It was an interesting week, with shorts getting arrested on Friday, flung carelessly into ravines, as markets ripped tits, higher, to new all-time highs. Inside of the hallowed halls of Exodus, there was lively discussion inside The Pelican Room (12631), pertaining to a great many trades and community oriented ideas.

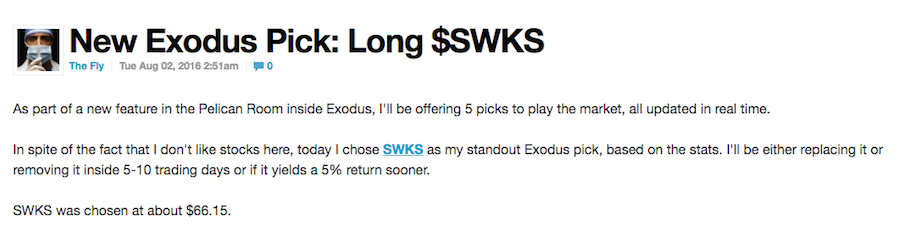

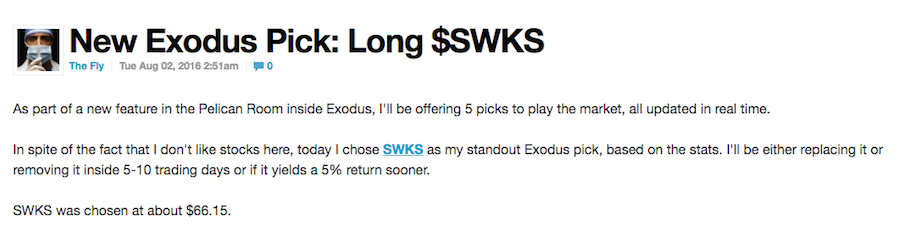

In the beginning of the week, I highlighted SWKS as oversold and designated it as the Exodus pick of the week. While it struggled early in the week, towards the end it proved to be marginally profitable.

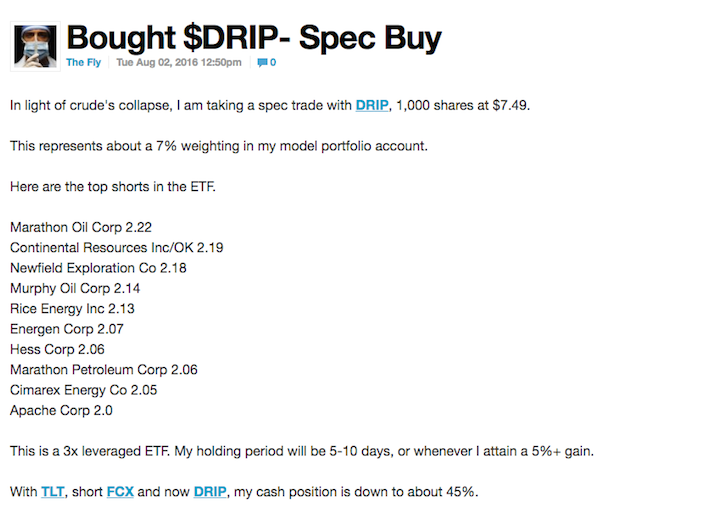

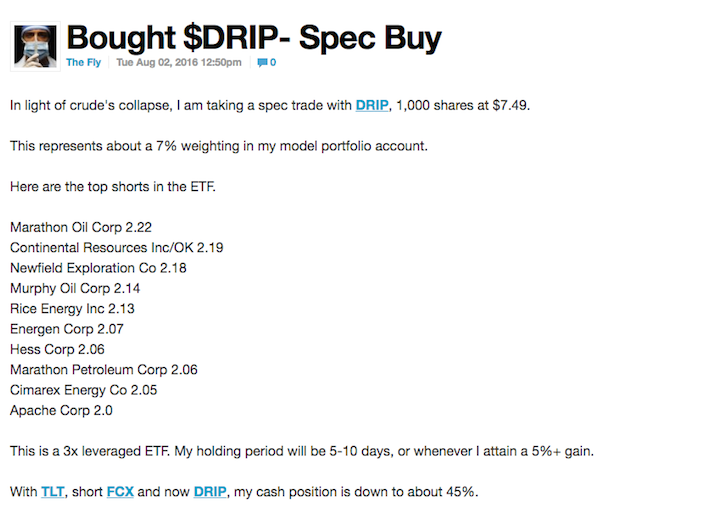

Once again, I was dispatched into the poorhouse with another wise idea to short crude, into the hole. This was an idea of mine, nothing to do with the algorithms. I’ll hang on to this bowser until early next week.

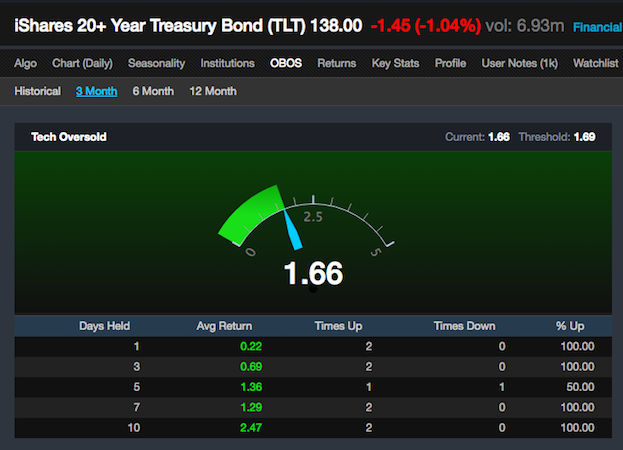

Based off impressive overbought data, I sold short FCX. Despite the rally in stocks, FCX closed lower than my entry point. I am confident in this short enough to hold it for another week, maybe longer. Additionally, TLT paid out its monthly divvy, lowering my cost to $118.85.

Towards the end of the week, the German ETF, EWG, was flagging OS. This had me thinking about swapping out the Exodus long pick for EWG. I might do this trade next week.

As of Friday, some overbought stocks, with impressive stats, include BHP, MUR, CEA, ETFC, JBL, MU, ESRX and ORCL.

On the oversold side, NSA, G and SIX look okay.

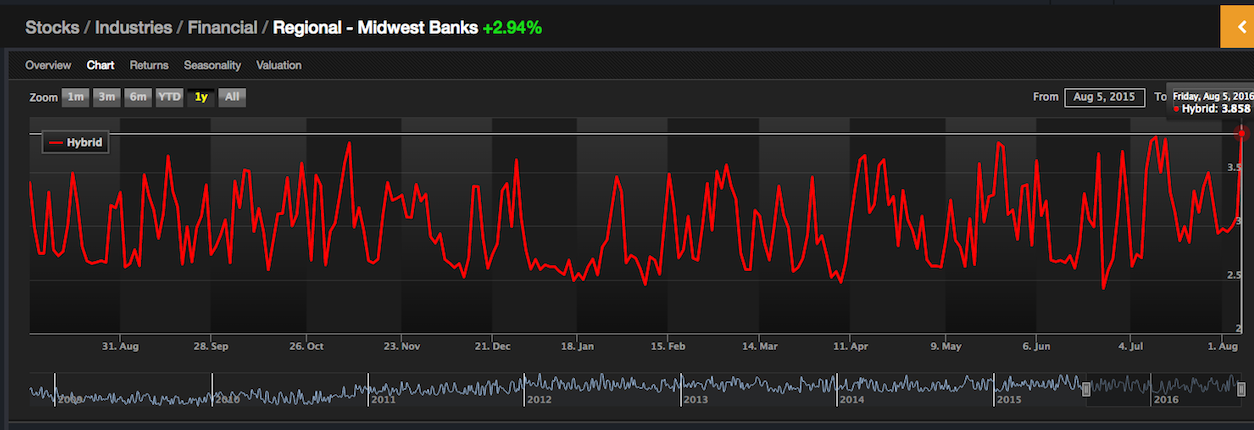

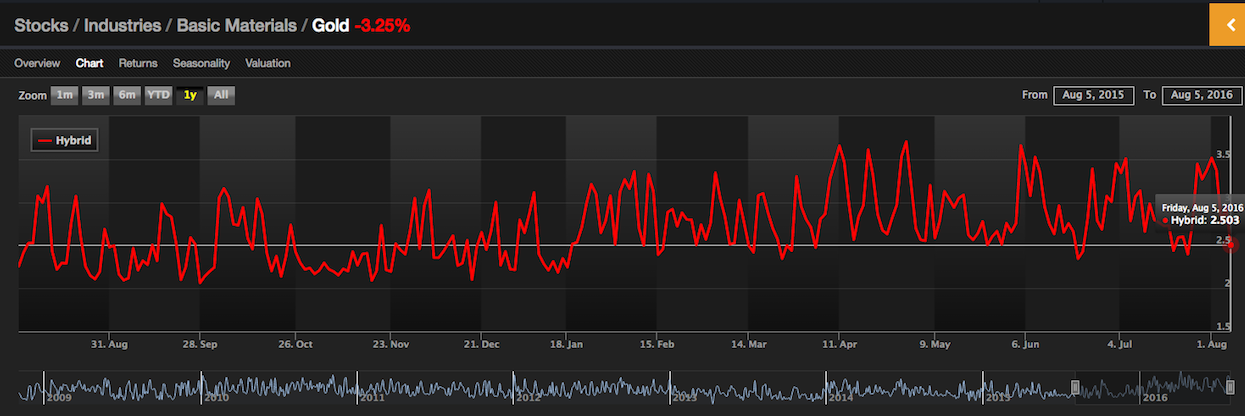

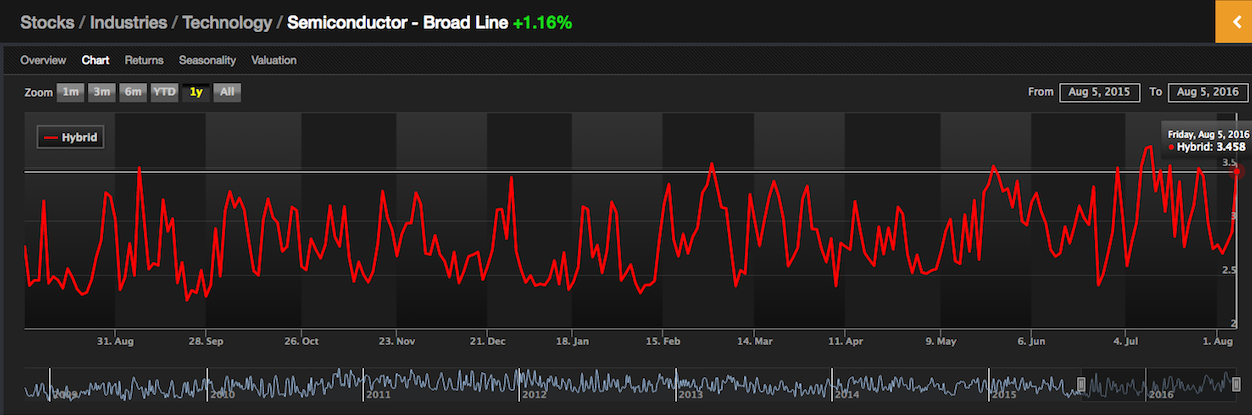

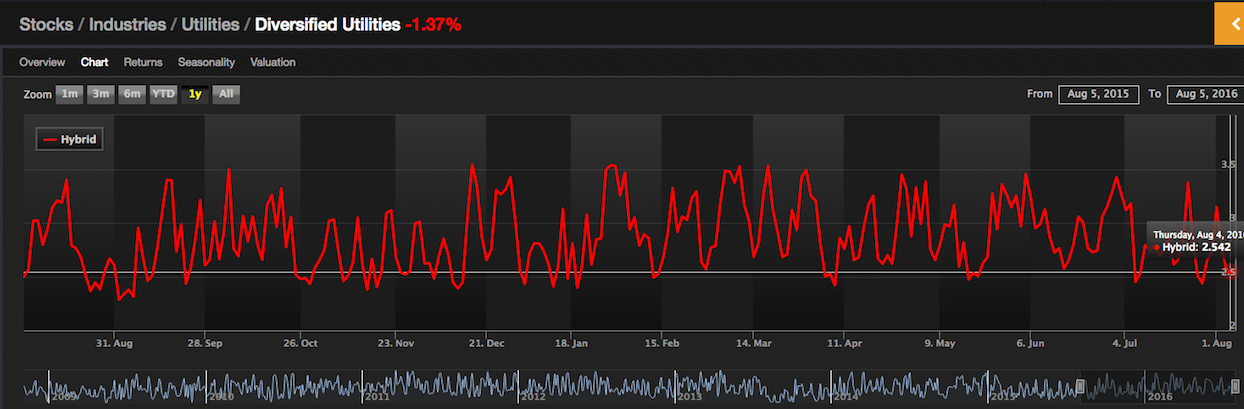

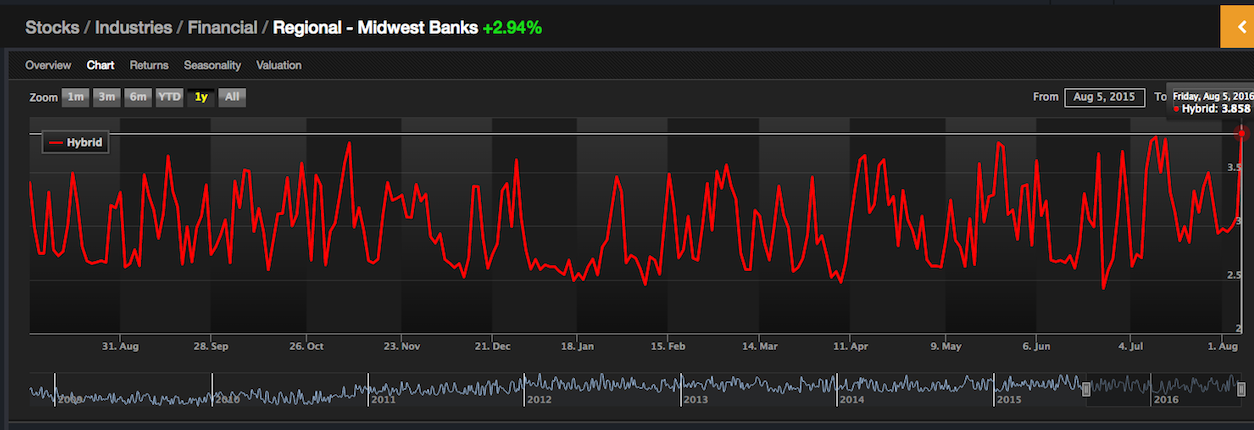

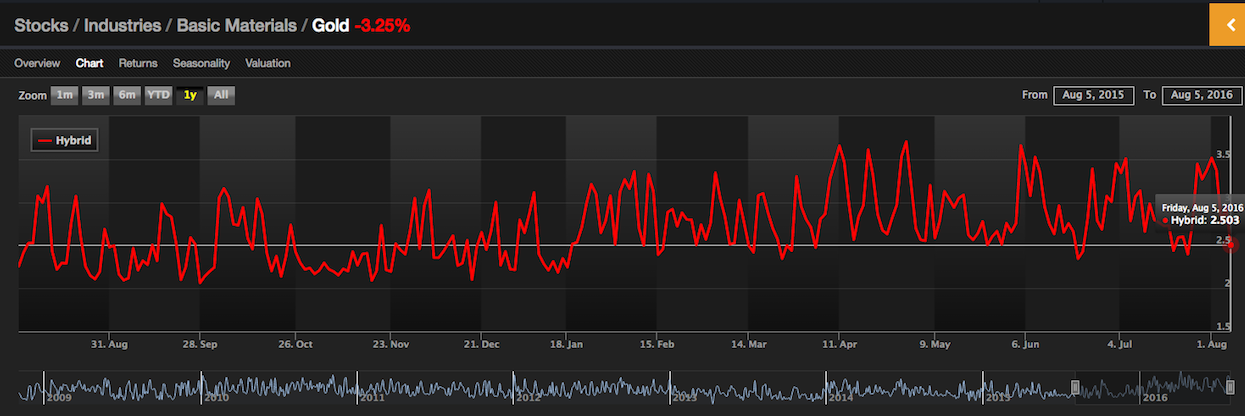

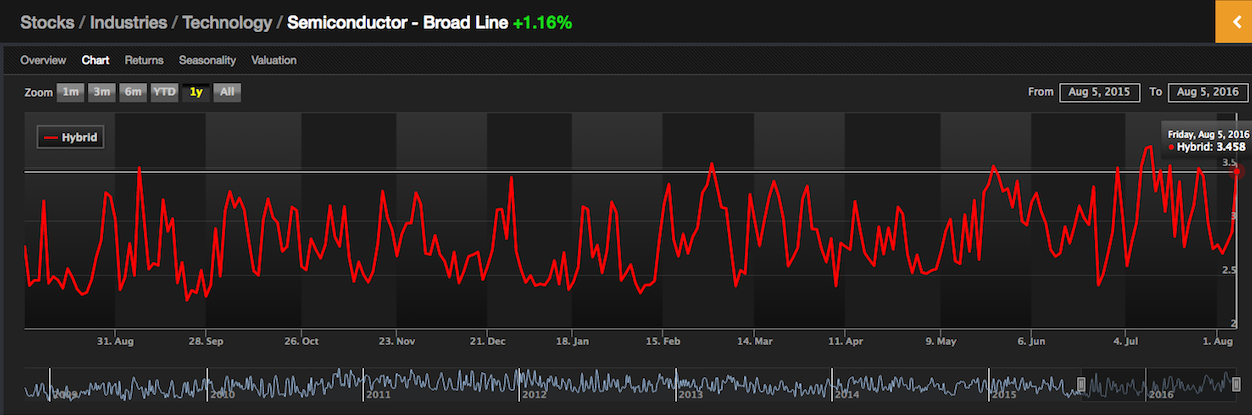

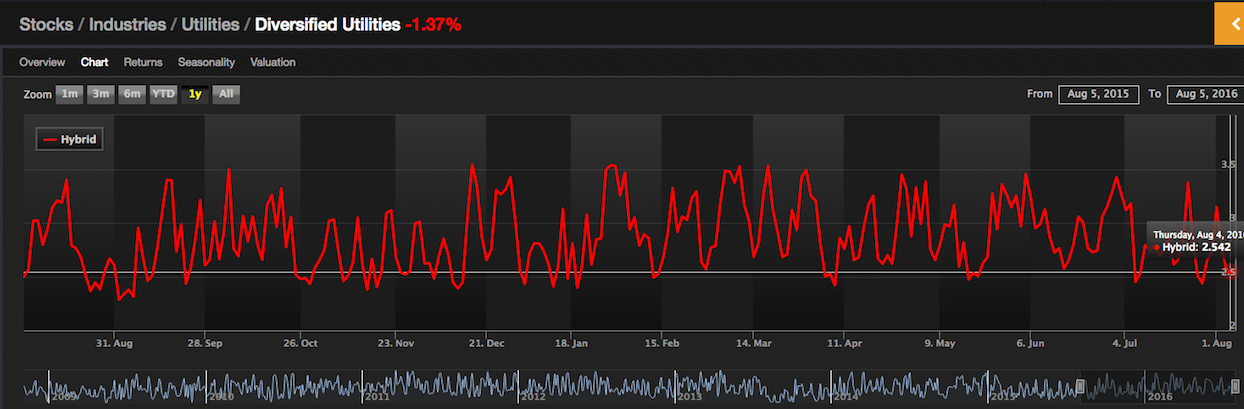

Overall, it was a solid week for oil, banks and semis, while utilities, gold and REITs suffered. This is exactly what you want to see as a bull, all of that scared money fleeing for riskier parts of the market.

Looking at the individual industries, banks and semis look very overbought, while utilities and gold are pressing the low end of their recent ranges. These charts aren’t price oriented. They are a composite of all technical and fundamental grades, based off the Exodus algorithms, in an effort to find predictive patterns. You be the judge.

Notice how the current range is much higher than last year, before the melt up in gold? This is a result of shallower pullbacks, indicative of a sector that is prone to be purchased on dips. Exodus is constantly learning to evaluate ranges in real time, using moving averages.

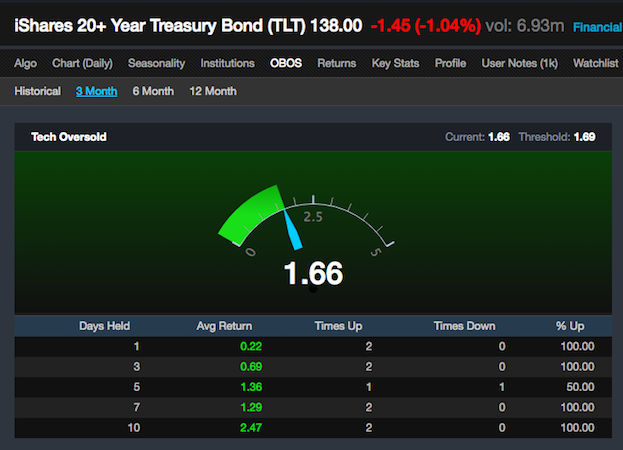

Based off the above charts and several key stocks that are overbought, I’d bet for a pullback of a primordial nature in the week ahead. Also, TLT is oversold on its 3 mo algo, albeit with limited occasions to judge the signal. It’s, nonetheless, impressive.

It comes down to this one question: is the market behavior about to change or will the status quo that is sleepy and methodical in nature, at times tedious and frustrating, preside over the indices?

Comments »