Generally I have no reason to follow stocks like this. The ones that you are unable to avoid seeing in the headlines. My stance is that the more eyes, the more participants, the more hype and the more opinions involved, the more random things become.

However, the biggest edge in trading a stock like this, especially one that has gone the way of the waterfall is to incorporate sentiment into the equation. People seek action. Lots of movement in a stock can mask weaknesses as a trader. For example, if your buy points are weak, you can miss a good entry but feel validated in your efforts in a big price swing as long as you get a piece of the middle.

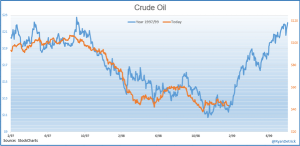

Let’s apply a sentiment comparison on this ticker.

I reduced the time frame to an hourly chart, but the daily is worth a comparison as well.

I only took interest in this name today, because today was the day I didn’t really hear it mentioned.

Any thoughts?

Comments »