Given all the family wealth why in the world would you do said things ?

Comments »Monthly Archives: August 2011

50 Stocks that Have Been Destroyed Over the Past Two Weeks

No. Ticker 2-week Return Industry Market Cap

1 TNAV -56.74 Communication Equipment 405,100,000

2 STEC -46.36 Data Storage Devices 486,500,000

3 CBR -45.75 Information Technology Services 367,440,000

4 HOLI -43.84 Chinese Burritos 342,920,000

5 PCS -40.87 Wireless Communications 3,680,000,000

6 FBC -37.34 Savings & Loans 409,870,000

7 CVGI -36.50 Auto Parts 261,840,000

8 AGP -35.86 Health Care Plans 2,450,000,000

9 VPRT -35.74 Business Services 1,210,000,000

10 IMAX -35.71 Photographic Equipment & Supplies 1,130,000,000

11 TZOO -35.62 Internet Information Providers 912,430,000

12 GOL -34.34 Regional Airlines 2,050,000,000

13 AVID -33.81 Specialty Retail, Other 488,600,000

14 KFRC -33.77 Staffing & Outsourcing Services 513,310,000

15 EXAM -33.13 Business Services 728,510,000

16 KRA -32.92 Chemicals – Major Diversified 1,110,000,000

17 IPHI -32.87 Semiconductor – Broad Line 320,140,000

18 SSYS -32.85 Computer Peripherals 538,840,000

19 LEAP -32.72 Wireless Communications 807,210,000

20 KND -32.63 Long-Term Care Facilities 558,110,000

21 VDSI -32.55 Security Software & Services 345,540,000

22 ONTY -32.25 Biotechnology 306,970,000

23 PCX -32.13 Industrial Metals & Minerals 1,610,000,000

24 GTIV -31.72 Home Health Care 415,530,000

25 CLWR -31.56 Wireless Communications 551,490,000

26 FOE -31.40 Specialty Chemicals 849,100,000

27 AMCC -31.37 Semiconductor – Integrated Circuits 366,860,000

28 AKS -31.33 Steel & Iron 1,220,000,000

29 ACOM -31.28 Internet Information Providers 1,490,000,000

30 ALU -31.03 Communication Equipment 7,990,000,000

31 HCA -30.83 Hospitals 13,270,000,000

32 TEX -30.69 Farm & Construction Machinery 2,160,000,000

33 HRC -30.56 Medical Instruments & Supplies 2,140,000,000

34 KAI -30.55 Paper & Paper Products 292,100,000

35 DEPO -30.06 Drug Manufacturers – Other 349,950,000

36 IO -29.93 Scientific & Technical 1,490,000,000

37 OCZ -29.35 Data Storage Devices 382,170,000

38 LINC -29.14 Education & Training Services 390,180,000

39 QTM -28.66 Data Storage Devices 557,350,000

40 ENSG -27.81 Long-Term Care Facilities 447,530,000

41 WNC -27.75 Trucks & Other Vehicles 469,880,000

42 HRBN -27.57 Chinese Burritos 529,690,000

43 IPG -27.55 Advertising Agencies 4,420,000,000

44 ARAY -27.51 Medical Appliances & Equipment 381,980,000

45 BPAX -27.45 Biotechnology 265,980,000

46 MOH -27.42 Health Care Plans 991,760,000

47 BRKR -27.35 Scientific & Technical 2,700,000,000

48 TQNT -27.33 Semiconductor – Integrated Circuits 1,250,000,000

49 AONE -27.22 Industrial Electrical Equipment 560,520,000

50 JNPR -27.16 Networking & Communication Devices 12,130,000,000

Lunch Break: Please Forget You New My Name

Are shale gas companies overstating reserves?

Comments »NEW YORK (CNNMoney) — Recent reports of an investigation by the Securities and Exchange Commission into whether shale gas companies are overstating their gas reserves highlights the challenges investors face in navigating this emerging sector.

Last week a research note from the investment management firm Robert W. Baird, citing industry lawyers, said the SEC is looking into whether shale gas companies may be overestimating the amount of natural gas they hold beneath the ground.

The investigation is most likely politically motivated and not entirely unwelcome, the note said, sparked by congressional calls for SEC action following a scathing report in the New York Times questioning the reserves held by some shale gas firms.

“We view it as appropriate and expected for the SEC to evaluate compliance with new regulations if compliance is publicly questioned,” Christine Tezak, an energy and environmental policy analyst at Baird, wrote in the note. “A regulatory investigation may provide a clearer investment horizon than a ‘trial’ in the press.”

The SEC would not confirm or deny if an investigation is underway.

Syria continues brutal crackdown

Comments »CNN) — Syrian security forces on Wednesday cranked up a full-court press on the restive city of Hama, witnesses said, and the U.N. Security Council again planned to tackle the nearly five-months-long crisis in the volatile Arab land.

Citizens in Hama describe a fearful metropolis under siege by security forces amid a military offensive, according to the London-based Syrian Observatory for Human Rights, and witnesses said communications have been shut off amid the military push.

Along with its military operations, the government is dealing with the instability. Syria’s parliament, meanwhile, plans to meet on Sunday to discuss “issues related to the homeland and citizens’ interests,” the state-run Syrian Arab News Agency reported on Wednesday.

“There is a big, ongoing military operation,” said the observatory’s Rami Abdul-Rahman. His group monitors the unrest in Syria through many contacts on the ground, and his sources report hearing explosions and seeing plumes of smoke. “There are great concerns of a massacre in the city.”

“The human situation is very bad,” said an eyewitness from an opposition movement who said he is in the center of Hama and asked not to be named for security reasons. He said people are fearing 1982 again — a reference to a deadly government crackdown there a few decades ago.

There have been dozens of deaths in Hama and other Syrian cities in recent days, but there was no official word on Wednesday casualties.

However, corpses remained on the ground Wednesday after tanks occupied parts of central Hama amid heavy shelling, said a resident who fled the city — a bastion of anti-government sentiment and the site of massive demonstrations.

Residents said the city is lacking food. Power and water are scarce and residents said they fear a humanitarian crisis. Across Hama, intermittent gunfire and shelling rang out, helicopters whirled overhead and government snipers took positions, making it difficult for people to venture out, residents said.

EU: systemic capicity in doubt

Comments »BRUSSELS/ROME (Reuters) – The European Union voiced support for Italy and Spain under attack on financial markets but acknowledged that investors now doubt whether the euro zone can overcome its sovereign debt woes.

European Commission President Jose Manuel Barroso said a surge in Italian and Spanish bond yields to 14-year highs was cause for deep concern and did not reflect the true state of the third and fourth largest economies in the currency area.

“In fact, the tensions in bond markets reflect a growing concern among investors about the systemic capacity of the euro area to respond to the evolving crisis,” Barroso said in a statement.

He urged member states to speed up parliamentary approval of crisis-fighting measures agreed at a July 21 summit meant to stop contagion from Greece, Ireland and Portugal, which have received EU/IMF bailouts, to larger European economies.

But neither he nor European Monetary Affairs Commissioner Olli Rehn offered any immediate steps to stem the crisis, which has flared again with full force less than two weeks after that emergency meeting.

Italy has borne the brunt of a selloff triggered by the unresolved debt crisis and fears of a global economic slowdown. Its stocks and bonds gained some respite after a further early slump on Wednesday.

Italian Economy Minister Giulio Tremonti held two hours of emergency talks with the chairman of euro zone finance ministers, Jean-Claude Juncker, in Luxembourg but neither disclosed anything of substance after the meeting.

The European Commission said after Rehn spoke to Tremonti that Italy was “doing what is necessary to put the country back on track for higher sustainable growth and ensuring fiscal consolidation.”

A Commission spokeswoman said there had been no discussion of a bailout for Italy, which would overwhelm the bloc’s existing rescue funds.

The market turmoil caused alarm in some parts of Europe but apparent insouciance in the bloc’s biggest economy.

“Italian and Spanish bond yields rose to their new record highs. This is a very alarming and scary thing,” Finnish Prime Minister Jyrki Katainen told public broadcaster YLE. “The whole of Europe is in a very dangerous situation.”

FLASH: 10 Year Note in a Race to 2%, Gold Hits New Highs

FLASH: Art Cashin Says A Technical Breakdown in the S&P Opens Up a Downside Target of 1120

FAA Shutdown Costs Uncle Sam $1 Billion in Lost Revenues

Thanks to congress taking a vacation with unsettled bi we loose revenuesz….thought we were concerned about revenues and spiraling deficit spending. A billion saved is a billion earned….no ?

Comments »Crude Oil Inventories Build by 950k Barrels and Gasoline Saw a Build of 1.7 Million Barrels

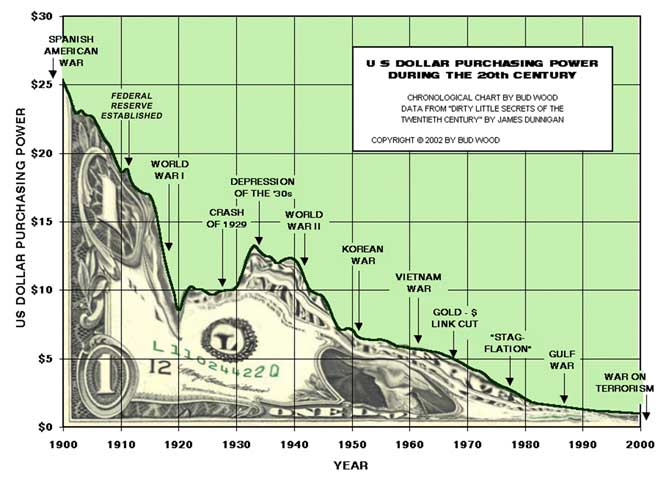

Kings of the Wild Frontier: Bill Gross Explains How Uncle Sam Plans to Steal From You

- Balance the budget and/or grow out of it

- Unexpected inflation

- Currency depreciation

- Financial repression via low/negative real interest rates

All of these guarantee that investor pocketbooks will be dramatically affected… Adversely. Let’s dig in…”

Comments »

Analysts Forecast a 17% Correction on a Closing S&P Price Below 1250

The S&P is trying to hang on to 1244-1249 currently. Currency problems, banking problems, and growth worries are climbing into Europes close leaving us to hold up world markets.

Not mention legislation in Europe will be non existent as August marks the holiday season for all.

Comments »Across the Pond: Stealth Bank Runs

Europe, specifically Italy and Greece are facing an increasing run on the banks. While this is story is conjecture it has been backed by factual data and news articles….

Comments »Commodity Trader Peter Brandt: The trendline from the 2009 low has been broken and a H&S top has been completed on the closing price chart

Peter Brandt continues his technical analysis foretelling of a major shift in technical market behavior. he feels rallies back to the trend line should be sold.

Comments »ISM Non Manufacturing Data: Prior 53.3, Mkt Expects 53.7, Actual 52.7

On The Matter of Tea Party Accomplishments

What we need is a left balance to the tea party and it will fun times for sure…

Comments »Marc Faber: “The Bear Market is Clawing its Way Back”

“When you compare equities to bonds and cash I don’t think equities are very positive,” Faber said.

“The Treasury market is telling you that the economy is in recession,” Faber told CNBC. “So if the bond market is telling you that the economies of the Western world are weakening, but at the same time the stock market is still relatively high, I think the stock market is vulnerable.”

Comments »Bill Gross Sees a QE3 Launch This Month

Moody’s & Fitch: U.S. Must Do More to Maintain Triple A Rating

Despite reaffirming our rating the rating agencies say we have more work to do.

Comments »China credit rating agency downgrades US

Woah!

They think they have a credit rating agency…

I wonder if it’s called Stand & Pours? I wish the picture on the webpage was actually in front of one of those counterfeit McDonald’s. That would really add a twist to the story.

Comments »Beijing (CNN) — Although the United States narrowly avoided an unprecedented default following congressional approval of a last-minute compromise plan to raise the debt ceiling, China’s leading credit rating agency Wednesday downgraded U.S. sovereign debt after putting it on negative watch last month.

The Dagong Global Credit Rating Company, which lowered the United States to A+ last November after the U.S. Federal Reserve decided to continue loosening its monetary policy, announced a further downgrade to A, indicating heightened doubts over Washington’s long-term ability to repay its debts.

It said the gloomy assessment — much lower than the AAA ratings given by the so-called “big three” Western agencies Moody’s, Fitch, and Standard and Poor’s — was inevitable given the level of market concern generated by the stalemate between Democrats and Republicans over the debt ceiling.

“The squabbling between the two political parties on raising the U.S. debt ceiling reflected an irreversible trend on the United States’ declining ability to repay its debts,” Dagong Chairman Guan Jianzhong told CNN.

“The two parties acted in a very irresponsible way and their actions greatly exposed the negative impact of the U.S. political system on its economic fundamentals,” he said.

Ironically, Dagong’s move could hurt not just the United States but also China, the largest foreign owner of U.S. debt with holdings worth almost $1.2 trillion.

“Our downgrade simply reflects reality,” Guan said. “Our rating didn’t cause China to lose any money — it was the inappropriately high ratings for the U.S. by Western agencies that had led China to make risky investments in U.S. debt.”

Observers say China, whose foreign exchange reserves now stand at $3.2 trillion, has had little choice but to buy U.S. Treasury bonds.

“There aren’t that many other markets that are as deep or as liquid as treasuries,” said Patrick Chovanec, an economic analyst with Tsinghua University in Beijing. “When they accumulate reserves, this is the only place they can put them.”

The privately held Dagong, founded in 1994 to rate Chinese companies, attracted worldwide attention last July when it published its first sovereign credit ratings and, citing growing deficits in the developed world, ranked China higher than the United States and Japan.

Dagong now rates 67 countries and aims to more than double the number by the end of this year. Its ambition to become an alternative to the “big three” suffered a setback, however, when the U.S. Securities and Exchange Commission refused to recognize its rating because of the commission’s inability to supervise the Beijing-based agency.

Guan, who worked as a civil servant and a Wall Street accountant before taking the helm at Dagong, is quick to defend his firm’s independence and objectivity. He points to what he calls Western agencies’ “double standard” in rating the U.S. and European economies to underscore the global need for a newcomer like Dagong.

“People are used to credit ratings issued by the ‘big three,’ but the financial crisis has clearly proved them wrong,” Guan said. “They can no longer shoulder the responsibility of rating the world.”

“That’s the role we are striving to play,” he added.