ARMH, BIG, CHKM, CSCO, CPWM, DLB, HGSI, JDSU, LINE, MMM, NOV, ORCL, RGP, TPX, TLLP, TEVA, VRTX

Comments »Upgrades and Downgrades This Morning

AIG, ADI, ARNA, COP, DMD, DOW, FOSL, HSY, JIVE, MRVL, MELI, PSX, QIHU, UBNT, YOKU

Comments »Upgrades and Downgrades This Morning

ACM, ALNY, BIIB, BP, COF, SNP, CTSH, EA, EPB, ERJ, F, LPX, MFC, MM, RAX, SYNC, VRTX, WYNN

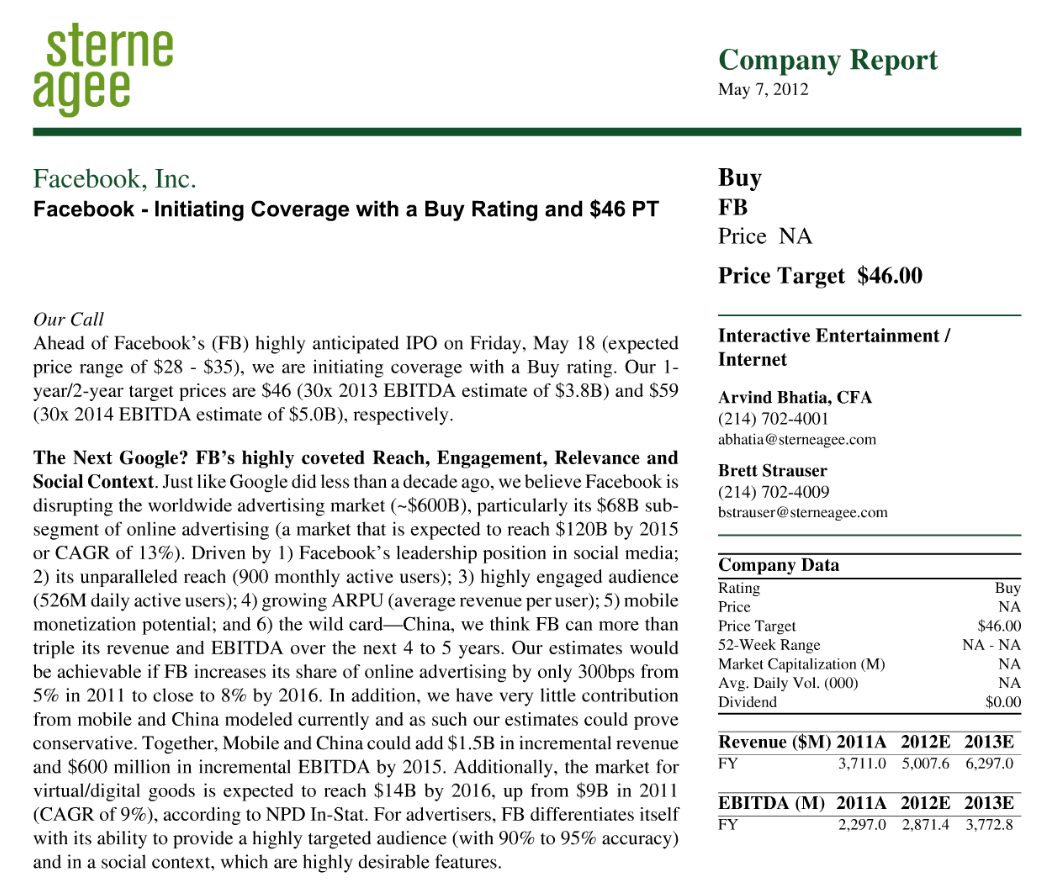

Comments »Sterne Agee Starts Facebook with Buy Rating, Price Target $46: $FB

Upgrades and Downgrades This Morning

Upgrades and Downgrades This Morning

AIR, ALL, EPD, FDX, FSLR, HON, JDSU, LNKD, BIN, RHT, SKS, SFY, SPRD, SPWR, TRLG, VCLK, WFM

Comments »Upgrades and Downgrades This Morning: $ALGN, $BHI, $CACI, $CAB, $CHK, $DVA, $GMCR, $LVLT, $MSCI, $ONXX, $PCLN, $QCOM, $QIHU, $CRM, $TTM

S&P Takes Greek Bond Ratings Out of Default Zone

“Standard & Poor’s rating agency upgraded Greece’s long-term credit rating from ‘selective default’ to sub-investment grade triple-C on Wednesday, citing the country’s recently-completed bond swap…”

Comments »Upgrades and Downgrades This Morning

Upgrades and Downgrades This Morning

Goldman Sachs: US Jobs Report to Fall Far Short of Estimates

“The United States likely added only 125,000 net jobs in April, a Goldman Sachs report finds, far less than calls from Reuters for a gain of 170,000, and an average of 177,250 jobs created every month from December to March.

The Bureau of Labor Statistics will release the official number Friday, about a month after the March jobs report came in well below expectations with 120,000 jobs added.

“Real income growth remains soft, partly because of higher energy prices, wealth effects are not yet particularly positive, consumer confidence remains modest, and again some of the recent strength in retail sales probably reflects weather effects,” says Goldman Sachs chief U.S. economist Jan Hatzius, according to CNBC…”

Comments »S&P Downgrades 16 Spanish Banks

“Standard & Poor’s (S&P) Ratings Services announced on Monday that it had lowered the credit rating of 16 Spanish banks. The downgrade came ahead of an announcement of Spain’s first quarter GDP figures, which showed the country had fallen back into recession….”

Comments »Upgrades and Downgrades This Morning

“Citigroup upgrades British Sky Broadcasting from neutral to buy

Goldman Sachs upgrades India’s biggest real estate developer DLF to buy fro neutral

Canaccord said Rovi Corporation (ROVI : NASDAQ) is still a buy and upped its target pric to $48″

Comments »Upgrades and Downgrades This Morning

AET, AEM, APD, ALU, MDRX, AMZN, AMCC, BIDU, CBG, CTCT, DECK, EBAY, LOGI, PCS, PM, REGN, SNDK, STX, WDC, ZNGA

Comments »Facebook Downgraded: Company Is Not Worth $100 Billion

“Weeks ahead of its IPO, Facebook’s valuation on private markets is above $100 billion.

Capstone Investments analyst Rory Maher thinks that’s too high.

Here’s why:

- Decelerating Revenue Growth. According to the recently filed S1 amendment, Facebook revenue grew 45% in 1Q12 versus 55% in 4Q11, 104% in 3Q11, and 108% in 2Q11. We believe it is unlikely that meaningful re-acceleration of revenue will occur this year as there are not many indications the Company will release a meaningful number of new premium ad products.

- Growth Investments Hurting Near-Term Profits. The Company reported a free cash flow loss of -$12M in 1Q12 versus a gain of $192M in 1Q11, driven by a significant increase in capital expenditures [“capex”] related to building data centers and storage capability. Capex at 43% of revenue is higher than we expected and we believe there could be more investment in the future due to growth in emerging markets. As a result, we are assuming a more gradual step down in capex through 2016.

- Lowering Revenue Forecast Due To Less Than Expected Traction From Premium Ads. We lower our annual revenue growth rate from 2012E-2016E to 32% from 43% as we believe sellout of premium inventory is growing at a lower-than-expected rate since many otherwise premium advertisers are finding comparable ROI on the cheaper self-serve marketplace ads. We believe this could be a long-term issue.

- Lower EBITDA Margin Forecast. The Company reported higher-than-expected expense margins across most lines, with the largest increased coming from sales and marketing and product development. We continue to believe the Company will scale its expenses as it grows in overseas markets, but this could be more gradual than expected. As a result, we currently forecast 59% EBITDA margins in 2016E versus our previous forecast of 64%.

- $90 Billion Valuation. We value Facebook at $90 Billion following changes in our long-term outlook vs. a previous range of $75B-$110B. We use a combination of DCF and EV/EBITDA multiples to determine our target (see Figure 3).

Our take: It’s unclear that Mark Zuckerberg – and therefore Facebook, which he unilaterally controls – cares enough about making money to be a $100 billion company. We’re not sure Zuckerberg would disagree or care.”

Comments »Upgrades and Downgrades This Morning

“ABB Ltd. (NYSE: ABB) Cut to Neutral at JPMorgan.

Air Products & Chemicals Inc. (NYSE: APD) Raised to Equal-weight at Morgan Stanley.

Akamai Technologies, Inc. (NASDAQ: AKAM) Raised to Buy on weakness at UBS.

ConcoPhillips (NYSE: COP) Raised to Neutral at Macquarie.

General Dynamics Corp. (NYSE: GD) Cut to Equal-weight at Morgan Stanley.

Harley-Davidson, Inc. (NYSE: HOG) Raised to Overweight at Barclays.

Hess Corporation (NYSE: HES) Cut to Neutral at JPMorgan; Cut to Equal-weight at Barclays; Cut to Neutral at Credit Suisse.

Infosys Ltd. (NASDAQ: INFY) Raised to Buy at Citigroup.

ManpowerGroup (NYSE: MAN) named Bull of the Day at Zacks.

Marriott International (NYSE: MAR) Raised to Buy at Argus.

SAP AG (NYSE: SAP) Cut to Market Perform at Wells Fargo.

Sprint Nextel Corporation (NYSE: S) maintained Hold at Argus.

The Travelers Companies, Inc. (NYSE: TRV) Raised to Hold at Deutsche Bank.

Watson Pharmaceuticals, Inc. (NYSE: WPI) Raised to Buy at Citigroup.”

Comments »Upgrades and Downgrades This Morning

“Apple Inc. (NASDAQ: AAPL) Raised to Outperform at Scotia.

Bank of Ireland (NYSE: IRE) Cut to Neutral at Credit Suisse.

Buffalo Wild Wings (NASDAQ: BWLD) Raised to Buy at Deutsche Bank.

Cymer Inc. (NASDAQ: CYMI) Raised to Outperform at Credit Suisse.

Domino’s Pizza (NYSE: DPZ) Raised to Neutral at BofA/ML.

Ethan Allen Interiors Inc. (NYSE: ETH) Raised to Buy at Stifel Nicolaus.

Fifth Third Bancorp (NASDAQ: FITB) Raised to Buy at Deutsche Bank.

Intuitive Surgical, Inc. (NASDAQ: ISRG) Started as Outperform at Raymond James; Named as Bull of the Day at Zacks.

J. C. Penney Company, Inc. (NYSE: JCP) Raised to Market Perform at BMO.

Leggett & Platt, Inc. (NYSE: LEG) named Bear of the Day at Zacks.

McDonald’s Corporation (NYSE: MCD) Cut to Hold at Argus.

Regions Financial (NYSE: RF) Raised to Buy at Rochdale Securities.

Symantec Corporation (NASDAQ: SYMC) Cut to Sector Perform at RBC.

Time Warner Cable (NYSE: TWC) Started as Buy at Citigroup.

United Technologies (NYSE: UTX) Raised to Buy at Argus.

Wal-Mart Stores, Inc. (NYSE: WMT) Cut to Hold at Argus.”

Comments »U.S. Lost AAA Rating on Danger of Liquidity Crisis, S&P’s Kraemer Says

“The U.S. lost its top credit grade in August because of the imminent danger of a “real liquidity crisis,” and Standard & Poor’s made no errors in its analysis, said Moritz Kraemer, managing director of sovereign ratings.

“Last summer, the U.S. government got extremely close to a real liquidity crisis because the Washington establishment could not agree on the way forward that would have been required to raise the debt ceiling,” Kraemer told lawmakers on the U.K. Parliament’s Treasury Committee today in London.

S&P cut the rating by one level to AA+ on Aug. 5, criticizing the nation’s political process and saying that spending cuts agreed on by lawmakers wouldn’t be enough to reduce record deficits. Treasuries surged after the move, and while Moody’s Investors Service and Fitch Ratings have kept their top grades on the U.S., both have a negative outlook. The U.S. Treasury criticized S&P for flawed analysis.

“There was no mistake,” Kraemer said today. “There were different scenarios. These are measures about the future which you have to have an analytical debate on what is the likely strategy of fiscal consolidation the government might take.”

S&P made a $2 trillion error and then changed the rationale for its decision, raising “fundamental questions about the credibility and integrity” of its ratings action, John Bellows, acting assistant secretary for economic policy, wrote in a Treasury blog post on Aug. 6.

Kraemer dismissed that analysis, echoing comments at the time by David Beers, S&P’s former head of sovereign ratings, who said it was a “complete misrepresentation” of what happened. Kraemer’s testimony today was part of an inquiry by lawmakers into credit rating companies.

CBO Scenarios

The discussion with the Treasury before the downgrade was announced “was about which of the scenarios which were published by the Congressional Budget Office, which is a nonpartisan institution, should be underlying the analysis,” Kraemer said. “Originally the S&P team was following the alternative scenario of the CBO, the alternative fiscal scenario, which in terms of expenditure trajectory did foresee a growth in spending in line broadly with nominal GDP.”

S&P agreed to use a different scenario after a “normal process of interaction” with Treasury officials, Kraemer said.

“The 2 trillion is the difference in the net debt ratio in 2021 depending on which scenario you use,” he said. “Under the alternative scenario, which we had initially pursued, the debt ratio in 2021 would have come up at $22 trillion — I’m using round numbers — 22.1, which is 2 trillion higher than under the baseline scenario, which is 20 trillion.”

$2 Trillion

In August S&P said it went ahead with a downgrade because the Treasury’s $2 trillion figure was derived by calculating government debt over a 10-year period while S&P’s ratings are determined using a three- to five-year time horizon.

Questioned today on why Finland is graded AAA while the U.S. has lost its top rating, Kraemer highlighted the differences in both nations’ political environment.

“The debt ratio in the U.S. is much higher, the debt trajectory is more adverse, but most importantly, it has been our finding at least, people may come to different conclusions on that, but we felt the governance challenges that the U.S. political system is facing in generating a coherent strategy of getting the public finance challenge under control are more pronounced than they are in Finland,” Kraemer said.”

Comments »Upgrades and Downgrades This Morning

“Allison Transmission Holdings, Inc. (NYSE: ALSN) Started as Neutral at Credit Suisse; Started as Neutral at Goldman Sachs; Started as Neutral at Citigroup.

AutoZone Inc. (NYSE: AZO) Raised to Overweight at JPMorgan.

Big Lots Inc. (NYSE: BIG) Cut to Hold at Deutsche Bank.

Check Point Software Technologies Ltd. (NASDAQ: CHKP) Maintained Hold at Argus.

Chipotle Mexican Grill, Inc. (NYSE: CMG) Cut to Neutral on valuation at Credit Suisse; Reiterated Buy with $480 target at Argus.

Citi Trends, Inc. (NASDAQ: CTRN) named Bear of the Day at Zacks.

Demandware, Inc. (NYSE: DWRE) Started as Buy at Deutsche Bank; Started as Outperform at William Blair; Started as Outperform at Oppenheimer; Started as Neutral at Goldman Sachs.

General Electric Co. (NYSE: GE) Reiterated Buy with $22 target at Argus.

Illumina, Inc. (NASDAQ: ILMN) Reiterated Buy with $54 target at BofA/ML.

LinkedIn Corporation (NYSE: LNKD) Started as Overweight at Piper Jaffray.

Pep Boys-Manny, Moe & Jack Inc. (NYSE: PBY) Cut to Sell at Argus.

Rambus Inc. (NASDAQ: RMBS) Raised to Overweight at JPMorgan.

Texas Instruments Inc. (NASDAQ: TXN) Reiterated Buy with $36 target at BofA/ML.

UnitedHealth Group (NYSE: UNH) named Bull of the Day at Zacks.

Xerox Corporation (NYSE: XRX) Reiterated Buy with $13 target at Argus.”

Comments »