So what is so special about this edition of the daily breakout? I want to discuss a strategy for setting effective stops, as well as some position sizing. This strategy has been very effective in the current, extremely volatile, market environment.

First, lets look at some breakouts. Some of these have broken out, and have completed the first pullback to test the pivot point. Others are brand new breakouts.

[[AMN]] Ameron International Corporation had a nice breakout on good volume, and has pulled back to complete what appears to be a successful test of the pivot point.

[[BMI]] Badger Meter, Inc. broke out, tested the pivot, and is moving up on great volume.

[[HRB]] H&R Block, Inc. continues to punch the noses of short-sellers. In a perfect world, I would have wanted better volume today. Other than that, being long a financial stock that is fixin’ to make new highs is hot.

[[KSU]] Kansas City Southern and [[NSC]] Norfolk Southern Corp. continue to make new highs, on volume.

[[MRTN]] Marten Transport, Ltd has come close to testing its pivot point. I think this stock is great way to play falling oil.

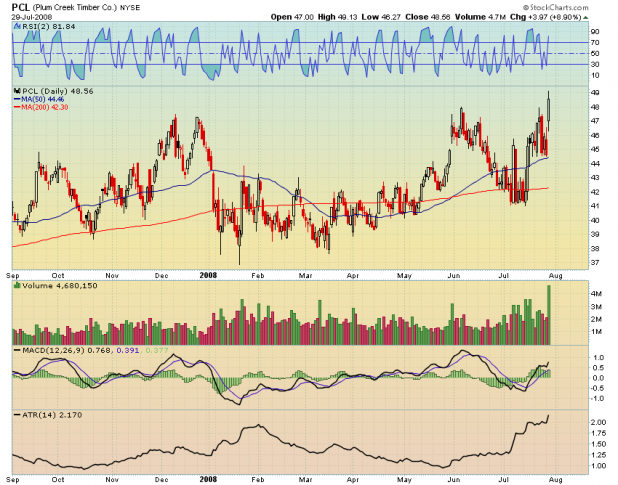

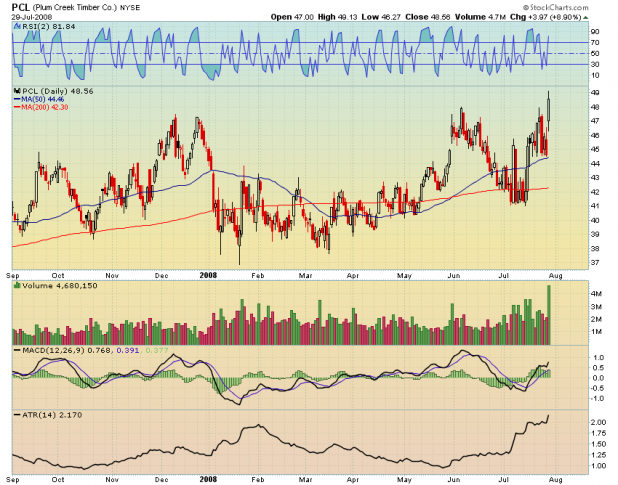

[[PCL]] Plum Creek Timber Co. Inc. I’m not sure what is driving this one, but the volume on the move is spectacular.

[[PETS]] PetMed Express, Inc. It is hard to believe that this stock is breaking out, considering the retail environment. People will treat their dogs better than their own children, so maybe it has some staying power. 17% of the float is sold short.

[[SAP]] SAP AG (ADR) Wow…

Now, let me suggest a method for setting stops on these breakouts.

I assume that many people are getting shaken out of what would be successful trades. One way to avoid this is to have a stop based on volatility, not risk to capital. If you have been setting stops based only on risk to capital, I bet this environment has been rather painful for your trades.

Some of you may have noticed that I did not include Stochastics, but instead included Average True Range (ATR), at the bottom of each chart. ATR will be our proxy for volatility. The reason for using volatility for determining stops is that the more volatile the stock, the looser, or larger your stop should be from your entry point.

Take another look at the chart of PCL. It is easy to see that the stock has been very volatile. The ATR is $2.17, meaning PCL has averaged a range of 2.17 points, over the last 14 days. Lets add a multiplier. The larger the multiplier, the larger your stop will be from your entry point. I have been using a multiplier of 2.5-3.0.

With PCL’s ATR of 2.17, a 2.5 x ATR stop would be 5.42 points from the entry. Had you purchased PCL at today’s close of $48.56, your stop would be placed at $43.14. A stop at this level looks good as it is well beneath recent support at the 50 day average. This ATR-based stop will give your trade room to breathe.

Now, Let’s Protect Your Capital

Now that you have determined the level for your stop, lets determine the size of your position. In order to do this, you must decide what percent of your total capital you want to risk on this trade. If you have 25K, and you want to risk 1%, then you are risking 250 bucks each trade. Now divide your risk, 250 bucks, by the ATR and multiplier. 250/(ATR*2.5)

For PCL, 250/(2.17*2.5) = 46.12 Therefore, your position size will be 46 shares. Now you buy 46 shares, set your stop at $43.14, and if your stop gets hit, you have lost 1% of your capital.

Why ATR Stops and Position Sizing are Crucial in this Market

2 Reasons: The first is that you have to give these trades room to move. Everything is volatile right now. You can’t set stops the same way you did 2 years ago, or they’ll get hit before your trade moves in the right direction.

Secondly, in my experience, volatility raises fear and decreases confidence. Using this system for setting stops and determining position size will have you buying smaller positions on volatile stocks and larger positions on less volatile stocks. This will enable you to have more confidence in your trades by decreasing the likelihood that a few stocks will cause a gut-wrenching swing in your equity. This method also allows for strict control over risk. If you experience 10 losses in a row, your total drawdown will only be 10%.

As with most things, this is only the tip of the iceberg in terms of developing a system for trading breakouts. I highly encourage you to check out IBD Index, which is simply the best damn blog on the internet for developing systems for trading breakouts.

Comments »