If you are new to options trading, I think it’s important to understand a few things in order to develop a winning trading system. I’ve been trading options for almost half of my life, and have experienced all there is to experience.

First, options are wasting assets. Remember that before you stick half of your account in an out-the-money call option on a Chinese cardboard company.

Next, as an option buyer, it’s fair to say that buying options is a win big, lose often strategy. In order to keep in the win column, I have spent most of my career developing my stock picking and timing skills. This I feel, is my edge in trading.

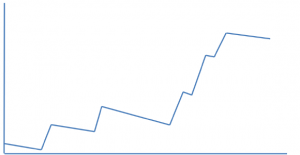

Even if you are 50/50 at picking winners, by introducing leverage you are afforded unlimited upside potential in each trade with the luxury of defined risk. All you can lose is what you put on the table. Under these circumstances, it’s fair to say your equity curve, over time, should look like this…

At the end of the year, my equity curve will look pretty similar, with the exception of the length of the drawdowns. Notice that while the account is gaining value, it is not always going up. If you had the expectation that even great traders don’t drawdown from time to time, then we ought to address your expectations.

In my experience, I go through a similar process. Take my recent winning streak here as an example. For the last couple months, I’ve gone about 70/30 in terms of win loss ratio. My equity curve has taken a huge leap in the last few months. However, the market pulled back for three days on me while having long positions on. I’m not the guy that takes off long positions just because the market is going to decline for a day or two. As result, my account has drawdown a few percentage points over the last 3 days. Was it enough to give back all of my gains over the last few weeks? Of course not.

One thing you’ll learn about my style is that I erase drawdowns faster than most. However, during the course of a drawdown, I don’t hit the panic button and look to realize losses for no reason other than emotion. If you find you are emotional, reduce position size and total number of positions. I could easily take a couple gains (BYD, MCP) and pay down a couple losses (CREE, VMW). I could then scratch two positions at breakeven (DANG, BZH) and get small. But then I would feel like a puss for taking off perfectly good trades only for a slight fluctuation in the market.

Listen, I want to make money every day I sit in front of my trading terminal; but its not realistic. I think as a whole, everyone here needs to start working on eliminating emotion, doing a better job of managing risk, and take a second to recognize that we truly have an edge here. Therefore, fix yourself in order to make it work for you.

Amen.

If you enjoy the content at iBankCoin, please follow us on Twitter

Wonderful piece.

if you’re emotional, a big reason most times is because your position size is too large. You’re beyond what you’re comfortable in losing.

MCP is bull flagging on the 5min. If she goes she could get $8 today.

Awesome. Ill sign up soon enough.

Sage advice. OA are there any specific techniques you use to manage your expectations from a trade outcome? Or has this come through experience? I personally just go away from my computer if there is an emotional setback. Sometimes I feel like that is not the best thing to do if you need to manage the trades. So I was wondering if there were any specific ideas or affirmations that have helped you.

I block out my account values.

Watching account value fluctuations triggers emotions. Traders like to count money before they realize wins.

That has been the ONE thing that has kept me back from being a good trader in my years.

LOL. yeah, some days when i log on i put my hand over the part where the balance will be displayed before i can switch to another page. I know i’m hurting but i don’t wanna know.

I have an awesome sticker for that. I’ll post a photo of it soon.

Dude, I would love that, will immediately hang it up lol. YGE is quite a sex machine today, love it.

the bull flag on the daily for YGE is beautiful. Would love to see it burst north a buck this week.

I find that your commentary is allowing me to get less emotional and stick to my convictions more consistently. This post is another very helpful example.

very good, OA

Awesome post.

great stuff!

The biggest takeaways so far for me have been position sizing and buying myself more time.

The cheapest options are not necessarily the best. I’ve gone back over my trades and at least half that expired worthless would have been ITM with even 1 extra week of time.

So positon sizing being equal, I would have less contracts but more wins.

Invaluable information from the OA – thanks much!

What a difference a day makes, yesterday seemed like all was lost only to have it reverse.

I have to talk people down from the ledge from time to time.

and man, I must thank you for that. Much appreciated.

Hi OA, do you use your own money to trade all the trade you post here, or clients money? Thanks.

Mostly mine.

Great article! Thanks OA I recently let emotions get the best of me and it was the only time ive experienced a really big loss. Only positive to take away from friday was that Im still profitable. (just started trading real money options this month)

Avoid emotion. Ruins everything.

So I’m new to options, just buying some calls when I have a strong hunch. Now I’m 4-6 points deep on 4 positions in SWY. when do I close out the positions and take profits? They are Oct-Dec-Jan dated. Maybe a future post could address your views on closing out profitable situations. Thanks for the valuable info you post.

Always plan in advance what your expectation is, so you know where to book gains. Have a target, in other words.

Really useful insights and advice. Thanks!

Thanks for some great pointers and insight.

Do you mostly run naked exposure on options or use a hedge, like last month with TZA?

Thanks for sharing an incredible skill in a mostly impossible options area!

Out

I hedge. It’s a must.

Would like to hear what must kick in in order for you to hedge. If positions are winning and thus allocation towards risk has inflated overall? Or if market overall has resistance above/volume pocket below (in other words if market indices are bearish)?

Or if you really want to take on another position but have reached a particular “maximum”? A little of all of the above?

Market up and extended usually does it for me. I would have hedged into enthusiasm Wednesday last week, but the intraday structure made me hesitate.

Cool.

I’d like to write another post today, but that pic on the home page is too classic.

Therefore, I’ll stay…

OA, perfectly said. We as traders are often our worst enemies. Thanks for keeping us in check from time to time. Should be a good After hours tonight.

What do you think of AMZN short term? Seems like it could easily go up to 320 within a day.

Man, they can’t keep that stock down.

I’m thinking FSLR is looking good, especially after so many were jumping ship on it recently.

I know. Wait til this stock is mid 40’s…people will whistle a totally different tune around here.

agreed. very excited for that.

I’m thinking to get in FEYE recent ipo. What do you think, you like it ?

No, I don’t usually trade an IPO this soon.

Whats up with the rewrite? It was worded perfectly the first time. If you ask me that was a @#$%y move.

J/K but I did like the original better.

Oh, I am a

pussywhen it comes to being brutally honest with my thoughts.Anyone else hold onto those ANGI Oct calls? yeehaw, out @ +228% thanks OA (& Fly)…

I held and sold today too. Thanks OC!

thoughts on $ANGI? too late to get in?

Very late. Most of use were accumulating at $20.

GNK has been a cash register for me today. Thanks, OA!. I know have a 6% cushion plus another 3% gain on top of a 1/2 position I will let ride.

Love your strategy.Way better than

not opening up your mutual fund reports

in down periods.

cheers