Monthly Archives: March 2012

Day 1 Recap of NFL Free Agency

Free Agency Day 1: The Insightful and the Incoherent

By Bill Barnwell on

On Tuesday morning, word around the NFL was that the Bears were basically formalities away from locking up Vincent Jackson and Mario Williams. By 5 p.m., the Bears had acquired Brandon Marshall, but the Bills were now going to host Robert Meachem and Mario Williams and sign them both before their fans woke up the following morning. As the clock struck midnight on the East Coast, Meachem was on the Chargers, Williams was a free man, and we vowed to stop listening to the rumor mill. And then on Wednesday at 12:05 am on the East Coast, we started refreshing Twitter every five seconds while jonesing for our fix. We’re only human.

By the end of a busy first day of free agency, the league had raided the wide receiver and cornerback aisles and left them barren, with 10 notable signings between the two positions alone. About half of those moves made a lick of sense, as logic took a backseat to getting (or spending) cash now. It is our duty to cover both the insightful and the incoherent, and so we start our look at Day 1 of free agency in Washington, where the Redskins defied the odds to pull off their best Redskins impersonation.

The More I Get, The More I Want

With their draft picks tied up in the RG3 trade and their spending money repossessed by the NFL, you would have forgiven the Redskins for taking a rare opening day of free agency off. And then they would have said, “Thanks for forgiving us! Now, please get out of our way so we can get back to spending money we may or may not have. There are second-tier free agents just roaming around out there! For free! Without contracts!”

And so the Redskins found it in their hearts to give Pierre Garcon a five-year, $42.5 million contract with $21.5 million in guaranteed money. This is the same Pierre Garcon who has caught just over 53 percent of the passes thrown to him over the past three seasons despite having Peyton Manning at quarterback for two of those three years. The other Colts wide receivers caught just under 64 percent of the passes thrown to them over that time frame. And while a low catch rate is fine if you’re a deep threat or a demon after the catch, Garcon’s averaged 13.6 yards per catch over that span, which is almost exactly league average. Jabar Gaffney has averaged more yards per catch over the past three years than Pierre Garcon. Is he a downfield threat?

Garcon fits one of the archetypes we identified last year when we described the free agents you meet in hell, a second or third wideout from an effective passing offense. These sorts of players look good against single coverage with great quarterbacks around them, but when you move them into the no. 1 slot on a team with an inferior quarterback, they fail to meet expectations. Last year, Garcon’s raw numbers showed some improvement because he took more snaps and made it through all 16 games for the first time in his career, but his catch rate without Manning fell from 56 percent to 52 percent, and that came while Garcon enjoyed the splendor of garbage-time yardage for the first time in his career. He had three receptions for more than 40 yards all year, and two of them came in one game against the dismal Buccaneers. What about this guy says, “We need to give him $21.5 million as soon as possible?”

While the Redskins were seemingly down to Santana Moss and flotsam at wideout, they already had a useful receiver sitting in Mike Shanahan’s ample doghouse. Anthony Armstrong spent most of 2011 on the bench because Shanahan thought he couldn’t get off press coverage at the line of scrimmage, but Armstrong’s production as a starter in 2010 was arguably better than Garcon’s, despite the fact that the former swapped out Peyton Manning for Donovan McNabb and Rex Grossman:

Garcon might be the better player, but it’s not a clear case. At the very least, the difference between the two of them over the next two seasons certainly isn’t $21.5 million in guaranteed cash. As bad signings go, this isn’t bringing in Albert Haynesworth, since Haynesworth was at least at the top of his game in the two seasons before the Redskins paid too much for him. This is more like the signings of DeAngelo Hall or Brandon Lloyd, when the Redskins acquired (or retained) a B-list player by giving him A-list money. You can make the case that Washington needed to upgrade at wide receiver and give RG3 options, but you don’t accomplish that by throwing $21.5 million at league-average receivers.

On the other hand, the Redskins made a perfectly rational, reasonable decision to buy low on Josh Morgan, who broke his leg after five games and missed most of San Francisco’s 2011 season. Morgan’s statistics aren’t all that impressive, and he’s not regarded as a burner, but he’s spent the past three years playing with Alex Smith in a conservative offense. It’s also worth noting that he’s averaged 13.0 yards per catch over those three seasons, virtually identical to Garcon’s figure. The Redskins only paid $7.5 million in guaranteed money for Morgan on a five-year, $12 million contract that will void after two years (for cap purposes, the Skins will spread the signing bonus hit over five years, but it’s essentially a two-year deal). Washington may find that Morgan’s actually the better player of the two.

Big Receiver-a-Go-Go

We were right to assume that there were two oversize wideouts on the market who would move fast during free agency, but we had the wrong receivers. After the Saints locked up Marques Colston early Tuesday morning, the Bears abandoned their chase of Vincent Jackson and shockingly acquired Brandon Marshall from the Dolphins for a pair of third-round picks.

The Marshall trade didn’t obviously stink the way that the Santonio Holmes trade did — when the Jets acquired a Pro Bowl-caliber receiver for a fifth-rounder — but the sudden availability and acquisition of Marshall suggested that there was more to the move than meets the eye. It was no surprise hours later, then, when Adam Schefter reported that Marshall was being investigated by the league for yet another off-field incident. It later came to light that Marshall had allegedly “slugged” a woman in the face at a New York City club on Sunday, a move that might have inspired Miami’s desire to give up on Marshall.

The only logical perspective from which this makes sense for the Dolphins is the disciplinarian angle, where a new head coach simply wanted to move on from a frustrating player. That makes for wonderful quotes, but Marshall was the team’s best offensive weapon by a wide margin, and there’s nobody left on the market to replace him. They gave up two second-round picks for Marshall and then paid him $19 million for two years of above-average production before shipping him away for two third-round picks.

Obviously, what Marshall offers on the field is worth more than two third-round picks. Over the past five years, only four players have more receiving yards than Marshall, and his three 100-catch seasons all came in Denver with Jay Cutler at the helm. Cutler, of course, will be Marshall’s starting quarterback again in Chicago. Marshall’s arrival will take the heat off Devin Hester as a no. 1 wideout and keep Earl Bennett in the slot, moves that will make everyone in the offense better. In addition, the Bears won’t be responsible for paying Marshall’s signing bonus and should only owe Marshall his base salary (a little over $9 million) in each of the next three years. If Marshall becomes too much to handle, they can cut him without incurring any cap penalty.

We had a whole paragraph written here about how the Dolphins now needed to sign Reggie Wayne — even if it meant throwing him a few extra bucks — because it would fill their biggest need while giving Peyton Manning extra ammunition to choose Miami over Denver in his quest for a new organization. After being linked with Manning for the past week as a combo deal, Wayne stunningly returned to the one place Manning isn’t heading to, Indianapolis. The Colts gave him a three-year deal worth $17.5 million with $7.5 million guaranteed. It’s shocking that the a receiver-needy team like the Dolphins wouldn’t have offered Wayne more in guaranteed money, but perhaps the veteran wanted to finish his career in Indianapolis after all. The Colts don’t exactly need a 33-year-old wideout these days, but at that price, Wayne can be a viable target for the beginning of Andrew Luck’s career without costing the organization very much. It’s a win-win-oh-my-god-the-Dolphins-lose deal.

And as for Jackson, he finally got the long-term deal he’s sought for years by inking a five-year, $55,555,555 contract with the Buccaneers to serve as Josh Freeman’s top wideout. The deal guarantees Jackson $26 million. To put that in context, consider that Jackson has more receiving yards over the past three years than Garcon despite being thrown 97 fewer passes (344 for Garcon, 247 for Jackson), while his catch rate is at a far-superior 58 percent despite being the target of so many Philip Rivers prayers downfield. We’ll stop picking on Garcon now. Jackson has his own history of off-field issues and has spent his entire career playing in an effective passing offense with a great quarterback, so he could qualify as a free agent from hell (especially if you consider Antonio Gates to be the team’s top target), but his sheer size and athleticism should play well in a division with small corners like Brent Grimes and Jabari Greer. The Bucs should be a little concerned that they have two wideouts of markedly similar styles in Jackson and Mike Williams, though, and they might want to stay in the market to add a slot receiver who can do some damage underneath. That player could be Early Doucet, who the Cardinals can’t afford to retain.

The Chargers found their replacement for Jackson in Robert Meachem, giving the former Saints wideout a four-year deal with $14 million in guaranteed money after he failed to come to terms with the Bills. As a third or fourth option in the Saints’ passing attack over the past few years, Meachem’s been remarkably consistent. Over the past three seasons, he’s started either seven or eight games, caught between 40 and 45 passes, and averaged between 14.5 and 16.0 yards per catch. Those numbers have some value, but at 28, it’s worth wondering whether Meachem is ever going to become anything more than that. If the Chargers continue to use Meachem as a third target, they should find that he’s up to the task. If they expect Meachem to be their no. 1 receiver, though, San Diego might be disappointed by what they find.

Finnegan’s Wake of Money

Last August, Cortland Finnegan disappeared from Titans training camp and attributed the absence to a personal matter. The personal matter was that he wasn’t happy with his contract and wanted the Titans to give him a new one. As you might suspect, the Titans were not desperate to re-sign Finnegan this offseason and let him go to St. Louis, which released a bevy of veterans to sign Finnegan to a five-year, $50 million deal with $26.5 million in guaranteed money. Much like the Redskins, the Rams desperately needed help at cornerback. Their top three corners all went down with season-ending injuries last year, and since previous ace Ron Bartell’s injury was a fractured neck, it’s easy to understand why the Rams would go out and target a top corner.

Is Finnegan a top cornerback, though? Pro Bowl voting is far from exact, but Finnegan’s only made one Pro Bowl in his career, and that was in 2008. More importantly, is Finnegan going to be a Pro Bowler with the Rams? St. Louis is paying him like one, and there are reasons to be concerned about his future viability. Finnegan, who just turned 28 in February, is generously listed at 5-foot-9. The recent history of short cornerbacks making it into their thirties as starters is not very long, as only five players listed at 5-foot-9 or less have started 12 or more games in a season after they turned 31 since 2002. That includes a few embarrassingly bad seasons, too, for guys like Fred Thomas, Dre’ Bly, and Tyrone Poole. The only short corner to really keep up his performance at a high level into his early thirties is Antoine Winfield, while dozens of taller corners have lasted into and beyond that age range over the same time frame. The Rams might get a year or two of solid performance out of Finnegan, but this contract is likely to end very messily.

Compare the Finnegan signing to that of Carlos Rogers, who re-signed with the Niners on Tuesday on a four-year deal for about $30 million. There’s no word yet on the guaranteed money, but Giants cornerback Terrell Thomas re-signed with his team on a similar deal with about $11 million guaranteed, and it’s hard to imagine that Rogers would get more than $15 million or so of his deal locked up in guaranteed cash. Rogers was better than Finnegan last year, when he made his first Pro Bowl, and he’s arguably been better over the whole of the past three years. And for that, Rogers is getting about as much total money over the length of his contract as Finnegan’s getting in guaranteed cash. That’s a victory for the San Francisco front office, which now returns all 11 starters from last year’s dominant unit.

Block the Doors With Beef on Weck

Don’t let him leave the facility. It’s the rule that every team follows when a big-time free agent heads to their city for a visit. If you get a player to hop on your private plane and head to your town for hours of meetings and interviews, your best way to sign that player is to lock him in your offices until he puts pen to paper. If that means ordering in the fanciest dinner in town, turning on the stadium’s lights, and dining on the 50-yard line, you do it. If it means adding a few million dollars to the contract figure you had in mind, you do it. If it literally means locking the doors and stalling the player in question from getting in a limo to take him back to the airport, you do it. The moment that player leaves your facility and heads out of town, though, your odds of signing him decrease dramatically. The Bills had their shot at Mario Williams last night. They weren’t able to keep him in the facility.

Although we suggested that the Bills should only enter the market to make a Godfather offer to Williams, we were pleasantly surprised to see that they actually went ahead and convinced Williams to start his free agent tour in Buffalo. They presumably got Williams to head there by telling his agent that the organization would give Williams the prescribed $40 million in guaranteed money that would help make him the highest-paid defensive player in NFL history.

It’s here where the NFL’s business model shines through. Because the league’s television contract is entirely national and split evenly between the league’s 32 teams, every team has enough money to make a legitimate top-dollar offer to the best free agent on the marketplace. Meanwhile, baseball teams who were already struggling with an income gap between the haves and have-nots are facing cavernous differences in their local television deals. The Pirates would not have been able to credibly offer Albert Pujols $300 million this offseason. The Bills — in a tiny market with a 40-year-old stadium — can outbid the rest of the league for an elite player if they want to.

Unfortunately for the Bills, it takes two to tango, and it doesn’t appear that Williams wants to dance. In all likelihood, Williams chose to start his national tour in Buffalo to send a message to his other suitors. Baseball’s rumor mill is famous for introducing the Mystery Team, an unknown suitor who agents would perpetually report as lurking in the shadows to sign their free agent for an exorbitant sum. Williams has basically started free agency by going to visit the Mystery Team. He can now go visit any other team in the league and tell them that Buffalo’s made him the biggest offer any defensive free agent has ever seen, and unless they’re willing to come close to that offer, he’ll go back to Buffalo and take their money. The Bills don’t have the leverage to take their deal off the table, since there’s nobody else in the market who would be worth that sort of contract. Even if Williams has no intention of ever signing with the Bills, it makes total sense for him to start his search there and strike fear into the penurious hearts of owners around the league.

Of course, Williams could still end up sticking around in Buffalo and signing with the Bills. Maybe they sweeten the pot and make it $45 million, or Williams simply changes his mind after a long night’s sleep and decides to stay. Nobody even whispered Williams’s name in reference to the Bills before free agency began, so there’s little reason to trust the rumor mill surrounding him now. We know one thing for sure, though: You can’t sign a contract with one team when you’re locked inside another team’s facility. Once the Bills got Mario Williams inside of Ralph Wilson Stadium, he shouldn’t have left without a contract.

Comments »Happy Steak and Blowjob Day

I’ve just been informed that it is Steak and Blowjob day. I had no idea this day existed until now, but excited to find out such a day exist.

Celebrated on March 14th, Steak and Blowjob Day is a holiday for men, celebrated the month after Valentine’s Day — a holiday for women.

The idea is simple: no cards, flowers, candy or other whimsical gifts. Ladies, you simply bestow your partner with a steak and a blowjob. Not necessarily in that order.

http://www.youtube.com/watch?feature=player_embedded&v=wie1gte6IRE

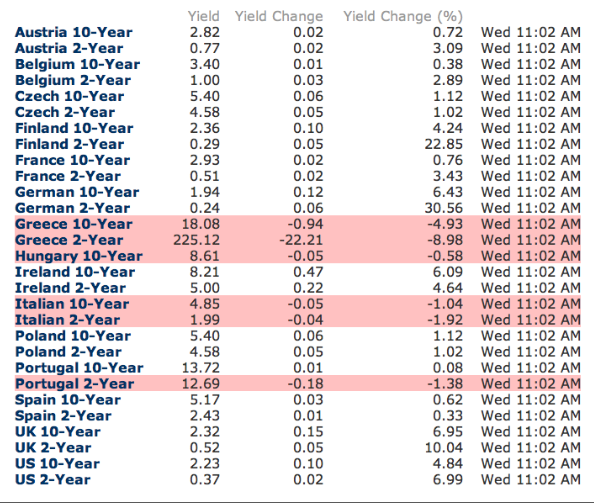

Comments »FLASH: Sovereign Bonds Yields of Solvent Nations Spike

Restaurants are Mad as Hell at No-Shows and They’re Ready to Fight Back

By SUMATHI REDDY

The morning after two groups of diners didn’t show up at the restaurant Noma in Copenhagen last month, chef and co-owner René Redzepi took to Twitter. “And now a message from the Noma staff: to the people of two different no-show tables last night,” he wrote, and sent a picture of staff members showing their middle fingers.

The tweet, deleted shortly after it was posted, was a joke, says Peter Kreiner, managing director of Noma. But at a restaurant that has just 12 tables and takes in as much as $500 per person for a meal, no-shows aren’t taken lightly. “It’s quite a large percentage of the sales that we missed out on,” he says.

Fickle diners are every restaurant’s worst nightmare. A select group of high-end chefs and restaurants are fighting back—from charging people who don’t cancel in time to using Twitter and other social media to call out no-shows.

The impact of an empty table can be a significant in an industry where average profit margins run as low as 3% to 5%. In cities like New York, it’s not unusual to find 20% of diners unaccounted for on any given night.

Ryan LeeTorrisi Italian Specialties of New York City is among the restaurants that charge people who don’t show up for a reservation, in an effort to stave off no-shows.

Restaurant owners expend tremendous resources trying to confirm reservations. Some restaurants, like Wylie Dufresne’s wd~50, will turn down a reservation from someone with a history of not showing up. Other chefs, like Ron Eyester of Rosebud in Atlanta, will jot down a note if a diner seems wavering on the phone, so that the staff knows not to hold the empty table too long.

A number of high-end restaurants now require credit-card numbers from anyone reserving a table. Some, like Hearth in New York and Cochon in New Orleans, seek credit cards only for larger parties and for special occasions. Others, like Eleven Madison Park in New York and Coi in San Francisco, extend the policy to parties of any size.

NextAt Chicago’s Next, a nonrefundable-ticket system has left the restaurant with virtually no empty tables.

In January, Eleven Madison began charging anyone who didn’t show up or cancel a reservation 48 hours beforehand $75 a head. Owner Will Guidara says the restaurant was losing eight to 10 people per night. He adds, “With the length of our wait list and how many people we’re turning away, it just became really difficult to say, ‘No, no, no,’ to so many people and then have people who were supposed to be joining us just not showing up.”

Since the policy has been in place, Mr. Guidara says he has had to charge only a couple of cards a week.

According to online-reservation system OpenTable, 10% of restaurants nationally seek credit-card numbers for certain reservations, while about 15% of restaurants in New York do so. Those numbers have been trending down, the company says.

![[RESERVEjp]](http://ibankcoin.com/news/wp-content/imagescaler/735c67fa9fa4c02a86dbf950d08680b7.jpg) Eleven Madison Park / Francesco TonelliManhattan’s Eleven Madison Park requires credit cards for reservations and charge people who don’t show.

Eleven Madison Park / Francesco TonelliManhattan’s Eleven Madison Park requires credit cards for reservations and charge people who don’t show.

But Sherri Kimes, a professor at the Cornell School of Hotel Administration, thinks the practice will only increase. Ms. Kimes says her research has found that consumers are open to being charged for last-minute cancellations—as long as restaurants keep up their end of the bargain. “When the customer shows up… their table better be ready,” she says.

In Australia, a campaign to publicly name no-show diners through Twitter has been gaining steam. Erez Gordon, owner of Sydney’s Bistro Bruno, said in an email that he has outed customers just a few times, when they failed to respond to his calls. He likened it to diners’ jumping online to anonymously rate restaurants. “With Twitter, we are given the opportunity to respond in exactly the same manner as our guests respond if they feel we have let them down,” he said.

In the U.S., too, frustrations run high. “Every single day I will look at how the previous night went and every single day there’s upwards of 40—four, zero—no-shows at Nobu,” says Drew Nieporent, owner of the Myriad Restaurant Group.

Mr. Nieporent has called people the next day to find out why they didn’t show up. “Quite frankly, it’s worse now, because with online reservations we’re not even speaking to the customer,” he says. “So it could be someone in theory who is a concierge at a hotel or a broker who can book prime-time tables 30 days in advance, hold on to tables for 29 days and maybe, if they feel like it, call to cancel.”

CoiSan Francisco’s Coi also imposes fees for no-shows.

Often, the price charged for a no-show doesn’t compensate a restaurant for its loss. At New York City’s Del Posto and Jean-Georges, the no-show fee for OpenTable.com reservations is $50 a head. In October, Mr. Nieporent’s Corton began requiring credit cards to reserve tables on Friday and Saturday nights and charging no-shows a $50 fee if they don’t cancel 48 hours ahead.

Daniel Patterson, the owner of Coi, says that when he started a $25 and then a $50 penalty for no-shows about three years ago, he saw few results. It wasn’t until he upped the amount to $100 that the rate dropped from 20% to 10%. “Our menu is $165, so we’re still losing money,” he says. “It’s really not about charging people. It’s really more about making sure they’re serious about the reservation.”

Other restaurants charge more. When Torrisi Italian Specialties in Manhattan began accepting reservations in November, it chose to charge diners for the full $125 tasting menu if they don’t cancel 24 hours ahead. Diners who reserve its shorter $60 menu have until 4 p.m. that day.

At the Chef’s Table at Brooklyn Fare, where reservations are snapped up six weeks ahead of time, consumers pay the full $225 prix-fixe price about a week in advance.

Perhaps most radical is the system started last year at Grant Achatz’s Chicago restaurant Next. To dine there, customers must buy nonrefundable tickets for a meal in advance. A dynamic pricing system makes tickets at prime times pricier. Mr. Achatz’s business partner, Nick Kokonas, says the system has been so successful they plan to use it at their Alinea restaurant.

Mr. Kokonas is working on a system for other restaurants. Another Chicago restaurant will pilot-test it soon. He sees one reaction from restaurateurs: “Show me how to do it.”

Write to Sumathi Reddy at [email protected]

Comments »Crude Oil Inventories

Prior: 832k build

Actual: +1.8 mln barrels….less than expected

Distillates: -4.7 million barrels …in line

Gasoline: -1.4 million barrels….more than expected

Comments »Today’s Money Flows

ISSUE GAINERS SYMBOL EXCH LAST PRICE MONEY FLOW RATIO

(in millions)

iShs Tr DJ U.S. Real Es IYR ARCA 62.19 +44.2 16.20

iShrs Russell 2000 IWM ARCA 83.12 +43.3 3.08

Bank Of America BAC NYSE 8.72 +36.2 1.30

SPDR S&P 500 SPY ARCA 140.30 +22.0 1.13

PwrShrs QQQ Tr Series 1 QQQ NASD 66.47 +17.2 1.42

Wells Fargo WFC NYSE 33.10 +16.9 1.39

Goldman Sachs GS NYSE 122.64 +15.2 1.25

Lowe's Cos LOW NYSE 30.46 +12.6 2.32

GNC Holdings A GNC NYSE 33.49 +12.1 2.01

iShrs Barclays TIPS Bond TIP ARCA 117.95 +11.5 4.76

Home Depot HD NYSE 49.57 +10.9 1.93

Caterpillar CAT NYSE 112.91 +10.0 1.56

Cheniere Energy LNG AMEX 15.06 +9.5 1.79

Anadarko Pete APC NYSE 84.88 +8.9 1.70

Suntrust Banks STI NYSE 23.73 +8.9 1.29

Johnson & Johnson JNJ NYSE 65.23 +8.7 2.01

Lazard LAZ NYSE 31.00 +8.6 29.49

Bebidas de Americas ADS ABV NYSE 41.62 +8.2 6.83

Pfizer PFE NYSE 21.98 +8.0 2.04

American Express AXP NYSE 55.95 +7.1 1.38

ISSUE DECLINERS SYMBOL EXCH LAST PRICE MONEY FLOW RATIO

(in millions)

Apple AAPL NASD 581.33 -220.3 0.87

JPMorgan Chase JPM NYSE 43.47 -47.5 0.65

Citigroup C NYSE 35.42 -22.2 0.85

General Electric GE NYSE 19.86 -17.6 0.55

Microsoft MSFT NASD 32.58 -17.3 0.48

Oracle ORCL NASD 30.02 -17.3 0.36

IBM IBM NYSE 204.54 -14.5 0.57

Hewlett-Packard HPQ NYSE 24.28 -13.0 0.34

Starbucks SBUX NASD 52.62 -12.5 0.43

Philip Morris Intl PM NYSE 85.41 -12.0 0.40

iShrs MSCI S Korea EWY ARCA 60.48 -11.9 0.08

Cameron Intl CAM NYSE 53.69 -11.2 0.13

Intel INTC NASD 27.59 -10.7 0.55

ExxonMobil XOM NYSE 86.54 -10.2 0.66

Newmont Mining NEM NYSE 54.20 -10.2 0.67

Disney DIS NYSE 43.44 -10.0 0.42

McDonald's MCD NYSE 96.95 -10.0 0.64

Procter & Gamble PG NYSE 67.94 -9.9 0.45

Regions Fincl RF NYSE 6.14 -9.8 0.76

Amer Cap Mortgage Invt MTGE NASD 21.84 -9.3 0.48

Comments »

52 Week Highs and Lows

NYSE

New Highs 122 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ Actuant ATU 29.31 106,903 Advance Auto Parts AAP 88.86 44,066 Airgas Inc ARG 84.00 15,629 Allergan AGN 93.65 112,062 Allied World AWH 71.00 16,216 Amer Eagle Outfitters AEO 16.81 833,840 American Express AXP 55.96 2,159,624 Amphenol APH 58.21 18,974 Anheuser Busch BUD 72.00 149,505 Asbury Automotive ABG 27.71 7,335 Assured Guaranty Ltd AGO 18.86 183,074 Atlas Energy ATLS 27.09 81,836 BB&T Corp BBT 30.58 629,471 Banco Latinamer BLX 21.13 26,895 Beam Inc BEAM 58.14 93,412 Blyth BTH 78.70 59,020 CBS Corp B CBS 31.80 1,044,315 CBS Corp A CBS/A 32.35 200 Cedar Fair LP FUN 29.98 14,256 Chevron CVX 111.80 750,023 Chipotle Mexican Grill CMG 401.52 50,608 Church & Dwight CHD 49.30 94,415 Coach COH 79.18 289,898 Coca-Cola Femsa KOF 103.82 22,898 Colgate-Palmolive CL 95.74 174,341 Core Labs CLB 129.83 23,566 Cushing Royalty & Incm Fd SRF 25.55 1,700 Cytec Indus CYT 62.20 22,236 DTE Energy DTE 56.52 185,868 DTEEnCo.Series6.50% DTZ 28.11 1,864 Dick's Sporting Goods DKS 48.46 117,720 Discover Fnl Svcs DFS 32.64 717,778 Dominos Pizza DPZ 40.36 21,610 Eagle Materials EXP 35.50 74,537 Eaton Vance BuyWrite Opp ETV 13.27 105,694 Ecopetrol EC 60.86 18,889 Estee Lauder EL 62.08 189,433 Ethan Allen ETH 27.93 18,148 Express EXPR 26.08 36,279 Fair Isaac FICO 43.23 34,171 Federal Realty Inv Trust FRT 98.55 81,140 Foot Locker FL 30.42 64,637 Gabelli Hlthcr & Well GRX 8.13 2,168 Gallagher AJG 35.92 32,577 Global Cash Access GCA 6.92 53,554 WW Grainger GWW 216.98 34,180 Guidewire Software GWRE 32.85 252,094 Harley Davidson HOG 49.99 216,421 Hels High Income Fund HIH 8.64 1,483 Home Depot HD 49.68 1,936,080 DR Horton DHI 16.09 686,929 Hospitality Properties Tr HPT 25.94 46,055 Hubbell B HUB/B 79.49 6,220 Imperva IMPV 39.40 3,715 IBM IBM 204.75 437,600 Intl Paper IP 36.32 395,157 Jabil Circuit JBL 27.35 312,027 Kayne Anderson Engy Dev KED 25.75 8,754 Kayne Andrsn Midstr Engy KMF 27.27 7,721 LSI Corp LSI 8.92 6,715,301 LEH 7% CAN Finl JZV 26.09 2,100 Lennar Corp A LEN 26.92 394,232 Lennar Corp B LEN/B 22.01 4,662 Limited Brands LTD 47.56 95,688 Liz Claiborne LIZ 12.74 400,210 Lowe's Cos LOW 30.60 2,667,614 MI Developments MIM 37.75 10,876 MSC Indust Direct MSM 84.41 4,296 Marriott Intl MAR 38.63 316,467 Marsh & McLennan MMC 32.75 212,678 Mead Johnson Nutrition MJN 80.75 51,178 Movado Group MOV 21.98 6,959 Nike Inc NKE 111.23 259,939 Nordstrom Inc JWN 54.98 274,636 Northeast Utilities NU 37.64 141,795 Nstar NST 49.25 12,710 Nuveen Invest Qual Muni NQM 16.28 9,224 PVH Corp. PVH 89.48 35,397 Pier 1 Imports PIR 17.89 165,199 PPLUS 6.7% TRUCs LMG-4 PYL 23.99 800 Procter & Gamble PG 67.95 1,011,694 Progressive Corp PGR 22.66 379,823 Protective Life PL 29.04 56,755 PulteGroup PHM 9.58 904,422 Questar Corp STR 20.18 31,623 Ralph Lauren Cl A RL 182.48 113,894 Raytheon RTN 52.83 171,295 Realty Income O 38.19 92,846 Rite Aid RAD 2.00 11,936,365 Roper Indus ROP 99.23 102,107 STRNS GS Grp HJG 24.93 1,248 Simon Property Group SPG 141.89 148,551 Southwest Gas SWX 43.64 12,489 Special Opp Fund SPE 16.38 22,898 Stanley Black & Decker SWK 81.56 217,611 Sun Communities SUI 43.70 7,061 SYNNEX SNX 42.60 9,322 Taiwan Semi Mfg TSM 15.11 1,417,374 Target Corp TGT 58.77 579,749 Taubman Ctrs TCO 71.52 39,261 Telus Corp TU 58.20 15,542 Tempur-Pedic TPX 83.62 146,157 Tesoro TSO 30.04 251,534 Time Warner Cbl TWC 81.21 120,046 Toll Brothers TOL 24.79 251,117 Torchmark TMK 49.62 47,303 Toro Co TTC 71.49 24,151 Total Sys Svcs TSS 22.69 87,020 Triangle Cap Notes 2019 TCC 25.60 3,050 Tri-Continental TY 16.15 12,041 Under Armour A UA 98.56 110,018 United Parcel Service B UPS 78.44 299,703 US Bancorp USB 31.24 4,803,445 Vaalco Engy EGY 9.09 359,994 Valspar Corp VAL 49.85 31,885 Watsco WSO 75.07 55,901 Wesco Aircraft Holdings WAIR 16.15 11,294 Western Alliance Bancorp WAL 9.00 52,247 Wstrn Asset Emerg Mkt II EMD 15.10 29,998 Wyndham Worldwide WYN 46.25 88,435 Xylem Inc. XYL 28.46 48,288 YUM! Brands YUM 69.30 500,801 New Lows 7 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ AngloGold Ashanti AU 38.10 840,287 AngloGold Ashanti Pfd A AUpA 43.95 3,645 Campus Crest Communities CCGpA 24.81 1,000 IamGold IAG 13.42 559,650 STR Holdings Inc. STRI 5.52 89,829 Standard Register SR 1.38 22,301 Telekom Indonesia TLK 29.55 54,443

NASDAQ

New Highs 110 COMPANY SYMBOL HIGH VOLUME ------- ------ ---- ------ AMC Networks A AMCX 46.69 41,749 Advisory Board ABCO 87.12 42,385 Ameris Bancorp ABCB 12.35 2,800 Apple AAPL 583.85 8,621,621 Arctic Cat ACAT 42.00 10,351 Ascena Retail Group ASNA 44.26 96,309 athenahealth ATHN 78.08 66,150 BBCN Bancorp BBCN 11.15 18,786 BE Aerospace BEAV 47.99 100,662 Bank of The Ozarks OZRK 31.49 27,812 Beacon Roofing Supply BECN 25.79 100,394 Bed Bath & Beyond BBBY 64.37 978,047 Benihana BNHN 12.30 20,306 Bottomline Techs EPAY 29.82 19,452 Builders FirstSource BLDR 3.55 17,927 Cabot Microelectronics CCMP 39.89 42,712 Cal-Maine Foods CALM 42.16 14,965 Celgene CELG 76.39 314,567 Centerstate Banks CSFL 7.85 2,745 Chefs' Warehouse CHEF 23.16 11,650 ChipMOS Techs Bermuda IMOS 15.50 59,446 Cintas CTAS 40.25 241,714 Cirrus Logic CRUS 24.38 191,007 Citizens Republic Bancorp CRBC 14.22 43,641 Coinstar CSTR 63.64 100,204 Columbia Banking System COLB 22.65 13,688 Copart CPRT 52.95 21,969 Cubist Pharmaceuticals CBST 44.28 43,864 Cynosure (Cl A) CYNO 19.50 5,521 DDi DDIC 12.48 13,391 DXP Enterprises DXPE 43.23 10,722 Discovery Comm C DISCK 45.66 28,285 Discovery Comm A DISCA 48.50 239,764 Dorman Products DORM 48.25 3,220 Dunkin' Brands Group DNKN 32.44 83,615 East West Bancorp EWBC 23.70 83,003 eBay EBAY 37.37 1,302,233 Encore Wire WIRE 30.43 8,515 Endologix ELGX 13.84 168,273 EXACT Sciences EXAS 10.11 60,169 Exar EXAR 7.64 17,497 F5 Networks FFIV 133.60 231,572 Farmers National Banc FMNB 6.33 2,200 Fastenal Co FAST 53.60 120,073 Fidelity Nasdaq Cmp-Trckg ONEQ 121.07 10,385 First California Finl Grp FCAL 5.35 11,784 First Tr NASDAQ 100Tch Sc QTEC 28.41 4,352 First Tr NASDAQ100EqWt QQEW 26.79 700 Fiserv FISV 69.09 56,010 Flamel Techs SA FLML 7.40 12,994 Francesca's Holdings FRAN 32.32 1,152,862 Furiex Pharmaceuticals FURX 23.92 1,502 Genomic Health GHDX 32.03 9,313 Hancock Hldg Co HBHC 35.92 40,042 Helios&Matheson Info Tech HMNY 7.00 87,728 Hibbett Sports HIBB 52.77 24,207 Hudson Tech HDSN 3.59 30,812 JB Hunt Transport JBHT 53.49 80,257 IAC/InterActive IACI 49.42 77,630 InfoSpace INSP 13.62 55,605 IntegraMed America INMD 12.32 7,388 Integrated Silicon Sol ISSI 11.08 25,589 Intel INTC 27.60 4,559,908 Intl Bancshares IBOC 20.16 47,015 Intuitive Surgical ISRG 532.66 16,118 Jive Software JIVE 25.49 41,875 Landstar System LSTR 56.99 34,380 Liberty Global Cl A LBTYA 52.00 74,679 Liberty Global Cl C LBTYK 49.80 13,451 Liquidity Services LQDT 46.85 33,431 lululemon athletica LULU 73.73 217,568 MTS Systems MTSC 51.91 8,989 Manhattan Associates MANH 49.92 4,243 Mantex Intl MNTX 7.83 9,165 Market Leader LEDR 3.99 21,622 Micros Systems MCRS 55.70 35,500 Molex A MOLXA 23.41 8,552 Molex MOLX 28.16 31,658 Monster Beverage MNST 60.66 148,534 North Central Bancshares FFFD 30.14 403 ORBCOMM ORBC 3.82 3,372 Pacific Premier Bancorp PPBI 8.09 3,754 PacWest Bancorp PACW 23.81 12,475 Panera Bread Co PNRA 164.94 55,393 Perma-Fix PESI 1.85 1,855,251 Pinnacle Fincl Partners PNFP 17.84 18,875 PwrShrs QQQ Tr Series 1 QQQ 66.53 9,287,187 PwrShs SP SmCp Cons Discr PSCD 32.05 700 PwrShs S&P SmCp Cons PSCC 33.76 200 Procera Networks PKT 21.63 44,929 ProShares UltraPro QQQ TQQQ 113.89 311,106 The Providence Service PRSC 15.94 10,376 Qualcomm QCOM 65.19 1,905,776 Ross Stores ROST 57.20 161,879 SBA Comm SBAC 50.39 79,542 SVB Fincl Group SIVB 65.98 62,981 Salem Comm SALM 4.33 133,114 Salix Pharmaceuticals SLXP 51.42 179,054 Santarus SNTS 5.43 132,769 Select Comfort SCSS 32.99 65,014 Spirit Airlines SAVE 20.66 121,273 Standard Parking STAN 21.48 27,671 Starbucks SBUX 52.78 1,252,161 Sucampo Pharm (Cl A) SCMP 7.65 18,683 Threshold Pharmaceuticals THLD 7.37 982,312 Town Sports Intl Hldgs CLUB 11.39 4,908 Vanguard Russell 1000 VONE 64.13 106 Vanguard Russ 1000 Growth VONG 67.22 344 Vanguard Russell 3000 VTHR 64.21 800 WisdomTree Emg Mkts Corp EMCB 75.38 26,670 New Lows 9 COMPANY SYMBOL LOW VOLUME ------- ------ ---- ------ Ampio Pharmaceuticals AMPE 3.13 7,816 Ceres CERE 12.86 700 Dataram DRAM 0.65 1,752 Lumos Networks LMOS 10.90 5,974 Nanophase Techs NANX 0.37 54,296 Pointer Telocation PNTR 2.74 1,216 ProShr Ul Sh QQQ SQQQ 11.39 487,389 Seven Arts Entertainment SAPX 0.14 703,587 Sterling Construction Co STRL 9.11 54,231Comments »

Your Tax Dollars @ Work: TARP Loans Payed Off With More Tax Payer Loans

CBO Doubles Obamacare Estimates to $1.76 Trillion

“President Obama’s national health care law will cost $1.76 trillion over a decade, according to a new projection released today by the Congressional Budget Office, rather than the $940 billion forecast when it was signed into law.

Democrats employed many accounting tricks when they were pushing through the national health care legislation, the most egregious of which was to delay full implementation of the law until 2014, so it would appear cheaper under the CBO’s standard ten-year budget window and, at least on paper, meet Obama’s pledge that the legislation would cost “around $900 billion over 10 years.” When the final CBO score came out before passage, critics noted that the true 10 year cost would be far higher than advertised once projections accounted for full implementation.

Today, the CBO released new projections from 2013 extending through 2022, and the results are as critics expected: the ten-year cost of the law’s core provisions to expand health insurance coverage has now ballooned to $1.76 trillion. That’s because we now have estimates for Obamacare’s first nine years of full implementation, rather than the mere six when it was signed into law. Only next year will we get a true ten-year cost estimate, if the law isn’t overturned by the Supreme Court or repealed by then. Given that in 2022, the last year available, the gross cost of the coverage expansions are $265 billion, we’re likely looking at about $2 trillion over the first decade, or more than double what Obama advertised.

UPDATE: I’ve done another post with additional details from the CBO report.”

Comments »Has the Fed Signaled Their First Hint of Tightening ?

“The most interesting thing about Tuesday’s Fed meeting: What the committee didn’t say.

The Federal Reserve’s monetary policy making committee left policy as it is and said it was remaining in “wait and see” mode. The Fed expressed more optimism than it has in recent post-meeting statements, though there was still the obligatory acknowledgement of risks. What I was looking for, however, was some sign about future policy. In particular, will the Fed renew its operation twist program in some guise? Are there any signs that it is getting ready to implement an exit strategy?

As I discussed here, there have been recent discussions of a sterilized bond program that could replace its earlier stimulus effort, operation twist. But there are no hints in the statement about this. For that reason, unless there is unexpected negative news ahead I don’t think the Fed will continue its attempts to lower long-term interest rates through programs such as operation twist or sterilized bond buying. If the program is not renewed, and it doesn’t look like it will be, that will represent the first step in tightening policy.

I also don’t expect the Fed to give up its commitment to keep interest rates low through late 2014, a commitment it renewed today, especially since, as I noted here, the Fed has other ways to begin tightening before it has to raise interest rates. For example, because the interest rate is at the zero bound the Fed can begin reducing its balance sheet through sales of financial assets and that won’t impact interest rates until the downward pressure that is holding rates at the zero bound is eliminated. I expect it will pursue those policies first.

Thus, for me the big takeaway, and one that is a bit disappointing given my outlook for the recovery — i.e. that the recovery will be slower than tolerable — is that there are no signs at all that the Fed is considering further easing. In fact, even though the Fed is in “wait and see” mode, all signs point in the other direction.

Here’s the release:…”

Comments »Are We Entering a New Era of Job Destruction ?

Author Todd Harrison argues a new ear is upon us…..

“The change in thinking we’re going to undergo is shifting from a mindset of “we don’t have enough jobs for our citizens” to “we don’t have enough citizens for the amount of work we want to do.”

Sound crazy? Consider this: Since the end of the year 2000, according to a household survey, the number of U.S. workers age 45 or older has increased from 49.2 million to 63.1 million, an increase of 13.9 million.

Meanwhile, the number of U.S. workers age 25 to 44 has fallen from 67.9 million to 61.1 million, a decrease of 6.8 million.

This phenomenon has been driven by a few factors. The “pig moving through the python” progression of the baby boomers, who on average turned 45 in the year 2000 and began moving from the 25-to-44 bucket to the 45+ bucket. The 2008 recession is delaying retirement for older people and delaying careers for millennials. And generally lower birth rates starting in the late 1960s are leading to fewer bodies replacing the baby boomers in the twenties and thirties age buckets….”

Comments »Today’s Heat Map and A/D Lines

State of the Union: New Report Finds US Workers Worrying More About Retirement, Saving Less

Most Active Options Trades This Morning

-CALLS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE BAC 3/17/12 8.0000 13977 0.7200 up 0.2100 BAC 4/21/12 9.0000 13917 0.2900 up 0.0500 AAPL 3/17/12 585.0000 7560 6.0500 up 4.9700 BAC 3/17/12 9.0000 7279 0.0500 up 0.0000 AAPL 3/17/12 580.0000 5735 8.4500 up 6.6900 AAPL 3/17/12 565.0000 4734 18.4500 up 11.2500 C 3/17/12 36.0000 4332 0.2300 dn 0.6800 AAPL 3/17/12 590.0000 4095 4.2500 up 3.5800 AAPL 3/17/12 570.0000 3758 15.2100 up 10.4600 AAPL 3/17/12 575.0000 3578 11.3600 up 8.4800 -PUTS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE ORCL 6/16/12 25.0000 15232 0.3900 up 0.0400 AAPL 3/17/12 570.0000 2538 3.3000 dn 3.3000 AAPL 3/17/12 580.0000 2288 6.9000 dn 6.8100 AAPL 3/17/12 565.0000 2183 2.1700 dn 1.9800 AAPL 3/17/12 575.0000 1932 4.8500 dn 4.9000 AAPL 3/17/12 560.0000 1787 1.3300 dn 1.1600 GLD 3/30/12 129.0000 1769 0.0300 dn 0.0300 JPM 3/17/12 42.0000 1717 0.1100 dn 0.0300 AAPL 3/17/12 550.0000 1434 0.5200 dn 0.2200 AAPL 3/17/12 555.0000 1262 0.8000 dn 0.5600 -VOLUME- CALLS PUTS TOTAL 444586 327282 771868

-CALLS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE BAC 4/21/12 9.0000 522 0.2700 up 0.0400 BAC 3/17/12 9.0000 507 0.0400 dn 0.0100 AAPL 3/17/12 570.0000 356 15.0000 up 10.2500 AAPL 3/17/12 580.0000 339 8.8000 up 7.0500 STI 3/17/12 23.0000 333 0.5500 up 0.4700 BAC 3/17/12 8.0000 319 0.7300 up 0.2200 AAPL 3/17/12 575.0000 288 12.7000 up 9.8000 AAPL 3/17/12 585.0000 267 6.2500 up 5.3600 GE 3/17/12 20.0000 230 0.1500 up 0.0900 AAPL 3/17/12 590.0000 229 4.1500 up 3.5000 -PUTS- OPTION EXP.DATE STRIKE PRC. VOLUME LAST S/PRC. NET CHANGE GLD 3/17/12 160.0000 669 1.1900 up 0.5300 C 3/17/12 35.0000 251 0.3100 up 0.1000 AAPL 3/17/12 550.0000 237 0.5000 dn 0.2400 AAPL 3/17/12 570.0000 223 3.3500 dn 3.3700 AAPL 3/17/12 575.0000 208 4.7500 dn 5.2500 AAPL 3/17/12 580.0000 170 7.0000 dn 6.6500 YHOO 3/17/12 16.0000 134 1.4200 dn 0.0900 YHOO 7/21/12 16.0000 134 1.9600 up 0.0000 AAPL 3/17/12 565.0000 132 2.1500 dn 2.1000 ABX 4/21/12 43.0000 117 0.9200 up 0.3200 -VOLUME- CALLS PUTS TOTAL 22762 17220 39982Comments »

Kyle Bass: Fed Has Made Gold a Solid Investment for Years

A Class Action Suit Was Filed for Privacy Issues Against Facebook, Apple, Twitter and 15 Other Companies

“It was bound to happen sooner or later, but it looks like all the heated conversation we’ve seen over user privacy in mobile apps has now finally boiled over into a class action lawsuit, filed this week in the Western Division of the U.S. District Court, Austin Division.

A list of 13 plaintiffs, acting “on behalf of themselves and all others similarly situated,” have filed a suit against a series of high-profile companies that make some of the most popular mobile apps around today. The list names 18 companies in all: Path, Twitter, Apple, Facebook, Beluga, Yelp!, Burbn, Instagram, Foursquare, Gowalla, Foodspotting, Hipster, LinkedIn, Rovio, ZeptoLab, Chillingo, Electronic Arts and Kik Interactive. Coincidentally, the suit was filed on Monday, the same day that Yahoo filed a patent infringement suit against Facebook.

And it looks like the lawyers representing the plaintiffs — the Austin firms of Edwards Law, Carl F. Schwenker, and the Jordan Law Firm — appear to have filed this week in an attempt at maximum effect: the suit was made public right in the middle of the SXSW interactive event that brings upwards of 20,000 tech types to the city, including those from the companies named in the suit, and of course exactly the kind of people who use these apps regularly.

Some of the defendant list seems to be intentionally doubling up actions: for example, Gowalla is now owned by Facebook; and Burbn is the developer behind Instagram…..”

Comments »Russia Relays U.S. Message to Iran: Comply or Die by Year End

“In what can only be seen as raising the rhetoric bar on the timing, scale, and seriousness of the Iran ‘situation’, Kommersant is reporting that“Tehran has one last chance” as US Secretary of State Clinton asks her Russian counterpart Sergei Lavrov to relay the message to Iranian leaders. If this ‘last chance’ is wasted an attack will happen in months as diplomats noted that the probability of an Israel/US attack on Iran is now a specific ‘when’ instead of an indefinite ‘if’. The sentiment is best summarized by a quote from inside the meeting “The invasion will happen before year’s end. The Israelis are de facto blackmailing Obama. They’ve put him in this interesting position – either he supports the war or loses the support of the Jewish lobby”. Russian diplomats, as Russia Today points out, criticized the ‘last chance’ rhetoric as unprofessional suggesting “those tempted to use military force should restrain themselves – a war will not solve any problems, but create a million new ones.”

Comments »Farmers Fear Austerity May Come to the Ag Industry as Subsidies are Set to Run Out Later This Year

“(Reuters) – U.S. lawmakers are short on time and money to make the biggest cuts in agriculture in a generation and failure risks unintentionally driving up food prices and adding to an already onerous deficit.

Just as Congress took the country to the brink of an unprecedented debt default by haggling over whether to raise the debt ceiling, fractious Republicans and Democrats may wait this year until the last minute to agree to significant cuts to farm supports amid historically high crop prices.

The U.S. farm law, mammoth legislation that covers everything from food stamps to soil erosion, expires September 30.

Without a new law or an extension, a 1949 law — the bogeyman of farm bill showdowns — would automatically go into effect. It would limit plantings and have the government pay farmers up to twice what crops would sell for on the open market. Farm subsidies would rise by tens of billions of dollars and consumer grocery bills would rise while the economy is still struggling to recover from the recession.

There are fiscal and policy obstacles to a new farm law….”

Comments »