It’s a hard thing to do, be bullish in an era of blatant manipulation. Frankly, to be bullish is to be blind in this market. Literally, you have to embrace ignorance and say fuck it.

Technical analysis helps you do that, as it requires next to zero cognitive thinking.

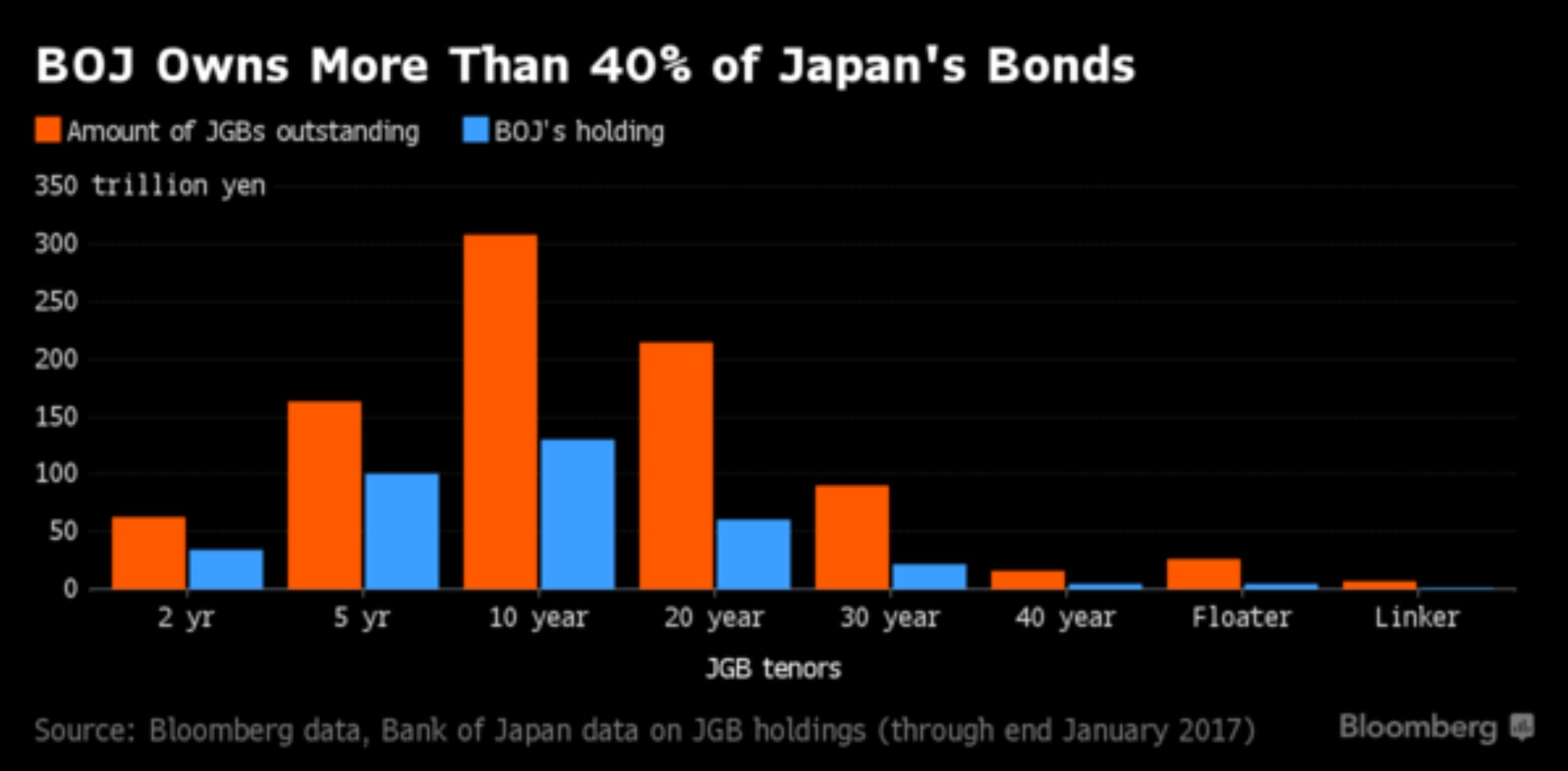

The Bank of Japan is for top 10 shareholder in 90% of Japanese companies. And, now, thanks to QE, they own 40% of the bond market.

You do see where this is going, right? An illiquid quagmire of Kafkaesque proportions.

Source: Bloomberg

The BOJ snapped up a record 2.1 trillion yen ($18 billion) of five- to 10-year JGBs between Feb. 3 and Feb. 8 — buying on three out of four trading days. The haul, which included an emergency “fixed-rate” operation, was a record for that maturity band since Kuroda started his mega-stimulus in April 2013. The central bank stepped in after 10-year yields spiked to a one-year high of 0.15 percent, threatening to becoming unhinged from the BOJ’s target.

The new regime was also aimed at steepening the yield curve — and it has certainly done that. The premium that 30-year notes offer over 10-year debt has widened since November at the fastest pace in more than six years, reaching 82 basis points last week. That contrasts with the 50 basis point level seen when yield-curve control was introduced.

And with Japanese investors selling off Treasuries at the fastest pace since 2013, it also raises the likelihood of pension funds and life insurers, which need long-term assets to meet similar liabilities, being drawn back to so-called superlong bonds — worsening the BOJ’s potential supply constraint. Also raising stimulus-sustainability issues: banks are seen getting closer to their target limits when it comes to selling down JGB holdings.

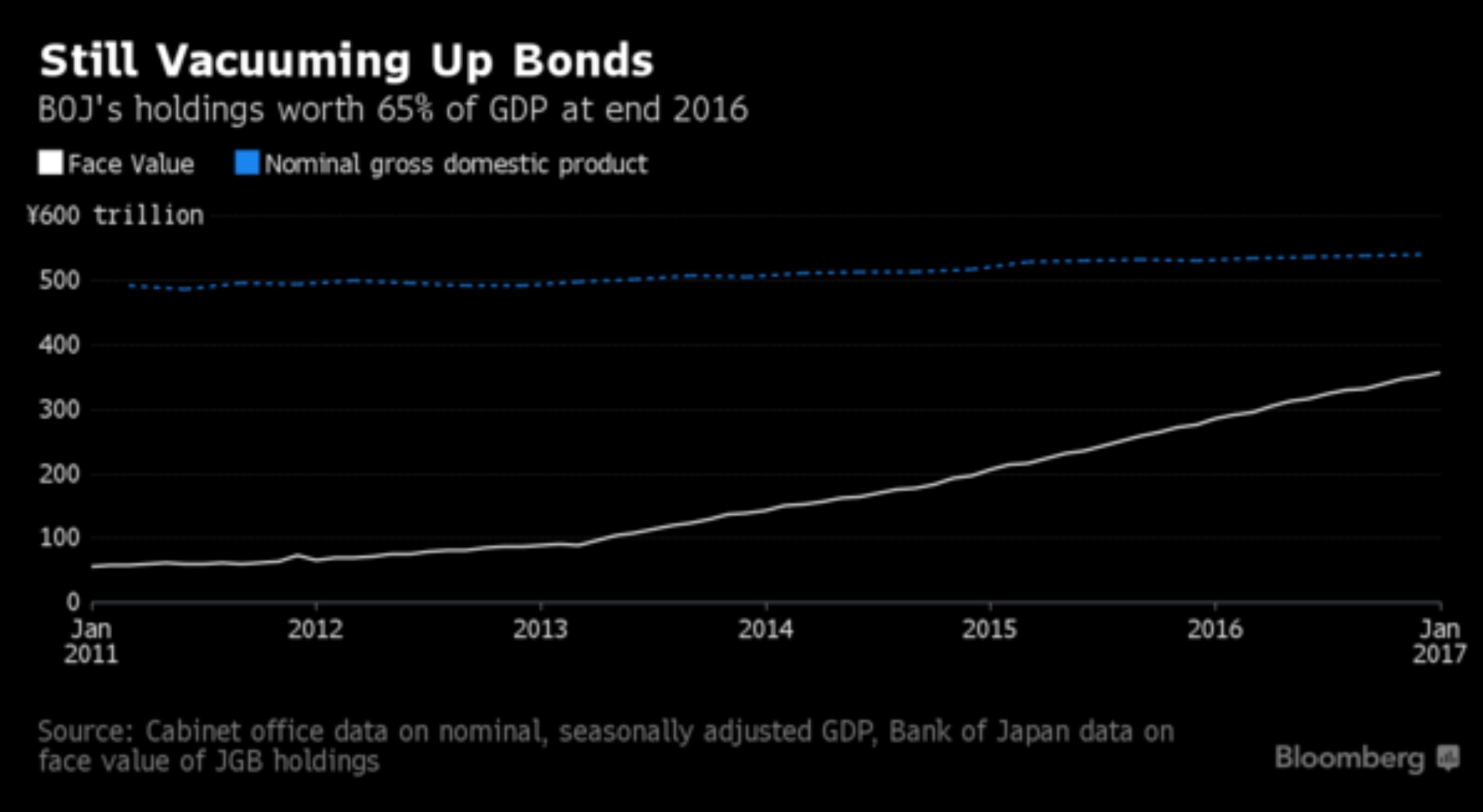

Japan’s banks sold 141 trillion yen of government debt in the first 3 1/2 years of Kuroda’s easing, playing a key role in supplying the 298 trillion yen that the BOJ bought in the same period. Banks have just 219 trillion yen of the securities left, and they need to keep some of that to meet regulatory requirements. That all adds up to the real possibility that the BOJ will face constraints on its capacity to buy bonds.

At least a climb in yields may end the vicious cycle the BOJ was creating for itself when its actions drove rates on all Japan’s bonds to almost zero. That had raised the specter of eroding the BOJ’s balance sheet thanks to diminishing bond returns. Even so, almost a third of the bonds it owns have no income — or just pay it 0.1 percent a year in interest.

The surge in bond prices over the past four years could still create losses for the BOJ, because most of the debt it buys costs well above face value, even though face value is what the central bank will get back, because it plans on holding the securities to maturity. The looming balance sheet shortfall that creates is another of the concerns surrounding the long-term sustainability of the policy.

“The BOJ doesn’t seem to care about exceeding 40 percent, so they will maintain the pace of buying for now — though they face the prospect of running out of bonds to acquire some time next year,” UBS’s Aoki said. “Any exit from the program is a very, very long way away.”

Looking forward, it seems the BOJ can’t stop buying, otherwise it would lose control of yields while its inflation target remains far from 2 percent. Yet it can’t go on buying forever either, thanks to a lack of ready sellers. With his term due next year, Kuroda may not be around to rue his 2014 crack.

QE is financial cannibalism.

If you enjoy the content at iBankCoin, please follow us on Twitter

> “Bank of Japan Now Owns 40% of Japanese Bond Market..”

And is anybody asking who owns Bank of Japan?

“298 trillion yen”

Lemme see now…if one billion is 1000 million, then one trillion is 1000 Billion… Current exchange rate $1= ¥113.36 wow that is a lot of zeros.