“Year-to-date, the U.S. dollar is up; does that mean we are in a rising dollar environment? Or is it an opportunity to diversify out of the greenback?

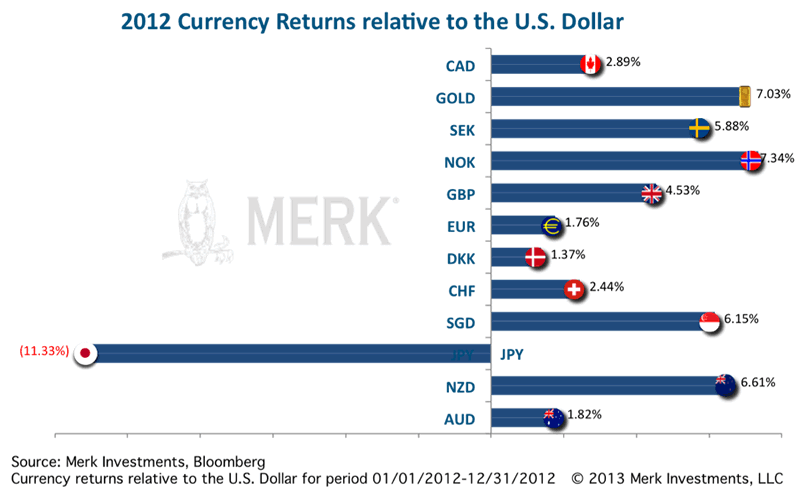

Last year, with all the turmoil in the Eurozone, the euro was up 1.79% versus the dollar; that appeared to be the best the U.S. dollar could do in times of turmoil. Of the major currencies only the Japanese yen was down versus the U.S. dollar:

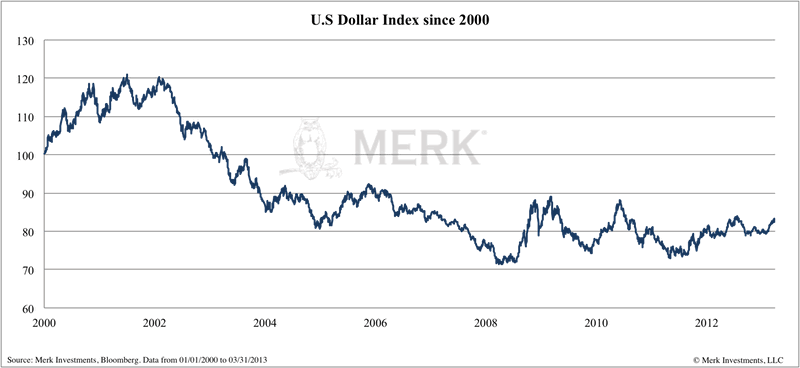

Year-to-date, the dollar index, a trade weighted index comparing the U.S. dollar to a basket of six major currencies, is up 2.95% as of April 29, 2013. What many are not aware is that this index has not really been updated since it was first created in the early 1970s, giving the euro a 57.6% exposure. The dollar’s downward trend has been slowed in recent years in large part by the turmoil in the Eurozone. Additionally, the New Zealand dollar for example, which is not in the index, is up 3.37% year-to-date.

To ascertain what may happen to the dollar, let’s look at the greenback from a couple of different angles:

Myth: U.S. dollar’s safe haven status

In recent years, when there has been talk about a “flight to quality” benefiting the U.S. dollar, we had a couple of observations:

•Flight to quality may be a misnomer: our analysis suggests the dollar tends to be in demand in times of turmoil because of liquidity, not quality considerations;

•Since the onset of the financial crisis, each time the pendulum swings in favor of the U.S. dollar, it may be swinging there less so;

•The balance sheet of the U.S. appears to be deteriorating at a faster pace than the balance sheets of much of the rest of the world;

•Wherever there is a crisis, it is being “patched up”, suggesting that when the pendulum once again favors risky assets, more money might flow towards those assets; and when the pendulum swings once again in favor of the U.S. dollar, it may be less and less of a beneficiary.

In other words, the safe haven status of the U.S. dollar may slowly be eroding.

Myth: a rising rate environment favors the U.S. dollar…”

If you enjoy the content at iBankCoin, please follow us on Twitter