I almost feel bad doing this. After all, billionaires (extra Bernie Sanders) have feelings too. But the peril Bill Ackman and his cohorts face now were brought on by their own hubris. These brush fires were lit a few years ago, when they used VRX to make a bid for AGN, clearly an insider trading scheme that was permitted to go unchecked. The net result was Pershing Square concentrating 40% of their fund in AGN, into a self-directed, Valeant led, buyout offer–which resulted in a 40% return for the Man from Montauk.

Ironically, he is now being hung by his own petard in the burning house of cards, which is VRX–currently off by a staggering 40%.

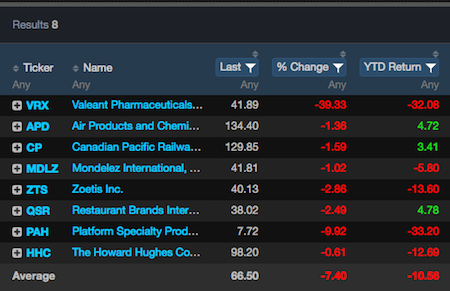

Here are Pershing Square’s positions. Should this decline in VRX force redemptions, which is bound to happen en masse, the following stocks might come under pressure–as he liquidates the fund.

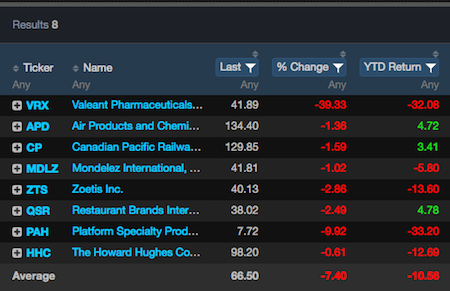

And let’s not forget this.

Ackman is short 20 million shares and is exposed to a short squeeze, now that his fund is being shredded.

Comments »