Citron Research has put out a negative report on Nu Skin, stating the company is not transparent with disclosures on the balance sheet. As a result the stock is getting the homo hammer.

Comments »Monthly Archives: August 2012

Possible da Vinci Painting Found in Scottish Farmhouse; Could Be Worth $150 Million

via yahoo.com

Comments »Fiona McLaren, 59, had kept an old painting in her Scottish farmhouse for decades. She reportedly didn’t think much of the painting, which had been given to her as a gift by her father. But after she finally decided to have the painting appraised, some experts are speculating that it may in fact be a 500-year-old painting by Leonardo da Vinci and potentially worth more than $150 million.

“I showed it to him [auctioneer Harry Robertson] and he was staggered, speechless save for a sigh of exclamation,” said Ms. McLaren, according to The People.

The Daily Mail says the painting may be of Mary Magdalene holding a young child. The painting is now undergoing further analysis by experts at the Cambridge University and the Hamilton Kerr Institute, who will attempt to uncover its exact age and origins.

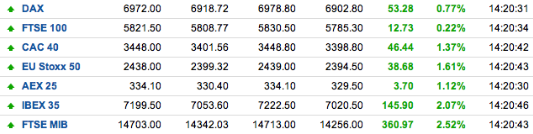

FLASH: ITALY AND SPAIN LEAD GAINS IN EUROPE

Spanish and Italian Bond Yields Halt Their Fall

Since Draghi’s comment of “doing what ever it takes” to save the Euro and debt ridden countries; bond yields have fallen. As of today that trend has halted and we have seen a bit of a spike today in Italy and Spain.

Comments »A New Freddie Kruger Presentation: A Study in Global Systemic Collapse- “Trade-Off: Financial System Supply-Chain Cross-Contagion”

A white paper has been released by David Korowicz, a physicist and human-systems ecologist on the risks to the global economy.

Comments »No Bad News, a Clam Put, and Good Earnings Help to Boost Equities

“U.S. stocks advanced, sending the Standard & Poor’s 500 Index higher for a third straight day, amid better-than-estimated corporate earnings and speculation global central banks will take steps to boost economic growth.”

Comments »Gapping Up and Down This Morning

Gapping Up

BSFT +21.9%, CRMB +19.5%, LOPE +15.2%, IHG +7.7%, TUMI +6.7%,

CHK +4%, TWGP +3.8%, NOK +2.8%, PSTI +2.6%, PLT +2.5%, CF +2%,

OPEN +1.8%, GDP +1.7%, VVUS +3.7%, COH +1.9%,

Gapping Down

LEAP -11.2%, ELN -11.1%, SNHY -10.5%, JDAS -8.8%, HEK -8.3%, DUF -7.1%,

CBOU -5.9%, ISIS -4.5%, FR -3.2%, CLNE -2.9%, HCN -2%, HOS -1.8%,

ESL -1.8%, PFE -1.7%, MTW -0.9%,

Comments »Upgrades and Downgrades This Morning

AMGN, AMT, AMAT, COH, DELL, FLEX, GILD, HPQ, KCG, LEAP, NTAP, SANM, SPLK, VE, VRTX, VVUS, WMT,

Comments »In Play and On the Wires

The Cheapest Stocks You Can Buy on the DJIA

Pimco’s Gross: Stay Away From Europe

“Bill Gross, co-chief investment officer of the world’s largest bond fund, warns investors to stay away from Europe, as the eurozone won’t be coming out of intensive care any time soon.

Pimco’s Gross, writing in a Financial Times editorial, says European leaders Angela Merkel, François Hollande, Christine Lagarde and Mario Draghi all have one thing in common: “They want your money!”

“The ultimate goal of monetary and fiscal policy in the EU is to re-engage the private sector,” he writes. “The EU needs the private sector as a willing (but not necessarily equal) partner in funding its economy.”

Comments »$AMZN Starts Gunning for $ZNGA as They Enter Social Gaming

Amazon has released a social game called Living Classics which is in direct competition with Zynga. This is Amazon’s first release in this realm and is totally free on the $FB platform.

Comments »$FB Looks to Gambling for New Revenue Stream

“For the last three quarters, Facebook has beenstruggling to move the needle on its payments business, but today a new game has launched that could provide a clue to how that could change that in the future: the social network has, for the first time, allowed a gaming app on its platform that allows users to play with real money — not Facebook Credits.

Comments »Apple May Kill Interweb Fun

Fed Official Calls for Bond Buying

“Eric Rosengren, president of the Federal Reserve Bank of Boston, called on the Fed to launch an aggressive, open-ended bond buying program that the central bank would continue until economic growth picks up and unemployment starts falling again.

His call came in an interview with The Wall Street Journal, the first since the central bank signaled last week that it was leaning strongly toward taking new measures to support economic growth.

Mr. Rosengren isn’t currently among the regional Fed bank presidents with a vote on monetary policy. Although all 12 presidents participate in Fed deliberations, only five join the seven Fed governors in Washington in the formal committee vote.”

Comments »Google Plunks $40 Billion Down for Auto Loans

“Feeling lucky, Google Inc. GOOG +0.23% has found a new place to park some of its $40 billion cash hoard: bonds backed by car loans.

The Mountain View, Calif., company has plowed hundreds of millions of dollars in recent months into asset-backed securities, tied largely to automobile loans and consumer credit-card payments. Among Google’s recent purchases: triple-A-rated debt from car makers Honda Motor Co. 7267.TO +1.17% and Hyundai Corp. 011760.SE +3.27%Google had previously restricted itself to U.S. Treasurys, high-quality corporate bonds and other low-risk securities.”

Comments »Italy Economy Shrinks For A Fourth Quarter As Slump Deepens

“Italy’s economy contracted for a fourth straight quarter in the three months through June as manufacturing slumped and the euro-area debt crisis intensified.

Gross domestic product declined 0.7 percent in the second quarter, Rome-based national statistics institute Istat said in a preliminary report today. The contraction was less than the median forecast for a 0.8 percent decline in a survey of 22 economists by Bloomberg News. GDP fell 2.5 percent from a year earlier, the most since the final quarter of 2009.”

Comments »German Factory Orders Fall Twice As Much As Forecast

“German factory orders declined more than twice as much as economists forecast in June as sales to euro-area countries slumped.

Orders, adjusted for seasonal swings and inflation, dropped 1.7 percent from May, when they rose 0.7 percent, the Economy Ministry in Berlin said today. Economists forecast a 0.8 percent decline, according to the median of 35 estimates in a Bloomberg News survey. From a year earlier, orders fell 7.8 percent when adjusted for work days.”

Comments »Oil Rises on U.S. Supply Issues

WTI and Brent are on the rise this morning as inventories are expected to fall…

Comments »The Aussie Dollar Rises as Central Banks Keep Interest Rates Steady

“Australia’s dollar touched its highest level in more than four months after the Reserve Bank keptinterest rates unchanged and said current policy settings are “appropriate.”

The so-called Aussie rose against most major peers after RBA Governor Glenn Stevens and his board said in a statement from Sydney the nation’s growth is close to trend. New Zealand’s currency maintained a three-day gain as Asian stocks extended a global rally, supporting demand for riskier assets.

“I think the RBA hasn’t really set out a case for lowering interest rates, so I suspect that’s probably maybe a surprise to the markets,” said Annette Beacher, head of Asia-Pacific research at TD Securities in Singapore. The overall statement “seemed to be quite bullish for the Aussie dollar.”

Comments »