[youtube:http://www.youtube.com/watch?v=u7P5WP0CSX4&feature=g-all-u 603 500]

Comments »Savage: Sara Palin is a Faker

Sandvine: $NFLX Bandwidth Usage Has Peaked

[youtube:http://www.youtube.com/watch?v=kltaSirUsVQ&feature=g-all-u 603 500]

Comments »Detroit is Such a Piece of Shit

Think Your Market is Bad? Have a Look at the Greek Stock Market

Top Performing Stocks (1 week)

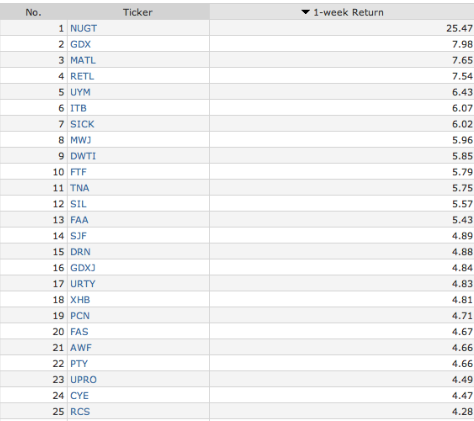

Top Performing ETFs (1 week)

FLASH: US Futures Are Higher

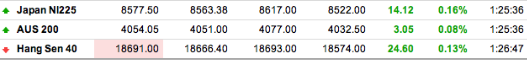

FLASH: Asian Markets Are Moderately Higher in Early Trade

Citadel Got Fucked on the Facebook IPO Too

Citadel’s losses were said by one of the people to be in a similar range. Both Knight and Citadel submitted claims for financial accommodation from Nasdaq by Monday’s deadline, these people said.

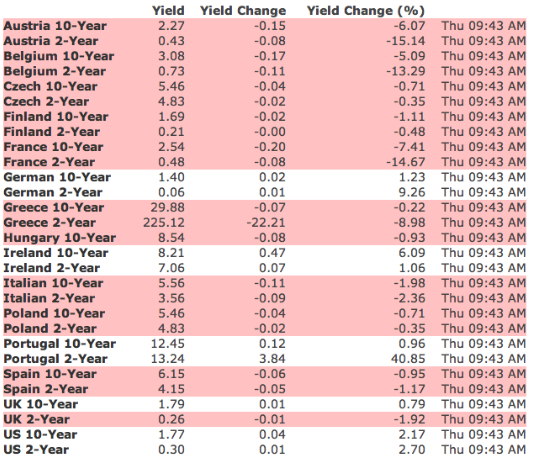

Comments »ALERT: Spanish and Italian Yields are Dropping

CUT FUNDING TO PAKISTAN: MAN WHO INFORMED WHEREABOUTS OF BIN LADEN CONVICTED OF TREASON

A Pakistani court on Wednesday imposed a 33-year sentence on a doctor who assisted the CIA in the hunt for Osama bin Laden, prompting dismay among U.S. officials and warnings that the punishment will exacerbate already-strained relations and could lead to cuts in aid.

Shakil Afridi, 48, a government surgeon in the semiautonomous Khyber Agency along the Afghanistan border, was convicted of treason for using a vaccination drive to try to gather DNA samples from the Abbottabad compound where bin Laden was in hiding.

Comments »FLASH: European Indices Pointing to +1% Open

Marc Cuban: The Facebook IPO Post Mortem- $FB

1. Say goodbye to the individual investor on Wall Street. Whatever positive impression they had of the IPO market and the stock market in general was just torched to the ground. When everyone you know associated with the stock market is telling you and the media is confirming that this could be a huge IPO that will make money for those lucky enough to get shares and the opposite happens, goodnight. All confidence in the stock is destroyed. Put your money in the bank or if you want to gamble, at least slot machines in Vegas pay out 98pct.

2. The Valuation Bubble in Silicon Valley is bursting – but not for the reasons you think. Historically IPOs function as a means of getting stock to outsiders. People who were not sold/assigned/granted shares could only buy shares once they reached the public markets. The new secondary markets in private shares changed that. They allowed outsiders to purchase shares in a market with very little liquidity.

The demand for shares outstripped the supply and you know what happens when demand outstrips supply ? The price goes up. So shares of FB on secondary market went up and up and up. (Just as LinkedIn had done before them, but it greater volumes) When it was time to go public the IPO had to be priced higher than the prevailing share price on the secondary market.

To make matters worse, those folks who bought shares in the secondary private market, driving up the share price now had the shares they wanted to buy , so they were no longer going to be the buyers the IPO counted on to eat up shares in the open market.

Can you imagine how pissed you would be if you bought a boatload of Facebook thinking you got in at a better than IPO price only to watch the price on the open market post IPO drop below the price you paid in the private market ? Ouch.

The law of unintended consequences is that the dynamics for how private companies are valued and are able to raise Pre IPO rounds could quickly change if the prices and volumes on SecondMarket and its competitors declined significantly.

3. I always laugh at all the pundits /analysts who try to tell you what any non dividend paying stock is worth. Its a function of supply and demand. Its never fundamentals. Read what I wrote a long time ago about the stock market. In the case of facebook they put an ENORMOUS number of shares into the market. Too much supply. Valuation has no relevance what so ever. Conventional wisdom says the buyers of stocks will try to determine the value of a stock before they buy or sell and make the appropriate rational decision. Not even in a Richie Rich cartoon does that happen.

NOTE: Marc is long 150,000 FB at around $32.

Comments »FLASH: CHINESE PMI FALLS TO 47.8 in May from 50.2 in April

Final April reading was 49.3

Comments »ATTENTION: Taking Calcium Pills Increases Chance of Heart Attack by 86%!

The study of approximately 24,000 people between the ages of 35 and 64 found participants who took regular calcium supplements were 86% more likely to have a heart attack than those who didn’t take supplements. Those who took only calcium supplements were twice as likely to suffer a heart attack as those who didn’t take any vitamin supplements. Calcium supplements have been linked to kidney stones and bloating in other studies, according to the National Institutes of Health.

“Calcium supplements have been widely embraced by doctors and the public, on the grounds that they are a natural and therefore safe way of preventing osteoporatic fractures,” the authors write. “We should return to seeing calcium as an important component of a balanced diet.”

The study, primarily undertaken to determine if calcium supplements modify cardiovascular risk factors, found no direct link between the supplements and heart attacks, nor did they identify brands of supplements. Participants answered questions about their use of supplements and their diet during an 11-year study of their health.

The study did not look at what caused the heart attacks, but the authors write: “Supplements cause calcium levels to soar above the normal range, and it is this flooding effect which might ultimately be harmful.”

“Doctors who work with the elderly and people who are postmenopausal routinely tell them to take a calcium supplement,” says Linda Russell, a rheumatologist and osteoporosis specialist at Hospital for Special Surgery in New York. “It’s really time to re-examine that philosophy. Other studies about calcium have been suggesting this in recent years, but maybe this study really should get doctors to rethink this approach.”

Comments »MIT Team Creates Non-Stick Ketchup Bottle (VIDEO) $HNZ

It has been FDA approved and ready for market.

http://www.youtube.com/watch?v=67H1eZBHiDQ&feature=player_embedded

Comments »German Newspaper: “The Greek Exit Is A Done Deal”

The loud sounds of the left-politician Tsipras were just the straw that has brought the camel’s back. In the EU, the ECB and the IMF have been completed with the issue. Greece must get out of the euro, it is generally agreed across all sectors. The information contained in the former central banker and technocratic Prime Minister Lucas Papademos had delivered. He had enough time to convince the one hand, the full extent of the calamity, and also by the unwillingness of the parties to save money. Basically, his tenure was a fact-finding mission on behalf of the EU. His conclusion: Mission Impossible. About the consequences, there are different views: the central bankers do not want to pay more because they see that the whole is a bottomless pit. The politicians, led by Angela Merkel reluctant yet. As always there are the politicians advocate the status quo, because they fear nothing more than the unknown. And there are unknowns with a Euro exit any quantities.

It begins with the question: How does it work really practical? An outlet to see the EU treaties before any more than one eviction. For safety reasons, both the ECB and the Bundesbank formed crisis teams that are preparing now as the commanders on various contingencies. A small consolation is believed to have, because the debt incision was made, and therefore actually is a direct contamination of the banks as rather unlikely. Although this may not confirm officially Banker: The unofficial interpretation is that the risk of infection by the average debt “significantly reduced” was.

Most debts are now in the public sector – ie the ECB and the IMF. In the case of a state bankruptcy of Greece on the Target 2 system, the German Bundesbank would be taken immediately. Altogether, it is so appreciated, are the Greeks with 200 billion euros at the ECB and the IMF in debt. Therefore, all of which are currently very careful with scenarios: One does not want to be in the cards look. And as even the most amicable divorce in the end always haggled over the cost. Even the ECB and the IMF want to see their money again. They need the cooperation of the Greeks. A representative of the public sector: “When it comes to the discharge, the creditors will negotiate with the debtor. The creditors have no interest that the debtor is no longer on the legs. ”

However, the debtor to cooperate with the creditors, some skirmishes will be fought. The Greeks would say, then we throw it out once – we do not pay but not our debt.

This game can not last for long. Since Greece can take no money in the capital markets, Greece must cooperate with the Troika. Without money, the country is very fast at the end: it can pay its civil servants no longer afford no energy, public life threatens to spiral out of control.

Right here wants to start the Troika: The next installment is due in June, there will be only when the Greeks come up with a fairly reasonable exit plan. Until then, the ECB can keep up with their financial instruments, the Greek banks so far over water, not everything falls apart.

At the same time it is hoped the troika that the ESM is surprising, because then enough money is available to prevent the contamination of other states. Because you can answer a question no one, like a of involved banker says: “We all know not whether it comes after the withdrawal of the Greeks to a domino effect or whether it really is the great liberation has been.” There is always some require “discretionary action” of the ECB to keep the situation under control. In plain German: As some will have to be printed on money, so the crash can not go but even the whole euro zone in the air.

Comments »CHINA PLANNING STIMULUS IF GREECE EXITS

CICC said they need a CNY600 billion stimulus to support growth, which could drop to 6.4% on a Greek exit.

Comments »FLASH: The Next European Summit– Where They Do Nothing– Has Been Announced

June 28th-29th

Comments »