SOURCE

NYSE

NASDAQ

AMEX

“ZURICH/LONDON (Reuters) – UBS faced a fresh call to separate its investment banking operations and wealth management division at an investor meeting on Thursday, after activist investor Knight Vinke Asset Management demanded a review of the Swiss bank’s structure.

The surprise intervention by New York-based Knight Vinke comes six months after UBS decided to pull out of the most risky areas of investment banking and just days after first-quarter results beat expectations, giving investors some reassurance that the strategy was working.

One top ten shareholder dismissed Knight Vinke’s argument that UBS’s investment bank was holding back its wealth management arm, which attracted the most customer money in six years in the first quarter of this year.

“I would not buy the argument that one side is preventing the other side from reaching full potential. For sure, there was a phase where that was the case because of the way the investment bank was run but to me, UBS is learning from past mistakes and is moving forward,” said the investor, who declined to be named.

UBS said it would listen to the arguments and ideas of its shareholders and discuss them at the annual general meeting, which was being held on the outskirts of Zurich….”

Comments »“Expect Labs has already received funding from the likes of Google Ventures and Greylock Partners, but the San Francisco-based startup (and TechCrunch Disrupt alum) announced this morning that Intel Capital, Samsung Ventures, and Telefonica Digital have made their own strategic investments in the company.

In case you haven’t been keeping tabs on Expect Labs, well, you should be. It was founded by Tim Tuttle and Moninder Jheeta in 2011, and since then the team has been tackling a hefty problem — they want to be able to listen to and analyze your conversations as they happen, and surface relevant information right at the moment you need it without you having to search for it.

Granted, some of these new strategic partners are more surprising than others. Our own Jordan Crook sat down with Intel Capital president Arvind Sodhani back in March, who revealed that the chipmaker’s venture arm had indeed invested in Expect Labs and strongly hinted that Intel would lean on the startup’s Anticipatory Computing Engine to bring what Intel refers to as “sophisticated voice control” to ultrabooks. Tuttle naturally wouldn’t confirm whether ultrabooks in particular would soon benefit from Expect Labs tech, but noted that Intel is “trying to develop more expertise in software” and realizes that voice, touch, and gestures will become dominant modes of interaction with new devices.

At first glance, Samsung’s interest in Expect Labs and its thoughtful approach to surfacing information seems like a no-brainer. As seen in blockbuster devices like the Galaxy S4, the Korean electronics giant has sought to stay at the front of the smartphone pack by packing its smartphones full of first-party software like the S Voice assistant. That sort of approach hasn’t always been very well-received, but baking the ability to chew on conversations and spit out information on subjects users have just spoken about into yet another Samsung app would be a very savvy move for a company that’s continually looking to push the envelope on software. It’s not just smartphones that will benefit either — Tuttle specifically calls out smart TVs as a potential recipient of Expect Labs tech.

Telefonica seems like a much more interesting case — it’s the fifth largest mobile network operator in the world with roughly 315 million customers across Europe and the Americas. To date Expect Labs has shown off the proactive power of its Anticipatory Computing Engine in app form, but that sort of approach simply wouldn’t work for many of Telefonica’s subscribers since a considerable chunk of them in developing and mature markets don’t own smartphones…..”

Comments »“After three years of slow roll outs and testing with specific partners, Twitter’s Senior Director of Product for Revenue Kevin Weil justannounced the general availability of its advertising options for all US business. Weil revealed the move on stage at TechCrunch Disrupt, which could ramp up revenues and prep Twitter for a widely anticipated IPO.

Twitter first announced it would begin showing ads in April 2010. Since then it revealed promoted tweets and accounts, which let businesses pay to get their tweets seen and their profiles followed. Twitter more recently announced limited availability of a self-serve tool for buying ads, and an Ads API for programmatic buying of huge campaigns.

“Until today it’s been invite only, we’ve had brands and agencies and small business using the platform, and today we’re opening Tiwtter to all businesses, every account, every individual. Now every business in the US can us Twitter ads” said Weil.

Anyone can now go to Twitter’s self-serve interface to start buying Twitter ads….”

Comments »“LONDON (Reuters) – BP Plc has been hit by over 2,200 new lawsuits seeking payback for the 2010Gulf of Mexico oil spill in the past few weeks as individuals, companies and government bodies rushed to stake their claim before their right to do so expired.

The British oil company, whose deepwater Macondo well ruptured on April 20, 2010, killing 11 men and spilling crude into the sea for weeks, revealed the number of new claims made since March 6 in its first-quarter results on Tuesday.

The United States Oil Pollution Act of 1990, under which most of the new lawsuits were registered, has a three year statute of limitations which could make bringing further legal action difficult after the third anniversary of the disaster.

BP said it would be applying to have the new legal challenges consolidated into a trial that is already under way in New Orleans.

The first phase of the trial of BP and its partners in the well, Transocean and Halliburton , ended earlier in April, but the judge, Carl Barbier, has yet to rule on the degree of blame that will be apportioned to each party and on the level of negligence that will be applied.

Both decisions could have a big impact on the size of BP’s final liability, already measured in tens of billions of dollars. His ruling, to be made without a jury as is traditional under U.S. maritime law, could come this summer…”

Comments »“NEW YORK/LONDON (Reuters) – U.S. retailer Best Buy Co Inc retreated from its ill-fated European expansion on Tuesday by selling its stake in a joint venture to Carphone Warehouse Group for less than half what it paid five years ago.

The 500 million pounds ($775 million) sale is the latest sign the world’s largest consumer electronics chain is scaling back its overseas ambitions to focus on its mainstay U.S. business, which faces cut-throat competition from the likes of Wal-Mart Stores Inc and Amazon.com Inc .

The deal will strengthen Best Buy’s balance sheet, simplify its business and improve its return on invested capital, CEO Hubert Joly said in a statement, adding that the timing and economics felt right for the deal.

But allowing for currency fluctuations, the price is less than half the roughly $2.1 billion Best Buy paid in 2008 for 50 percent of the independent mobile seller’s retail operations.

“(Best Buy) basically paid 1.1 billion (pounds) for the same half they are selling back to us today for a lot less,” Carphone Chief Executive Roger Taylor said.

“When they bought in they had aspirations to put Best Buy stores across Europe, and they probably paid a premium for that, and in the end that strategy didn’t work for many reasons.”

Europe’s economic prospects continue to worsen on the back of searing budget cutbacks to deal with a crisis of government debt in several southern countries, while the U.S. economic recovery increasingly looks firmly on track….”

Comments »“Deutsche Bank AG (DBK) (DBK), continental Europe’s biggest bank, is raising 5 billion euros ($6.5 billion) in capital, three months after co-Chief Executive Officer Anshu Jain said a share sale wasn’t in investors’ interests.

The company issued 2.96 billion euros of stock at 32.90 euros apiece, exceeding an initial goal of 2.8 billion euros, as part of the capital increase, the Frankfurt-based lender said in a statement today. Deutsche Bank’s shares surged as much as 7.9 percent, the biggest rise since August.

Jain timed the capital increase to coincide with a report showing first-quarter earnings rose 19 percent, beating estimates. He’s boosting reserves after Standard & Poor’ (SPY)s warned of a possible credit rating downgrade. Jain said in January he was willing to take losses on asset sales rather than issue new stock, citing the level of the share price.

“We are now among the best capitalized banks in our global peer group,” Jain said on a conference call with analysts and investors today. “These measures allow us to take advantage of organic growth opportunities in a changing competitive landscape.”

Deutsche Bank’s shares climbed 6.3 percent to 34.98 euros at 9:32 a.m. in Frankfurt trading, valuing the firm at 33 billion euros. The Bloomberg Europe Banks and Financial Services Indexrose 1.3 percent.

The bank will also sell 2 billion euros of subordinated debt, Jain said on the conference call.

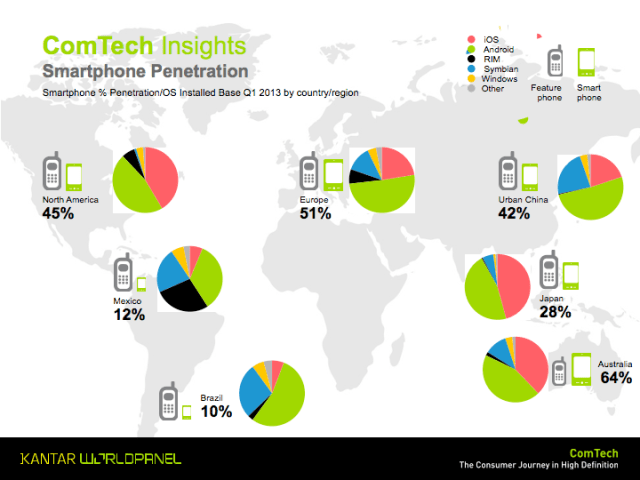

“Google’s mobile OS Android continues to power ahead as the world’s most popular smartphone platform, according to figures out today from Kantar Worldpanel Comtech, the WPP-owned market research company that tracks sales of handsets across key markets on a 12-week rolling cycle. In the nine markets surveyed by Kantar — Australia, China, France, Germany, Italy, Japan, Spain, UK and the U.S., all detailed in the table below — Android on average accounted for 64.2% of all handset sales in the 12 weeks that ended March 31.

The only market where Android did not dominate was Japan, where Apple’s iOS just about eked out a lead against it (49.2% versus 45.8% of sales) for the three months ending March 31. Elsewhere, the figures indicate that regardless of whether the market is developed (U.S., UK, Germany) or emerging (China) or struggling financially (Spain), collectively, Android handset makers are winning them all, with sales figures for the platform reaching their high point in Spain, at 93.5% of all smartphone sales.

As you can see below, when it comes to smartphone penetration of actual devices in use, Android is leading everywhere.

Kantar — which bases its figures on (as samples) 240,000 interviews annually in the U.S. and some 1 million across Europe — believes that Android’s lead will only grow more in the months ahead, with the ongoing roll out of two new Android handsets, the Galaxy S4 from Samsung and the HTC One, driving sales of the platform.

“We expect to see a further spike in [Android’s] share in the coming months, as sales from the HTC One start coming through and the Samsung Galaxy S4 is launched,” writes Dominic Sunnebo, global consumer insight director at Kantar Worldpanel ComTech. “This will pile pressure on Apple, BlackBerry and Nokia to keep their products front of consumers’ minds in the midst of a Samsung and HTC marketing blitz.” …”

Comments »“DETROITChrysler says its first-quarter net profit fell 65 percent as it shipped fewer older vehicles in preparation for several key product launches.

The company earned $166 million in the January-March quarter, compared with $473 million a year ago. Revenue fell 6 percent to $15.4 billion….”

Comments »“PLANO, TEXASJ.C. Penney (JCP) is confirming that Goldman Sachs (GS) will provide it with $1.75 billion in financing, sending shares up 3 percent in trading.

Rumors about the financing had begun to circulate Friday. J.C. Penney shares were up 2.2 percent, to $17.38, in morning trade, although that remains well below the stock’s 52-week high of $36.89….”

Comments »“MADRID—Banco Santander SA SAN.MC +1.92% announced the resignation of Chief Executive Alfredo Sáenz, following a wave of criticism of a recent move by the Spanish government to relax its standards of conduct for bankers to allow Mr. Sáenz to keep his job despite a criminal conviction.

A spokesman for Spain’s central bank, the Bank of Spain, said the announcement Monday was a “positive step” that should have a “favorable effect on the stability of Spain’s financial sector,” but didn’t amplify on the reasons for the resignation of the 70-year-old banker. Mr. Sáenz will be replaced as CEO by Javier Marín, until now managing director of the bank.

Santander’s shares rose Monday following news of Mr. Sáenz’s resignation.

The decision followed discussions between Mr. Sáenz and officials at the central bank, according to people familiar with the talks. At least one person said the central bank had indicated to Mr. Sáenz that it was likely to conclude that he didn’t belong in a senior role at the bank, suggesting that the central bank had a sterner view of Mr. Sáenz’s case than the government of Prime Minister Mariano Rajoy….”

Comments »“$FB has lost millions of users per month in its biggest markets, independent data suggests, as alternative social networks attract the attention of those looking for fresh online playgrounds.

As Facebook prepares to update investors on its performance in the first three months of the year, with analysts forecasting revenues up 36% on last year, studies suggest that its expansion in the US, UK and other major European countries has peaked.

In the last month, the world’s largest social network has lost 6m US visitors, a 4% fall, according to analysis firm SocialBakers. In the UK, 1.4m fewer users checked in last month, a fall of 4.5%. The declines are sustained. In the last six months, Facebook has lost nearly 9m monthly visitors in the US and 2m in the UK.

Users are also switching off in Canada, Spain, France, Germany and Japan, where Facebook has some of its biggest followings. A spokeswoman for Facebook declined to comment.

“The problem is that, in the US and UK, most people who want to sign up for Facebook have already done it,” said new media specialist Ian Maude at Enders Analysis. “There is a boredom factor where people like to try something new. Is Facebook going to go the way of Myspace? The risk is relatively small, but that is not to say it isn’t there.”

Alternative social networks such as Instagram, the photo sharing site that won 30m users in 18 months before Facebook acquired the business a year ago, have seen surges in popularity with younger age groups.

Path, the mobile phone-based social network founded by former Facebook employee Dave Morin, which restricts its users to 150 friends, is gaining 1m users a week and has recently topped 9m, with 500,000 Venezuelans downloading the app in a single weekend.

Facebook is still growing fast in South America: monthly visitors in Brazil were up 6% in the last month to 70m , according to SocialBakers, whose information is used by Facebook advertisers, while India has seen a 4% rise to 64m – still a fraction of the country’s population, leaving room for further growth.

But in developed markets….”

Comments »The company’s stock had climbed 22 percent since the start of the year as the maker of Tide detergent and Crest toothpaste turned in better profits for two quarters in a row. Last Thursday, P&G reported even higher earnings. And its stock immediately dropped 6 percent.

What happened? Like so many other big companies reporting results recently, P&G hit its target for earnings but missed on revenue. Nearly halfway through the first-quarter earnings season, Corporate America is still reporting solid profits, with seven of every ten big companies hurdling over Wall Street’s expectations. Sales, however, are another story.

Nearly the same proportion of big companies — six out of ten — have fallen short of revenue targets, according to S&P Capital IQ. The tally so far looks grim: Revenue has shrunk 2.4 percent compared with last year.

“The norm is becoming, beat your earnings, but miss on revenue,” says Scott Freeze, president of Street One Financial.

“Two problems persist: Europe’s ongoing recession and slower economic growth in China. Because nearly half of revenue for Standard & Poor’s 500 companies comes from abroad, it would seem logical to think the problem is just overseas. But many companies with a U.S. focus have also reported disappointing revenue.

Freeze says that revenue presents a more accurate picture of Corporate America’s health. “You can play with the earnings numbers and have them skewed,” he says. “But you can’t mess with the revenue numbers — they are what they are. If people are not coming in droves to buy your products, your revenue’s going to miss even if your earnings beat.”

Aside from Apple’s falling profit and some other high-profile flops, the headline numbers for first-quarter earnings appear solid. So far, 271 companies in the S&P 500 have said earnings are up 5 percent over the year before. And 189 of them have cleared Wall Street’s estimates.

Investors say that’s no surprise. They believe companies set the bar so low that it’s easy to jump over it. The 3.6 percent earnings growth analysts expect to see after all the results are tallied works out to $26.36. That’s just $1 more than the same period last year.

As one company after another turned in weak revenue results last week, analysts, investors and economists started raising concerns about the prospect for future profits….”

Comments »