In Play ,

Comments »Monthly Archives: April 2013

Initial Claims: Prior 385k, Market Expects 365k, Actual 346k

Bitcoin Becomes Oh Shitcoin

It looked like a Garvestone Doji was forming on Tuesday, but we had a parabolic spike yesterday to $260 with a reversal down to the low $100s closing at $180.

Comments »

Hussman: Profits Will Fall and Stocks Will Tank

“Fund manager John Hussman of the Hussman Funds has been hammering on what is probably the biggest risk to future stock performance:

The risk that today’s record-high profit margins will fall, taking corporate earnings down with them.

Those who want stocks to keep charging higher have come up with a list of many reasons why it’s “different this time” and today’s profit margins will keep on increasing. These include:

- Almost half of big corporate profits now come from international operations, so profit-to-US GDP measures aren’t meaningful

- The source of the high profit margins is efficiency and low labor costs, and those gains will continue (labor glut, high unemployment, etc.)

- There is no law that says profit margins HAVE TO drop…

Those points have some merit.

But the idea that it really is “different this time” and that corporate profit margins will now remain at record levels forever seems, at best, dreamy.

After all, this is what profit margins (blue) have done in the past….”

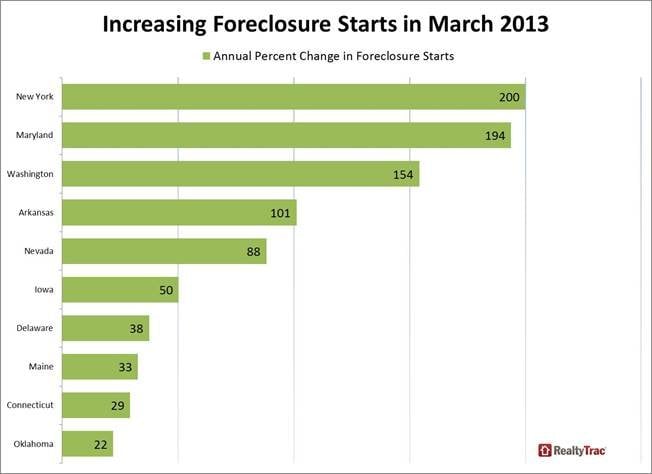

Comments »Realtytrac: NYC Sees a 200% Jump in Foreclosures

RealtyTrac: US Home Repossessions Fell in March

“LOS ANGELES (AP) — The number of U.S. homes repossessed by lenders last month fell to the lowest level in more than five years, the latest evidence that the nation’s foreclosure crisis is abating amid an improving housing market.

While some states still saw increases in homes taken back by banks, nationally home repossessions fell 3 percent in March from the previous month and were down 21 percent from a year earlier,foreclosure listing firm RealtyTrac Inc. said Thursday.

Thirty-four states posted annual declines in completed foreclosures. Among those bucking that trend: Arkansas, Maryland, Washington and Pennsylvania.

All told, lenders repossessed 43,597 homes last month, the lowest level since September 2007.

At the current monthly pace, completed foreclosures will total roughly 550,000 this year, down from 671,000 last year, RealtyTrac said.

An uptick in homes that entered the foreclosure process last month, however, may end up pushing that total to 600,000, said Daren Blomquist, a vice president at RealtyTrac.

Several factors are contributing to the decline in completed foreclosures: Steady job growth and ultra-low mortgage rates are helping the once-battered housing market recover, driving demand for homes and prices upward.

Higher home values help restore equity to homeowners, which can help those at risk of foreclosureby improving their chances of refinancing their mortgage to a lower payment or place them in a better position to sell their home.

Meanwhile, states like California, Nevada and others have passed laws to increase homeowners’ protections from foreclosure. Those laws have effectively delayed the pace of homes entering the foreclosure process, which has helped to thin the pipeline of completed foreclosures in those states.

Even so, the number of foreclosure starts, or homes that entered the foreclosure process, edged higher for the second month in a row in March….”

Comments »$PL to Buy Axa’s U.S. Life Insurance Portfolio for $1.1 Billion

“(Reuters) – Protective Life Corp agreed to buy a portfolio of old policies from French insurer AXA SA’s U.S. business for $1.1 billion, with the aim of squeezing more value out of them.

Birmingham, Alabama-based Protective Life said the deal with Axa’s Mony Life Insurance Companyshould produce a steady income stream and increase earnings per share. Most of the policies are life insurance written before 2004.

AXA, which bought Mony in 2004 for $1.5 billion, will take a capital loss of below 100 million euros ($131 million), in part attributable to the difference between what it paid for the business initially and what it is being sold for now.

Last month, people familiar with the situation said Protective Life was the leading candidate to buy U.S. life insurance assets from Axa, which has been expanding into emerging markets while scaling back its presence in North America after years of underperformance in that region.

AXA said on Thursday it would continue to use Mony Life to write new business in the United States.

“This transaction allows us to further grow our US business where we have been achieving good momentum while freeing up capital invested in closed portfolios to improve our financial flexibility and enable additional investment in high-growth markets and businesses,” AXA Chief Executive Henri de Castries said in a statement.

AXA shares were up 1.2 percent at 3.38 a.m ET, outperforming the European insurance sector <.sxip>, which was up 0.4 percent.

The transaction values the portfolio at 0.7 times its book value, a premium to AXA’s own book value, a Paris-based analyst said. AXA trades at 0.6 times book, according to Thomson Reuters data….”

Comments »Bill Ackman Says He is Still Hanging With $JCP

“Two days after J.C. Penney’s board of directors ousted Ron Johnson from the chief executive role, hedge fund manager and board member Bill Ackman has broken his silence to say he’s sticking by the beleaguered department store retailer, according to a report.

“We’re not going anywhere,” Ackman told “Women’s Wear Daily” in his first public comments about the retailer since Johnson was fired. “In fact, we’re going the other direction. We’re digging in.”

On Monday, the company announced that former CEO Mike Ullman, who held the position from 2005 to 2011, would take over again in the middle of a planned multi-year turnaround that hasn’t gone well so far.

Last year, comparable same-store sales dropped 25 percent as J.C. Penney customers turned away from its new everyday low price strategy, which replaced heavy discounting and couponing.

As sales have slid, so has the value of both the company’s stock price and Ackman’s Pershing Square Capital Management fund’s stake in the company. The fund currently holds 17.8 percent of the retailer’s outstanding shares.

The fund manager helped recruit Johnson last year, and had previously defended him throughout the company’s struggles but turned more critical of Johnson on Friday, shortly before he was fired….”

Comments »$CVX Reports a Decline in Refinery Production After a Strong Q4

“Chevron, the second-largest U.S. oil company, said on Wednesday its production of oil and gas has declined from a relatively strong fourth quarter while work on two of its three biggest U.S. refineries cut into downstream performance.

Output from oil and gas wells – accounting for about nine tenths of the company’s business – declined in the first two months of the first quarter from the previous quarter, due to maintenance in the Gulf of Mexico and weather-related downtime elsewhere.

Maintenance at Chevron’s largest refinery in Pascagoula, Mississippi, the ninth-largest refinery in the country, led to a decline of 145,000 barrels per day in U.S. refining input from the previous quarter to 557,000 bpd.

Its domestic refining operations have already been hit hard by the shutdown of a key unit at its plant in Richmond, California, after a fire last August. That unit is due to start up at some point this quarter.

In the second quarter of 2012 – the last period of full U.S. refining production before the fire – input was 928,000 bpd.

Unlike past quarters, the San Ramon, California-based company did not indicate where its first-quarter earnings were headed in its quarterly interim update on Wednesday….”

Comments »$YUM Reports Declining Sales in China Amid Bird Flu Concerns

The Fed’s Plosser Calls for QE Reduction Given Gains in the Labor Market

Not sure how a drop in the participation rate is a gain in unemployment, but never the less some call this a win for improving unemployment.

Comments »U.S. Futures Point to Another Record High

DOW and S&P futures are indicating a higher open. Markets will make the final decision after initial claims at 8:30am. Last week intitial claims and employment data suggested a shift in momentum.

Currently NASDAQ futures look not so good, but yesterday the NASDAQ put in the best upside performance.

Comments »Expectations for Inflation Climb to 4.5 Year Highs in the U.K.

“The U.K. 10-year break-even rate, an index of annual inflation expectations, climbed to the highest level in more than 4 1/2 years after the nation sold index-linked securities at an auction today.

The 30-year break-even rate was close to the highest in almost two years as the Debt Management Office sold 1.6 billion pounds ($2.5 billion) of inflation-linked gilts maturing in 2024 in the second bond sale of the fiscal year starting this month. The pound advanced to the highest level in seven weeks against the dollar. U.K. 10-year government bonds were little changed.

“There is ongoing demand for inflation-protected securities,” said Simon Peck, a fixed-income strategist at Royal Bank of Scotland Group Plc in London. “There’s more room to go in the 30-year area. Longer-term break-even rates can move higher.”

The 10-year break-even rate, derived from the difference in yield between gilts and index-linked securities, rose four basis points, or 0.04 percentage point, to 3.38 percentage points as of 10:52 a.m. London time, after reaching 3.39, the most since September 2008. The 30-year break-even rate was little changed at 3.47 percentage point after touching 3.51 on Feb. 14, the most since August 2011.

The U.K. sold index-linked gilts due in March 2024 at a so- called real yield of minus 1.262 percent, the debt office said on its website. Investors bid for 1.86 times the amount of securities allotted.

Gilt Yields….”

Comments »Italy Kicks Off a Successful Bond Auction With Lower Yields

“Italian borrowing costs dropped at an auction of 7.17 billion euros ($9.38 billion) of bonds today as investors shrug off risks tied to the country’s political crisis.

Italy sold 4 billion euros of a new 2.25% 2016 bond at 2.29 percent, down from the 2.48 percent on similar maturing debt March 13. Investors bid 1.40 times the amount of the new three- year bond offered, up from 1.28 times last month.

The Rome-based treasury also sold longer-term debt, placing 1.67 billion euros of 4.75% 2028 bonds and 1.5 billion euros of floating-rate 2017 bonds to yield respectively 4.68 percent and 2.74 percent. Italy sold a total of 7.17 billion euros of debt, near the 7.5 billion-euro maximum target.

“The auction was smoothly absorbed,” Annalisa Piazza…”

Comments »Slovenia Must Scramble to Solve Impending Debt Crisis

“Slovenian political leaders face mounting pressure to solve the nation’s banking woes and avert a fiscal crisis after the European Union’s sternest warning yet that action is needed.

Parliament in the capital, Ljubljana, may debate a plan to place a legal limit on debt as early as today, while a vote may be hastened in the coming days. Prime Minister Alenka Bratusek pledged to continue talks with party leaders to reach a consensus after failing to cobble together a plan last night.

Slovenia’s ailing banks have made it a target for financial markets, with shrinking demand at a debt auction this week signaling investor expectations that the country may be the next domino to fall in the 17-nation euro area. Cyprus became the region’s fifth bailout victim last month when it agreed to a 10 billion-euro ($13.1 billion) rescue.

“It’s time to act in order to break a current devastating cycle,” Saso Stanovnik and Matej Simnic, economists at Alta Invest d.d. in Ljubljana, wrote in a report today. “It’s the new government’s turn to regain confidence by proposing its own scheme to salvage Slovenia, but it has to be concrete and credible and since time for refinancing is short, it also has to be efficient and quickly implemented.”

Bad Loans

Slovenia, whose 35 billion-euro economy is the fourth smallest in the euro area, fell into the crossfire after European creditors and the International Monetary Fund forced losses on bank depositors in the aid package for Cyprus….”

Comments »Deutsche Telekom Sweetens MetroPCS Bid by Cutting Debt

“Deutsche Telekom AG (DTE) sweetened the debt terms of an October proposal to merge its T-Mobile USA unit with MetroPCS Communications Inc. (PCS) to placate shareholders.

Under what it called a “best and final offer,” Deutsche Telekom cut the amount of debt it’s imposing on the combined company by $3.8 billion, according to a statement from the Bonn- based company yesterday. The carrier also lowered the interest rate it plans to charge on the loan by half a percentage point.

The transaction has faced opposition from investor-advisory firms and some of MetroPCS’s largest shareholders, who were concerned the new company would be loaded with too much debt, threatening to scuttle Deutsche Telekom’s second attempt to sell T-Mobile in as many years. MetroPCS agreed to delay a shareholder vote to April 24 on the new terms, which would cut the loans to $11.2 billion from $15 billion.

“This puts the new company under less pressure and gives them more strategic flexibility,” said Jonathan Chaplin, an analyst with New Street Research LLP in New York. With less of a debt burden, the new company can more easily afford to make network investments and acquire more wireless airwaves, he said.

Deutsche Telekom also extended the lockup period during which it’s barred from publicly selling shares in the combined company. The time frame will now be 18 months, up from six. That may reassure investors that the German company doesn’t plan to cut and run….”

Comments »Central Bank Activity Drives Another Day of Green Equities in Europe

“European (SXXP) stocks advanced for a fourth day, as retailers and household-goods makers rallied, before a report that may show American unemployment claims fell. U.S. index futures and Asian shares also rose.

Marks & Spencer (MKS) Group Plc climbed the most in three weeks after posting sales growth that exceeded projections. Ashmore Group Plc jumped the most in four years as its assets under management increased. Eurasian Natural Resources Corp. dropped 5.1 percent after a report that its chairman has threatened to quit. Evraz (EVR) Plc declined the most since November 2011 as it refrained from announcing a final dividend for 2012.

The Stoxx Europe 600 Index added 0.5 percent to 294.77 at 10:25 a.m. in London, for the longest winning streak since Jan. 4. The gauge has erased its losses so far this month, after rallying for 10 successive months. Futures on the Standard & Poor’s 500 Index rose 0.2 percent, while the MSCI Asia Pacific Index gained 1.5 percent to a 20-month high.

“We’ve clearly got the equity markets underpinned by the continuation of quantitative easing in the States and the aggressive easing of monetary policy in Japan,” Bob Parker, who helps oversee about $400 billion as senior adviser at Credit Suisse Asset Management in London, told Francine Lacqua on Bloomberg Television. “I think the next move will be some form of easing by the European Central Bank. If we do have a correction — and I use the word ‘if’ — it’s going to be very minor indeed.”

The volume of shares changing hands in companies on the Stoxx 600 was 18 percent greater than the average of the past 30 days, according to data compiled by Bloomberg.

American Jobs…”

Comments »The Yen Takes a Rest From Free Fall to 100

“The yen halted a decline that took it to within 0.1 percent of 100 per dollar after official data showed Japanese investors sold foreign bonds.

The yen was supported as a technical indicator signaled the currency may pare its 6.6 percent loss against the greenback since the Bank of Japan (8301) expanded monetary easing last week. Australia’s dollar halted a five-day gain versus the yen after the nation’s unemployment rate unexpectedly rose. South Korea’s won appreciated for a third day after the central bank kept its key rate unchanged….”

Comments »$TM Joins Recall With $HMC & $NSANY on Faulty Airbags

“Takata Corp. (7312) faces its biggest recall crisis in almost two decades after defective airbag inflators led Toyota Motor Corp. (7203), Honda Motor Co. (7267) and Nissan Motor Co. to call back more than 3 million vehicles.

The Japanese safety-gear producer made the products from 2000 to 2002, Takata spokesman Hideyuki Matsumoto said, declining to comment on its customers, who identified the supplier. According to Toyota, malfunctioning inflators could cause the airbag to deploy abnormally during a crash.

Takata tumbled as much as 15 percent in Tokyo trading after Japan’s three biggest carmakers made the announcements. It’s the biggest recall involving Takata since 1995, when several automakers called back almost 9 million vehicles to replace faulty seat belts made by the Japanese company — a record for the auto industry at the time.

“It looks like the cost of the recalls may be pretty big,” saidSatoru Takada, a Tokyo-based analyst at Toward the Infinite World Inc., referring to Takata. “It doesn’t seem like something that would be easy to identify and fix. But if the cause is clear, it shouldn’t have a lasting effect.”

Takata, which says it’s the second-biggest maker of automotive safety parts, fell 9 percent to close at 1,819 yen in Tokyo, the biggest drop in two months. Autoliv Inc. (ALV), the world’s biggest maker of airbags, rose as much as 1.6 percent in Stockholm.

Toyota rose 5.8 percent to 5,640 yen, Nissan gained 4.4 percent and Honda rose 3.1 percent in Tokyo. The benchmark Nikkei 225 (NKY) Stock Average climbed 2 percent.

Other Recalls…”

Comments »China Walks a Fine Line as Money Supply and Risks of Tight Credit Grow

“China’s new yuan loans and money supply exceeded analyst estimates last month, aiding the nation’s recovery from the slowest growth in 13 years while adding to financial risks that may presage tighter credit.

New local-currency lending in March was 1.06 trillion yuan ($171 billion), the People’s Bank of China said today in Beijing. That compares with the 900 billion yuan median estimate in a Bloomberg News survey of 34 economists and 620 billion yuan in February. M2, China’s broadest measure of money supply, rose 15.7 percent, compared with the median forecast for 14.6 percent.

New Premier Li Keqiang is trying to keep credit flowing to sustain an economic rebound without creating asset bubbles or excessive risks in the banking system. While inflation eased more than forecast last month, Fitch Ratings Ltd. cut the nation’s long-term local-currency debt rating this week, citing dangers to financial stability.

“China’s monetary policy makers are in a tough position to balance short-term growth stability, market worries and long- term economic health,” said Lu Ting, Hong Kong-based chief economist for Greater China at Bank of America Corp.

While growth momentum is “not strong” and “external conditions are still volatile,” the data “could once again trigger fears on CPI inflation, property bubbles, government debt, shadow banking and then monetary tightening,” Lu said in a note today, referring to the consumer price index. (SHCOMP)