Yearly Archives: 2013

$BP Get Snagged With More Lawsuits

“LONDON (Reuters) – BP Plc has been hit by over 2,200 new lawsuits seeking payback for the 2010Gulf of Mexico oil spill in the past few weeks as individuals, companies and government bodies rushed to stake their claim before their right to do so expired.

The British oil company, whose deepwater Macondo well ruptured on April 20, 2010, killing 11 men and spilling crude into the sea for weeks, revealed the number of new claims made since March 6 in its first-quarter results on Tuesday.

The United States Oil Pollution Act of 1990, under which most of the new lawsuits were registered, has a three year statute of limitations which could make bringing further legal action difficult after the third anniversary of the disaster.

BP said it would be applying to have the new legal challenges consolidated into a trial that is already under way in New Orleans.

The first phase of the trial of BP and its partners in the well, Transocean and Halliburton , ended earlier in April, but the judge, Carl Barbier, has yet to rule on the degree of blame that will be apportioned to each party and on the level of negligence that will be applied.

Both decisions could have a big impact on the size of BP’s final liability, already measured in tens of billions of dollars. His ruling, to be made without a jury as is traditional under U.S. maritime law, could come this summer…”

Comments »$BBY Hits the Bid on Europe After Selling its Carphone Warehouse Unit

“NEW YORK/LONDON (Reuters) – U.S. retailer Best Buy Co Inc retreated from its ill-fated European expansion on Tuesday by selling its stake in a joint venture to Carphone Warehouse Group for less than half what it paid five years ago.

The 500 million pounds ($775 million) sale is the latest sign the world’s largest consumer electronics chain is scaling back its overseas ambitions to focus on its mainstay U.S. business, which faces cut-throat competition from the likes of Wal-Mart Stores Inc and Amazon.com Inc .

The deal will strengthen Best Buy’s balance sheet, simplify its business and improve its return on invested capital, CEO Hubert Joly said in a statement, adding that the timing and economics felt right for the deal.

But allowing for currency fluctuations, the price is less than half the roughly $2.1 billion Best Buy paid in 2008 for 50 percent of the independent mobile seller’s retail operations.

“(Best Buy) basically paid 1.1 billion (pounds) for the same half they are selling back to us today for a lot less,” Carphone Chief Executive Roger Taylor said.

“When they bought in they had aspirations to put Best Buy stores across Europe, and they probably paid a premium for that, and in the end that strategy didn’t work for many reasons.”

Europe’s economic prospects continue to worsen on the back of searing budget cutbacks to deal with a crisis of government debt in several southern countries, while the U.S. economic recovery increasingly looks firmly on track….”

Comments »Cost Cutting Helps $AVP Post Better Than Expected Profits, Revs Rise

“(Reuters) – Avon Products Inc (AVP.N) on Tuesday reported a better-than-expected first-quarter profit in the latest sign the beauty products company’s business continues to improve, helped by higher sales in key markets Brazil and Russia and cost cuts.

Overall, revenue in the quarter fell 3.5 percent to $2.48 billion, but was flat when stripping away the impact of currency fluctuations. Avon’s growth in Latin America and Eastern Europe contrasted with a poor showing in North America, where sales again slid, falling 15 percent.

Avon reported a net loss of $13.7 million, or 3 cents per share, compared with net income of $26.5 million, or 6 cents per share a year earlier.

Excluding items such as a charge related to the recent currency devaluation in Venezuela, a big market for Avon, the company reported adjusted net income was $112 million, or 26 cents per share, helped in large part by cost cutting efforts.

That was well above the 14 cents per share Wall Street analysts were projection, according to Thomson Reuters I/B/E/S….”

Comments »$PFE Misses Expectations and Guides Lower

“Pfizer Inc. (PFE), the world’s biggest drugmaker, lowered its 2013 profit forecast after first-quarter sales and earnings missed analyst estimates.

Full-year earnings excluding one-time items may be $2.14 to $2.24 a share, New York-based Pfizer said in a statement today. The company’s gave a previous 2013 forecast of $2.20 to $2.30 in January. First-quarter profit missed analyst estimates by 1 cent, the average of 17 analysts’ estimates compiled by Bloomberg.

First-quarter sales were $13.5 billion, less than analyst estimates of $13.94 billion, as revenue for Prevnar, a vaccine for pneumococcal diseases, and erectile dysfunction drug Viagra fell short of expectations. Investors are focused on whether Pfizer will split apart after shedding two non-drug units. Chief Executive Officer Ian Read has been floating the idea of cleaving the company into a brand-name drug unit and a generics business, as a move to raise the total value of two companies….”

Comments »Physical Demand for Gold Jumps All Over the Globe

“Surging demand for gold from Dubai to Istanbul has pushed physical premiums in the region to levels not seen in years as the biggest price slump in three decades lures consumers, according to MKS (Switzerland) SA.

Premiums paid by wholesalers and bulk buyers in Dubai to secure a 1 kilogram bar of bullion are being quoted between $6 an ounce and $9 an ounce over the London cash price, said Frederic Panizzutti, global head of marketing and sales at the Swiss-based bullion refiner. That compares with about 50 cents before the rout, Panizzutti, also chief executive officer of MKS Precious Metals DMCC, said in an interview from Dubai.

Gold fell to the lowest in more than two years this month on speculation that the global economy is recovering, unleashing a purchasing frenzy among coin and jewelry buyers from China to the U.S. Consumer demand for jewelry, bars and coins inTurkey and the Middle East represented about 9.4 percent of the global total last year, according to the World Gold Council. Bars have been cleared from display in the souks, according to Gerry Schubert, head of precious metals at Emirates NBD PJSC.

“Physical demand has been tremendous in a way I haven’t seen for a number of years,” said Jeffrey Rhodes, global head of precious metals at INTL FCStone Inc., who’s worked in the industry for more than three decades. “The price collapse prompted a physical gold rush and the evidence of the extent of that is the prolonged period of high premiums that we’ve seen. Reports from the gold souks are that business is good,” Rhodes said from Dubai.

Bear Market….”

Comments »Unemployment Climbs in Germany for a Second Month

“German unemployment rose for a second month in April, adding to signs that Europe’s largest economy is struggling to recover from a slump at the end of last year.

The number of people out of work climbed a seasonally adjusted 4,000 to 2.94 million, the Nuremberg-based Federal Labor Agency said today. Economists predicted an increase of 2,000, according to the median of 29 estimates in a Bloomberg News survey. The adjusted jobless rate held at 6.9 percent, just above a two-decade low of 6.8 percent.

The International Monetary Fund predicts the German economy will expand 0.6 percent this year, even as its biggest export market, the euro area, remains mired in recession. German business and investor confidence dropped in April as Europe’s debt crisis and an unusually long winter delayed the first- quarter rebound predicted by the Bundesbank.

“Uncertainty in the euro area is back and it has taken its toll on the German labor market,” said David Milleker, chief economist at Union Investment GmbH in Frankfurt. “I wouldn’t expect a reduction of unemployment anytime soon.”

The euro was little changed after the report, trading at $1.3086 at 10:30 a.m. in Frankfurt. European stocks rose, with theStoxx Europe 600 Index (SXXP) up 0.1 percent.

Long Winter…”

Comments »$DB Announces a $6.5 Billion Share Offering

“Deutsche Bank AG (DBK) (DBK), continental Europe’s biggest bank, is raising 5 billion euros ($6.5 billion) in capital, three months after co-Chief Executive Officer Anshu Jain said a share sale wasn’t in investors’ interests.

The company issued 2.96 billion euros of stock at 32.90 euros apiece, exceeding an initial goal of 2.8 billion euros, as part of the capital increase, the Frankfurt-based lender said in a statement today. Deutsche Bank’s shares surged as much as 7.9 percent, the biggest rise since August.

Jain timed the capital increase to coincide with a report showing first-quarter earnings rose 19 percent, beating estimates. He’s boosting reserves after Standard & Poor’ (SPY)s warned of a possible credit rating downgrade. Jain said in January he was willing to take losses on asset sales rather than issue new stock, citing the level of the share price.

“We are now among the best capitalized banks in our global peer group,” Jain said on a conference call with analysts and investors today. “These measures allow us to take advantage of organic growth opportunities in a changing competitive landscape.”

Deutsche Bank’s shares climbed 6.3 percent to 34.98 euros at 9:32 a.m. in Frankfurt trading, valuing the firm at 33 billion euros. The Bloomberg Europe Banks and Financial Services Indexrose 1.3 percent.

The bank will also sell 2 billion euros of subordinated debt, Jain said on the conference call.

‘Best-Capitalized’…”

Comments »Eurozone Inflation Falls to 1.2%

“Euro-area inflation at a three-year low and record unemployment increased pressure on theEuropean Central Bank to cut interest rates later this week to spur lending and growth.

The annual inflation rate dipped to 1.2 percent in April, thelowest since February 2010, from 1.7 percent a month earlier, the European Union’s statistics office in Luxembourg said today. The rate has been below the ECB’s 2 percent ceiling since February. The March jobless rate advanced to 12.1 percent, the highest since the data series began in 1995.

The ECB’s Governing Council will cut its benchmark rate to a record low 0.50 percent on May 2 from 0.75 percent, according to the median of 70 economists’ estimates in a Bloomberg News survey. The Frankfurt-based central bank sees inflation at 1.6 percent this year and 1.3 percent in 2014.

“If it weren’t for the ECB’s usual reluctance to make large changes, there would be a strong case to cut by 50 basis points, and I think the likelihood is perhaps higher than the market expects,” Frederik Ducrozet, an economist at Credit Agricole SA (ACA), said by telephone from Paris. “It’s probably around 20 percent, because with inflation that low it’s really the best time to do such things and maximize the impact on the market.”

Debt Crisis….”

Comments »Austria Considers Bad Bank Idea to Wind Down Delinquent Loans

“Austria is reconsidering plans to establish a separate “bad bank” to wind down delinquent loans at nationalized lender Hypo Alpe-Adria-Bank International AG, a move that could add to the nation’s debt.

The government is discussing whether separate wind-down units modeled on Germany’s FMS Wertmanagement AoeR or Austria’s KA Finanz AG would make sense for Hypo Alpe, Chancellor Werner Faymann told journalists in Vienna today. The Finance Ministry is also in talks with the European Union to allow more time for the bank to sell its viable assets, he said.

“There are intensive consultations about whether there could be ‘bad-bank’ parts like the German or the previous Austrian model,” Faymann said after the weekly government meeting. “The goal is to manage as many assets as possible as beneficial as possible.”

Austria is under pressure by EU Competition Commissioner Joaquin Almunia, who is reviewing state aid of as much as 2.2 billion euros ($2.9 billion) the country has provided to the lender since 2008. A firesale of the bank’s assets by the end of the year may cause as much as 14 billion euros of additional losses for Austrian taxpayers, according to a central bank document cited by Profil magazine April 27….”

Comments »The Pound Lifts Against the Dollar and the Euro for the First Monthly Gains in a While

“The pound headed for its biggest monthly gain versus the dollar since September as a report showed British banks granted more loans for homes in March than analysts predicted, adding to signs the economy is improving.

Sterling was set for its first monthly advance against the euro since July even as a report showed U.K. consumer confidence unexpectedly declined in April. Futures traders decreased their bets that the pound will weaken against the dollar, figures from the Washington-based Commodity Futures Trading Commission showed last week. U.K. government bonds were little changed as the Debt Management Office sold 50-year inflation-linked gilts at a record-low yield.

“If you look at speculative positions, accounts are still fairly short the pound,” said Kasper Kirkegaard, a senior currency strategist at Danske Bank A/S (DANSKE) in Copenhagen, referring to a bet that the price of an asset will fall. “That’s been gradually scaled back and we can see potential for it to go even higher in the short term.”

The pound was little changed at $1.5479 at 12:38 p.m. London time after climbing to $1.5546 yesterday, the most since Feb. 15. The U.K. currency has gained 1.9 percent this month. Sterling traded at 84.47 pence per euro after appreciating to 83.98 pence on April 26, the strongest since Jan. 24. It has risen 2 percent against the common currency in April.

Britain’s currency may weaken to $1.43 and 88 pence per euro in six months’ time, Danske Bank’s Kirkegaard said. The median predictions in Bloomberg surveys of economists and strategists is for the British currency to end the year at $1.49 and 85 pence per euro.

Mortgage Approvals…”

Comments »The Euro and European Bond yields Fall as Low Inflation Raises Easing Prospects

“European government bonds rose, pushing French yields to a record low, and the euro weakened as slowing inflation boosted the prospect of more central bank stimulus. Futures on the Standard & Poor’s 500 Index (SPX) were little changed after the gauge closed at an all-time high yesterday.

French 10-year bond yields fell as low as 1.70 percent as of 7:25 a.m. New York time, while the euro weakened against all but two of its 16 major peers. The MSCI All-Country World Index of shares added 0.2 percent, extending the highest level since June 2008. European stocksheaded for an 11th month of gains, and corn for July delivery advanced 0.8 percent to $6.65 a bushel in Chicago. Treasuries rose…”

Comments »The Aussie Dollar Gains Against Most Peer Currencies

“The Australian dollar rose to the highest in almost two weeks against its U.S. counterpart before the Federal Reserve opens a two-day meeting amid speculation it will maintain bond purchases for the foreseeable future.

The so-called Aussie rose against most of its major peers as Asian stocks gained and data showed private sector credit increased in March. Demand for New Zealand’s dollar was limited after the nation’s building approvals unexpectedly declined, easing pressure on the Reserve Bank to tighten monetary policy.

“There could be more reserve diversification flowing into currencies like the Australian dollar,” said Jonathan Cavenagh, a strategist at Westpac Banking Corp. (WBC) in Singapore. “The general consensus is that the Fed is going to remain fairly dovish. The question is not whether or not quantitative easing is going to be maintained, but if it’s going to be stepped up, and that’s played a part in the U.S. dollar’s recent selloff.”

The Australian dollar touched $1.0372, the highest level since April 17, before trading 0.1 percent higher than yesterday at $1.0358 as of 5:08 p.m. in Sydney, trimming its monthly slide to 0.6 percent. The currency rose 0.2 percent to NZ$1.2105. New Zealand’s dollar slid 0.1 percent to 85.57 U.S. cents.

Australian government bonds rose, with the yield on 10-year debt falling one basis point, or 0.01 percentage point, to 3.09 percent, after touching 3.077 percent, matching the lowest since Nov. 19. The three-year rate dropped as low as 2.57 percent, a level unseen since Dec. 3.

The MSCI Asia Pacific Index of stocks climbed 0.8 percent, following a 0.7 percent gain in the MSCI World Index yesterday.

FOMC Meeting…”

Comments »Taiwan’s GDP Grows Slower Than Estimated in Q1

“Taiwan’s economy expanded at a slower pace than economists estimated in the first quarter as a faltering global recovery hurt exports, increasing pressure on the central bank to extend an interest-rate pause to aid growth.

Gross domestic product rose 1.54 percent in the three months through March from a year earlier, after increasing 3.72 percent in the fourth quarter, the statistics bureau said in a preliminary report in Taipei today. The gain was less than all estimates in a Bloomberg Newssurvey of 17 economists, where the median was 3.1 percent.

The island’s growth slowdown adds to signs of a cooling global economy after China and the U.S. expanded less than analysts estimated last quarter. Taiwan’s export orders and industrial output for March unexpectedly fell, while Japanese and South Korean production missed forecasts as faltering demand limitsAsia’s recovery.

“Taiwan’s GDP is a reflection of a sluggish global recovery and the decline of global demand, notably from China (CNGDPYOY),” said Raymond Yeung, a Hong Kong-based senior economist at Australia & New Zealand Banking Group Ltd. The data suggests the monetary policy stance will be maintained, “unless there is a significant contraction of the regional economies from unforeseeable risks, including avian flu.”

The benchmark Taiex stock index gained 0.8 percent at 9:53 a.m. in Taipei. The Taiwan dollar climbed 0.3 percent to NT$29.464 against its U.S. counterpart, according to Taipei Forex Inc. It has declined about 1 percent this year.

Lowest Profit….”

Comments »Asia Has a Small Bounce, Europe is Mixed, and U.S. Futures Digest

Yields for Italy, Spain, France, and Germany …

Comments »Fun With Wire Tapping

“When one conspires to violate federal law, it helps to have a government agency or two as one’s co-conspirators when law enforcement comes poking around, as telecom giant AT&T and others learned recently when the Defense Department (DOD) and theDepartment of Homeland Security (DHS) successfully pressured the Justice Department(DOJ) to agree secretly not to prosecute blatantly illegal wiretaps conducted by AT&T and other Internet service providers at the request of the agencies.

Although some press reports have termed this an authorization of activity that would otherwise be illegal, this is a misnomer. The executive branch lacks the power to retroactively declare criminal conduct to be lawful, but it can choose to ignore it by waiving prosecution pursuant to “prosecutorial discretion.”

Although the secret DOJ prosecution waiver initially applied to a cyber-security pilot project—the DIB Cyber Pilot—that allowed the military to monitor defense contractors’ Internet links, the program has since been renamed Enhanced Cybersecurity Services and is being expanded by President Obama to allow the government to snoop on the private networks of all companies operating in “critical infrastructure sectors,” including energy, healthcare, and finance starting June 12.

“The Justice Department is helping private companies evade federal wiretap laws,” warned Marc Rotenberg, executive director of the Electronic Privacy Information Center, which obtained more than 1,000 pages of government documents relating to the issue via a Freedom of Information Act request. “Alarm bells should be going off.” …”

Comments »Fun With Fracking

“A truck carrying drill cuttings from a fracking site set off a radiation alarm at a landfill in Pennsylvania. Emitting gamma radiation ten times higher than the permitted level, the waste was rejected by the landfill.

After the alarm went off, the MAX Environmental Technologies truck was immediately quarantined and sent back to the Marcellus Shale fracking site it had come from in Greene County, Va. The 159-acre Pennsylvania landfill site accepts residual and hazardous waste, but the cuttings were too radioactive for the site to safely dispose.

The Pennsylvania landfill, located in South Huntingdon, rejects waste that emits more than 10 microerm per hour of radiation. The fracking materials were found to emit 96 microerm per hour of Radium 226 – a rate that is 84 times higher than the Environmental Protection Agency’s air-pollution standard and ten times higher than the landfill’s permitted level, Forbes reports.

Exposure to the materials taken from the fracking site can have serious health consequences, including the risk of developing cancer. The high level of radiation emitted by the materials serves as alarming news for environmentalists and residents located near hydraulic fracturing sites across the US.

“Long-term exposure to radium increases the risk of developing several diseases,” the EPA writes. “Inhaled or ingested radium increases the risk of developing such diseases as lymphoma, bone cancer and diseases that affect the formation of blood, such as leukemia and aplastic anemia… External exposure to radium’s gamma radiation increases the risk of cancer to varying degrees in all tissues and organs.”

The drill cuttings have been sent back to the well pad where they were extracted. The production company, Rice Energy, must now apply to have the waste discarded at other landfill sites that accept materials with higher levels of radiation….”

Comments »

Fun With Your Money

Well perhaps ghost money is not really your money….but the fun is there indeud!

“April 29 (Reuters) – Tens of millions of U.S. dollars in cash were delivered by the CIA in suitcases, backpacks and plastic shopping bags to the office of Afghanistan President Hamid Karzai for more than a decade, the New York Times says, citing current and former advisers to the Afghan leader.

The so-called “ghost money” was meant to buy influence for the Central Intelligence Agency (CIA) but instead fuelled corruption and empowered warlords, undermining Washington’s exit strategy from Afghanistan, the newspaper quoted U.S. officials as saying.

“The biggest source of corruption in Afghanistan”, one American official said, “was the United States.”

The CIA declined to comment on the report and the U.S. State Department did not immediately comment. The New York Times did not publish any comment from Karzai or his office.

“We called it ‘ghost money’,” Khalil Roman, who served as Karzai’s chief of staff from 2002 until 2005, told the New York Times. “It came in secret and it left in secret.”

There was no evidence that Karzai personally received any of the money, Afghan officials told the newspaper. The cash was handled by his National Security Council, it added.

In response to the report, Karzai told reporters in Helsinki after a meeting with Finnish leaders that the office of the National Security Council had been receiving support from the U.S. government for the past 10 years. He said the amounts had been “not big” and the funds were used for various purposes including assistance for the wounded….”

Comments »Samurai Abenomics Fails as Deflation Worsens

“We’re getting deeper and deeper into the experiment now known as “Abenomics” in Japan. Ultimately, the plan is designed to defeat the decades of deflationary pressures in the Japanese economy. They’ve announced a massive fiscal plan, an official 2% inflation “target” a doubling of the BOJ’s balance sheet and as a result the Yen has declined 30% in a matter of months and the Japanese stock market has surged over 60%. By the looks of the market reaction you’d think that something had not just changed, but that we’d be looking at a new economy entirely.

But the latest CPI report shows that the deflation is actually WORSENING. The Statistics Bureau in Japan reported that Japan’s National Core CPI fell to -0.5% in march, down from -0.3%. This was worse than expectations of -0.4%. The headline rate fell to -0.9% versus expectations of -0.8%.

The latest reading is the worst reading since 2010. In fact, it’s the worst reading this year and down almost 1% from when the aggressive Japanese easing was first announced. In other words, if Abenomics is inflating prices it certainly isn’t working in the real economy and appears to only be “working” where gamblers are placing bets that it will eventually show itself….”

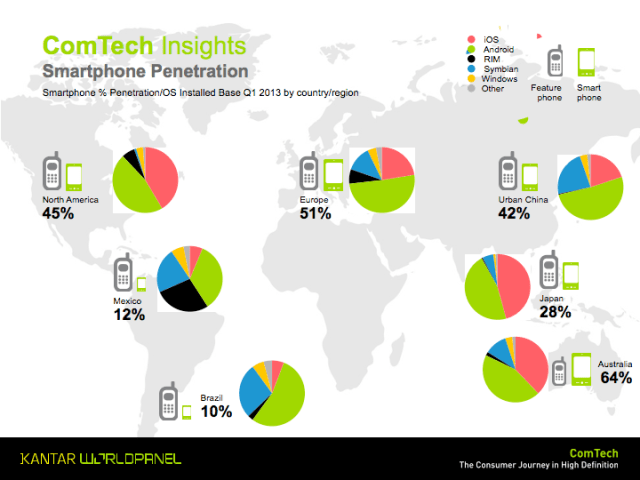

Comments »$GOOG’s Android Grabs 64% of All Smartphone Sales Globally in Q1

“Google’s mobile OS Android continues to power ahead as the world’s most popular smartphone platform, according to figures out today from Kantar Worldpanel Comtech, the WPP-owned market research company that tracks sales of handsets across key markets on a 12-week rolling cycle. In the nine markets surveyed by Kantar — Australia, China, France, Germany, Italy, Japan, Spain, UK and the U.S., all detailed in the table below — Android on average accounted for 64.2% of all handset sales in the 12 weeks that ended March 31.

The only market where Android did not dominate was Japan, where Apple’s iOS just about eked out a lead against it (49.2% versus 45.8% of sales) for the three months ending March 31. Elsewhere, the figures indicate that regardless of whether the market is developed (U.S., UK, Germany) or emerging (China) or struggling financially (Spain), collectively, Android handset makers are winning them all, with sales figures for the platform reaching their high point in Spain, at 93.5% of all smartphone sales.

As you can see below, when it comes to smartphone penetration of actual devices in use, Android is leading everywhere.

Kantar — which bases its figures on (as samples) 240,000 interviews annually in the U.S. and some 1 million across Europe — believes that Android’s lead will only grow more in the months ahead, with the ongoing roll out of two new Android handsets, the Galaxy S4 from Samsung and the HTC One, driving sales of the platform.

“We expect to see a further spike in [Android’s] share in the coming months, as sales from the HTC One start coming through and the Samsung Galaxy S4 is launched,” writes Dominic Sunnebo, global consumer insight director at Kantar Worldpanel ComTech. “This will pile pressure on Apple, BlackBerry and Nokia to keep their products front of consumers’ minds in the midst of a Samsung and HTC marketing blitz.” …”

Comments »