Who said Jack Dorsey was a fascist ruler of news and information on Twitter? I certainly did not. Did you see what his other company just did? They beat earnings expectations and guided up, all the while @Jack grew his beard. In other words, the company grew faster than Jack’s beard.

For the quarter, Square lost a shit load of money, but grew the top line at a 54% clip. The company guided up, ever so slightly, also increasing EBITDA to $18-24m from $8-14m

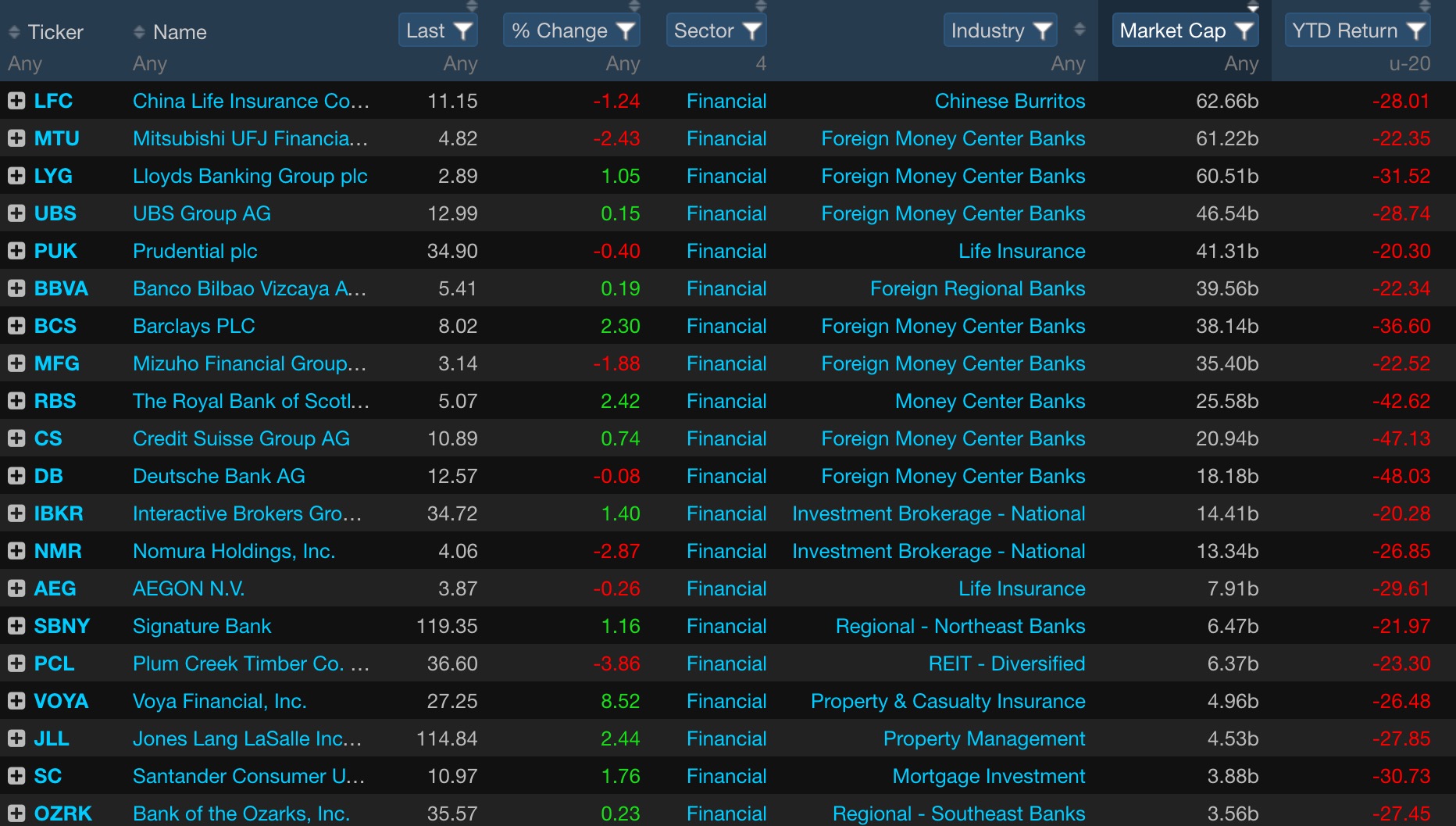

Reports Q2 (Jun) loss of $0.08 per share, $0.04 better than the Capital IQ Consensus of ($0.12); revenues rose 54.1% year/year to $171 mln vs the $157.88 mln Capital IQ Consensus.

In 2Q16, it processed $12.5 bln in GPV, an increase of 42% from 2Q15. New-seller growth made up the majority of its GPV increase, while positive dollar-based retention from existing sellers also had a meaningful impact.

Co achieved positive EBITDA of $13 mln.

Extended $189 mln in Square Capital, up 123% year over year and 23% sequentially.

Co issues upside guidance for Q3, sees Q3 revs of $167-$171 mln vs. $164.19 mln Capital IQ Consensus Estimate. Expects Adjusted EBITDA of $5-$6 mln.

Co issues raises guidance for FY16, sees FY16 revs of $655-$670 mln, up 6% at the mid-point of its prior guidance, and vs. $641.98 mln Capital IQ Consensus Estimate. SQ expects Adjusted EBITDA to be in the range of $18-$24 million, up from its previously guided range of $8-$14 mln.

God bless Jack Vissarionovich Dorsey.

SQ is higher by 9% in the after-hours, and lower by a mere 17% over the past 3 months. Winning.

Comments »