I have accepted the stupidity of America. You all know I have been a major hater of the banks. I dislike the CEO’s of our banks as if they were responsible for making my appendix burst. However, I knew, given the situation, the market would crater, without government assistance.

I understand the philosophical and moral opposition to the bailout. Why bail out Wall Street fat cats? Hell, we have gotten too lazy and decadent. It’s time to prepare for some great depression type era.

All of that resonates with my inner evil. But, it’s entirely nonsensical, if you actually take a minute to think about the repercussions.

Your banks will close and never reopen. Jp Morgan and Bank of America will not be able to buy every bullshit bank. The Fed and FDIC will fold tent and reopen as a popsicle stand. Your (low end) job is in jeopardy. Actually, your fucking grocery stores will shut down.

Many of you say “this was going to happen with or without the bailout, so let it burn.” Yeah, that might be true. Actually, I know it is. However, what the fuck are we retarded idiots? If we know what the problem is, the least we can do is try to resolve it. Apparently, our ballot box fuckers thought we needed a little tough medicine. They say: “this is the normal business cycle.”

Oh really?

Tell me how this “normal business cycle” feels when your fucking farm is seized by creditors and your local Mcdonalds shuts the fuck down, due to a credit line explosion.

This is irresponsibility on an epic level. I will now embrace it.

As for my portfolio:

I reduced my risk to nil. I took tremendous losses today, which is doubly sickening since I have been calling for this exact scenario for more than a year. At the present, I have equal shorts to longs. Therefore, I cannot “enjoy” another down 10% afternoon.

So, in closing, today’s market decline cost the “american (idiot) taxpayer” $1.4 trillion in capital destruction. Let me see, $700 billion is less than $1.4 trillion, right?

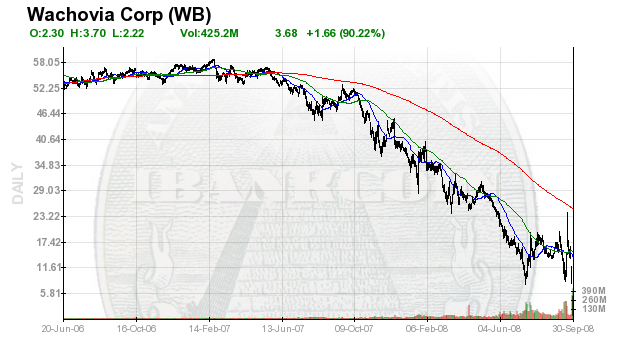

The good news: we’re not done yet. Should the BBQ eating idiots from “Main Street” continue to dominate policy, this market is going to 8,000 Dow, faster than Bob Steele golden parachutes the fuck out of this bullshit country.

Get ready for deflationary pain.

UPDATE: Looking around the wonderful world of internet blogs, most right wing sites are against the bailout, mainly because they are idiots. Liberals are always down for a little government intervention; so they are worthless. One guy is going against his audience, in support of some bailout fun.

Unfortunately, not everyone understands the ramifications. Again, they are idiots.

Comments »