TradingMarkets does a good job of providing technical setups, as well as trader education services, with most of it available free-of-charge. Some of the recent publications from TradingMarket’s Larry Connors and authors Cesar Alvarez and David Penn promise simple yet profitable strategies. Indeed, as I found, the Double 7s does make money, although the test did not account for commissions or slippage.

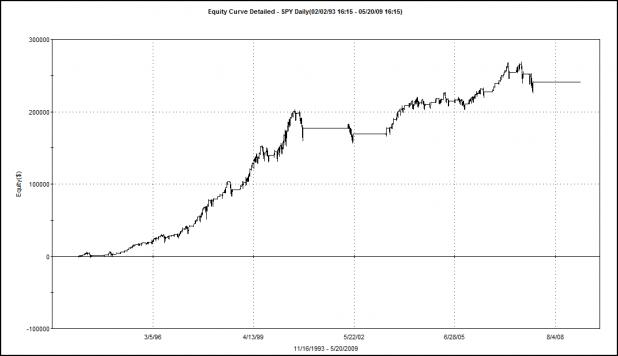

The problem with the Double 7s strategy, traded over the SPY, is that it does not trade often enough to generate a substantial annual return. However, TradingMarkets lists three other ETFs that work well with this strategy. In fact, they mention most of the equity ETFs work well with the Double 7s. The solution to the lack of opportunity may be to trade the 7s across a portfolio of ETFs.

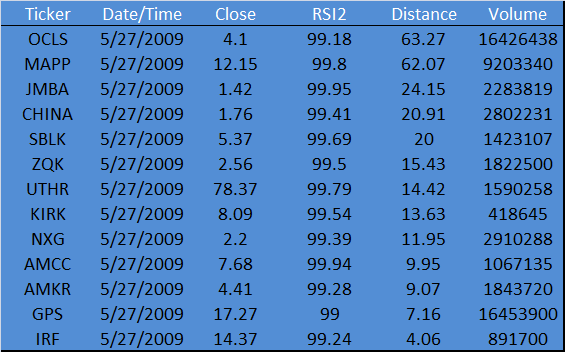

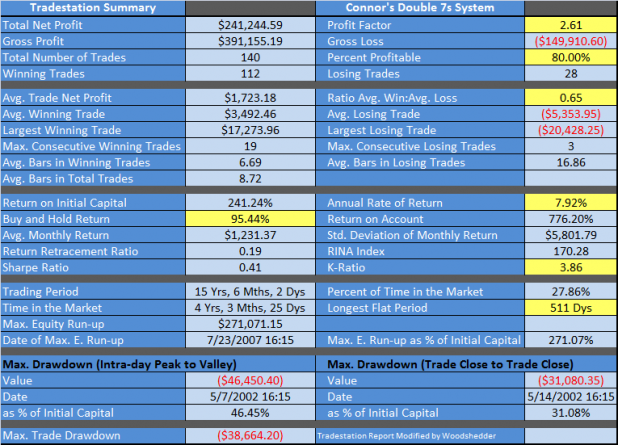

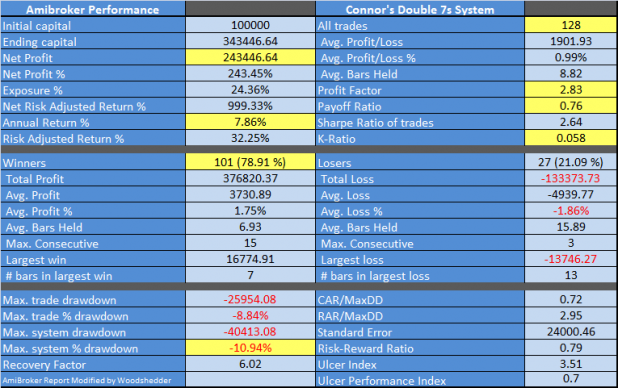

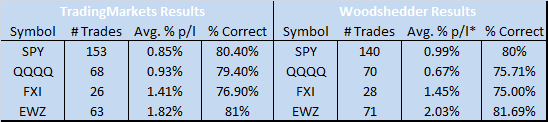

Here are the results as published in Connors’s book, vs. the results when I tested the strategy on the same ETFs.

*denotes data from AmiBroker platform. Tradestation results are used everywhere else.

Except for two places (SPY #Trades and QQQQ Avg. % p/l) the data derived from my testing is close to the results reported by TradingMarkets. I have a suspicion that TradingMarkets may have used the SPX 200 day average and applied it to the SPY, when the ETF was fewer than 200 days old. That may explain the 13 extra trades. The other difference in the #Trades seems to be due to subsequent strategy trading after publication of TradingMarkets results in 2008.

I did not determine why the AmiBroker Avg. % p/. results of 0.67% differs so greatly from TradingMarkets results of 0.93% for the Qs.

My main concern is that the system behaves as advertised, and it appears that it does.

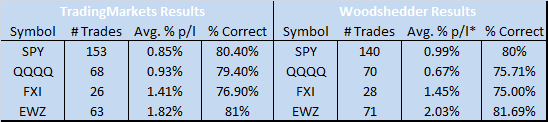

The one detail not published about the Double 7s are equity curves. A strategy can be profitable and not be tradeable. The equity curve can help one determine if a profitable strategy is tradeable.

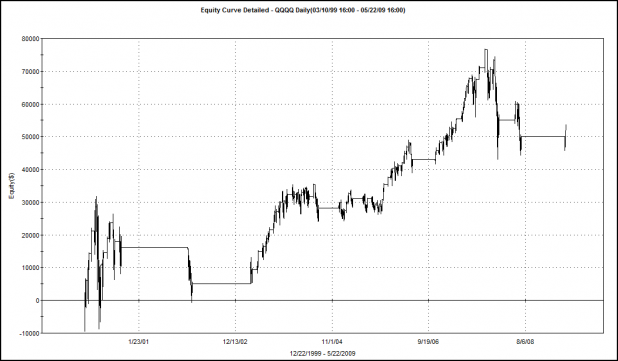

QQQQ Equity Curve

Not very pretty, or smooth… Notice the large drawdowns.

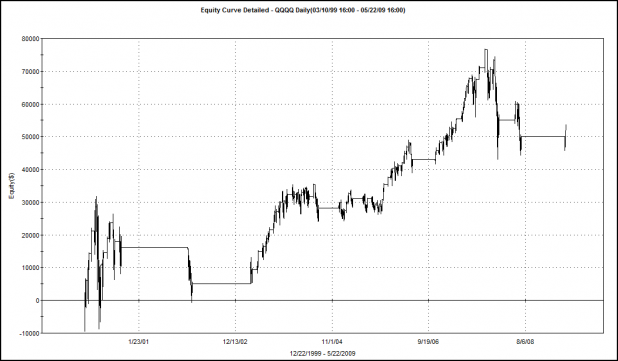

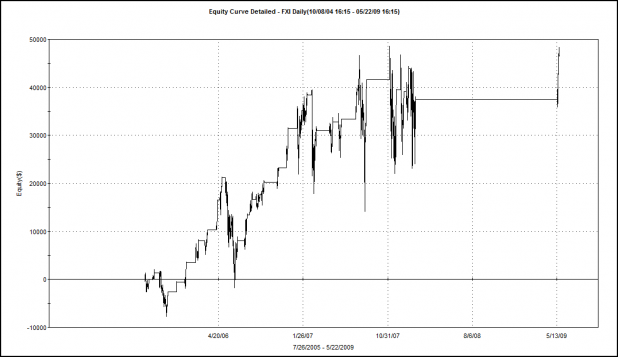

FXI Equity Curve

Note the huge drawdowns on FXI. One of the drawdowns was well over 50%. Again, not pretty, or smooth…

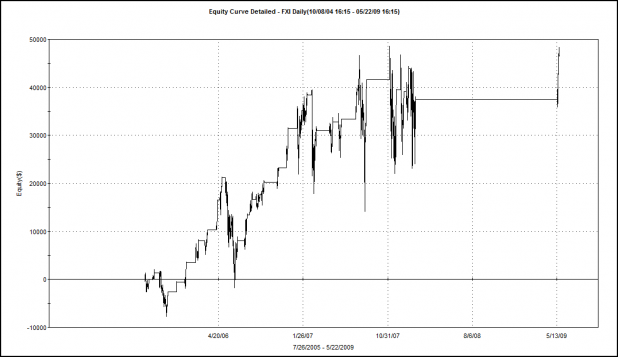

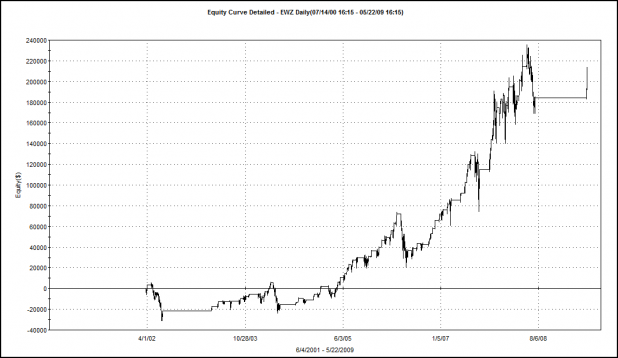

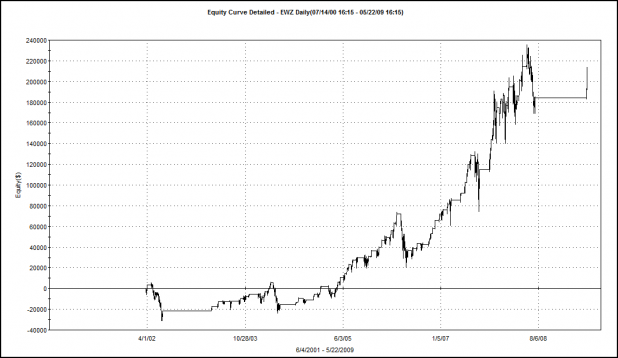

EWZ Equity Curve

The EWZ equity curve is a little better, there are several large drawdowns. One thing is for sure…this strategy likes to be traded over EWZ. The annual rate of return, when traded over EWZ is 14.10%, or almost double the return when the Double 7s is traded over the SPY.

What’s Next?

I have determined that results as reported by TradingMarkets can be replicated. However, the analysis has uncovered weaknesses in the strategy. These weaknesses have not been reported or discussed.

The first weakness is that the system does not trade often enough. By allowing the system to go short and trade a portfolio of ETFs, we can expect greater opportunity.

The second weakness is that the system, while profitable, may not be tradeable, due to the large drawdowns exposed within the equity curves.

Adding a short component to the system may smooth the equity curves. Also, allowing the system to trade a portfolio of ETFs may smooth the curve as well. We have to be careful though, assuming that the ETFs will trade independently of each other and smooth the curve, because as we saw in October and November 2008, all correlations became 1.

The next post will examine how adding short trades affects performance.

Comments »