Danny’s recent post reminded me of a good many assumptions that I possess. Mainly, through eye-balling many charts over many different time periods, and doing some calculations by hand, I developed the idea that the best time to buy during a bear market period was when the index price closed above the 50 day average.

I should have examined this bias months ago. Better late than never.

Here are the rules:

1. Buy the next open after the S&P 500 closes above the 50 day average.

2. Sell the next open after the S&P 500 closes beneath the 50 day average.

Obviously, this a very very simple strategy. There are very simple improvements we could make to it that will drastically improve performance, but that is not my goal, right now. What I want to examine is some baseline performance metrics, and then I want to compare the baseline metrics against performance during the 2000-2002 and 2007-2008 bear markets. The results should allow some assumptions to be made about the validity of my bias.

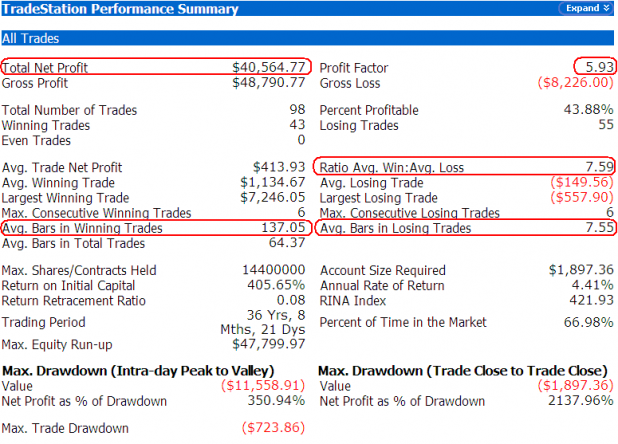

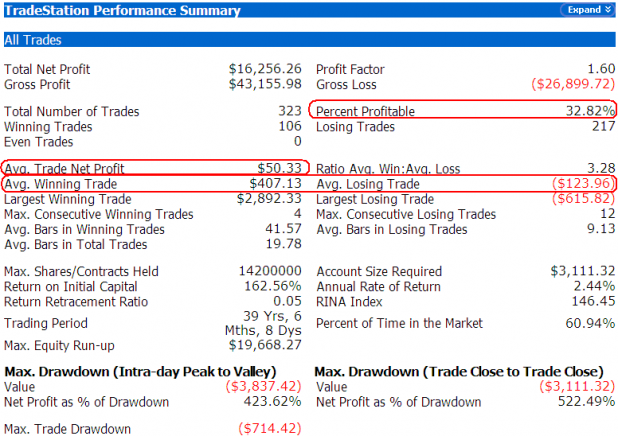

The above performance report starts on Friday’s close (8/8/08) and goes back 40 years. I’ve used the $INX, which is what Tradestation needs to backtest the S&P 500.

I have outlined in red the metrics I will focus on.

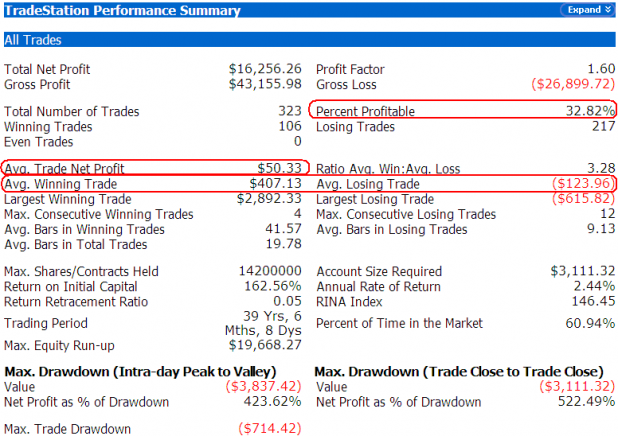

First, the system is profitable. However, it loses a lot more often than it wins, but that is typical of a trend following / moving average system. Secondly, the average trade is profitable, to the amount of 50 bucks. The average win is 3.28 times larger than the average loss. The largest winning trade swamps the largest loser, but that large winner is probably an outlier (I didn’t check to be sure).

Note the 12 consecutive losing trades in a row. Position sizing and risk management is a must if one is trading a system.

These metrics will serve as our baseline, to which we will compare the data from the 2000-2002 and 2007-2008 bear markets.

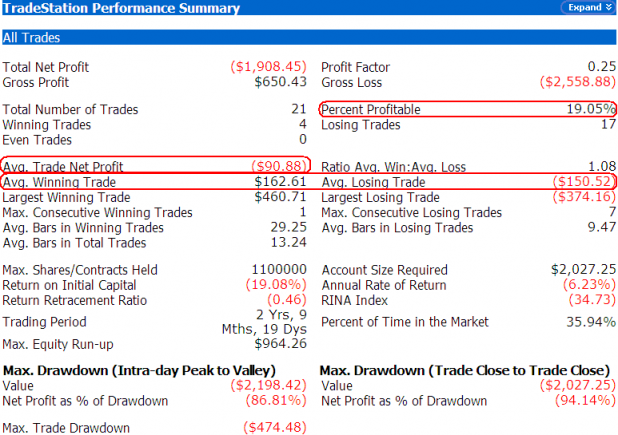

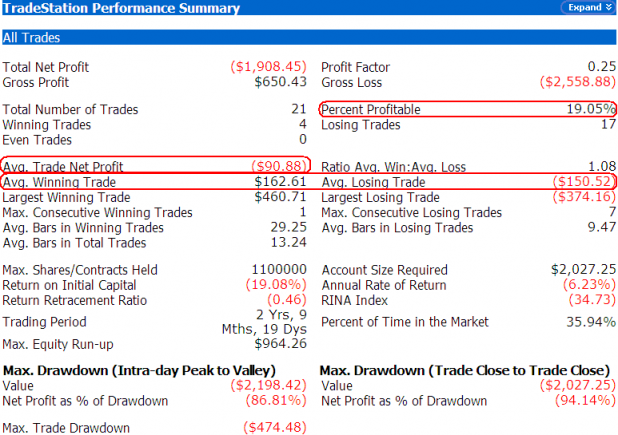

The above data is the results of testing from 1/10/2000–1/10/2003. I chose these dates as it gives us a couple of months of data on either side of the start and end of the bear market. In hindsight, we can determine the start and end, but in real-time, we would not reliably be able to make that determination.

Compared to our baseline metrics, we see that during this period, the system was not profitable. The average trade results in a loss. The average winner is almost the same amount as the average loser. The win percentage dropped down even lower, to 19.05%. There were 7 losing trades in a row.

Obviously, this system does not work well during a bear market.

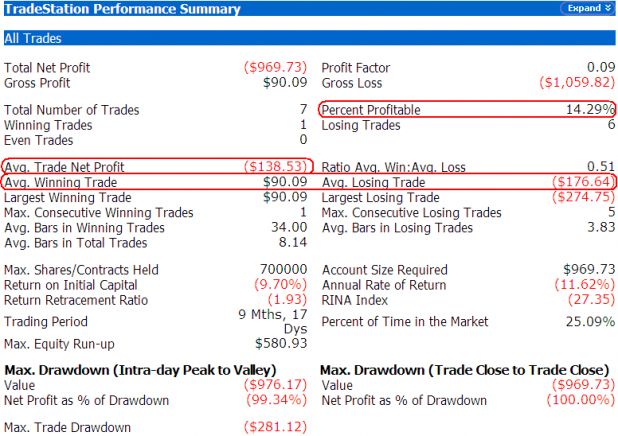

Lets look at the current period.

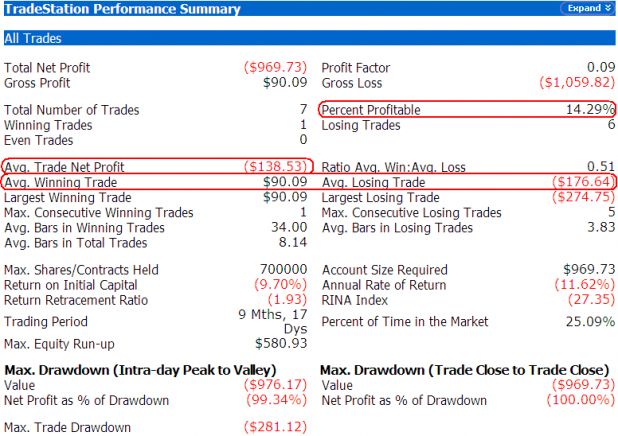

The above results are from 8/8/08 to 8/10/07. The results are very similar to the 2000-2002 bear market. The system is not profitable, and the performance is getting worse. Now, the average win is half the average loser, and the win percentage is even lower at 14.29%. The system has had 5 losing trades in a row.

Conclusions

As the S&P 500 closed Friday less than 1 point beneath its 50 day moving average, it is important to consider the above results.

Buying tomorrow could be a purchase on the first day of a new bull market. Or, it could be a losing trade.

While over the long term, buying the S&P 500 when it crosses above the 50 day average has an edge; in the current environment, it will be necessary to develop a robust exit strategy. Simply selling when it crosses back beneath the 50 day is not enough.

As I alluded to earlier, adding some additional variables and conditions to this simple strategy will improve the results. I will examine these issues in the future.

Comments »