The Kleiman vs Wright Bitcoin trial has come to a conclusion and Craig Wright’s defense won on all counts except one. The plaintiffs won regarding “conversion” of assets in W&K Info Defense at the time of Dave Kleiman’s death. The price tag on the conversion ruling is $100M.

So how is a $100M judgement a win for Wright? $100M is a fraction of the $65B or more that was at stake in the case and allegedly a fraction of a recent $3B settlement offer. Here is an exchange between the plaintiff lead lawyer Vel Freedman and BSV billionaire investor Calvin Ayre.

you are pathetic small man Vel…you lost and you will continue to lose. I was in multiple settlment rounds as a business advisor and you are lying. The last settlement numbers just a few weeks back was multiple billions and you talked Ira out of it on behalf of you real bosses.

— Calvin Ayre (@CalvinAyre) December 7, 2021

yes…because Vel works for Digital Currency Group not Ira…in my opinion. There was a settlement that Craig and Ira negotiated in person and Iras advisors talked him out of it because it would have made Craig look good. Ira should be suing his lawyers now.

— Calvin Ayre (@CalvinAyre) December 7, 2021

These are big accusations from Calvin Ayre but they are not without merit. We will see how it plays out.

Back to the case, the ruling awards the funds to W&K Info Defense rather than the plaintiff Ira Kleiman. Kleiman will have a difficult time claiming any of the money assigned to W&K Info Defense as Ira was a minority shareholder. W&K Info Defense was legally shut down with zero value by majority shareholders Craig Wright and his (at the time) wife Ramona Watts when Dave Kleiman passed away. Ira’s $100M “victory” will likely end up costing him money if he chooses to pursue this dead end as it appears Ira doesn’t have proper legal standing to bring a case against W&K to claim the money.

The $100 mill will be awarded to his ex wife: the owner of W&K, of which a probate case is going on right now. Craig will win again. Craig is Satoshi, as we always knew, and he continues to work on the original Bitcoin BSV

He is up to 3200+ Blockchain patents now FYI pic.twitter.com/TvzVojQYvW

— Andreas u/475 🍌 (@LoveBitcoinSV) December 6, 2021

What does the end of this trial mean? It means a jury found that Craig Wright is the sole inventor of Bitcoin. Ladies and gentlemen, this is Satoshi Nakamoto:

After his resounding trial WINs in the Kleiman case today, a word from #CraigWright (#SatoshiNakamoto) to his supporters#Satoshi #Bitcoin #CraigWrightisSatoshi pic.twitter.com/oS6UbglGN8

— Jimmy Nguyen (@JimmyWinSV) December 6, 2021

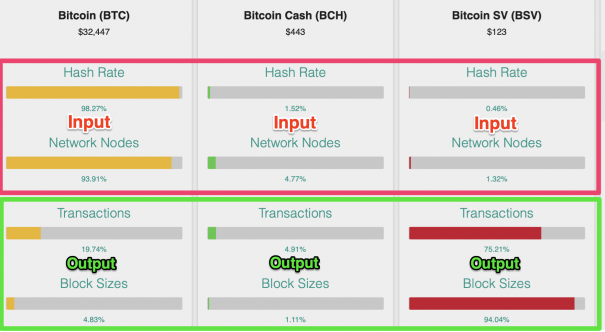

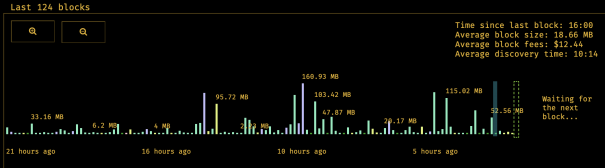

And what did the markets think? Not much really. BSV had a pump off it’s recent lows but it is back in the range it’s been in for over six months. People are still digesting the news and crypto twitter is a shitshow of mudslinging, cope and FUD.

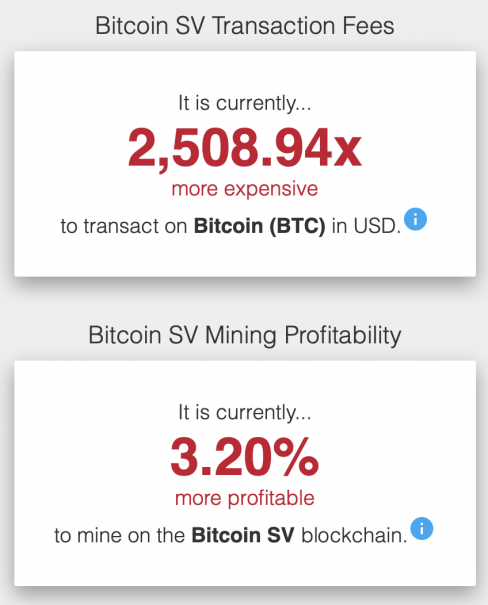

My take is this is a good thing for BSV and Craig Wright. However, I don’t see this legal confirmation and news changing the crypto landscape overnight. In fact, I think there would be much more impact if Craig follows through on his statements about moving Satoshi coins, win or lose, at the end of the trial.

Moving the coins will shock the entire crypto ecosystem and reset the balance of power in BTC vs BSV. For maximum impact these coins should move soon.

Comments »