“The dollar strengthened before reports economists said will show manufacturing in the Philadelphia region expanded, while first-time jobless claims were near the lowest since January 2008.

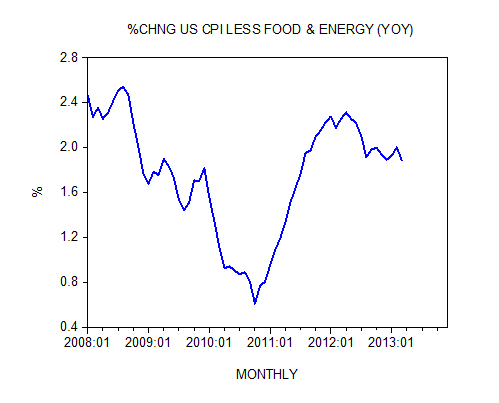

The U.S. currency rose against all its 16 major counterparts after Federal Reserve Bank of Philadelphia President Charles Plosser said he favors phasing out the central bank’s asset purchases. The euro weakened for a sixth day against the greenback, the longest losing streak in 12 months, after a report confirmed consumer-price inflation in the region slowed to the least in three years in April. Australia’s dollar slid to an 11-month low as commodity prices declined.

“There’s been a change in expectations with respect to the dollar,” said Jane Foley, a senior currency strategist at Rabobank International in London. “May has brought news which is more constructive. If the U.S. continues notching better growth data, it brings in the likelihood that the Fed will start paring its asset purchases.”

The dollar rose 0.4 percent to 102.68 yen at 7 a.m. in New Yorkafter climbing to 102.76 yesterday, the strongest since October 2008. The U.S. currency appreciated 0.2 percent to $1.2867 per euro after reaching $1.2843 yesterday, the strongest since April 4. The six-day gain is the longest since May 2012. The single currency advanced 0.3 percent to 132.11 yen.

Manufacturing Expands

The Fed Bank of Philadelphia’s general economic index rose to 2 in May from 1.3 the prior month, according to the median estimate of economists in a Bloomberg survey. Initial jobless claims were at 330,000 in the week through May 11, U.S. Labor Department data will say today, a separate Bloomberg survey showed. That compares with a reading of 323,000 a week earlier, the least since January 2008….”

Comments »