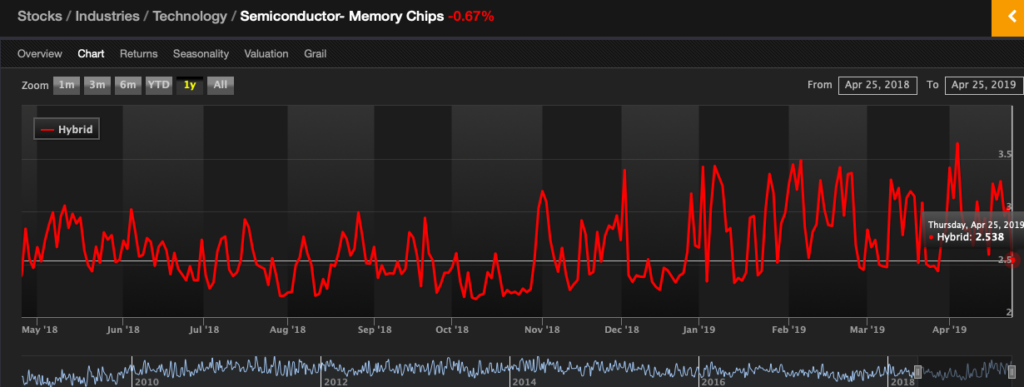

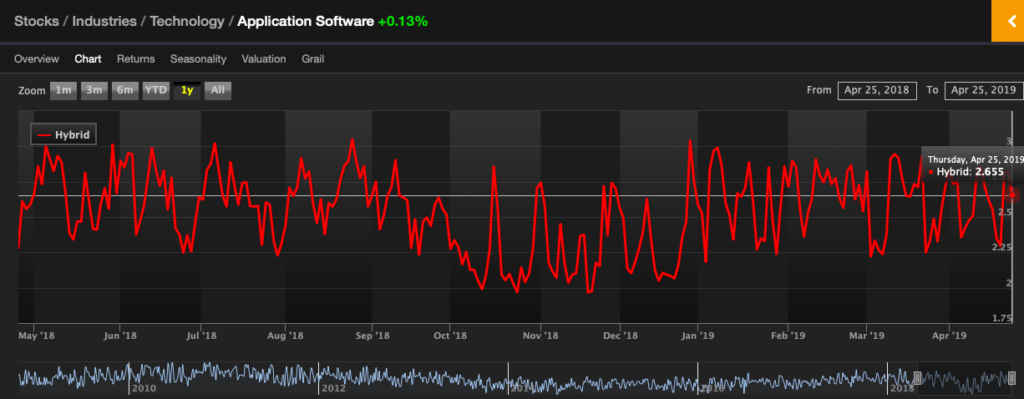

Software stocks are, by far, better than the semis. However, these two sectors tend to measure dick sizes against one another all the time. Considering INTC and XLNX just played themselves and the semis might get lit up tomorrow, I thought now would be a good time to show you a chart of the Exodus oscillator for these two fucking sectors.

Two things to consider.

- The semis are weak now, based upon all of the technical scores in memory — ranked by my computer genius brain. But it’s nowhere close to the OS levels of Oct-Dec.

- Software technicals are elevated, more near overbought levels if anything else.

While it’s possible for semis to diverge from software for an extended period, it’s not likely. My gut, these two sectors will soon correlate tightly, with software dropping like a rock or semis recovering.

We shall see.

If you enjoy the content at iBankCoin, please follow us on Twitter

Yup, but this isn’t as signifcant as the disconnect between rising stocks and rising long-term yields, or large caps at ATH and small-caps that can’t break resistance (look at March and April divergence)

As I’ve suggested to you before, the market may be adjusting to new realities re small caps v large and the affects of dollar strength relative valuations. Big companies are less likely to be importers of raw materials, and less likely to be exporters of US value-added goods than they used to be. They are more likely to be either service companies or retailers of stuff that they import from overseas. While small companies are more likely to be dependent on relatively expensive domestic labor. For now at least.

Relationships change and so must your dogma.

Yes, but as I repleid: you’re wrong 🙂

Keep in mind that the follwoing can all be true:

1) “Big companies are less likely to be importers of raw materials, and less likely to be exporters of US value-added goods than they used to be. ”

2) “small companies are more likely to be dependent on relatively expensive domestic labor”

3) Big companies are hurt by a stronger dollar more than small companies

If I have $100 and you have $10, even if my money goes down and yours goes up, I would still leikyl ahve more money than you.

Silver thinking about breaking out of declining wedge after retracing to strong support area.

Also, look at Fly’s NVDA indicator.

Was that the blow off for PINS?