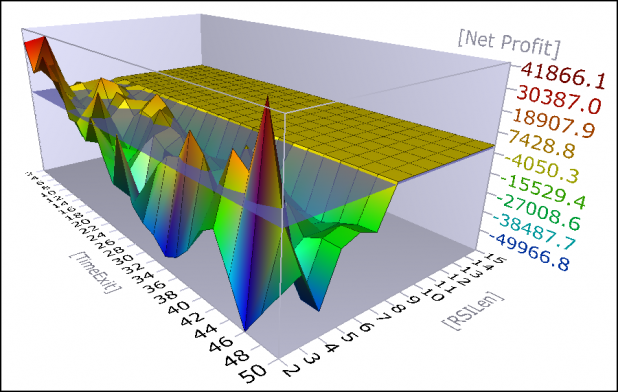

Un-scientific observations noted here piqued my curiosity as to what RSI period setting is the most predictive. Over the next week I will be running some tests in order to determine which RSI settings are predictive and which ones might be discarded as useless.

First I will look at using RSI as an overbought indicator.

As 70, 80, and 90 are commonly used as upper boundaries on RSI, I ran a test for each of these levels.

Parameters:

All short-sells and buys-to-cover were executed on the open of the day following the buy/sell criteria being met. For example, if RSI(?) closed at 71, then a short entry was executed on the following open.

A time exit was used, starting with a 2 day exit (which means an exit on the open of the 3rd day) and increasing in increments of 2 with a maximum length of 50.

The minimum RSI period length tested was 2 with a maximum of 15.

The SPY was the first symbol tested, using all history available. Future tests will include more ETFs and stocks.

The test uses 100K of starting equity with gains compounded on each trade.

Results:

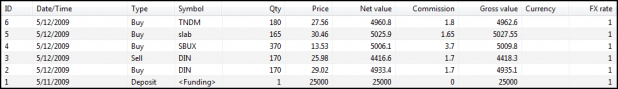

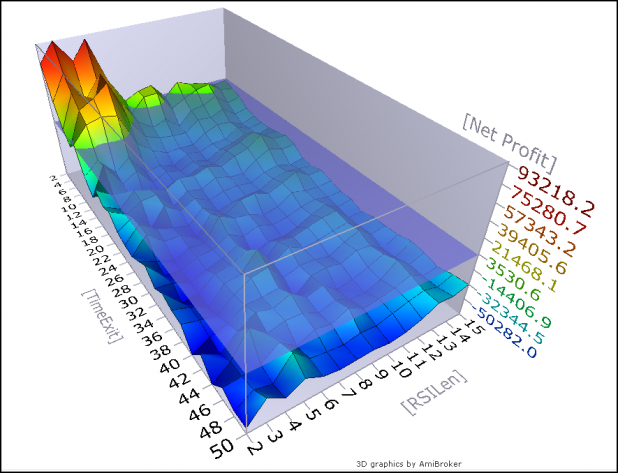

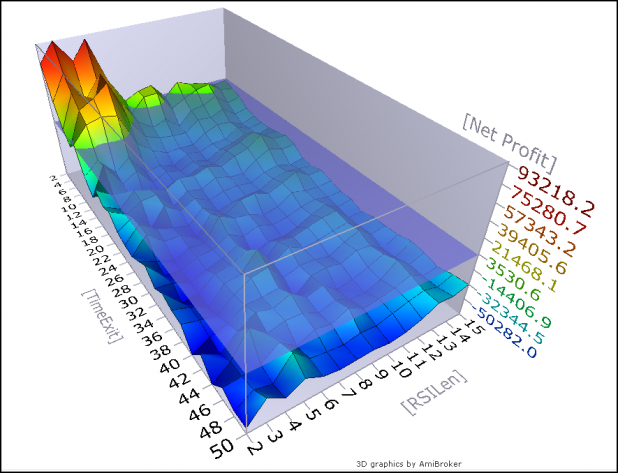

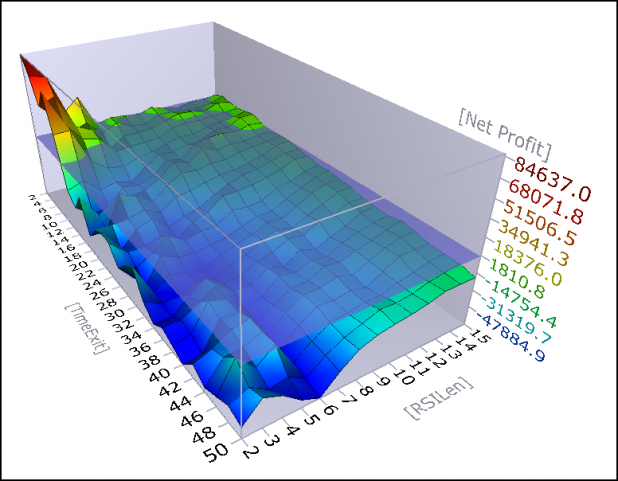

Overbought = 70

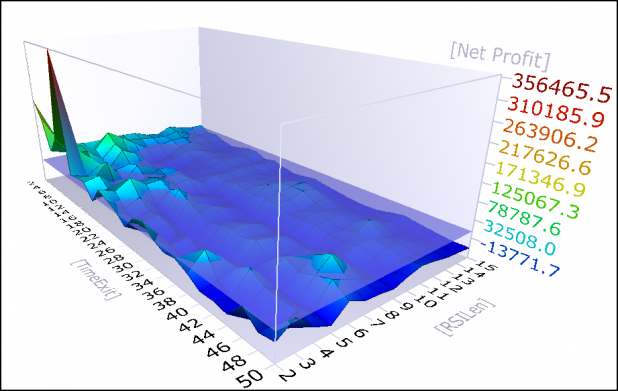

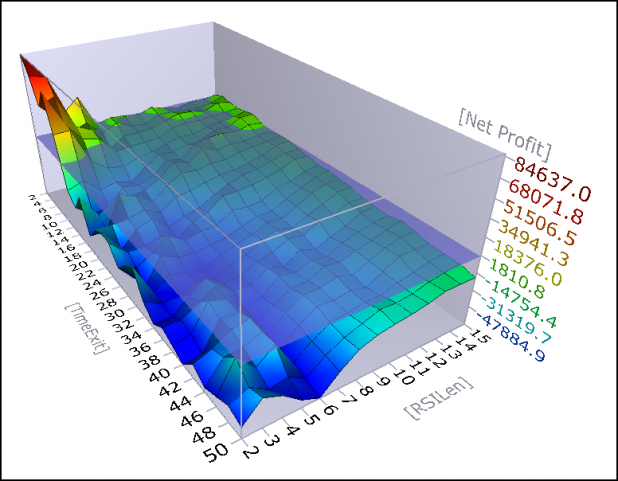

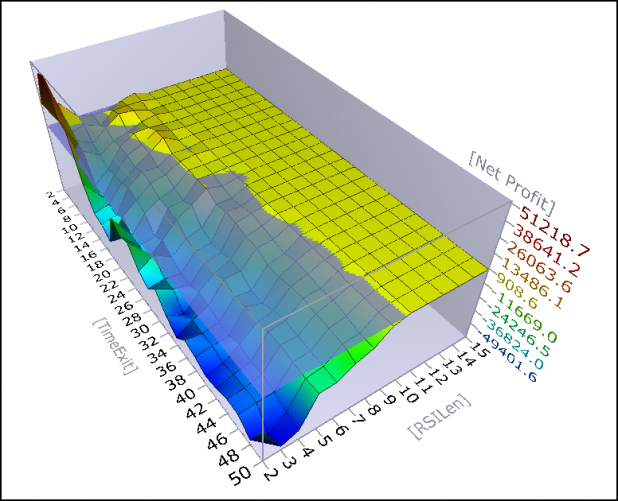

Overbought = 80

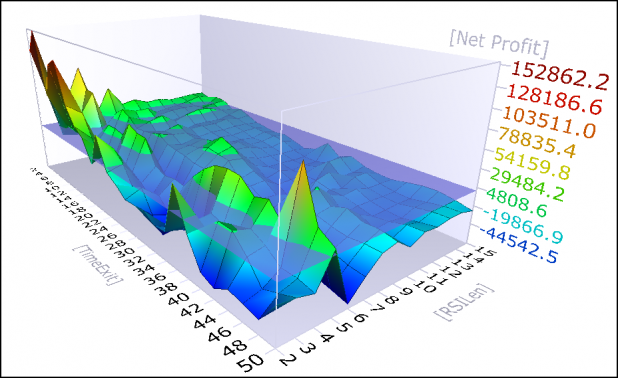

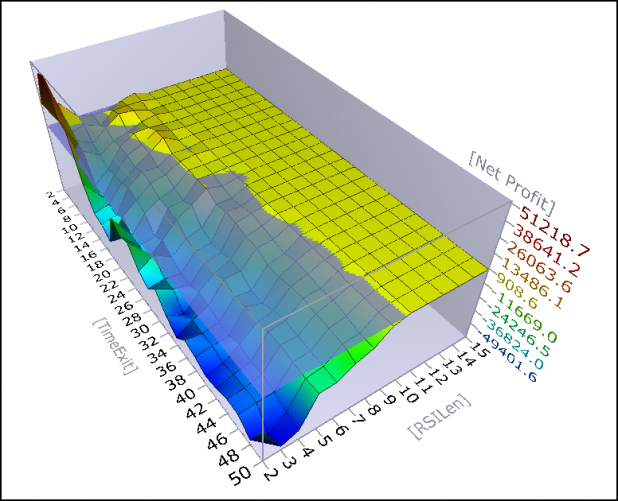

Overbought = 90

Discussion:

Feel free to discuss this amongst yourselves. It is my birthday today, and I have lots of things to do to prepare for the grand Luau.

As time permits today, I will be back to update this post to include some discussion about these results and to draw some conclusions.

I will leave on this thought (If only to stir up some controversy/discussion): it appears that the standard RSI setting of 14 has been almost useless, over the past 16 years, as an overbought indicator. Of course I have tested the most simple application of this indicator and have not measured how it performs when showing a divergence.

Comments »