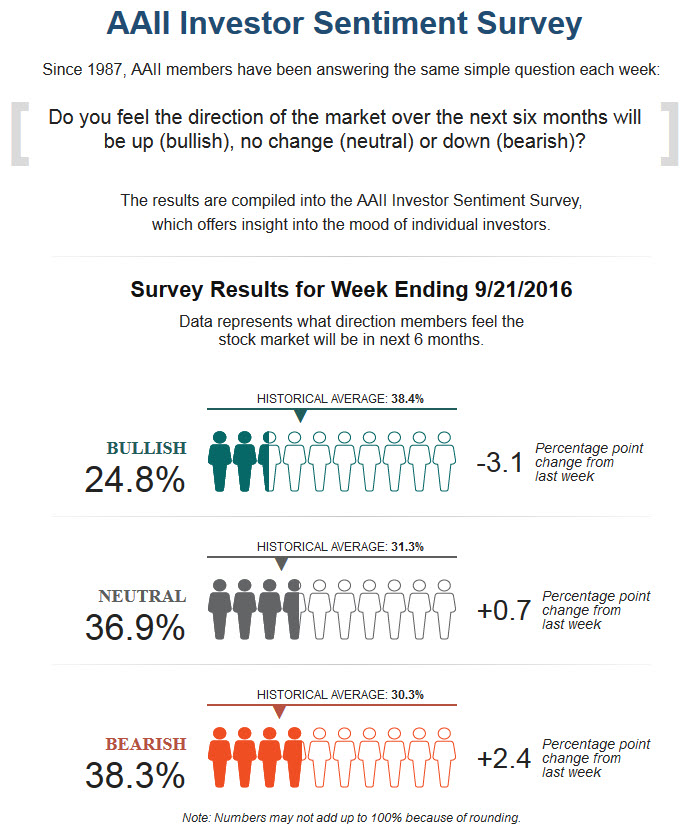

Last weeks poll was a great tell about the environment out there. Even if you are/were bullish, many were heavy cash going into the Fed. The reaction you saw was fast, which provoked you to chase the market up into the weekend.

We start off the week with a gap. I love when this happens, because that is usually what activates a pain trade sequence.

My thoughts here are that those that chased the market up late last week are probably not feeling as great about this, and are potentially being stopped out or taking things off into this move lower. More importantly, this is forcing shorts to initiate lower…just like the last few times we did this.

This gap down happens to be a retest of last weeks balance in the indices, which is the retest one should buy. With as quiet as it is out there, not sure if this read is most accurate, but that’s what I am thinking. I don’t see bulls out there cheer leading this dip. In fact, those that are shopping seem cautious. Bears are most vocal here from what I can tell, and that’s always a layup.

Stalking $ADRO, $GME, $SOHU and $VMW today.

Comments »

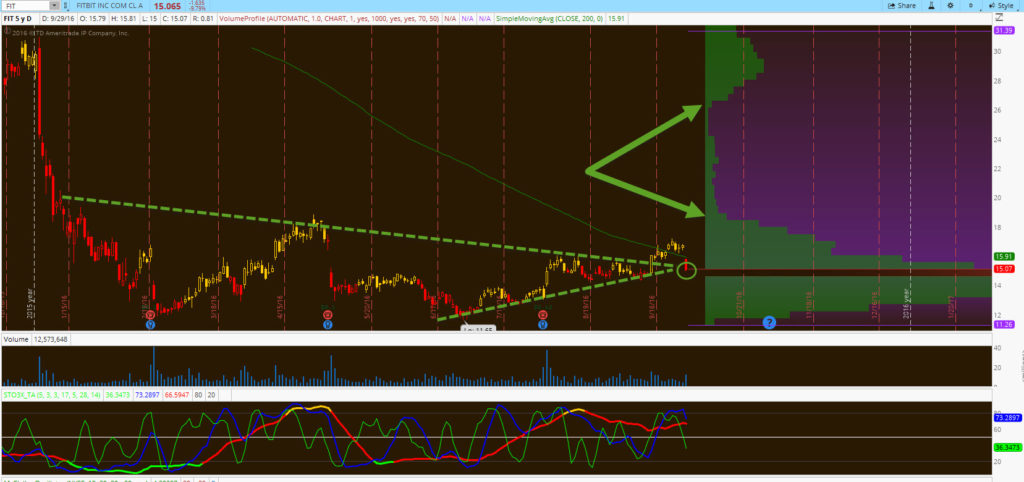

The spot is amazing, the space above is worth exploring over time. 34% of the float is held short.

The spot is amazing, the space above is worth exploring over time. 34% of the float is held short.