Let’s go over some rough stroke about what transpired today and then I’ll tell you what I did.

The newly formulated CPI data has confirmed that Jay Powell defeated the inflation scourge and has truly done a miracle in raising rates whilst at the same time producing an environ for rapid growth. I do not think this has ever been done before, so congrats to all involved.

The net result of the weaker than expected CPI data this morning was atomic detonations across the portfolios of bears — led higher by stocks of ill repute. The Russell 2000 was higher by 5%. The dollar was CRUSHED by 1.75% vs the Euro and the US 10yr was down 18bps.

What the market is saying: rate cuts are coming and we’ll be getting them before Europe. Ergo, and this goes withour saying, the stocks that led the market higher were heavily leveraged free cash flow losers — stocks considered dead in a high rate environment because the cost of capital was thought to have been restrictive. Well, in a lower rate climate, the zombie companies can flourish again and get rich off the fat.

As for me, you should’ve seen me out the: resolute and stoic — methodical yet daring. I weighed into the market mid afternoon after opening down 71bps after getting poleaxed early in TZA. I was ripping through the market like a champion, placing large bets — totally sure of myself and got all the way back to breakeven.

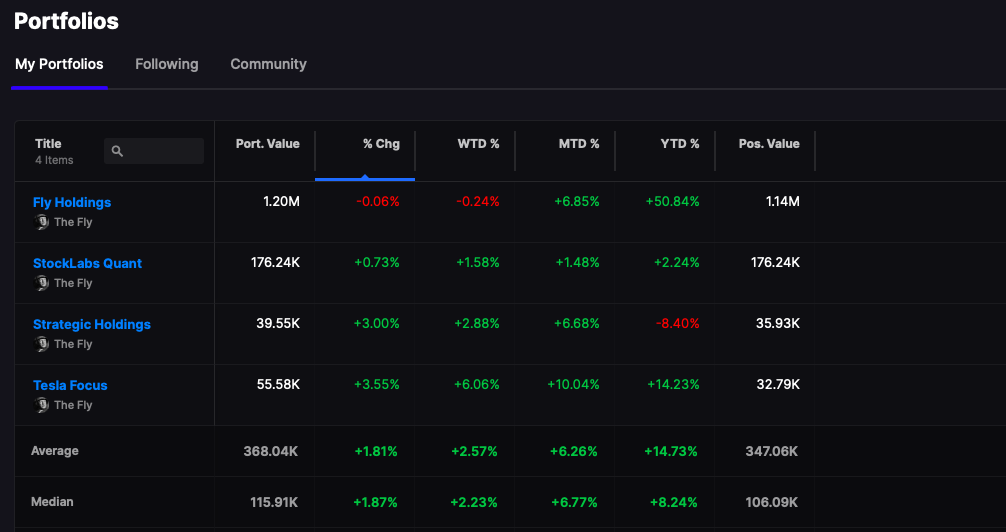

Normally speaking, breaking even on a day when the NASDAQ was +350, that would be impetus to throw myself into a lit fireplace. But not today, as I had other irons in the fire — all doing well. The trust accounts were all up, as they are PERMANENTLY BULLISH — and the most important factor was my absolute conviction in the near term direction of the market — which is up.

To understand the level of my commitment, you must know that I’d bet my soul to eternal damnation on stocks trading up from here. Given the vagaries of the internet, I will offer you absolute terms. The market will trade up else my soul will be forfeited to the fires for eternity.

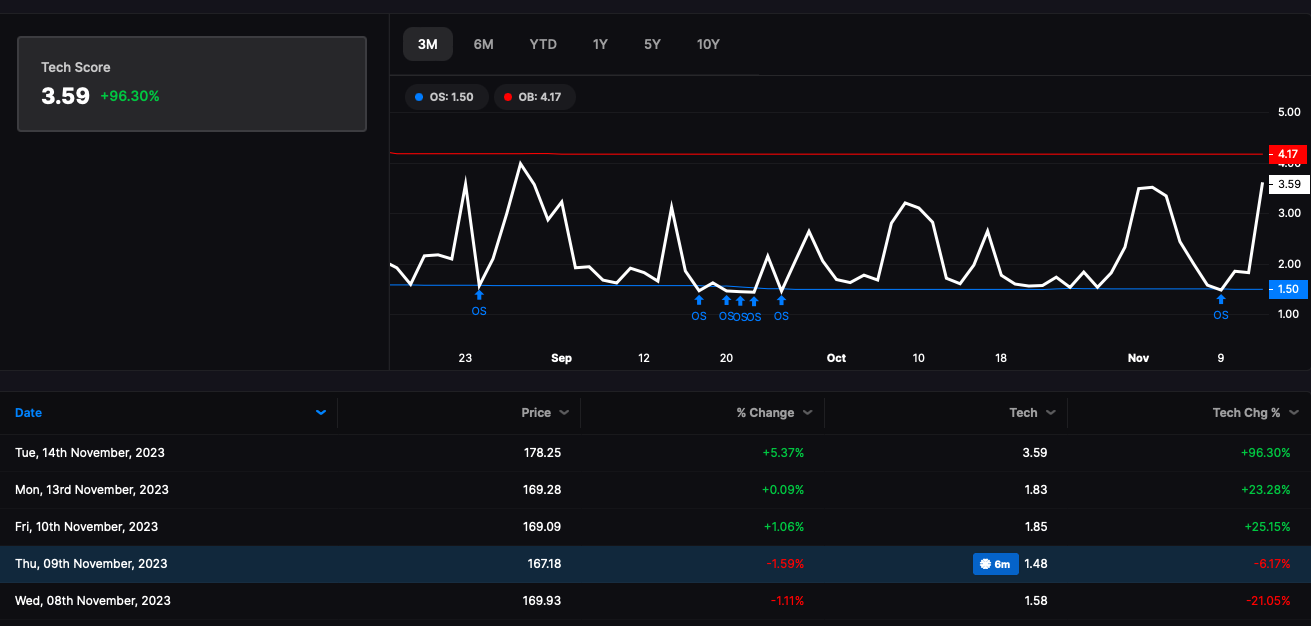

In case you’re wondering, the Stocklabs mean reversion algorithms gave members ample time to get involved. For those who did, 10,000 salutations and may the rest of your day be filled with celebration amidst pomp circumstances, fineries deserving of a man of both honor and substance.

Comments »