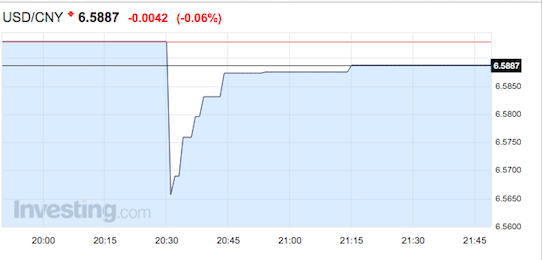

Well, well, well: what do we have here? Bloomberg just reported from a source who declined to be identified that Chinese controlled state funds were sopping up shares of large cap stocks to create a facade, a fiction of sorts, to make their damned markets trade up.

Chinese policy makers used purchases by government-linked funds to prop up shares over the summer as the CSI 300 plunged 43 percent from its June high. State funds probably spent $236 billion on equities in the three months through August, according to Goldman Sachs Group Inc. The China Securities Regulatory Commission didn’t immediately respond to a faxed request for comment.

Bear in mind, the United Steaks have been rumored to partake in a little wanton manipulation for years. The New World Order, in conjunction with the Grande Recursive Order of the Knights of the Lambda Calculus, alongside The Order of the Cinncinatus, The Holland Society of NYC– and a sundry of other private, well meaning organizations–have a desire to keep equity prices aloft. There is little to gain from a crash scenario playing out. Therefore, take out your best top hats and canes and prepare to enter the markets, using a Martingale strategy to take back your winnings.

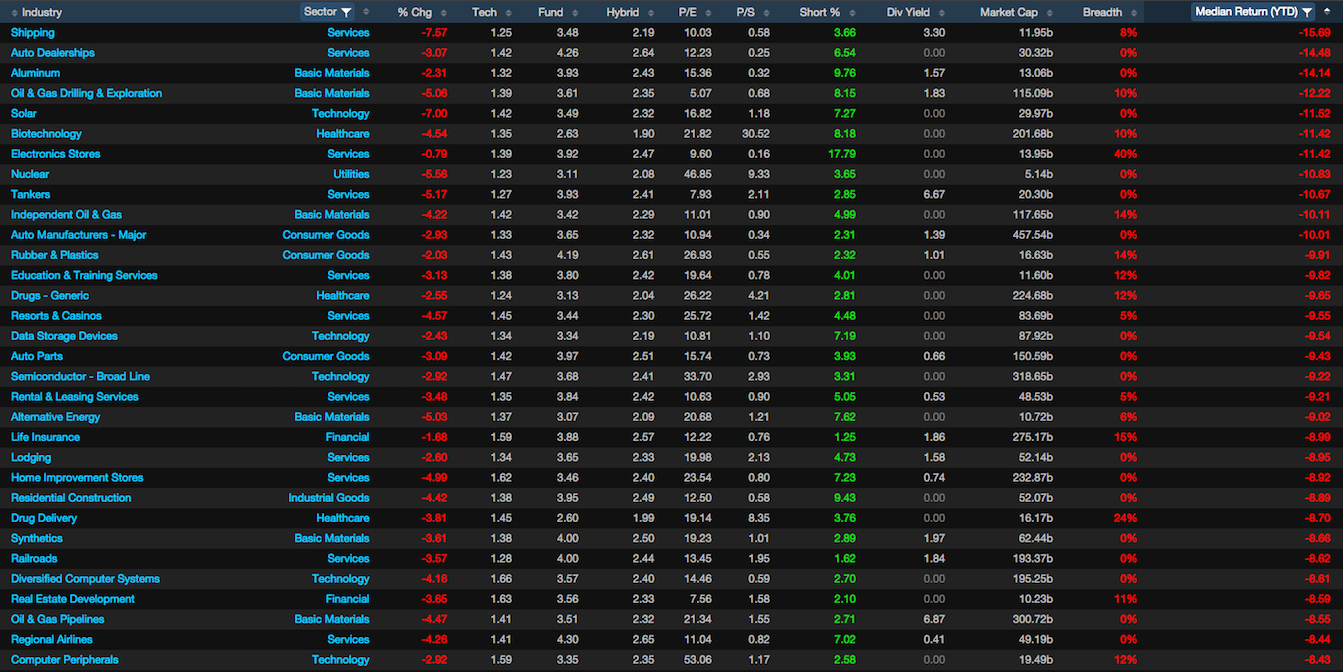

A rally is coming and when it does, it’s going to rip the faces clean off the clowns–down to the skeletons– who closed out the day heavily short into the hole.

NOTE: If you’ve noticed, we’ve really stepped up our video content game. Please subscribe to our Youtube Channel and bang on your neighbors door to tell them to do the same. Any time of night is acceptable.

Comments »