It’s going to be a VXX Halloween, believe me.

I’ll make this direct and to the point.

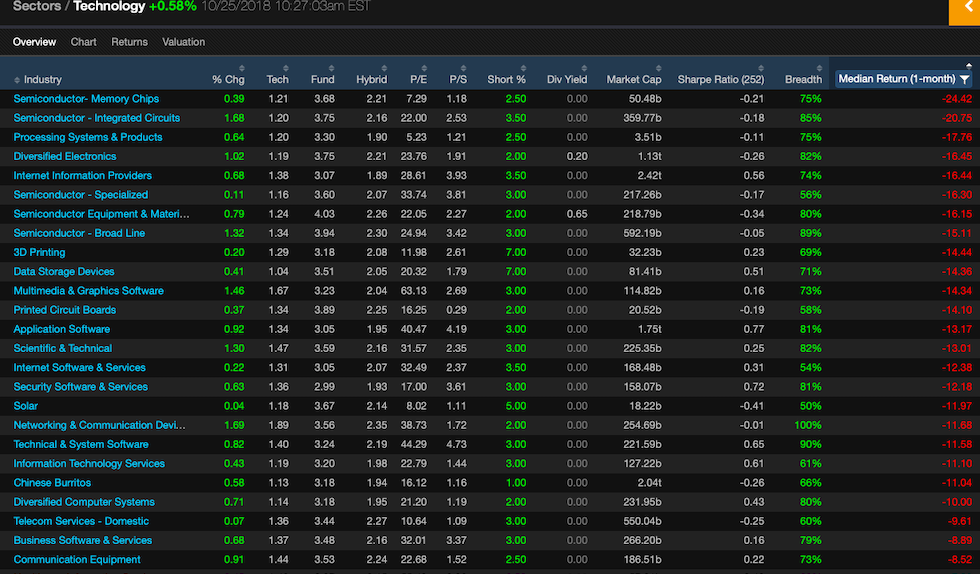

I have no idea if the market will bounce. But I will say, the market is trying to communicate something here and this isn’t a garden variety sell off. This price drop is in response to increasing pressures on the market, as foretold by the semis.

The Semis have gone down the most this month in six years.

The TXN and STM warnings are worrisome — because it has everything to do with their supply chains in China.

STMicroelectronics beats by $0.05, reports revs in-line; guides Q4 revs below consensus

Texas Instruments: Street collectively cuts targets following revenue miss, downside guide

Today’s Beige Book is painting an awfully grim tale, one FESTOONED with back breaking inflation by way of FUCKING TARIFFS on China.

Telling anecdotes: Nearly two-thirds of manufacturing contacts in the Cleveland district raised their prices in September and early October. This was the fifth straight report where more than half of manufacturers in the district raised prices.

In Philadelphia, one firm reported “significant pushback” to its announced price hikes from a major retail customer. Other firms in the district reported difficulty meeting the prices of foreign competitors now that tariffs were in place.

Because of worker shortages, one firm in St. Louis had launched a program to teach foreign-born workers English to prepare them for jobs in the medical field.

In Southern California, hotels were passing along higher costs to guests in the form of one-off surcharges.

Source: Marketwatch

Here’s the full run down of the Beige Book.

Overall Economic Activity

- Economic activity expanded across the United States, with the majority of Federal Reserve Districts reporting modest to moderate growth. New York and St. Louis indicated slight growth, overall, while Dallas reported robust growth driven by strong manufacturing, retail, and nonfinancial services activity.

- On balance, manufacturers reported moderate output growth; however, several Districts indicated that firms faced rising materials and shipping costs, uncertainties over the trade environment, and/or difficulties finding qualified workers.

- Demand for transportation services remained strong.

- Labor shortages were broadly noted and were linked to wage increases and/or constrained growth.

- Reports on commercial and residential real estate were mixed, although several Districts saw rising home prices and low levels of inventory.

- Overall, consumer spending increased at a modest pace while consumer price growth ranged from modest to moderate.

- Travel and tourism generally picked up with a notable exception of North and South Carolina, where Hurricane Florence deterred tourism.

- Agricultural conditions were mixed as rainy weather helped some farmers but caused delays and crop damages for others, including the loss of crops and livestock due to Hurricane Florence.

Employment and Wages

- Employment expanded modestly or moderately across most of the nation; San Francisco reported robust growth while three Districts reported little to no change.

- Employers throughout the country continued to report tight labor markets and difficulties finding qualified workers, including highly skilled engineers, finance and sales professionals, construction and manufacturing workers, IT professionals, and truck drivers.

- A couple of Districts reported that worker shortages were restraining growth in some sectors.

- Many firms reported high turnover rates and difficulties retaining employees.

- Some businesses implemented non-wage strategies to recruit and retain workers, such as giving signing bonuses, offering flexible work schedules, and increasing vacation allowances.

- Wage growth was mostly characterized as modest or moderate, though Dallas reported robust growth. Most businesses expected labor demand to increase modestly in the next six months, and looked for modest to moderate wage growth.

Prices

- Prices continued to rise, growing at a modest to moderate pace in all Districts.

- Manufacturers reported raising prices of finished goods out of necessity as costs of raw materials such as metals rose, which they attributed to tariffs.

- Construction contract prices increased to cover rising costs of labor and materials.

- Retailers and wholesalers in some Districts raised selling prices as they continued to see increased costs in transportation and also worried about impending cost increases resulting from tariffs.

- Districts reported rising oil and fuel prices but gave mixed reports on movement of agricultural commodity prices.

Why should you worry?

Motherfucking Smoot Hawley — that’s why.

The Fed is tightening while a trade war continues to gain steam. These taxes are not being absorbed by China — but by America. That’s right, fucked face, this is a new tax on your heads and based on the laws of macro-economics — THIS WILL SLOW THE ECONOMY and maybe even crash it.

Know your history.

The Tariff Act of 1930 (codified at 19 U.S.C. ch. 4), commonly known as the Smoot–Hawley Tariff or Hawley–Smoot Tariff,[1] was an Act implementing protectionist trade policies sponsored by Senator Reed Smoot and Representative Willis C. Hawley and was signed into law on June 17, 1930. The act raised U.S. tariffs on over 20,000 imported goods.[2]

The tariffs (this does not include duty-free imports – see Tariff levels below) under the act were the second-highest in the U.S. in 100 years, exceeded by a small margin by the Tariff of 1828.[3] The Act and following retaliatory tariffs by America’s trading partners were major factors of the reduction of American exports and imports by more than half during the Depression.[4] Although economists disagree by how much, the consensus view among economists and economic historians is that “The passage of the Smoot–Hawley Tariff exacerbated the Great Depression.”[5]

How will it happen?

China cracks from liquidity crisis and the world as we know it sinks into a giant orange void, on its path to war, pestilence, and famine.

I sold out of my last meaningless longs and bought triple upside bonds — TMF.

Current positions of note in my trading account: SOXS, DRIP, ABX, and TMF.

Comments »