This stock is a huge piece of shit. Clearly, there are pricing issues with their drug portfolio, especially for HCV.

Without putting this quarter under a microscope, I think it’s a fair analysis to assume any drug company who make a living off gouging American patients are in danger of missing numbers, in the foreseeable future.

The company missed on revenues and guided lower. This has been a value trap for some time now. At some point, apathy will take hold and shareholders will revolt.

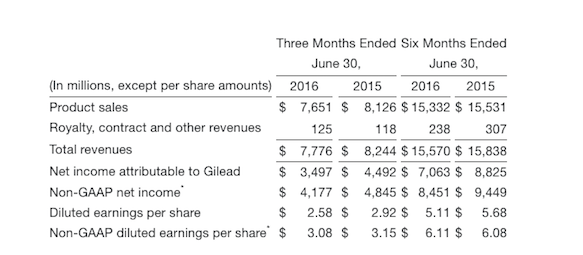

Reports Q2 (Jun) earnings of $3.08 per share, excluding non-recurring items, $0.07 better than the Capital IQ Consensus of $3.01; revenues fell 5.7% year/year to $7.78 bln vs the $7.8 bln Capital IQ Consensus.

Antiviral product sales, which include products in Gilead’s HIV and liver disease areas, were $7.1 billion for the second quarter of 2016 compared to $7.6 billion for the same period in 2015. HIV and other antiviral product sales were $3.1 billion compared to $2.7 billion for the same period in 2015.

HCV product sales, which consist of Harvoni, Sovaldi and Epclusa, were $4.0 bln (below estimates of ~$4.1 bln) compared to $4.9 billion last year, primarily due to a decline in sales of Harvoni; US HCV $2.25 bln vs. $2.1 bln ests.

Co issues guidance for FY16, lowers net product sales to $29.5-30.5 bln from $30-31 bln; reaffirms adj. gross margin 88-90%; raises R&D, lowers SG&A.

As of June 30, 2016, Gilead had $24.6 billion of cash, cash equivalents and marketable securities compared to $21.3 billion as of March 31, 2016. Cash flow from operating activities was $4.9 billion for the quarter.During the second quarter and the first six months of 2016, Gilead utilized $1.0 billion and $9.0 billion on stock repurchases, respectively.

The stock is lower by 3.5% in the after hours.

As per conference call.

If you enjoy the content at iBankCoin, please follow us on TwitterUpdated FY16 Guidance:

Lowered net product sales guidance range to between $29.5-30.5 bln (prior $30-31 bln reiterated April 28)

Reiterated product gross margin guidance between 88-90%Increased R & D expense guidance to $3.6-3.8 bln (prior $3.3-3.6 bln reiterated on April 28)

Lowered SG&A expense guidance range to between $3.1-3.3 bln (prior $3.3-3.6 bln reiterated on April 28)

The change in guidance from 1Q16 was primarily driven by patient flows & payer flows, did not change US prices, notes a ‘successful’ program from VA, more heavily discounted payers impacted resultsAmount of people treated with a Sofosbuvir-Based Regimen +116.8% y/y to over 1 mln patients

Since the beginning of the year, access has improved, almost all major commercial payers have been joining Medicare and the VA.

When asked to provide color on Hepatitis B product developments:

2 compounds in clinical development, a vaccine in the later stages of being evaluated in non-surpressed patients, in the later stages of being evaluated in hep B patients, those data have been released & did not show any activity, doesn’t have high hopes this compound will work.Notes the TLR seven agonist is just finishing the first cohort, co is currently initiating study, hopes to have the presentation by the extract deadline.

Pursuing three approaches to hepatitis B, one is adding another mechanism to the nucleotides because there is the observation that this might be undetectable

Sees little change in their Medicaid biz, notes public payers were about 45% of total, driven by VA

Estimates that 3 mln individuals remain affected with HCV in the U.S., approximately half of whom are diagnosed.Expects sequential decrease in cash flow in the second half of the year, less focused on share repurchases in second half of year after a ‘very aggressive’ 1Q16 buyback

I was worried about this ever since they started advertising for during NASCAR races for Harvoni……… Never a good sign.

my guess TLT 160.00