All of you fried rice loving meatloaf throwers are not only wrong when it comes to reflation and growth in Asia; you’re exactly wrong.

See, good Sir, the money that is being created or printed is being thrown into a deflationary vortex, mind you. The destruction of capital, worldwide, far outweighs the bullshit trillion dollar stimulus package.

And, I hear many of you discuss the virtues of Chinese banking institutions. As a point in fact, you praise the Asian lenders for being smart and not having fucked up balance sheets. Well, I have news for you again, good Sir, Asian banks, particularly Chinese ones, are fucked on a spindle.

The decline in property values is rapidly accelerating in Asia, indeed. Furthermore, the nonsense capital ratios you read of, regarding Chinese banks, is all fiction. Wait until the Western dollars file out of China, then tell me how self sustainable their bullshit economy is, with their low standards of living, coupled with industry after industry being sustained by government incentives aka life support.

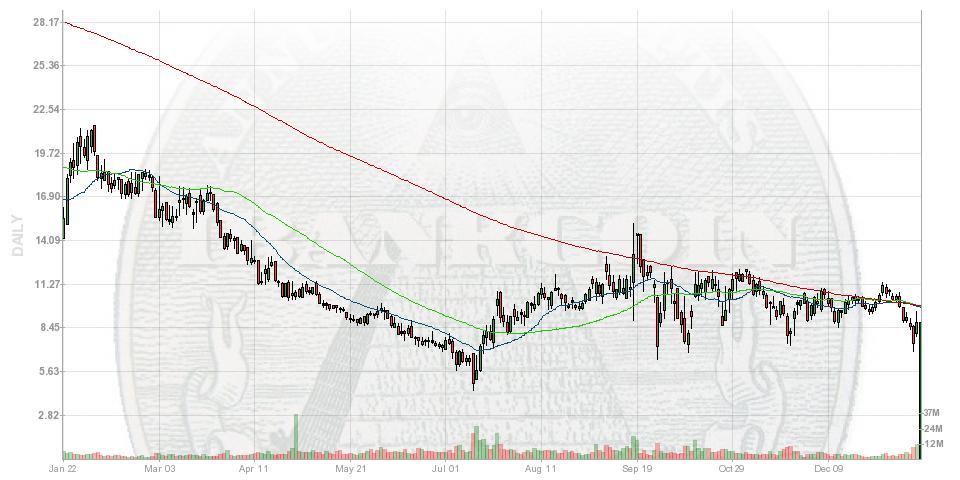

To bet against Asia and their currencies, I like EEV.

Look, I’m not here to throw acid in your face. “The Fly” is all about sharing the wealth of ideas, while kicking old men (47.5 and older) down shockingly big storm drains.

Hell, I make lots of mistakes. Just this morning, after giving a big huffy puffy chested lecture about “staying on the sidelines,” I went out, like an imbecile, and bought PFG a buck higher than where it is now. I deserve the loss and more.

It’s hard sitting on 90% cash. You have to be a special type of animal to just box watch and do nothing. If the weather was warmer, I could go swimming or go for a jog. But, NYC weather is like a fucking Siberian wasteland in the winter. I’m trapped and have no choice but to invest.

As for the markets:

I warned you about “Getting in the Funnel.” Some of you heeded my dire warnings, while most of you laughed, did a few lines of low grade blow, then bought USB on Guy Adami’s rec. Now, I am warning you about entering “The Deflationary Vortex.” You can do so at your own volition. However, just know, “The Fly” is never wrong for a period longer than 3 weeks. Furthermore, the dollar will punch your lights out, should you choose to sell it short.

Finally, I want to sell short all oil stocks, going into earnings. To do this, I have opted to short cut it by staying long DUG and ERY. However, at the moment, all of my positions are light.

I still have a 90% cash position, so you know.

Comments »