Man up son and daughters cause silver is going to surpass the Hunt Top of $50….

Comments »Monthly Archives: May 2011

Asian Markets Follow Wall Streets Lead; Nikkei Down 1.82%

“SINGAPORE — Asian stock markets were weaker Friday, with commodity-related stocks battered after oil and metals prices dropped sharply Thursday.

Risk aversion was the order of the day, after weaker-than-expected U.S. jobless claims data Thursday dragged down U.S. stocks and sparked a heavy selloff in oil and metals.

Japan’s Nikkei Stock Average was down 1.7%, Australia’s S&P/ASX 200 was down 0.3%, South Korea’s Kospi Composite dropped 1.3% and New Zealand’s NZX-50 was off 0.1%.

Dow Jones Industrial Average futures were up 11 points in screen trade.

Oil-bears remained in play in Asia, with June Nymex crude oil futures falling 29 cents to $99.51 per barrel on Globex, extending a massive 8.6%, or $9.44, fall Thursday to its lowest settlement since March 16.

Thursday’s sharp fall by crude futures virtually removes the chance of fresh price highs for at least two months, barring a major exogenous event, said Jim Ritterbusch, president of oil trading advisory firm Ritterbusch & Associates.

The likely scenario now was “another $5-$7 on the downside per both WTI and Brent (crude) in relatively short order as the large speculative community seeks to acquire a better balance within their energy positions to a rapidly changing risk environment,” he added.”

Comments »AIG Hits the Skids With a Fresh Billion Dollar Loss

“NEW YORK (Reuters) – Bailed-out insurer American International Group lost more than $1 billion from its ongoing operations in the first quarter, as the company took a huge charge for the termination of its credit facility with the Federal Reserve.

AIG’s Chartis unit also racked up $864 million in catastrophe losses related to the March 11 earthquake in Japan. The company, one of the top foreign insurers in Japan, had previously warned of substantial quake charges.

AIG shares, which have lost more than 30 percent of their value since late January, fell about 1 percent in after-hours trade to $30.50.

AIG reported a loss from continuing operations of $1.18 billion, or $1.41 per share, compared with a profit on the same basis a year earlier of $2.09 billion, or $2.16 per share.”

Comments »Vale Posts Quadruple Profits YOY and EBITDA of $9.18 Billion Vs Estimates of $8.73 Bn

What a phenomenal quarter; but you do have to take into account a one off sale of a division for $1.51 billion.

Comments »Gold and Silver Are Bouncing Higher

Gold +15.16 to 1,487.75

Silver +.20 to $34.88

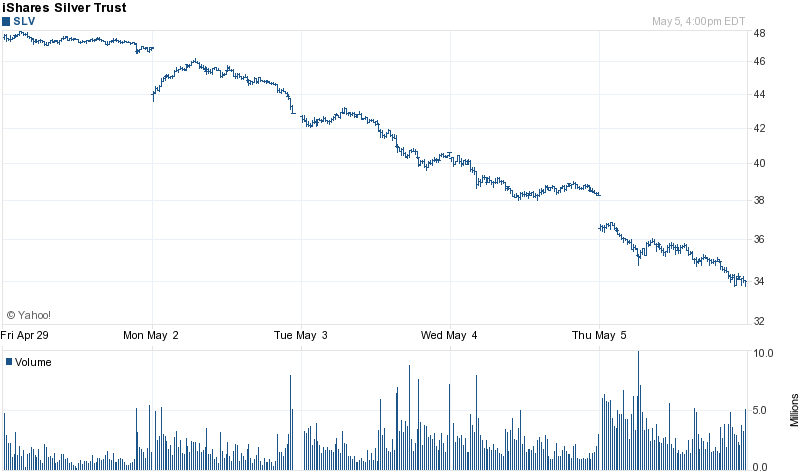

Epic Plunge in Silver Was Orchestrated

Silver has declined in value to the tune of 30% this week, the largest decline since 1983 when the Hunt brothers cornered the market. The fact of the matter is, silver was doing just fine until the CME hiked margin requirements a record 5 times over the past 2 weeks, an 84% increase in trading costs.

Comments »Oil Plunges But Crack Spreads Rise

Gasoline dropped far less than oil today. As a result, crude dropped about 10% and spreads went up 2%, nearing $28.

Comments »Silver: This is What a Margin Liquidation Looks Like

Moody’s: Basel 3 insufficient to strengthen bank’s credit

In their latest press release on May 4, Moody’s rating service confirms what many had the common sense to understand on their own. It is impossible to legislate oneself out of a crisis, and credibility and accompanying credit comes as a product of fullfilling obligations and successes, not international finance laws.

New York, May 04, 2011 — Moody’s Investors Service says in a new report that although Basel 3 is credit positive for banks, the standalone financial strength of banks weakened by the global financial crisis is unlikely to return to pre-crisis levels in the short term. The report discusses the likely impact of Basel 3 on bank credit profiles and how different groups of banks may be affected in the new Basel 3, post-crisis environment.

The framework agreed by the Basel Committee on Banking Supervision in the aftermath of the financial crisis sets new standards for global bank regulation. “Basel 3 will be positive for bank creditors overall, as it will improve the resilience of the global banking system by adding sizeable capital and liquidity buffers,” says Vice President and co-author of the report Tobias Moerschen. The recovery of banks’ credit profiles, however, is constrained by the pressures many institutions still face given the fragile economic recovery in developed markets, skittish financial markets, and new global risks.

“While directionally positive, Basel 3 does not cure the structural challenges banks continue to face from a credit perspective, such as illiquidity and high leverage, nor does it alleviate the tension between profit-maximizing equity holders and bank managers in contrast to risk-averse bondholders,” notes Senior Vice President and co-author of the report Alain Laurin. While important, the new regulatory framework is therefore only one part of the broader effort to improve banks’ resilience to economic downturns.

Stricter regulatory standards and investors’ elevated focus on risks in the post-crisis environment will not affect banks in a uniform manner. The report discusses three different groups of banks: 1) institutions that are able to raise additional capital and bolster liquidity to meet Basel 3 requirements, which may see their credit strength improve; 2) weaker banks that will be challenged to comply with the new rules, and may see their credit profiles deteriorate; and 3) banks that are already largely compliant with Basel 3, whose credit strength likely will remain stable. With the new rules acting as a catalyst for change, weaker banks may seek acquirers, seek government support, or wind down part or all of their operations, with potentially adverse consequences for creditors.

The report notes that considerable uncertainty remains about the effects of Basel 3 due to the long transition period (banks have until 2019 to fully comply) and the likelihood that parts of the proposed framework may change. Additionally, jurisdictions may differ in how they adopt the new rules, with the potential for regulatory arbitrage. Banks are also just beginning to formulate how they will adapt to the Basel 3, post-crisis world and their strategies could have a significant impact on their intrinsic financial strength.

Sadly, for the body of politicians who participated in the Basel process, increasing buffers and reserve requirements when the economy is on the fringe and no financial institution has the funds available to contribute to said buffers (which was sort of the problem to begin with), can hardly be helpful to the immediate release of the system.

And even worse for them, enacting a banking reform after a banking crisis is hardly great enough of an endevour to immediately reduce all pessimism in the system.

Perhaps Basel 3 will be helpful down the road, but for now, it isn’t.

Comments »Cinqo de Mayo S&P ratings actions

Host Hotels & Resorts L.P. $350M Senior Notes Due 2019 Rated ‘BB+’ 05-May-2011

13:02 EST

Esterline Technologies Corp. ‘BB+’ Rating Affirmed; Unsecured Debt Ratings On Watch Negative 05-May-2011

12:44 EST

Metaldyne LLC $355 Million Term Loan Assigned ‘B+’ Rating (Recovery Rating: 3); ‘B+’ CCR Affirmed 05-May-2011

12:12 EST

One OHSF II Financing Ltd. Rating Placed On CreditWatch Negative; Nine Ratings Affirmed 05-May-2011

12:11 EST

Clarksville Redevelopment Authority, IN Lease Rental Bond Rating Raised To ‘AA-‘; Outlook Stable 05-May-2011

11:50 EST

Sensata Technologies B.V. Proposed $1.45 Billion Credit Facility Rated ‘BB+’ , $600 Million Notes Rated ‘B’ 05-May-2011

11:30 EST

ABACUS 2006-NS2 Ltd. Rating Lowered On Class N To ‘D (sf)’ 05-May-2011

10:46 EST

Ally Auto Receivables Trust 2011-2 $802.00 Million Notes Assigned Ratings 05-May-2011

10:44 EST

City National Corp. Outlook Revised To Stable From Negative, ‘BBB+/A-2’ Ratings Affirmed On Asset Quality Improvement 05-May-2011

10:29 EST

Russia’s VEB-leasing Assigned ‘BBB/A-3’ Foreign Currency And ‘BBB+/A-2’ Local Currency Ratings; Outlook Stable 05-May-2011

07:15 EST

LGIM Euro Liquidity Fund Assigned ‘AAAm’ Principal Stability Fund Rating 05-May-2011

06:39 EST

Ratings Raised On Eurocredit CDO IV’s Class A-1 To C-2 Notes As Credit Quality Improves 05-May-2011

05:19 EST

SCB’s Proposed Senior Unsecured Notes Issue Under Its Euro Medium-Term Notes Program Rated ‘BBB+’ 05-May-2011

00:52 EST

Raw Commodities Undergoing Stiff Correction

Raw commodities have been punished over the past month, following monster returns. Recently, silver has been the headline loser, due to margin requirements being lifted 4 times over the past two weeks. However, the losses were not isolated to just silver.

1 month returns:

Cotton -22%

Sugar -21%

Lead -15%

Livestock -10%

Palladium -10%

Lithium -7%

Silver -6.5%

Coal -5%

WTI/Brent Spread Tightening

Due to a sharp pullback in Brent crude, the spread is now a touch under $10, down from a high of $15 a few weeks ago.

Comments »Android Gaining Market Share on Apple’s App Store

“There’s no doubt Android Market will at some point offer more applications for download and/or purchase than Apple’s App Store, as the latter’s growth has been slowing down of late, while the Android application store’s growth rate has been accelerating.

In a recent report, app store analytics company Distimo forecasted that Android would surpass the App Store in size before the end of July 2011.

Another research firm, Germany-based research2guidance, corroborates Distimo’s findings; the firm forecasts Android to blow past Apple’s App Store by August 2011.

Provided current growth rates for new app uploads are maintained, research2guidance expects Android Market to reach 425,000 apps next August, effectively overtaking App Store in size.

According to the firm, Android Market added 28,000 new apps in April 2011, whereas Apple lagged behind with only 11,000 new apps.”

Comments »JDS Uniphase Helps to Lift Nasdaq with Yesterday’ Report Being Better Than Expected

“MILPITAS, Calif. (AP) — JDS Uniphase Corp., which makes communications equipment for telecom and cable companies, said Wednesday that it swung back to a fiscal third-quarter profit on stronger demand for its products.

Shares of the company, whose results beat analyst forecasts, rose nearly 10 percent in extended trading.

For the quarter that ended April 2, JDS Uniphase earned $38.6 million, or 16 cents per share, compared with a loss of $11.9 million, or 5 cents per share, in the year-ago quarter.

Excluding one-time items, the company earned 22 cents per share, which is 2 cents more than what analysts polled by FactSet had forecast.

Revenue climbed 86 percent to $454 million from $332.3 million last year, also edging above analysts’ $448 million estimate. The company said a strong mix of new products helped it gain market share in the optical communications and test and measurement markets.

For the fourth quarter ending July 2, the Company expects net revenue in the range of $455 million to $475 million.

JDS shares rose $1.92 to $21.86 in after-hours trading. The stock had finished regular trading down 27 cents at $20 before the report.”

Comments »TPK Holdings of Taiwan Scrambles to Keep up With Apple Touchscreen Supplies

“This morning, touchscreen supplier TPK Holding [of Taiwan] held a conference call to discuss first-quarter results and provide a second-quarter outlook.

Overall, the tone of the call was upbeat, as the company continues to ramp new products and aggressively expand capacity to meet strong demand trends for smartphones and tablets. Keep in mind, TPK is the leading touchscreen supplier to Apple (AAPL) (rated at Buy) at over 70% of sales across the iPhone, iPad and iPod devices.

Overall, we believe the call reflects well on trends at Apple, while highlighting increased Japanese competition for Corning‘s (GLW) (rated at Sell) Gorilla glass.”

Comments »A Double Dip in Home Prices Is No Longer in Question

“It’s official.

Home prices have double dipped nationwide, now lower than their March 2009 trough, according to a new report from Clear Capital.

It was inevitable, and it was predicted (by me for sure) that a surge in sales of foreclosed properties and a big push by banks to facilitate short sales would force home prices down dramatically.

Sales of bank-owned (REO) properties hit 34.5 percent of the market, according to the survey, resulting in a national price drop of 4.9 percent quarterly and 5 percent year-over-year. National home prices have fallen 11.5 percent in the past nine months, a rate not seen since 2008. Add short sales, where the bank allows the borrower to sell for less than the value of the mortgage, and prices have nowhere to go but down.”

Comments »Privatizing Medicare Gets Held up in House

“U.S. House Ways and Means Committee Chairman Dave Camp said Thursday his panel has no plans on moving forward on a Republican proposal that would privatize the Medicare health program for future retirees.

“I’m not really interested in just laying down more markers,” Camp said at an event sponsored by Health Affairs, a health policy journal. Camp said he is more interested in acting on legislation that can be signed into law that would bring down soaring costs for the healthcare program for the elderly.”

Comments »The Worst Pundit Awards Go To….

“Cal Thomas and Lindsey Graham Win Worst Pundit Predictor Titles

Just how accurate are the political pundits who appear on television and write regular columns in newspapers? Students in a public policy class at Hamilton College in Clinton, New York, studied the predictions of 26 public figures made between September 2007 and December 2008 during the last presidential campaign and its aftermath, either in print or while speaking on one of three major network Sunday news shows—Face the Nation, Meet the Press and This Week.”

Comments »Your Tax Dollars @ Work

At least we got some money back; but how much have we missed ?

“Boeing has returned $1.6 million so far to the federal government for overcharging the U.S. Army for helicopter parts.

he refund was initiated by an audit from the inspector general of the Department of Defense, which uncovered extraordinary markups on Boeing’s parts.

Among the most outrageous examples: the defense contractor charged the Army $644.75 for a small, plastic spur gear that cost another Pentagon agency $12.51. It also billed the service $1,678.61 for a dime-sized, plastic “ramp gate roller assembly” that costs $7.71. Both parts are installed on the CH-47 Chinook helicopter.”

Comments »Treasury Department Recommends a $2 trillion Debt Ceiling Raise

“(Reuters) – The Treasury has told lawmakers a roughly $2 trillion rise in the legal limit on federal debt would be needed to ensure the government can keep borrowing through the 2012 presidential election, sources with knowledge of the discussions said.

Obama administration officials have repeatedly said that it is up to Congress to decide by how much the $14.3 trillion debt limit should be raised.

But when lawmakers asked how much of an increase would be needed to meet the government’s obligations into early 2013, Treasury officials floated the $2 trillion working figure, Senate and administration sources told Reuters.

Former Treasury officials have said it is routine for Congress to ask the Treasury Department for guidance. Republican leaders have asked the White House to provide the size of any proposed increase before the two sides sit down on Thursday to discuss the debt limit face-to-face.

“We have not specified an amount or a time frame. We think that should be left up to Congress,” Mary Miller, Treasury’s assistant secretary for financial markets, told reporters on Wednesday”

Comments »