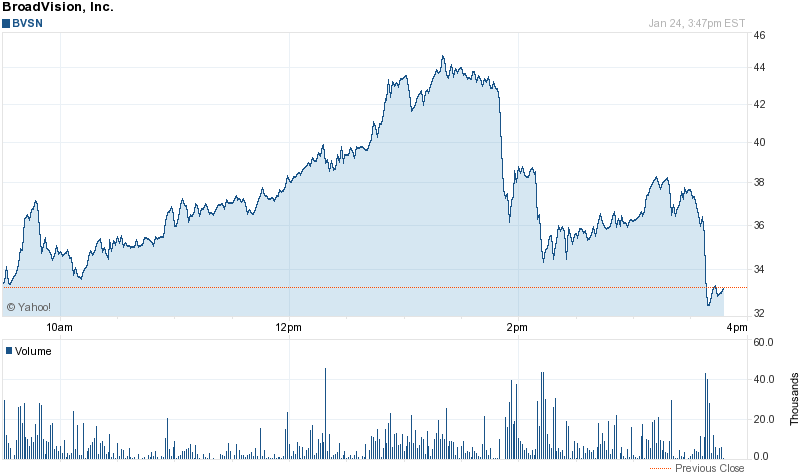

Comments »SHARES OF BVSN COMPLETE LATE DAY COLLAPSE

Some strong earnings defy weak economy

Read here:

Comments »In some ways it seems fitting – even telling – that the hottest stock in the Dow Jones Industrial Average over the past year comes down with a cold during January earnings season. It would be hard to say that McDonald’s (MCD) did anything wrong given the $27.2 billion record high revenues raked in last year, as well as record net income of $5.5 billion.

And despite beating bottom line estimates by 3-cents and matching sales, McDonald’s shares are shedding more than 2% on the news.

It should be pointed out that the fast-food giant’s decline is from a record high that was attained, as Macke says in the attached clip, through “perennial out-performance that warms my cockles of heart.”

From my standpoint, it is for that very same reason that this super-sized $100 billion business looks increasingly ripe to disappoint. It may be years away, or as soon as next quarter, but the burger baron is on a roll and its trajectory over the past year looks unsustainably steep, making its premium P/E ratio of 19 times 2012 estimates more difficult to justify because the fry oil is heating up.

Verizon (VZ) also reported record revenue growth today that matched expectations, but its muddled path to an ex-items bottom line miss by a penny is cause for concern in some circles.

“Ex-items are not all created equally, and VZ’s ex-items make sense,” Macke says.

What he is referring to is a net loss that came as the result of pension obligations, a legacy problem from the dark days that masks the sizzle of smartphones – which Verizon sold a lot of, and spent a lot doing so. Officially, 56% of 7.7 million smartphones it sold were iPhones (which means 44% weren’t), which drove 13% and 19% growth in its wireless and data businesses.

The other silver lining in this Macke-branded “consumer/utility/IT play” is every dip drives its dividend higher, which at last check was yielding 5.3%, which happens to be about 2.5-times the take on a 10-year Treasury.

And finally, we tear apart Johnson & Johnson (JNJ), the global healthcare conglomerate who’s defensive appeal outweighs its 4% sales growth. J&J comfortably beat on the bottom line with EPS of $1.13 versus $1.09 estimates. While its aforementioned low-single-digit revenue growth met analysts targets, a 10% jump in foreign sales was able to mask a 3.4% slide on the domestic side.

J&J is also one of the few to give full year guidance today. They guided cautiously on 2012, looking for $5.00 – $5.15 per share versus consensus at $5.21.

While Verizon and AT&T pay larger dividends, the fact that J&J is one of only four U.S. companies t0 carry a AAA-rating makes its 3.5% yield even more appealing. As does the fact that if and when they increase it again in April, it will mark the 50th consecutive year they have raised their dividend.

STICK TO BOEING! Engineers Find More Airbus A380 Cracks $BA

Engineers inspecting Airbus A380 aircraft for further wings cracks have found similar flaws on at least one aircraft, industry sources said on Tuesday.

European safety authorities ordered urgent inspections on just under a third of the superjumbo fleet last week after two types of cracks were discovered on the same type of bracket inside the wings of the world’s largest jetliner.

Airlines have until Friday to complete a first phase of checks, after which Airbus or safety regulators are expected to give an update on any new findings.

Airbus, which insists the superjumbo is safe to fly, declined to comment on any interim results while airlines carry out checks under the timetable established by regulators.

But a spokesman said recent events showed the industry’s process of continuous evaluation, designed to catch and repair any faults before they become a hazard, was working smoothly.

Read more: http://trade.cc/acfrixzz1kOqDcOIt

ALERT: European Banks are Getting Hammered

Gapping Up and Down This Morning

Gapping up

PEET +0.3%, DHT +18.7%, PLCM +9.1%, ACUR +7.5%, VMW +4.7%, WDC +3.7%, VMW +4.7%,DGX +4.3% , TXN +3.3%, SNV +7.4% , COH +3.4%, EMC +3%, ACUR +7.5% , BAX +2.3% ,

KORS +1.2%, BBBY +0.9% , ZNGA +0.8% , MRK +0.7% ,

Gapping down

IDCC -16.3%, NOK -7.5%, IRE -6.1%, ONCY -5.4%, PNNT -4.9%, KSU -4.1%, ZION -4%, DEPO -3.8%, GEL -3.5%, MSO -3.5%, TI -3.1%, CSX -3%, SI -2.7%, CS -1.9%, BAC -1.8%,

EAT -8%, JJSF -7.8%, ZION -7.8% , LYG -6.4%, IRE -6.1%, ING -3.4%, BCS -3%, BAC -2.1%, CS -1.9%, C -1.4%

Comments »Upgrades and Downgrades This Morning

Caterpillar, Inc. (NYSE: CAT) Raised to Outperform as Bull of the Day at Zacks.

Halliburton Co. (NYSE: HAL) Reiterated Buy but lowered target to $54 at Argus.

Harmony Gold Mining Co. Ltd. (NYSE: HMY) Raised to Buy at UBS.

Home Depot Inc. (NYSE: HD) Reiterated Buy and raised price target to $51 at Argus.

Interline Brands, Inc. (NYSE: IBI) named as Value stock of the day at Zacks.

KLA-Tencor Corporation (NASDAQ: KLAC) Raised to Buy at Citigroup.

Michael Kors Holdings Limited (NYSE: KORS) Started as Overweight at Morgan Stanley; Started as Outperform at Baird; Started as Buy at Goldman Sachs.

Netflix, Inc. (NASDAQ: NFLX) Maintained Outperform with $100 target at Credit Suisse.

NII Holdings, Inc. (NASDAQ: NIHD) Cut to Underperform as Bear of the Day at Zacks.

Novellus Systems, Inc. (NASDAQ: NVLS) Raised to Buy at Citigroup.

Pan American Silver Corp. (NASDAQ: PAAS) maintained Outperform but lowered estimates at Credit Suisse.

Texas Instruments Inc. (NYSE: TXN) Reiterated Outperform and raised target to $40 at Credit Suisse; Cut to Hold at Kaufman Bros.

Union Pacific Corp. (NYSE: UNP) Reiterated Buy and raised target to $130 at Argus.

Zumiez Inc. (NASDAQ: ZUMZ) Cut to Neutral at Credit Suisse.