I am about to sound as if I’m raining on your little parade now. There is nothing redeemable about today’s tape, unless of course you believe wild gyrations in crude and currencies is your thing.

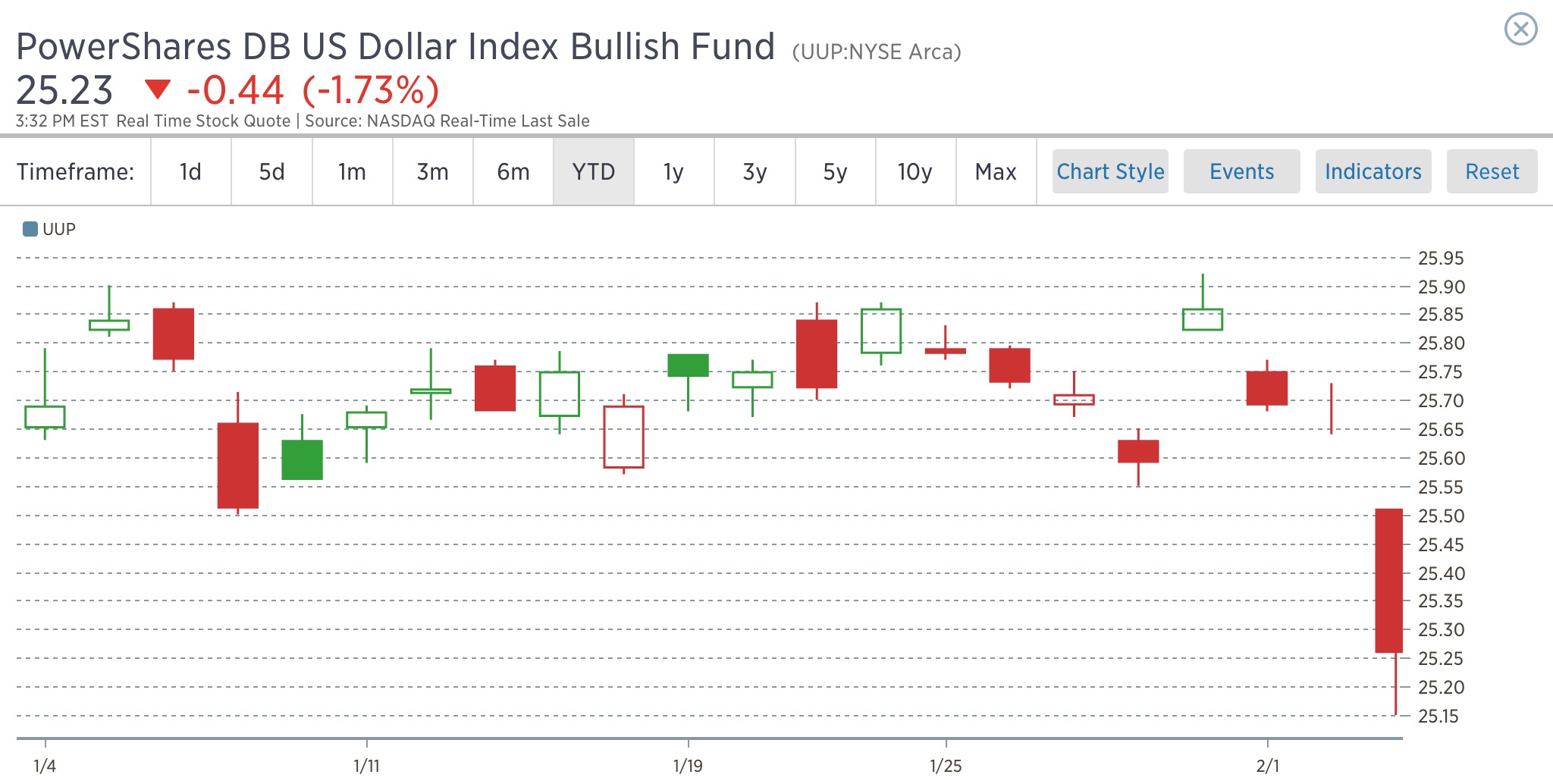

Today’s drop in the dollar is the worst since the Fed announced QE, 7 years ago.

“The currencies market has been at odds with the rates market, and now the rates market is winning,” said Peter Gorra, head of foreign-exchange trading in New York at BNP Paribas SA. “There’s a disconnect where the Fed says it’s four hikes while the market says it’s like 0.7 hike this year — someone is wrong.”

“Presumably investors are betting that lingering risk-off will stay Fed’s hand when it comes to further tightening,” said Valentin Marinov, head of Group-of-10 currency strategist at Credit Agricole SA’s corporate and investment banking unit in London. “It would take disappointing U.S. data today and Friday to see the dollar coming under sustained selling pressure.”

Stocks are rally, sort of. At the moment, just 60% of stocks are higher and the Nasdaq is down more than 0.6%. This is not the type of rally you want when putting in a bottom. This is the sort of rally that offers glimmers of false hope, then snatches it away before settlement date–thrusting a whole wide world of suckers into the black emptiness of a destructive bear market.

The real winners today are gold and silver stocks.

How wonderful. Prepare to be disappointed.

If you enjoy the content at iBankCoin, please follow us on Twitter

DUST time gents

Reminds me a bit of The Plaza Accord (dollar depreciation in 1985 after huge run up).

Read the second main paragraph (Trading hist a Protectionist Wall) and substitute China for Japan and West Germany. Sound familiar?

http://www.investopedia.com/articles/forex/09/plaza-accord.asp

Dollar down is good. Oil up is good. Gold is at the end of another round of short covering and the near term top will coincide with its 200DMA and the upper bound of its longer-term downtrend. 1130 and 1140 respectively.

I am upset that I sold my GLD 109 March calls two weeks ago.

I am looking forward to the market reassessing what a falling dollar means. I am also looking forward to the market reassessing why banks are down. It’s not a credit issue, it’s a “well if negative rates here then banks suck” issue.

Bernie is winning and he doesn’t even know why.