Here are the stocks we’re watching heading into next week:

Comments »Are These Your Shorts?

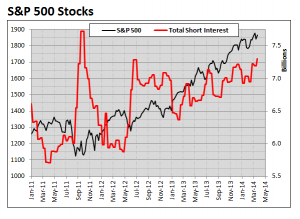

Short interest is at 2011 levels here. Need I remind you that we’re gently off the highs.

Should you bears get spooked here, I weep for your future.

I bought DE calls, MEET shares, and added to CORT because I am conveniently informed.

OA

Comments »Making My List

If there is one thing you should be doing tonight, it is this. You should be creating three individual lists right now.

The first list should be a buy list. These are stocks you feel are buyable for a trade. This might include stocks that have held up well recently that are nearly actionable. Focus on stocks from solid performing groups, such as financials, energy, semiconductors or select industrial stocks.

The second list should be a fire-sale list. These might be stocks you could invest in for awhile. Stocks that will be a good core to trade around over the next few months or year at minimum that have been severely over discounted in the short term.

The last list should be a list of “asshole stocks,” These are stocks that you are drawn to, like catfish internet predators, who are trying to lure you in with a fake avatar and a weakness to your glowing personality and lonely online classified advertisements. These should be stocks that trade with no soul. The stock you can’t look away from, but are losing in every single attempt at trading it. For me, I have a list of “asshole stocks.” They are as follows..

2007 – AMZN

2008 – HANS

2009 – TOL

2010 – X

2011 – BIDU

2012 – FB

2013 – NFLX

2014 – Everything

If you have found a particular stock that you are falling in love with, please feel free to openly express your sentiment towards this stock here in the comments. I am a shoulder to cry on during times of financial turmoil, and I promise to not laugh at your expense.

Comments »Grandpa OA Buys

Having liquidated a few long term holdings over the last few months, I made room to take some new makes and models out for a spin. Therefore, I am pulling my investment card out, and taking advantage of entry points that cannot be passed on.

I have purchased shares of SINA and shares of OIBR. Both of these I have been stalking for many months, as you may well know.

Again, these are investments. These will carry me for the next few years. Should you decide to wait until these are up 50% to buy, then riddle me with questions on how to manage it when it goes down, you can certainly go to hell. If necessary, I will average these down lower, but I believe downside is limited.

On the topic of long term ideas, I am jonesing for some long term action in Emerging Markets, particularly Brazil or China. I missed the pull on PBR, but aside from that, any hot tickers you are watching?

Comments »Everything Will Be OK

Take note of the relative strength in energy today. The XLE printed a 52 week high this morning, and favorite names like SLB, PXD, and NOV are trading well in spite of all this mess.

I am long of CTRP calls, and had a spasmic-long in GS that lasted about an hour.

Fuck this market, but I am preparing to rise to great levels soon. Be ready to go to war.

OA

Comments »

OA BUY: GOGO

I’m long April 24 calls of this stock. This was my “aversion” play for last nights After Hours with Option Addict homework assignment.

More later,

OA

NOTE: I picked up DANG again at $14.73.

Comments »