[youtube://http://www.youtube.com/watch?v=qXXMG-rl8fY#t=16 450 300]

Comments »WSJ Puts Out an Investor Worry List

“The S&P 500 is up nearly 10% since its 2014 low in the first week of February. The index, which tracks the largest stocks, is now at a record high, up 4.1% for the year.

Behind the rebound is a view that stocks will continue to benefit from robust earnings, low interest rates and scant inflation. If those conditions persist, the market’s climb could very well continue.

But it’s important to examine the issues that have the worrywarts up at night and the justification bears have for their downbeat outlooks.

Below are some critical investor concerns, with a 1 to 10 “worry level” ranking—1 being the least worried and 10 the most.

Earnings and the economy: worry level 8.

The U.S. economy just can’t seem to take off, and recent earnings have disappointed. On Thursday, government data showed the nation’s gross domestic product declined at an annual pace of 1% in the first quarter, worse than economists expected and the first time economic output contracted since the first quarter of 2011.

Meanwhile, profits for S&P 500 companies in the quarter rose about 2% from the same period a year earlier, below the previous quarter’s 8.5% rise.

Rising prices for Treasurys are a sign the bond market is more skeptical about growth than the equity market.

The bond market is giving “a thumbs-down vote on economic growth,” says Peter Boockvar, chief market analyst at Lindsey Group.

Adds Daniel Alpert of Westwood Capital: “The bond and equity markets are expressing dramatically different views of the economy. When this happens, bonds typically have it right about 80% of the time.”

Jeff Mangiat

What the Fed might do: worry level 6.

A key reason stocks have done well since 2009: The Federal Reserve has kept interest rates low while buying huge volumes of bonds, trying to stimulate the economy. That’s forced investors to flee fixed-income investments and shift to equities.

But the Fed is paring its bond purchases and eventually will raise interest rates, raising questions about the market’s underpinnings…..”

Comments »Is Low Volume and Complacency Something to Worry About?

“Federal Reserve officials are starting to wonder whether a tranquillity that has descended on financial markets is a sign that investors have become unafraid of the type of risk that could lead to bubbles and volatility.

The Dow Jones Industrial Average, up a steady if unspectacular 1% since the beginning of the year, has consolidated big gains registered last year. The VIX, a measure of expected stock-market fluctuations based on options trading, has gone 74 straight weeks below its long-run average—a string of steadiness not seen since 2006 and 2007, before the financial crisis and recession.

Moreover, the extra return that bond investors demand on investment-grade corporate debt over low-risk Treasury bonds, at one percentage point, hasn’t been this low since July 2007. The lower this “spread,” the less risk-averse are bond investors.

The Fed’s growing worry—which could influence future interest rate decisions—is that if investors start taking undue risk it could lead to economic turbulence down the road.

“Volatility in the markets is unusually low,”William Dudley, president of the Federal Reserve Bank of New York and a member of chairwoman Janet Yellen‘s inner circle, said after a speech last week. “I am a little bit nervous that people are taking too much comfort in this low-volatility period. As a consequence, they’ll take more risk than really what’s appropriate.”

One example of increased risk taking: Issuance of low-rated U.S. dollar-denominated junk bonds last year hit a record $366 billion, more than twice the level reached in the years before the 2008 financial crisis, according to financial-data provider Dealogic.

Richard Fisher, president of the Federal Reserve Bank of Dallas, added to the chorus of concern over complacency in an interview Tuesday. “Low volatility I don’t think is healthy,” he said. “This indicates to me a little bit too much complacency that [interest] rates are going to stay at abnormally low levels forever.”

Many officials appear more inclined to talk about market risks than act to pre-empt them given the worry about cutting off a fragile recovery with early interest-rate hikes. Though risk-taking is on an upswing, they don’t see a buildup of serious threats to the broader stability of the financial system.

Fed officials are expected at their June meeting to keep gradually scaling back their purchases of mortgage and Treasury bonds and stick to the plan to keep short-term interest rates near zero, where they have been since the height of the financial crisis in late 2008…..”

Comments »ADP Reports 179k in Job Creation vs Estimates of 215k

“The post-weather bounce is over in exuberant employment trends appears to be over. After January’s plunge, the last 3 months have seen beats but May’s data – printing at 179k (against expectations of 210k) is a major disappointment for the extrapolators and presses job griwth back to its lowest since January. Rubbing salt in the wound of recovery, April’s data was revised downward. It was so bad, even the permabullish Mark Zandi was unable to spin the data: “Job growth moderated in May. The slowing in growth was concentrated in Professional/Business Services and companies with 50-999 employees. The job market has yet to break out from the pace of growth that has prevailed over the last three years.”

From the report….”

Comments »All Eyes on Draghi and the ECB to Do Something in the Way of Stimulus

“A special European Central Bank edition of the CNBC Fed Survey shows the stakes are high for Mario Draghi and his fellow European central bankers going into their meeting Thursday.

The survey of 30 market participants, including economists, strategists and fund managers, finds that 65 percent of them expect the ECB to take at least one of three substantial actions: lowering the refinance rate, cutting the deposit rate or announcing a long-term refinance operation or LTRO. About half of the respondents expect two of those three actions to be announced and a quarter think all three will happen.

The leading choice: 55 percent think the ECB will cut the refi rate by an average of 11 basis points from the current level of 25 basis points; 52 percent think the deposit rate will be reduced to negative 10 basis points, on average. That would make the ECB one of the few central banks ever to have posted a negative official rate. A third of respondents look for an LTRO and a third say the ECB could do quantitative easing outright.

“Monetary policy is approaching a critical split in the road as the ECB shifts to more ease, the Fed begins to tighten, and the BOJ maintains its current stance,” Lynn Reaser of Point Loma Nazarene University wrote in response to the survey.

Respondents forecast euro zone gross domestic product to rise 1.11 percent this year compared to 2013 and……”

Your Tax Dollars at Work: The Millionaire’s Club

“Wealthy members of Congress are living the high life at taxpayer expense, while most of the rest of the country continues to suffer through one of the worst economic periods in our lifetimes. According to an analysis conducted by the Center for Responsive Politicsearlier this year, more than half of the members of Congress are millionaires. This is the first time that this has ever happened in U.S. history. In addition, the same study found that a hundred members of Congress are actually worth at least five million dollars. We have a government of the wealthy, by the wealthy and for the wealthy, but as you will see below, that isn’t stopping members of Congress from wasting taxpayer money in some incredibly bizarre ways. Millions of dollars are being spent on “office expenses” and on the hair care needs of Senators, but very little is being done to stop this abuse. It is almost as if the American people have just accepted that this is how “big government” is supposed to operate.

No matter what your political affiliation is, it should bother you that we are overwhelmingly being represented by the very wealthy. We are supposed to be a government “of the people”, but instead Congress is rapidly becoming a millionaire’s club…

For the first time in history, most members of Congress are millionaires, according to a new analysis of personal financial disclosure data by the Center for Responsive Politics.

Of 534 current members of Congress, at least 268 had an average net worth of $1 million or more in 2012, according to disclosures filed last year by all members of Congress and candidates. The median net worth for the 530 current lawmakers who were in Congress as of the May filing deadline was $1,008,767 — an increase from the previous year when it was $966,000.

And this is true on both sides of the aisle. In fact, when you break the numbers down by political party, they come out almost exactly the same…

Breaking the numbers down further, congressional Democrats had a median net worth of $1.04 million, while congressional Republicans had a median net worth of almost exactly $1 million. In both cases, the figures are up from last year, when the numbers were $990,000 and $907,000, respectively.

Of course wealthy people should not be prevented from serving in Congress.

All Americans should have that opportunity.

But when it gets to the point that only wealthy people are being elected, then we have a major problem on our hands.

Yes, a million dollars does not go as far as it used to. But it still puts you in the upper stratosphere of American society.

And these days, there are nearly 200 members of Congress that are multimillionaires…

Nearly 200 are multimillionaires. One hundred are worth more than $5 million; the top-10 deal in nine digits. The annual congressional salary alone—$174,000 a year—qualifies every member as the top 6 percent of earners. None of them are close to experiencing the poverty-reduction programs—affordable housing, food assistance, Medicaid—that they help control. Though some came from poverty, a recent analysis by Nicholas Carnes, in his book White Collar Government: The Hidden Role of Class in Economic Policymaking, found that only 13 out of 783 members of Congress from 1999 to 2008 came from a “blue-collar” upbringing.

Wow.

Shouldn’t we actually want to have some representatives that come from “blue collar” backgrounds?

So why do we have so few?

Has our political system failed?

Those are some important questions that we should be asking.

And then when all of these wealthy individuals get to Congress, they see absolutely no problem with spending U.S. taxpayer money like it is going out of style. For example, according to the Weekly Standard, more than five million dollars has been spent on the hair care needs of U.S. Senators alone over the past 15 years…

Senate Hair Care Services has cost taxpayers about $5.25 million over 15 years. They foot the bill of more than $40,000 for the shoeshine attendant last fiscal year. Six barbers took in more than $40,000 each, including nearly $80,000 for the head barber.

All of this is just for 100 U.S. Senators?

Many of them don’t even have much hair left anymore.,,,,”

Comments »Warren and Piketty on the Same Stage

“Senator Elizabeth Warren is not shy about being a crusader for the middle class.

The senior Massachusetts lawmaker had some choice words for the rich in an online dialogue Monday with French economist Thomas Piketty on economic inequality. Theforum, hosted by The Huffington Post’s Ryan Grim, was organized by MoveOn, a liberal political action group.

Warren and Piketty have each just written best-selling books on income inequality. Warren authored a memoir called “A Fighting Chance,” which also discusses what Washington can do to help the middle class. Piketty analyzed data from 20 countries in his tome on income inequality and the concentration of wealth, entitled “Capital in the Twenty-First Century.”

Here is a list of choice quotes from Warren on how the rich have rigged the system.

On Piketty’s findings: Wealth does not trickle down. It trickles up. It trickles from everyone else to those who are rich.

On taxes: When people feel like we’re not all in this together, we’re not all sharing, we’re not all paying a fair share of our income or our wealth, then I think what you get is it all comes all unraveled. Everyone moves towards I will pay the least because he’s paying the least.

On small businesses: Small business owners pay and pay and pay on taxes because the loopholes aren’t as available to them. You look at Fortune 500 companies, companies that are profitable and end up paying zero in taxes.

On rewriting the rules…”

Comments »Why Was MSN So Quiet On…..

“COPENHAGEN — If 120 to 150 celebrities were gathered at a hotel for a private three-day meeting, there would be no end to the media coverage, analysis, pictures, manufactured scandals, and ridiculous hype. Supposed “journalists” would have a field day. Just this weekend, about that many top globalists, whose decisions collectively affect the lives of virtually every person on the planet, gathered for the Bilderberg summit in the Danish capital. Establishment media outfits such as CNN, BBC, ABC, CBS, NBC, MSNBC, Fox, the New York Times, the Washington Post, the Associated Press, and others, however, were nowhere to be found.

The deafening lack of press coverage surrounding what many analysts say is perhaps one of the most important meetings of the year was not due to a lack of information about Bilderberg. This magazine and numerous reporters for alternative media outlets in the United States and Europe were there covering the summit. The Danish press was there, too, as were a handful of reporters for major European newspapers. A few government-funded media outlets from Russia, China, Iran, and other nations also reported on the summit. In the increasingly discredited and wildly mischaracterized American “mainstream” media, though, scarcely a word appeared about Bilderberg.

Incredibly, in attendance at the secrecy-obsessed gathering of globalists were numerous high-powered media executives and supposed “journalists” — from editors and publishers of major publications to influential columnists and corporate media magnates. All of them were mingling with over 100 figures representing the upper echelons of banking, politics, the Internet, business, war, government, foreign policy, the EU, NATO, military, spying, royalty, the Chinese Communist Party, and more. Naïve readers and viewers, though — for reasons that remain unclear, one in five Americans still trust the establishment media to keep them informed — were none the wiser…..”

Comments »If Big Banks Can Borrow Money For Nothing Then Why Not Students & Municipalities?

“Funding infrastructure through bonds doubles the price or worse. Costs can be cut in half by funding through the state’s own bank.

“The numbers are big. There is sticker shock,” said Jason Peltier, deputy manager of the Westlands Water District, describing Governor Jerry Brown’s plan to build two massive water tunnels through the California Delta. “But consider your other scenarios. How much more groundwater can we pump?”

Whether the tunnels are the best way to get water to the Delta is controversial, but the issue here is the cost. The tunnels were billed to voters as a $25 billion project. That estimate, however, omitted interest and fees. Construction itself is estimated at a relatively modest $18 billion. But financing through bonds issued at 5% for 30 years adds $24-40 billion to the tab. Another $9 billion will go to wetlands restoration, monitoring and other costs, bringing the grand total to $51-67 billion – three or four times the cost of construction.

A general rule for government bonds is that they double the cost of projects, once interest has been paid….”

“Sen. Elizabeth Warren introduced her first bill, a simple proposal to give students the same loan rates as the nation’s biggest banks. Her proposal would allow the cut-rate loans for students for one year, to give Congress the time to come to agreement on a long-term solution to interest rates. Federal Stafford subsidized loan rates for new students are set to double on July 1 to 6.8 percent.

Here’s a snippet from her floor speech introducing the bill….”

Comments »Euro Inflation Slows Tripping Up Chances of Bazooka Style Liquidity

“Euro-area inflation slowed more than economists forecast in May, cranking up pressure on the European Central Bankto deploy measures as soon as this week to kindle prices and drive growth.

The rate fell to 0.5 percent from 0.7 percent in April, the European Union’s statistics office in Luxembourg said today. Themedian forecast in a Bloomberg News survey of 38 economists was for a decline to 0.6 percent. The rate has been less than half the ECB’s target for eight months.

With ECB President Mario Draghiwarning about the risk of a negative price spiral, the Governing Council is considering measures from negative interest rates to conditional liquidity for banks. The central bank is also contending with high unemployment, which unexpectedly decreased in April while remaining near a record, a separate Eurostat report showed.

“It’s a surprise, but not enough of a surprise to change materially the global economic outlook that the ECB will release on Thursday,” said Michel Martinez, an economist at Societe Generale SA in Paris. “What seems highly likely is that the ECB will cut key rates and probably also inject further liquidity.”

The euro erased losses against the dollar after today’s date were released, trading at $1.3610 at 12:14 p.m. in Brussels, up 0.1 percent on the day.

Of 50 economists surveyed by Bloomberg News, 44 expect the Frankfurt-based ECB to become the first major central bank to take interest rates into negative territory by cutting its deposit rate. All but 2 of 60 respondents said the benchmark rate would also be reduced.

‘Ready to Act’

The ECB has prepared investors for the prospect of stimulus ….”

Comments »More Data Suggests China’s Economy May Be Firming Up

“BEIJING—Two more measures of China’s economic health showed improvement in May, adding to signs that the economy is stabilizing after its sluggish start this year and suggesting that government support policies may be starting to show results.

The government’s index of activity in the nonmanufacturing sector in May hit its highest level since November last year, according to data released Tuesday, while a private sector gauge of factory activity showed gains for the month as well.

Added to a stronger reading in May for the official manufacturing Purchasing Managers’ Index, released on Sunday, the overall economic picture appeared somewhat brighter following moves to accelerate spending on railways, offer business tax breaks and make more financing available to smaller companies.

“These are good signs,” said Citigroup C +0.40% economist Ding Shuang. “But real economic activity may not rebound that quickly,” he cautioned.

The official nonmanufacturing Purchasing Managers’ Index rose to 55.5 in May from 54.8 in April, according to the China Federation of Logistics and Purchasing, which releases the data along with the statistics bureau. The nonmanufacturing PMI covers services, including retail, aviation and software, as well as real estate and construction. The upturn was largely a result of the important services sector, a key source of employment, while construction was less robust as a result of weaker property prices.

A reading above 50 means expansion from the previous month while anything below that shows contraction.

Meanwhile, the HSBC China Manufacturing Purchasing Managers’ Index, a gauge of nationwide factory activity, rose to a final reading of 49.4 in May from 48.1 in April, HSBC Holdings HSBA.LN -0.64% PLC said Tuesday. The reading still remained below 50, where it has been every month this year, showing contraction from the previous month but at a slower pace.

“The final (manufacturing) PMI reading for May confirmed that the economy is stabilizing, but it is too early to say that it has bottomed out, particularly in light of a weaker property sector,” said Qu Hongbin, HSBC’s chief economist for China, in a statement accompanying the data.

China posted economic growth of 7.4% year on year in the first quarter, down from 7.7% in the final quarter of last year…..”

Comments »Dark Pools Shed Some Light on Their Trading Practices

“After years of operating in the shadows, dark pools are coming into the light.

Goldman Sachs Group Inc. GS +0.14% and Credit Suisse Group AG CSGN.VX -1.35% , two of the biggest operators of opaque trading venues known as dark pools, which execute trades away from stock exchanges, on Monday published documents explaining in detail how their venues work.

The disclosures came on the day that the Financial Industry Regulatory Authority issued for the first time data on volume of shares traded on dark pools.

Goldman Sachs has been weighing the move for more than two months. The bank has grown concerned that increases in complexity and instability in the stock market are harming investor confidence and hopes to address the issue by being more transparent about its own trading operations, said Brian Levine, co-head of Goldman’s Global Equities Trading and Execution Services.

Goldman executives have raised the possibility of closing its dark pool, known as Sigma X, in conversations with market participants in recent months, The Wall Street Journal reported in April.

Goldman is concerned that complexity is hurting investor confidence. Reuters

Dark pools, private, lightly regulated trading venues where buyers and sellers can swap shares with greater anonymity than on stock exchanges, have come under criticism recently as part of a wider complaint that the U.S. stock market has become too complex. Together with so-called internalizers—firms that execute trades on behalf of retail brokerages—they account for nearly 40% of all stock trading, according to Tabb Group.

Critics say that off-exchange trading hurts the ability of the market to accurately price securities, since buy and sell orders aren’t published. Some have also questioned the role played by high-frequency firms, superfast traders that use turbocharged computers and telecommunications networks to buy and sell stocks, in dark pools.

Dark-pool proponents say their venues offer big institutional investors the opportunity to buy or sell stocks without moving prices as much as they would by displaying their order on an exchange…..”

Comments »Radiation Spikes Across the U.S. Surpass Evacuation Hazmat Levels

[youtube://http://www.youtube.com/watch?v=ZP9_cR2PLnE#t=30 450 300] [youtube://http://www.youtube.com/watch?v=lpAqiGSp29c 450 300]

Comments »

Comdey Files: John Maynard Keynes and Paul Krugman Discuss Eating Dogshit

“………The following joke perfectly explains the ludicrosity of GDP.

Two Keynesian economists, John Maynard Keynes and Paul Krugman, were walking down the street one day when they passed two large piles of dog shit.

Then Krugman, feeling richer, says, “I’ll pay you $20,000 to eat the other pile of shit.” Keynes, feeling bad about the money he lost says okay, and eats the shit. Krugman pays him the $20,000.

They resume walking down the street.

After a while, Krugman says, “You know, I don’t feel very good. We both have the same amount of money as when we started. The only difference is we’ve both eaten shit.”

Keynes says: “Ah, but you’re ignoring the fact that we’ve increased the GDP by $40,000.

That is really all you need to know about GDP… it’s all dogshit….”

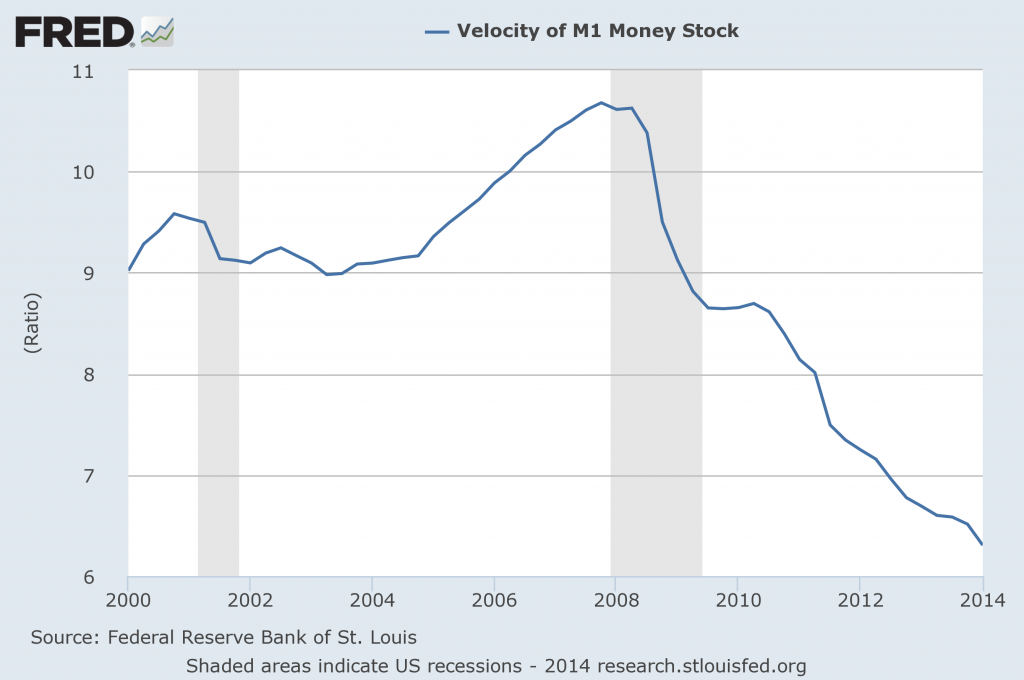

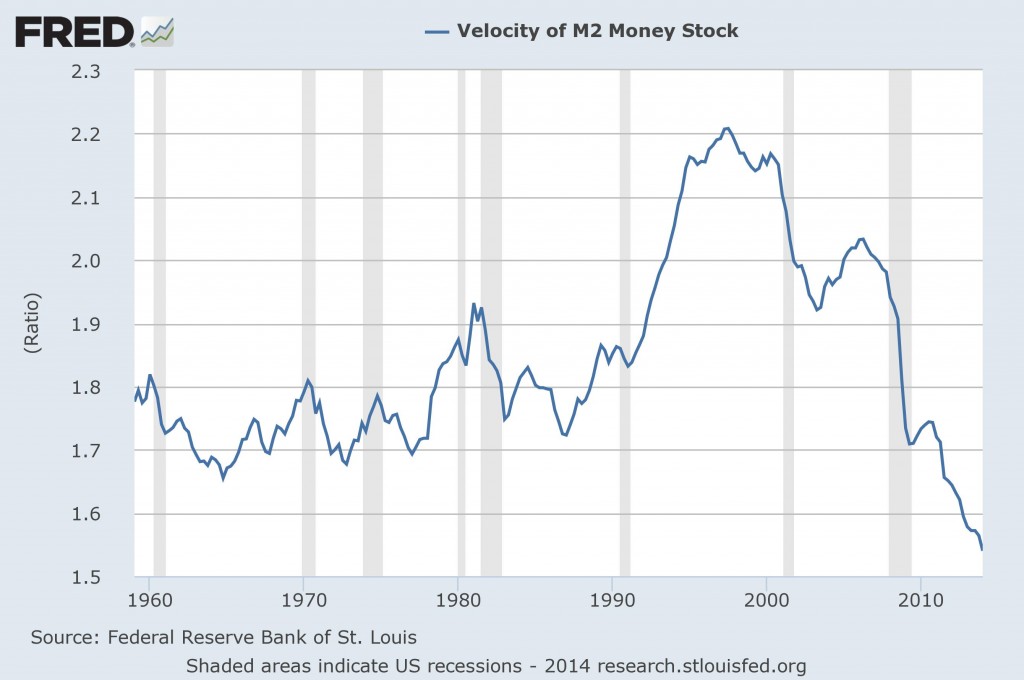

Comments »M1 & M2 Hit 20 Year Lows

June Marks 5 Years as the Offical End of the Great Recession, Are You Celebrating?

“It’s June 2014, and that means it’s been five years since the Great Recession officially ended. If you’re not ready to celebrate this milestone, you’re certainly not alone.

The majority of Americans still rate economic conditions as “poor” and for good reason: This jobs recovery is the slowest on record, wages are barely rising, home prices are still below their peak and more Americans are using food stamps than ever before.

Main Street America still doesn’t feel recovered, because, quite frankly, it’s not.

So how much longer will the healing process take? Economists surveyed by CNNMoney expect a full recovery is still two to three years away.

“The labor market is the scar on the economy that remains from the Great Recession, the financial and housing crises. It may be fading, but it is still clearly visible and will remain for years to come,” said Sean Snaith, economics professor at the University of Central Florida.

Interactive: Why you don’t feel recovered

Here’s how far we’ve come: Technically, the Great Recession ended in June 2009. That determination was made by the National Bureau of Economic Research, an independent group of economists that has officially called the beginning and end of business cycles since the 1920s.

Why pick that date? Essentially, that’s when the bleeding stopped and the slow healing process began. After that point, economic activity started picking up. Auto sales started rising, and the manufacturing sector slowdown ended. Home prices hit their bottom and finally started rising again, and the stock market came back to life.

Now, five years later, U.S. economic activity and the stock market are at all-time highs. States like North Dakota and Texas are benefiting from energy-related booms. Jobs in health care keep growing, and professional office positions are back. There are also more low-wage jobs at restaurants and bars.

But the recovery was far from a quick bounce-back. It’s been more like a long, slow slog, and here’s the key missing component: The broader job market…..”

Comments »BoA Expects Basing and Bear Trends to Continue for Treasury Yields

“US Treasury yields are on the verge of basing and resuming their long term bear trends, warns BofAML’s MacNeil Curry, as Treasury volatility (MOVE Index) appears poised for a reversal higher…

Via BofAML’s MacNeil Curry,

Treasury yields poised to base

US Treasury yields are on the verge of basing and resuming their long term bear trends. While we need to see a 10yr yield close above 2.568% to confirm, we reiterate our comment: THE LONG-TERM BEAR TREND IS POISED TO EMERGE FROM HIBERNATION. While such a turn would be supportive of our bullish US $ view against the likes of € and CHF (we are long the US $ against both) , it should also help push many $/EMFX pairs higher as well. The reason being is that Treasury volatility is also poised for a significant turn to the topside. Indeed, a turn higher in US yields should be the catalyst for such a turn in vol. In such an environment, $/ZAR is particularly well placed to benefit as it has just resumed its long term bull trend.

Chart of the week: 10yr Treasury yields at the basing zone

US 10yr Treasury yields have reached the 2.420%/2.346% basing zone. From this zone we look for a base and resumption of the long term bear trend…”

Jeremy Siegel expects bond yields to rise if data comes in stronger

Comments »Documentary: Freedom, A Complete Picture

While the research, information, and remedies provided herein are largely based on the Canadian system my reasearch indicates that this applies to all G-8 nations. A truly shocking reality!

Cheers on your weekend!

[youtube://http://www.youtube.com/watch?v=vW07vvxuHMA 450 300][youtube://http://www.youtube.com/watch?v=B1T8xgHdMEM 450 300] Comments »

Bilderberg at 60: Inside the World’s Most Secretive Conference

“It’s been a week of celebrations for Henry Kissinger. On Tuesday he turned 91, on Wednesday he broke his personal best in the 400m hurdles, and on Thursday in Copenhagen, he’ll be clinking champagne flutes with the secretary general of Nato and the queen of Spain, as they celebrate 60 glorious years of Bilderberg. I just hope George Osborne remembered to pack a party hat.

Thursday is the opening day of the influential three-day summit and it’s also the 60th anniversary of the Bilderberg Group’s first meeting, which took place in Holland on 29 May 1954. So this year’s event is a red-letter occasion, and the official participant list shows that the 2014 conference is a peculiarly high-powered affair.

The chancellor, at his seventh Bilderberg, is spending the next three days deep in conference with the heads of MI6, Nato, the International Monetary Fund, HSBC, Shell, BP and Goldman Sachs International, along with dozens of other chief executives, billionaires and high-ranking politicians from around Europe. This year also includes a visit from the supreme allied commander Europe, and a return of royalty – Queen Sofia of Spain and Princess Beatrix of the Netherlands, the daughter of the Bilderberg founder Prince Bernhard.

Back in the 1950s, when Bernhard sent out the invitations, it was to discuss “a number of problems facing western civilization”. These days, the Bilderberg Group prefers to call them “megatrends”. The megatrends on this year’s agenda include: “What next for Europe?”, “Ukraine”, “Intelligence sharing” and “Does privacy exist?”

That’s an exquisite irony: the world’s most secretive conference discussing whether privacy exists. Certainly for some it does. It’s not just birthday bunting that’s gone up in Copenhagen: there’s also a double ring of three-metre (10ft) high security fencing. The hotel is teeming with security: lithe gentlemen in loose slacks and dark glasses, trying not to kill the birthday vibe. Or anyone else.

Already, two reporters have been arrested trying to interview the organisers of the conference in the Marriott hotel bar. It’s easy enough to keep your privacy intact when you’re employing so many people to guard it.

There’s something distinctly chilling about the existence of privacy being debated, in extreme privacy, by people such as the executive chairman of Google, Eric Schmidt, and the board member of Facebook Peter Thiel: exactly the people who know how radically transparent the general public has become.

And to have them discussing it with the head of MI6, Sir John Sawers, and Keith Alexander, the recently replaced head of the National Security Agency. And with people such as the head of AXA, the insurance and investment conglomerate – Henri de Castries. Perhaps no one is more interested in data collection and public surveillance than the insurance giants. For them, privacy is the enemy. Public transparency is a goldmine.

Back in 2010, Osborne proudly launched “the most radical transparency agenda the country has ever seen”. However, this transparency agenda doesn’t seem to extend to Osborne himself making a public statement about what he has discussed at this meeting. And with whom.

We know, from the agenda and list, that Osborne will be there with the foreign affairs ministers from Spain and Sweden, and the deputy secretary general of the French presidency. And from closer to home, the international development secretary, Justine Greening, and fellow Bilderberg veteran and shadow chancellor, Ed Balls.

We know that he’s scheduled to discuss the situation in Ukraine…..”

Comments »Study: Half of All US Adults Hacked in the Last 12 Months

“Online computer hackers have infiltrated and exposed the personal information of 110 million Americans – nearly half of the US adult population – over the last year alone, according to an alarming new report.

The study – formulated by researchers at the Ponemon Institute, which measures data collection and information security in the public and private sectors – also determined that the number of hacked accounts belonging to those individuals numbered at or near 432 million.

Many of the people victimized may have inadvertently made available to hackers their names, debit or credit card information, email addresses, phone numbers, birth dates, passwords, security questions, and possibly their physical home addresses, according to CNN Money, which commissioned the study.

The news that so many people have been hacked comes on the heels of a series of vast security flubs at popular companies like Target and eBay. Target was the victim of a malware attack that compromised no less than 40 million credit card numbers (along with 70 million addresses, phone numbers, and other identifying materials) through the height of the holiday shopping season.

Snapchat admitted that five million user accounts were hacked, and 33 million Adobe users’ credentials were also taken …..”

Comments »