Starting last week, we talked only about the pain trade being up. Up into, and post Fed. Nailed it.

In fact, on the big rally we had on the 15th, I recall saying…

This was the first rally in weeks that I saw pretty much everyone pass over. Not much buying activity into this. If anything, I am being told all of the great prices I could short the market at here.

I would wager that if I polled all of you, none of you would think that this could continue into tomorrow.

Market kept going…I then said…

“For the day, I think we all ought to really ponder what the worst case scenario is here, for everybody. Set your biases and differences aside, even though you are pissed that literally everything is rallying today…and tell me what is the scenario in the next 48 hours that hurts everyone?”

Later that day, I warned we’d get squeezy….and then blogged this the morning ahead of the Fed…

http://ibankcoin.com/option_addict/2015/09/17/well-joe-whats-your-next-move/

A snippet of that post…

As I mentioned, the pain trade here is up. Today’s move will pop folks in at awful prices, and will trigger some short covering. Play it at your discretion, but nearly all the models we’ve run in After Hours with Option Addict suggest a move lower a week from now is highly likely.

My final thoughts last week going into the weekend…

What you just saw was exactly what needed to happen. We were up pretty good on the day, and into that strength we saw more breadth stats that have not been seen since 8/8/2011.

In that move, you triggered some big short covering and got longs involved too high.

The $NYMO was as high as 76 (that I saw) and as Fly mentioned, Exodus printed overbought yesterday.

Cool off on the longs for a bit. If you are in cash, start buying in about three weeks from now.

We talked about some chop for this week, but only got one day of it before sliding lower.

We made it through financial armageddon Wednesday, and after which I blogged about an important step in the process of finalizing all of this mess here. An excerpt…

HOWEVER, to effectively get out of this shit stage of market mispricings for the longer term, we are going to need to set out a trap. Two of them, actually.

This week has worn down bulls, and it’s only Wednesday. To really KO them, you’ve gotta give them a good trap around here. Perhaps a gap down and strong reversal, or a real strong trend day here in the next day or two. Once that happens, you’ll drag in a lot of tired and worn out bulls. Best case scenario from there is to see that rally faded hard the following day, and for the market to trade lower over the next few days…closer to or beyond 1900. By doing this you’ll kill a lot of the remaining bulls and force bears to participate from lower prices.

The same scenario played out in 1998, naturally…

I called out yesterday as the reversal day about 45 minutes after the open…and here we are with a gap up and fade going into the weekend.

On the day I hope we see a small late day push to make you feel great about going long into the weekend. Then I hope we gap the fuck lower on Monday to get this all over with next week.

If anything I have written was unclear, I apologize. I’ve tried to blog more about movements on the horizion rather than just making observations in real time. In choppy ranges like this, the moment you’ve found comfort to make a call, is the exact moment you are on display in front of all to be wrong.

Think of this market as a mechanism that is out to break everyone and it starts to become a little more clear.

After the final blow next week, I doubt we’ll speak of market direction for a very long time.

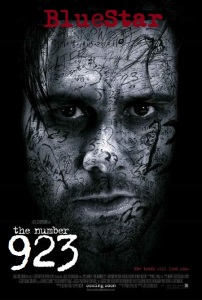

Big thanks to bottom feeder, but here’s an updated look at the 98/15 comparison…

OA

Comments »