I am leaving a little early today, heading west for the weekend.

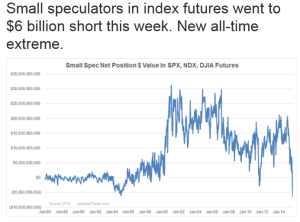

Get some rest for next week, for as the volatility has started to compress towards the tail end of these last few weeks, it’s going to pick up again next week.

We’re gearing up for NYC right now, which is right around the corner. Fly gave out my planned presentation topics, and I’d also like some feedback if there is any to offer. Here’s how it’s looking as of now:

- Understanding Market Dynamics – How to gauge speed, correlations,patterns, and direction.

- Past Versus Present – 2014 vs 2015…What Did We Learn?

- Market Rotations – Finding the Next Explosive Move in Stocks

- Trading through Different Market Conditions – A fast and slow portfolio

- Trading for a Living – Here’s How We Did It

Come out and spend the weekend with us. As you know, we’re at the Yale club, and the VIP gathering is going to be fantastic. I’m going to teach the above outlined topics because these are insights you can’t afford to trade without. The time we’ll spend at the conference will significantly reduce the learning curve needed to improve your investing efforts. If you have any questions about the conference, please email me directly. [email protected]

Have a great weekend,

OA

Comments »