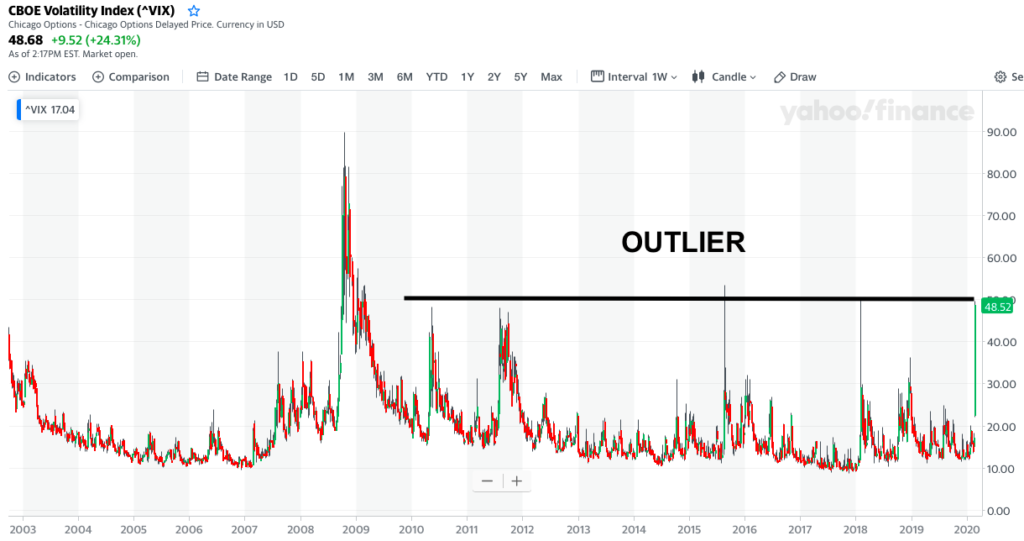

What say you? This time is truly different, or more of the same? If the same, this is a short here, meaning stocks go up.

If you enjoy the content at iBankCoin, please follow us on Twitter

18 years in Wall Street, left after finding out it was all horseshit. Founder/ Master and Commander: iBankCoin, finance news and commentary from the future.

Joined Nov 10, 2007

23,441 Blog Posts

Trump’s entire legacy hinges on this. Don’t overthink it.

Alas, he can only con so many people for so long.

Frankly, it’s looking more and more possible that the market is lower on election day 2020 than it was on election day 2016.

acehood your eyes must be brown.

Powell warned shorts this afternoon, but what can they really do? First death from the virus in the USA would certainly crash the markets.

I am fairly certain that the man in charge is praying that we’ll see the light so that we can enjoy the Rapture with him. What could go wrong?

Everybody gets AIDS. That’s the whole point. He was quite good at that back in Indiana.

Great comment Purdy but if you think Trump prays…..I think you are confusing him with George W.

Pence. You must not have received the telegram yet.

On Trump praying: does “God damn it!” count as a prayer?

I think it could be quiet for a couple of weeks (at least in US) and shorting the VIX could be good next week. We are still maybe 2 weeks away from wide-spread outbreak, schools and government buildings shutting down, etc., and a month out from when this starts to slowly go away… UNTIL NEXT FALL when the virus comes back with a vengeance.

But the outbreak is already occurring in many countries especially mid east and Europe, who are a head of us, so that might be enough to keep the fear pumped. They are supposed to start running with the Olympic torch next week and what if they cancel the Olympics? Supply shortages probably emerge in April (food, drug, manufacturing, labor shortages). By then it is campaign season and that could also start having a major effect if Brother Bernard Sanders looks like he can win it!

You think this is a special high level chess move by chinese? If you go back in time, this virus was probably released right as the trade deal happened, on purpose or not?

The Road to Correction has been quicker than the dot-come bust, quicker than the housing bust, and quicker than the ***Great Depression***. We are (over)due for an oversold bounce. At 3:42 pm, the market loaded the gun, put the barrel in its mouth (2880.62 @3:42pm) – and then decided, “Not today”. The current path is higher for Monday

Of course weekend news can alter that. *I* don’t expect the FED to annouce a cut to bail out a market that started out overbought, but waht does the *market* expect? Wil no news be seen as bad news?

At the same time, COVID-19 will not leave the TV screen anytime soon. Specifically, deaths and infections will keep increasing, at a rate **much higher than people anticipate**. Bounces should be sold.

This is what I see when I look at VIX: https://www.tradingview.com/x/DTARNTQu/ 50 MA (Monthly) only starting to head higher. VIX is trending up and heading higher no matter what happens, but the market environment suits Spastic, Mongoloid, End of Bull Market Rally rather than Market Crash. The only thing I can compare the present VIX to is the 3rd higher high for VIX in Aug 98 (except today we’ve made a 3rd lower high). Trump is keeping the economy red hot, so maybe < 2 yrs left of bull before it all falls apart, we are highly unlikely to rally as furiously as we did back 98-00.

On the chart image, you wrote: “Today’s conditions are more like this,” but its not clear what you are basing that opinion on. VIX bottom indicates the start of a stock rally in 1997, while stocks peaked at the VIX bottom in 2008. Whether you are right or wrong (“1-2 yr rally”), only time will tell, but I don’t see what in that chart supports any kind of opinion on where the market goes from here.

Just looking at your chart and ignoring any other data, it is clear that the VIX 50MA is a lagging indicator. it looks like it would be a good tool to decide when a bear market *is over* (MA peak), but not when it is starting.

Excellent time to start a short position in VXX or UVXY. Its been a 100% win rate on that stock over the last three years.

XIV crashed in 2018.

Do you have the margin it takes to short UVXY through a pandemic-induced crash?

Do you trust the lenders not to recall their shares and force you to cover?

Next week wil lne a good test. If VIX han’t dropped lower by the end of the week, then that measn we are in a new environment.

Also, “last three years”? Really? I’m assumign that you had $0 invested at the start of the last Bear market in 2006

This is actaulyl a HUGE problem in the Finacial Advisor industry: you have 10-year “veteran professionals” who have never seen a bear market. You shoudl never take investemetn advice form anybody who doesn’t have bear market investing experience, which means anybody under the age of 35.

My thoughts.. short term vix pullback.. maybe 30.. the cdc messed us up bad with there restrictive testing criteria and lack of test kits for a month. With our level of world travel and tourism and the fact that we won’t implement the level of restrictions China has until it’s too late I think we will be potentially one if the most affected when it all plays out. I honestly think super Tuesday wil be a massive spread event and numbers will skyrocket 2 weeks after with the improved testing capability. It all goes downhill from there.. pandemic announcement, public event restrictions, school closures, list goes on. I bought March $26 VIX calls and im still holding. Also bought grub fur to lazy Americans needing to eat and LRN due to school closures coming. I’ve never seen so much opportunity if you really understand the reality of what’s happening.