Upgrades and Downgrades This Morning

“ARM Holdings PLC (NASDAQ: ARMH) Raised to Neutral at JPMorgan.

Banco Santander (NYSE: STD) Added to Conviction Buy List at Goldman Sachs; Raised to Overweight at JPMorgan.

Banco Bilbao Vizcaya Argentaria, S.A. (NYSE: BBVA) maintained Buy but removed from Conviction Buy List at Goldman Sachs.

CafePress Inc. (NASDAQ: PRSS) Started as Buy at Janney

CBS Corporation (NYSE: CBS) named Bull of the Day at Zacks.

Dril-Quip, Inc. (NYSE: DRQ) named Bear of the Day at Zacks.

F5 Networks, Inc. (NASDAQ: FFIV) Started as Overweight at Morgan Stanley.

General Electric Co. (NYSE: GE) Reiterated Outperform with $22 target at Credit Suisse.

Groupon, Inc. (NASDAQ: GRPN) Raised to Overweight at Evercore.

Microsoft Corporation (NASDAQ: MSFT) Reiterated Buy with $39 target at Argus.

Nationstar Mortgage Holdings Inc. (NYSE: NSM) Started as Outperform with $20 target at Credit Suisse; Started as Outperform at Wells Fargo; Started as Buy with $18 target at BofA/ML.

priceline.com Incorporated (NASDAQ: PCLN) Reiterated Outperform and raised target to $811 at Credit Suisse.

Progressive Corp. (NYSE: PGR) Cut to Neutral at Citigroup.

Regeneron Pharmaceuticals, Inc. (NASDAQ: REGN) Reiterated Buy and raised target to $146 at BofA/ML.”

Comments »Upgrades and Downgrades This Morning

“Altera Corporation (NASDAQ: ALTR) Cut to Neutral at Citigroup.

Bank of America Corporation (NYSE: BAC) Cut to Sell from Underperform at Credit Agricole.

Boston Beer Co. Inc. (NYSE: SAM) Started as Neutral at UBS.

Chesapeake Energy Corporation (NYSE: CHK) Cut to Market Perform at Wells Fargo; called “a stock to avoid on more ‘off balance sheet’ debt and ‘Founders Well’ issues” by Argus.

Cirrus Logic Inc. (NASDAQ: CRUS) Started as Buy at Stern Agee.

Embraer SA (NYSE: ERJ) Cut to Neutral at Goldman Sachs.

EZCORP, Inc. (NASDAQ: EZPW) Cut to Underperform at Stern Agee.

Gran Tierra Energy, Inc. (AMEX: GTE) Started as Outperform at Credit Suisse.

Ixia (NASDAQ: XXIA) Raised to Buy at Wunderlich.

Lumber Liquidators Holdings, Inc. (NYSE: LL) Cut to Neutral at Goldman Sachs.

Myriad Genetics Inc. (NASDAQ: MYGN) Raised to Outperform at Cowen.

Nexen Inc. (NYSE: NXY) Raised to Outperform at Credit Suisse.

ONEOK Inc. (NYSE: OKE) Raised to Buy at UBS.

Plains All American Pipeline, L.P. (NYSE: PAA) Started as Overweight at Barclays.

Riverbed Technology, Inc. (NASDAQ: RVBD) Cut to Neutral at JPMorgan; Cut to Perform at Oppenheimer; downgrades and price target and estimates have been cut at multiple boutique firms.

SanDisk Corporation (NASDAQ: SNDK) Cut to Hold at Deutsche Bank; downgraded or estimate and price targets cut at several other boutique firms.

Syntroleum Corporation (NASDAQ: SYNM) Started as Market Outperform with $1.80 price target at JMP Securities.”

Comments »Nomura is Out With a 2012 & 2013 Global Report

“The global economy is expected to slow in 2012. As Europe enters a recession, the effects will trickle down to the rest of the world, write economists at Nomura.

Global GDP is projected to grow 3.4 percent in 2012, down from 3.7 percent last year. The biggest risks to the global economy stem from oil price spikes, a deterioration in the European crisis, the U.S. fiscal cliff effect at the end of the year, and an investment slump in China.

Growth is expected to be driven by emerging markets with collective GDP projected to rise 5.9 percent this year, compared with 1.3 percent expected for developed economies.

Nomura offered outlooks and commentary on individual countries….”

Comments »Upgrades and Downgrades This Morning

“Alexion Pharmaceuticals, Inc. (NASDAQ: ALXN) Raised to Outperform as Bull of the Day at Zacks.

Apple Inc. (NASDAQ: AAPL) Reiterated Buy and Raised target to $740 at Canaccord Genuity.

Automatic Data Processing, Inc. (NASDAQ: ADP) Reiterated Outperform with $65 target at Credit Suisse.

Corinthian Colleges Inc. (NASDAQ: COCO) Raised to Equal-weight at Barclays.

eBay Inc, (NASDAQ: EBAY) Raised to Buy at Benchmark; Raised to Overweight at Piper Jaffray; maintained as Hold at Canaccord Genuity.

F5 Networks, Inc. (NASDAQ: FFIV) Raised to Buy at Wunderlich.

Intel Corporation (NASDAQ: INTC) Reiterated Buy with $34 target at Argus.

Navistar International Corporation (NYSE: NAV) Cut to Market Perform at Wells Fargo.

Zynga, Inc. (NASDAQ: ZNGA) Raised to Hold at Needham.”

Comments »Meredith Whitney Upgrades Citibank; $C

Goldman Sachs, $GS, Puts Apple Inc., $AAPL, at a Screaming Buy

Upgrades and Downgrades This Morning

American International Group Inc. (NYSE: AIG) Raised to Outperform at William Blair.

Bankrate, Inc. (NYSE: RATE) Started as Buy at SunTrust Robinson Humphrey.

Comerica Inc. (NYSE: CMA) Cut to Market Perform at BMO.

CNOOC Ltd. (NYSE: CEO) Raised to Hold at Jefferies.

Cree Inc. (NASDAQ: CREE) Cut to Hold at ThinkEquity.

Deckers Outdoor Corporation (NASDAQ: DECK) Raised to Neutral at Stern Agee.

First Solar, Inc. (NASDAQ: FSLR) Raised to Hold at Cantor Fitzgerald; Cut to Sell at Wunderlich; Maintained as Buy but cut target $40 from $50 at Argus.

Intel Corporation (NASDAQ: INTC) Maintained Outperform with $35 target and raised 2013 estimates at Credit Suisse.

International Business Machines Corporation (NYSE: IBM) Cut to Neutral at Macquarie; Raised estimates but maintained as Neutral at Credit Suisse.

SAP AG (NYSE: SAP) Reiterated Buy with $84 target at Argus.

T. Rowe Price Group (NASDAQ: TROW) named as Bull of the Day at Zacks.

Tata Motors Ltd. (NYSE: TTM) maintained as the most undervalued stock on the price-to-book versus return on equity valuation model at Credit Suisse.

United Continental Holdings, Inc. (NYSE: UAL) named as Bear of the Day at Zacks.”

Comments »Nomura Forecasts Japan Climbing Out From Over a Decade Worth of Inflation

“Japan is poised to exit more than a decade of deflation as a strengthening yuan bolsters China’s buying power, fueling Japanese production and buoying prices, according to Nomura Holdings Inc. (8604)

Demand from China will propel continuous gains in Japanese consumer prices next year as companies ramp up production with factories now running at about three quarters of capacity,Takahide Kiuchi, Nomura’s chief economist, said in an interview on April 13. The yuan has gained 5.2 percent against the yen this year, making Japanese products more affordable in China, which became Japan’s biggest overseas market in 2009.

Premier Wen Jiabao last month said China will adopt policies to encourage domestic consumption and wean the country from its dependence on exports. The shift may help Japan absorb a glut of unused factory capacity and unwind a cycle of declining prices that has weighed on economic growth. Deflation has driven wages down 16 percent since a 1997 peak and caused tax revenues to fall by about 20 percent in the same period, according to government data compiled by Bloomberg.

“Even mild deflation is a bad thing,” Kiuchi said. “When people expect deflation, wages tend to decline more rapidly. That means real wages decline and that undermines consumption.”

Japanese companies are using about 73 percent of their factory capacity, according to trade ministry data released yesterday. An increase in capacity utilization to about 85 percent in August 2007 preceded Japan’s last period of inflation, a 15-month stretch of price gainsbetween October 2007 and December 2008….”

Comments »Sterne Agee Bullish on $CROX into Earnings

Sam Poser, the guy who nailed DECK, is very bullish on CROX ahead of numbers, with a $30 target on CROX.

Comments »IMF boosts global growth forecast, with caveat

NEW YORK (CNNMoney) — The outlook for the global economy has improved, but there are still major risks that policymakers need to address, the International Monetary Fund said Tuesday.

The IMF now expects global economic output to increase 3.5% in 2012, according to the latest edition of its World Economic Outlook. In January, the IMF projected a slightly weaker growth rate of 3.3%.

The fund raised its forecast for U.S. economic growth this year to 2.1% from 1.8% in January. But the outlook for Europe remains bleak, with the euro area economy expected to shrink 0.3% this year, according to the IMF.

The debt crisis in Europe and a potential spike in oil prices are the two main risks facing the global economy, the IMF warned.

“The most immediate concern is still that further escalation of the euro area crisis will trigger a much more generalized flight from risk,” the report states.

While officials in Europe have taken steps to contain the crisis, the IMF said more needs to be done to address longer-term economic problems in the eurozone….”

Comments »Upgrades and Downgrades This Morning

Achillion Pharmaceuticals Inc. (NASDAQ: ACHN) Started as Outperform with $11 target at Credit Suisse.

Apple Inc. (NASDAQ: AAPL) Started as Strong Buy with $800 target at Raymond James (late Monday call).

Boston Scientific Corp. (NYSE: BSX) Reiterated Outperform with $7 target at Credit Suisse.

Celestica Inc. (NYSE: CLS) Cut to Hold at Deutsche Bank.

Citigroup Inc. (NYSE: C) Reiterated Outperform with $48 target at Credit Suisse.

Citi Trends, Inc. (NASDAQ: CTRN) named Bear of the Day at Zacks.

First Solar, Inc. (NASDAQ: FSLR) Cut to Hold at Goldman Sachs.

Hain Celestial Group (NASDAQ: HAIN) named Bull of the Day at Zacks.

Idenix Pharmaceuticals Inc. (NASDAQ: IDIX) Started as Neutral at Credit Suisse.

Infosys Ltd. (NASDAQ: INFY) Cut to Neutral at Goldman Sachs.

Newcastle Investment Corporation (NYSE: NCT) Started as Outperform at Keefe Bruyette & Woods.

SAP AG (NYSE: SAP) Raised to Buy at SocGen; Cut to Neutral at HSBC.

Teekay Tankers Ltd. (NYSE: TNK) Raised to Neutral with new $5.20 target at BofA/ML.

Tiffany & Co. (NYSE: TIF) Started as Neutral at Macquarie.

Valero Energy Corporation (NYSE: VLO) Reiterated Outperform with $37 target at Credit Suisse.

Vertex Pharmaceuticals Inc. (NASDAQ: VRTX) Started as Outperform with $43 target at Credit Suisse.

Comments »Moody’s Downgrades Nokia

Upgrades and Downgrades This Morning

Ball Corporation (NYSE: BLL) Cut to Neutral at Credit Suisse.

Caterpillar Inc. (NYSE: CAT) Raised to Buy at BofA/ML.

Chesapeake Energy Corporation (NYSE: CHK) Cut to Neutral at Citigroup.

E-Commerce China Dangdang Inc. (NYSE: DANG) Cut to Neutral at Credit Suisse.

Esterline Technologies (NYSE: ESL) Raised to Outperform at Credit Suisse.

GeoResources, Inc. (NASDAQ: GEOI) named as Value stock of the day at Zacks.

Infosys Ltd. (NASDAQ: INFY) Cut to Hold at Deutsche Bank; Cut to Neutral at Macquarie.

Invesco, Ltd. (NYSE: IVZ) named as Bull of the Day at Zacks.

JetBlue Airways Corp. (NASDAQ: JBLU) Reiterated Hold at Argus.

Philips Electronics N.V. (NYSE: PHG) Named as Bear of the Day at Zacks.

Plains All American Pipeline. L.P. (NYSE: PAA) Reinstated as Outperform at Credit Suisse.

UIL Holdings Corp. (NYSE: UIL) Reiterated Hold at Argus.

Under Armour, Inc. (NYSE: UA) Reiterated Buy at Canaccord Genuity.

Vornado Realty Trust (NYSE: VNO) Raised to Outperform at Keefe Bruyette & Woods.

Waddell & Reed Financial Inc. (NYSE: WDR) Raised to Neutral at Citigroup.”

Comments »Moody’s Zandi Raises First-Quarter US Growth Forecast on Trade Data

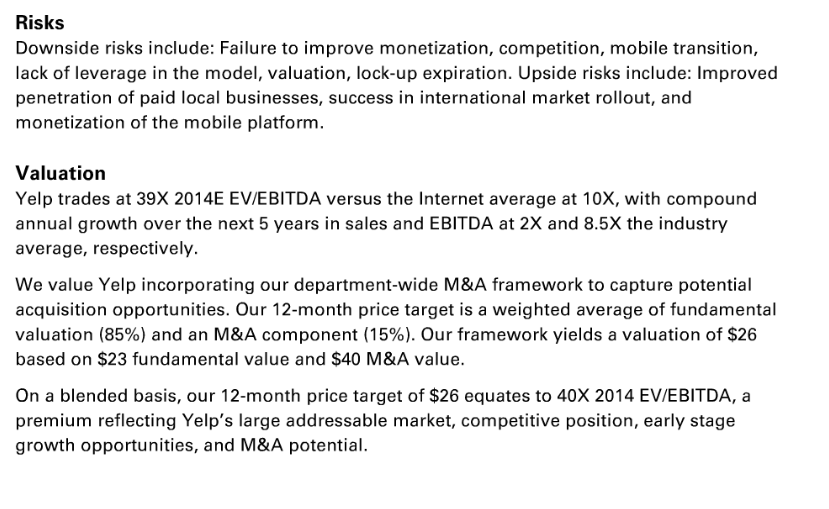

Goldman’s Valuation Notes on $YELP

Goldman Raises Q1 GDP Forecast To 2.5% On Trade Deficit Data

“US fiscal and monetary policy summarized: Baffle them with B(L)S data. This is what happened most recently this morning, when as we noted the labor data is finally reverting to a far weaker trendline now that the weather effect first written about here in February, has been fully exposed. And if it was only that it would be case closed: more QE is coming, especially with headling PPI coming less than expected. However, we also had trade data that came in $6 billion better than expected, a number we said would result in imminent Q1 GDP hikes. Sure enough, here comes Goldman. “The US trade deficit declined to $46.0 in February following a deficit of $52.5bn in January. Most of the improvement reflected a sharp decline in real goods imports, which fell by 3.9% (month-over-month). We suspect that the weakness reflects in part seasonality related to the Chinese New Year holidays. Real goods exports also declined during the month, falling by 1.0%. On net, the report raised our tracking estimate of Q1 GDP growth to 2.5% from 2.3% previously.” So what is a poor Fed chairman to do to keep the goldilocks illusion going, yet have a QE way out? Well, blame China for a jump in GDP helps. For everything else we have the weather.”

Comments »Upgrades and Downgrades This Morning

Adtran Inc. (NASDAQ: ADTN) Reiterated Buy with $39 target at Argus.

Agrium Inc. (NYSE: AGU) named Value stock of the day at Zacks.

Amazon.com, Inc. (NASDAQ: AMZN) Started as Neutral at SunTrust Robinson Humphreys.

AT&T, Inc. (NYSE: T) Raised to Overweight at JPMorgan.

Chipotle Mexican Grill Inc. (NYSE: CMG) Reiterated Buy and raised target to $480 at Argus.

Energy Transfer Equity. LP (NYSE: ETE) Started as Outperform at Credit Suisse.

Energy Transfer Partners. L.P. (NYSE: ETP) Started as Outperform at Credit Suisse.

Google Inc. (NASDAQ: GOOG) Started as Buy at SunTrust Robinson Humphreys.

Human Genome Sciences Inc. (NASDAQ: HGSI) Started as Neutral at UBS.

Marathon Petroleum Corporation (NYSE: MPC) named Bull of the Day at Zacks.

Netflix, Inc. (NASDAQ: NFLX) Started as Buy at SunTrust Robinson Humphreys.

Nokia Corporation (NYSE: NOK) Cut to Hold at SocGen.

Comments »

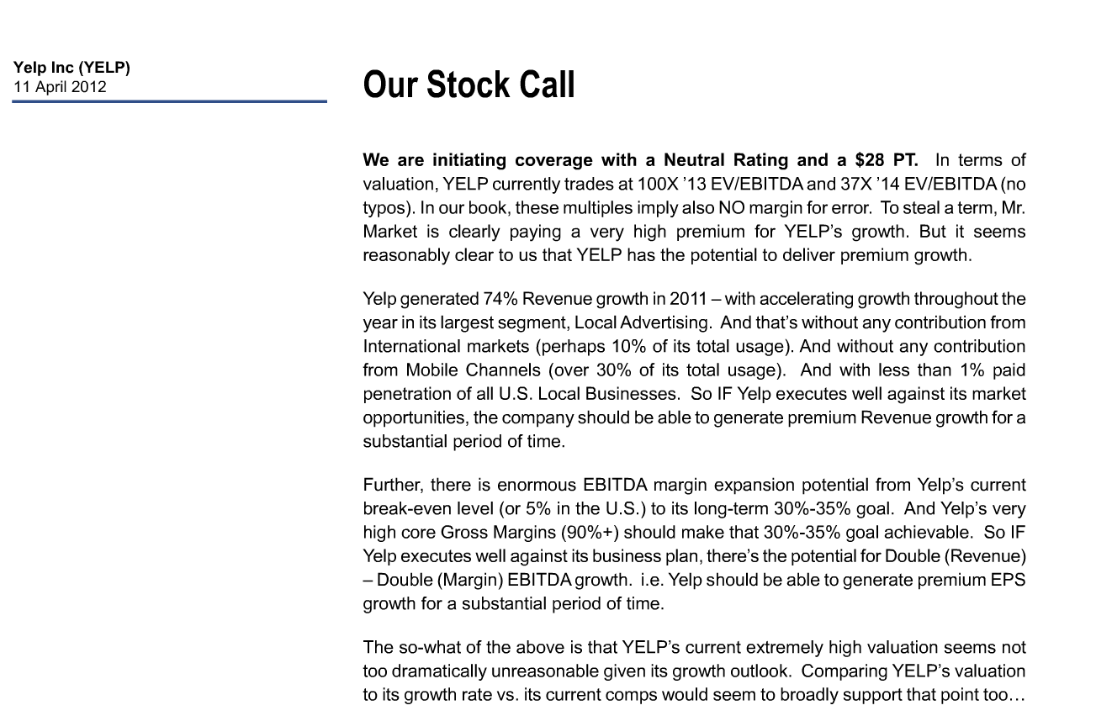

Citi Notes on $YELP

Upgrades and Downgrades This Morning

“American Superconductor Corporation (NASDAQ: AMSC) Started as Buy at Maxim Group.

Cepheid, Inc. (NASDAQ: CPHD) named Bull of the Day at Zacks.

Eldorado Gold Corporation (NYSE: EGO) Raised to Buy at Canaccord Genuity.

GameStop Corporation (NYSE: GME) Cut to Hold at Needham.

Huntington Bancshares (NASDAQ: HBAN) Started as Neutral at Goldman Sachs.

J. C. Penney Company, Inc. (NYSE: JCP) Started as Neutral at UBS.

Macy’s, Inc. (NYSE: M) Started as Neutral at UBS.

NVIDIA Corporation (NASDAQ: NVDA) Started as Outperform at RBC.

Polycom Inc. (NASDAQ: PLCM) Cut estimates but maintained Buy at Argus.

SAP AG (NYSE: SAP) Cut to Hold at ThinkEquity.

SuperValu Inc. (NYSE: SVU) maintained Neutral but cut target to $6 at Credit Suisse.

United Continental (NYSE: UAL) named as Bear of the Day at Zacks.

Yelp Inc. (NYSE: YELP) Started as Neutral at Goldman Sachs; Started as Neutral at Citigroup; Started as Perform at Oppenheimer; Started as Hold at Jefferies.”

Comments »