So, I was able to unload my $NQ_F long for +70 this morning, and its helped me to navigate some ups and downs in the remaining swings I have on.

All week the $RUT has been a leader of lower prices. That can’t be ignored.

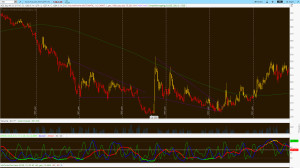

Off the gap and fail this morning, we’ve taken out yesterday’s balance area. If prices are unable to recover through this zone, start shorting rallies in the near term until the divergences signal change.

Both stocks and bonds are lower today, so I think today’s close in stocks is critical. If using the $SPX, north of 1986-88 area is preferred if you’re riding the bull case.

Comments »