Let’s renew our relevant buzzwords. I am going to instill fear in you on a micro-level, then the faggots will pick it up at CNBC, one or two of my readers there, and then broadcast it live for the world. By tomorrow afternoon, everyone will be singing the same funeral song, well on our way to perdition.

The buzzwords are “heading towards recession.”

Renewed trade tensions and a slump in economic data put U.S. profits and economic growth at risk, Morgan Stanley warned Tuesday.

“Numerous leading companies may be starting to throw in the towel on the second half rebound–something we have been expecting,” the bank writes.

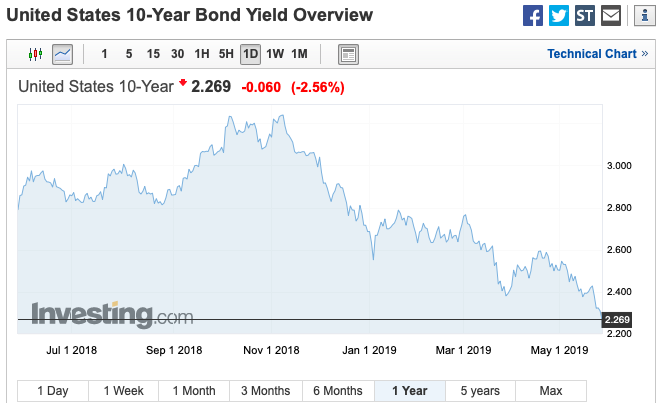

Wilson adds that market risks have been reflected in the bond market, pointing to an unusual phenomenon in government debt yields.

The second half rebound has been wilted under the forest fire that is Trump’s trade war. Valuations are excessive. We should barrel back towards the January lows — because the conditions of right now are inexorably worse than back then. Very soon, high yield debt will break lower and then leveraged loans. Once the leverage loan racket has been devoured, all will be lost and you will have yourselves a brand spanking new credit crisis — with all of the wondrous trimmings.

Nasdaq futures are OFF by 40, fucked face. WTI is sharply lower. Bond yields sinking. I fucking told you, I fucking told you not to get involved with all of that bullish fervor. This is what happens when the bulls get that exuberance — 900 points down fuckers. I call that capitulation.

Sorry for sperging out like that. I get really excited when investors get their virtual heads chopped off.

Good night.

Comments »