Growth-fags always seem to focus on the top line, merrily toting on the line of thinking that suggests, eventually, companies will learn to convert revenues growth into profits. This is pavement ape thinking at best — utterly retarded on the surface.

Investing in money losing companies because they’re growing the top line at a frenetic pace has ruined more portfolios than parties at moonshine infused trailer parks in Alabama.

As a point in fact, I can prove to you that investing in companies with earnings growth is preferable to revenues, via Exodus.

While the differences might be small, they still prove that earnings is the true driver behind share price appreciation and not revenues.

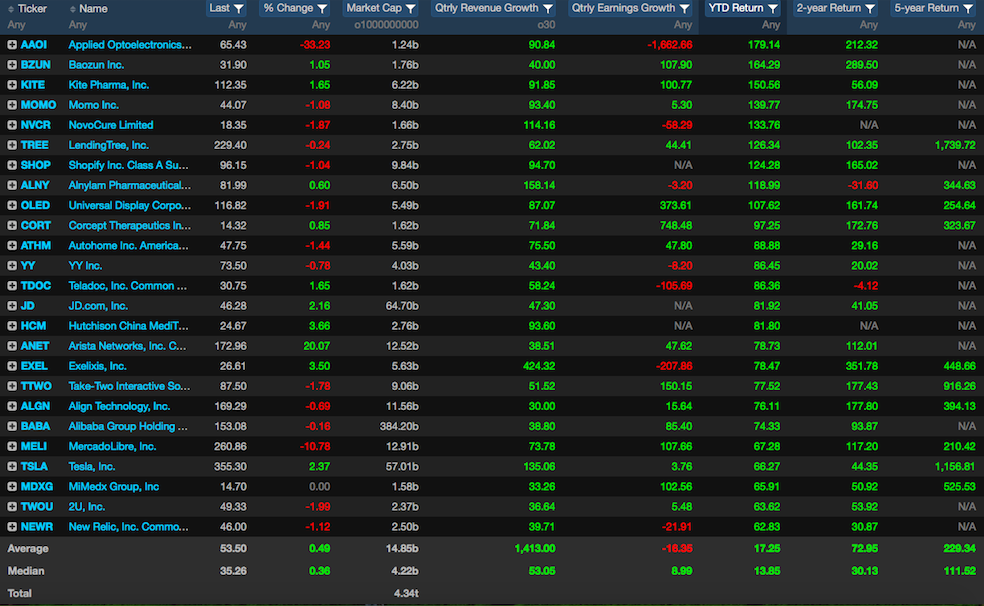

Earnings growth of +30%

Revenue growth of +30%

Year to date, the earnings screen edged out revenues by 40bps. That spread widened over 2 years to ~400 bps.

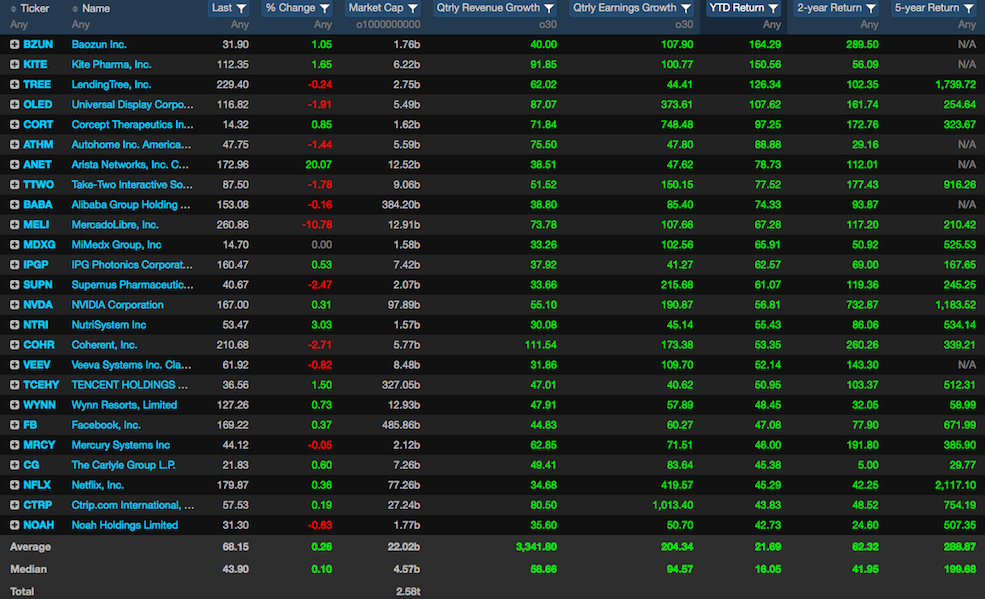

Then I came up with the novel idea: why not look for companies that possessed both earnings and revenues growth of +30%? Here were the results.

Earnings, Revenues growth of +30%

This mystical combination of both top and bottom line growth resulted in a 200bps advantage YTD, 800bps over 2 years and an 8,900bps edge over 5 years.

So here’s my question for you. If I just proved to you that narrowing your search down to companies that possessed both earnings and revenues growth of +30%, why are you still fiddling around with charts like god damned subhuman morons, hoping to find the next breakout?

If you insist to chase performance, why not narrow down your stock picking pool to only list companies that are fundamentally sound?

This is the very essence of quantitative trading. It’s not the hocus pocus that some investment advisors make it out to be. I should know, having been one for 18 years. They’ll say anything to justify their relevance. Truth is, I can do anything an advisor can do with some simple scripts, using the analytical tools inside Exodus. If you’re a serious minded investor and wanted to take control over your investments, cutting out the middle men who collect fees for bad advice, I can show you how to do it through a few simple screens and some risk hedges.

If you enjoy the content at iBankCoin, please follow us on Twitter

A+ fantastic piece Fly. Suck it chartfags.

Stock brokers are gigantic faggots.

Most dope homie

Yes, stocks of companies that had stellar sales and earnings growth over the past five years did outstandingly well. Obvious question is: What screen five years ago would have pointed you toward them?

Earning growth wins!

I still go with the great William O. Neil founder of Investor Business Daily and his focus on earnings growth.

Earnings or Revenue Growth?

corp./company with the best analysts/accountants can show you or me anything we want to see.

If they can’t jiggle things around to show us what we want to see;……that corp./company is REALLY in bad shape!!

IMO, that’s a lot of what’s going on with the stock markets now.

You are correct to a point. There’s only so much the CFO can do within a reasonable range. After that, they would be cooking the books.

This post gave me a good feeling. I’m going to follow that feeling.

LOL at the Tesla ad that displayed at the bottom of this article for me: “Tesla Reports Successful First Quarter For 2017”

Sorry if I missed it in another post somewhere–but how is your managed portfolio in Exodus doing so far?

what about “real” earnings growth vs. manipulated stock repurchase EPS?

Revenue and earnings are part of the picture they’re both important, but it’s how they’re improving/growing that really matters. In the end there are really only two legitimate strategies for investing: value and momentum. Growth of revenue and earnings play a part in both those strategies.