Come get your $0.29 rags yo….

[youtube://http://www.youtube.com/watch?v=JGD-xyY79Po 450 300] Comments »Buy the Fucking Dip

[youtube://hhtp://www.youtube.com/watch?v=jllJ-HeErjU 450 300]

Full article on margin debt hitting new highs

Comments »Silicon Valley Catches the Bitcoin Fever

“High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our Ts&Cs and Copyright Policy for more detail. Email [email protected] to buy additional rights. http://www.ft.com/cms/s/0/943494ea-5aa5-11e3-b255-00144feabdc0.html#ixzz2mK0Y8wHd

Silicon Valley is starting to catch Bitcoin fever – though the entrepreneurs and venture capitalists being drawn to the virtual currency claim that the biggest profits will come from using it to build a new digital finance industry rather than just as a vehicle for speculation.

Digital currency companies that have attracted early rounds of venture capital in recent weeks include Circle Internet Financial, headed by Jeremy Allaire, a serial entrepreneur from the media technology industry, and Ripple Labs, whose founder, Chris Larsen, was behind pioneering peer-to-peer lending company Prosper.

High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our Ts&Cs and Copyright Policy for more detail. Email [email protected] to buy additional rights. http://www.ft.com/cms/s/0/943494ea-5aa5-11e3-b255-00144feabdc0.html#ixzz2mK0dQIWp

Prominent investors who have been drawn to the field include Jim Breyer, a partner at Accel and early backer of Facebook, as well as Google’s venture capital arm, which has invested in Ripple and Buttercoin, a Bitcoin exchange.

Bitcoin’s tech industry backers argue that the shared protocols and common technology standards on which it is based echo the open technologies that lie at the heart of the internet. That could make it the foundation for a low-cost, standards-based financial system independent of the traditional banking industry.

“It reminds me of the internet protocols in the mid-1990s,” said Mr Breyer, who is also a director of retailer Walmart. Bitcoin was an “enormous ecommerce opportunity” for merchants, because it could greatly reduce transactions costs and make it easier to buy online, said Mr Breyer, who contributed to a $9m investment in Circle – the biggest first-round financing for a payments start-up, according to the company.

“It’s sort of like we’re in 1996,” said Mr Larsen. That could make possible the same sort of disruption in finance that the media and communications worlds faced with the rise of the internet. While riding the Bitcoin wave, his company has also created its own virtual currency, Ripples….”

Comments »

History Suggests Higher Indices in December

“It was an incredible November for stocks in what’s been an amazing year for the market. Will the rally continue in December?

The Dow Jones industrial average and the Nasdaq both ended November with a gain of about 3.5%. The S&P 500 advanced almost 3%. The Dow and S&P 500 are near record highs, while the Nasdaq rose above 4,000 last week for the first time in 13 years.

So far this year, the S&P 500 has soared nearly 27% in the latest phase of a bull market that started in March, 2009.

If history is any guide, stocks should head even higher in December. Over the past 30 years, the S&P 500 has gained in December 80% of the time, according to data from Schaeffer’s Investment Research.

Stocks often benefit in the last month of the year as fund managers bulk up on the best performers in an attempt to “window dress” portfolios.

But with prices at record highs, there are growing concerns that stock valuations are becoming stretched. The S&P 500 is currently trading at more than 15 times next year’s earnings estimates, which is slightly above the long-term average…..”

Comments »How to Bank Free Bitcoin

McAlvany Financial Group: Markets Could Drop 40% in a Cascade Effect

“Among McAlvany’s worries is low stock market volume. Trading activity has dropped 50 percent to 60 percent from about five years ago, he says.

In addition, “we have more people speculating in the stock market with someone else’s money,” McAlvany said. Margin debt hit a record of $401 billion for members of NYSE Euronext in September.

Those borrowings “increase what appears to be an absolutely sure bet in terms of upside in the stock market,” McAlvany said.

But, “another way of looking at that is we’ve got $400 billion of hot money that can come out of the market very quickly, and that’s enough to precipitate a major decline,” he said.

“We’ve anticipated 15 to 20 percent as a minimal move lower in the stock market, with as much as 40 percent being there if we begin to take out stop losses and really see a cascade effect in that market.”

Another bearish factor is the aggressive insider selling that has occurred amid the stock rally, McAlvany says. There’s a conflict between corporate executives selling their personal holdings as quickly as possible and their companies buying back shares, he says….”

Comments »Your Tax Dollars at Work

“The amount spent by the Transportation Security Administration (TSA) since 2007 on a program to identify suspicious airplane passengers: $900 million.

The number of terrorists arrested as a result of this expenditure: zero.

That is the inescapable conclusion of a General Accountability Office (GAO) study released in November and subsequent congressional testimony by GAO’s director of homeland security and justice, Stephen M. Lord….”

Comments »Evangelii Gaudium

“Pope Francis issued an apostolic exhortation Evangelii Gaudium (The Joy of the Gospel) November 24 that explicitly condemned free market economics with an epithet against “trickle-down” economics, causing establishment socialists to gloat prolifically.

Evangelii Gaudium — largely about evangelization within the Catholic Church — touched on a sweeping variety of issues, including pastoral care, the mentality of evangelists, international immigration, why women can’t be priests, and many other issues. But the brief parts condemning the free market have caught the attention of the press.

Francis wrote:

Some people continue to defend trickle-down theories which assume that economic growth, encouraged by a free market, will inevitably succeed in bringing about greater justice and inclusiveness in the world. This opinion, which has never been confirmed by the facts, expresses a crude and naïve trust in the goodness of those wielding economic power and in the sacralized workings of the prevailing economic system.

“Trickle down economics” has never been a term ever used by supporters of a free market to describe their views, but rather it has always been an insult deployed by opponents of free markets to ridicule their opponents. Thus, the pope’s letter received choruses of amens from the Washington Post’s leftist Eugene Robinson and huzzahs from the far-left ThinkProgress; and The Atlantic cheered the “Vatican’s journey from anti-communism to anti-capitalism.”

The “apostolic exhortation” (which is not an “infallible” ex cathedra pronouncement, and is even lower in authority than an encyclical letter) is a teaching document issued by a pope to address Catholics, but it doesn’t define any doctrines. As such, Catholics are not bound to accept the details of the letter. In practice, however, many Catholics will be persuaded they must do so by the mainstream media.

But was Pope Francis….”

Comments »The New American

“While what little remains of America’s middle class is happy and eager to put in its 9-to-5 each-and-every day, an increasing number of Americans – those record 91.5 million who are no longer part of the labor force – are perfectly happy to benefit from the ever more generous hand outs of the welfare state. Prepare yourself before listening to this… calling on her self-admitted Obamaphone, Texas welfare recipient Lucy, 32, explains why “taxpayers are the fools”…”

Comments »OPEC is Finding it Hard to Cut Output

“Tensions are emerging within the Organization of the Petroleum Exporting Countries over which member countries should trim oil production to make room for a resurgence in Iraqi exports and the possible return of more Iranian crude to world markets if sanctions are eased.

There is no expectation of a decision to cut back at the OPEC cartel’s meeting in Vienna on Wednesday. The group of 12 of the world’s largest producers, though long riven by squabbling, has kept its overall production ceiling at 30 million barrels a day since December 2011.

OPEC expects overall demand for its crude to drop by about 300,000 barrels a day next year and some members are pushing to trim output, according to people familiar with the debate.

Members will have to decide whether to cut production as early as the first half of the year, with the risk that short-term global supply might build to a level where prices fall, an OPEC official said…..”

Comments »Black Friday Brings Out the Red in Household Debt

“Sharp discounts and earlier hours drew slightly more shoppers into U.S. stores on Thanksgiving and Black Friday, according to preliminary results from market researcher ShopperTrak LLC, but tight budgets may have weighed on growth.

Foot traffic climbed 2.8% on Thanksgiving and Black Friday, the firm said, bumping sales up 2.3% to $12.3 billion over those two days. The jump was more pronounced on Thanksgiving after many chains lengthened their hours or opened their doors for the first time during the holiday.

Black Friday, meanwhile, lost out with traffic dropping 11%, while sales fell 13%, ShopperTrak said, as more customers got a jump on their shopping, in some cases at the expense of their turkey dinner.

ShopperTrak’s estimates provide a sense of how much consumers spent in stores and exclude online sales….”

Comments »The Unspoken Thanksgiving

A History Lesson With Glenn Beck

[youtube://http://www.youtube.com/watch?v=NgnRN-GOLLI 450 300]

Comments »Will the Housing Crisis Rear Its Ugly Head Yet Again?

?U.S. borrowers are increasingly missing payments on home equity lines of credit they took out during the housing bubble, a trend that could deal another blow to the country’s biggest banks.

The loans are a problem now because an increasing number are hitting their 10-year anniversary, at which point borrowers usually must start paying down the principal on the loans as well as the interest they had been paying all along.

More than $221 billion of these loans at the largest banks will hit this mark over the next four years, about 40 percent of the home equity lines of credit now outstanding.

For a typical consumer, that shift can translate to their monthly payment more than tripling, a particular burden for the subprime borrowers that often took out these loans. And payments will rise further when the Federal Reserve starts to hike rates, because the loans usually carry floating interest rates.

The number of borrowers missing payments around the 10-year point can double in their eleventh year, data from consumer credit agency Equifax shows. When the loans go bad, banks can lose an eye-popping 90 cents on the dollar, because a home equity line of credit is usually the second mortgage a borrower has. If the bank forecloses, most of the proceeds of the sale pay off the main mortgage, leaving little for the home equity lender.

There are scenarios where everything works out fine. For example, if economic growth picks up, and home prices rise, borrowers may be able to refinance their main mortgage and their home equity lines of credit into a single new fixed-rate loan. Some borrowers would also be able to repay their loans by selling their homes into a strengthening market…..”

Comments »

Asian Banking Families Possessing Trillions in U.S. Bonds Demands Liquidation

A grain of salt might be needed here:

“The following notice and question was sent to the US embassy in Tokyo, Japan two weeks ago:

“A group of influential Asian banking families possesses large amounts of US government bonds, verified as genuine by the BIS, with a face value of many trillions of dollars. These bonds were issued in the 1930’s and 40’s in exchange for Asian gold evacuated to the US during those decades. They would like to cash the bonds and use the money to finance a massive campaign to end poverty and stop environmental destruction. Will the US government support such a plan?”

So far, there has been no reply.

At the same time, detailed information was sent to Prime Minister Shinzo Abe of Japan telling him exactly how to enact the release of $700 trillion for the benefit of humanity. There has been no reply from him either.

For this reason, pressure against these two illegal regimes, both selected through fraud, will increase until they agree to this goal. That is why China announced it would stop buying US dollars last week.

It is also why they are increasing military pressure on Japan and the US first by upping the ante over disputed Islands with Japan and second by announcing China will no longer buy US dollars.

The next big move against these regimes is expected to be…”

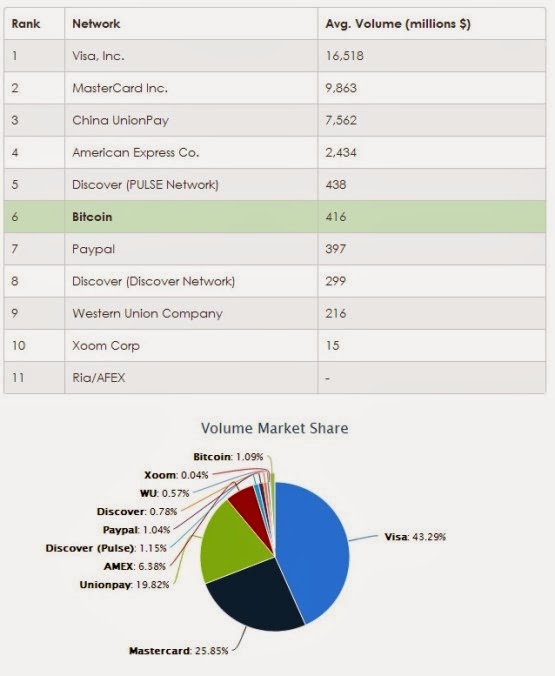

Bitcoin Exceeds Paypal in Total Transactions

Black Gold Says Hello to the Homo Hammer After Iran Deal

“Oil prices tumbled on Monday after a groundbreaking agreement aimed at curbing Iran’s nuclear program eased tensions in the region and raised the prospect of more oil exports from the country.

The preliminary accord, which was struck between Iran and six world powers, offers the Middle East nation $7 billion in relief from economic sanctions.

Iran, a major global oil producer, has seen oil salesslump by 60% from previous sanctions since the beginning of 2012. That has led to an $80 billion loss in revenue, according to the U.S. government.

Related: What the deal means for Iran’s oil sector

Although the new deal won’t allow Iran to increase oil sales for six months, it could still pave the way for more supplies to be released to the global market….”

Comments »Short Sellers Continue to Lick Their Wounds as 15% + Losses Mount for This Year’s Performance

“The U.S. stock market is at all-time highs. Technology stocks have surged, from TwitterTWTR -2.52% to LinkedIn to FacebookFB -1.01%. Even individual investors who doubted the staying power of the rally are now pouring money into stocks.

About the only people gnashing their teeth are short sellers, the investors who make a living betting that stocks will fall in price rather than rise. Short-selling hedge funds are down nearly 15% from the start of this year through October, according to hedge-fund tracker HFR.

Last week was another miserable one for those hedge funds and other grumpy investors who are skeptical of the market’s rise. The Dow Jones Industrial Average rose for the seventh week in a row, finishing at 16064.77. On Friday, the S&P 500 closed above 1800 for the first time.

There are few investors dedicated to wagering against stocks. James Chanos of Kynikos Associates runs a hedge fund that largely places short wagers, but there are only 24 other such firms, HFR says. Overall, these shorts manage about $6.3 billion, down from a peak of $7.8 billion in 2008.

But many more investors place bearish bets as part of their overall investing strategy. There are nearly 3,700 “long-short” hedge funds that invest in stocks, managing a total of $686 billion. Lately, these traders have had to adjust their strategies in significant ways to squeeze out returns during the market’s rally, or to just keep themselves going.

“Clearly, there’s been a tremendous amount of pain on the short side, and people are giving up on shorting individual stocks,” says Alan Fournier, who runs Pennant Capital Management. The hedge fund manages $6.5 billion, buys and shorts stocks, and is up more than 10% so far this year, according to investors.

Pennant has profited from shorts against BlackBerry Ltd., which has faced pressure on sales, and developer St. Joe Co., which has tussled with short sellers over the value of land holdings.

“Funds that are dedicated to short selling are closing, and others are starting long-only funds,” which buy shares but don’t short them, Mr. Fournier says.

Some bearish investors are exiting short positions more quickly than usual when their bets turn negative, trying to keep losses to a minimum. Others are reducing wagers they had placed against the broader market, to avoid further pain if the rally continues. Some of these investors continue to maintain bearish bets on individual companies they suspect will run into trouble. Still others are shifting to shorting emerging-market stocks and pockets of weakness in the U.S.

In any case, these investors have been licking their wounds.

“Being bearish in the bull market has been, thus far, a mug’s game and a hedge against profits,” says Douglas Kass, who runs hedge fund Seabreeze Partners Management in Palm Beach, Fla., and has been wagering against the market….”

Comments »Banks May Start Charging You Just to Hold Your Deposits

The Fed’s Catch 22 just got catchier. While most attention in the recently released FOMC minutes fell on the return of the taper as a possibility even as soon as December (making the November payrolls report the most important ever, ever, until the next one at least), a less discussed issue was the Fed’s comment that it would consider lowering the Interest on Excess Reserves to zero as a means to offset the implied tightening that would result from the reduction in the monthly flow once QE entered its terminal phase (for however briefly before the plunge in the S&P led to the Untaper). After all, the Fed’s policy book goes, if IOER is raised to tighten conditions, easing it to zero, or negative, should offset “tightening financial conditions”, right? Wrong. As the FT reports leading US banks have warned the Fed that should it lower IOER, they would be forced to start charging depositors.

In other words, just like Europe is already toying with the idea of NIRP (and has been for over a year, if still mostly in the rheotrical and market rumor phase), so the Fed’s IOER cut would also result in a negative rate on deposits which the FT tongue-in-cheekly summarizes “depositors already have to cope with near-zero interest rates, but paying just to leave money in the bank would be highly unusual and unwelcome for companies and households.”

If cutting IOER was as much of an easing move as the Fed believes, banks should be delighted – after all, according to the Fed’s guidelines it would mean that the return on their investments (recall that all US banks slowly but surely became glorified, TBTF prop trading hedge funds since Glass Steagall was repealed, and why the Volcker Rule implementation is virtually guaranteed to never happen) would increase. And yet, they are not:

Executives at two of the top five US banks said a cut in the 0.25 per cent rate of interest on the $2.4tn in reserves they hold at the Fed would lead them to pass on the cost to depositors.

Banks say they may have to charge because taking in deposits is not free: they have to pay premiums of a few basis points to a US government insurance programme.

“Right now you can at least break even from a revenue perspective,” said one executive, adding that a rate cut by the Fed “would turn it into negative revenue – banks would be disincentivised to take deposits and potentially charge for them”.

Other bankers said that a move to negative rates would not only trim margins but could backfire for banks and the system as a whole, as it would incentivise treasury managers to find higher-yielding, riskier assets.

“It’s not as if we are suddenly going to start lending to [small and medium-sized enterprises],” said one. “There really isn’t the level of demand, so the danger is that banks are pushed into riskier assets to find yield.”

All of the above is BS….”

Comments »Documentary: Will Work for Free

[youtube://http://www.youtube.com/watch?v=0SuGRgdJA_c 450 300] [youtube://http://www.youtube.com/watch?v=radFwHzD-PM 450 300] Comments »