I only bought ZPIN, which is a trade. I don’t want to micro manage entry points in what will probably be 5 year holds. However, the news about new and effective Russian sanctions, followed by a sharp sell off in the markets, has me waiting for lower prices.

Comments »Fly Buy: $ZPIN

This is a trade.

Comments »Let the Allocation Commence

I will begin allocating capital today, self funded, for the explicit purposes of achieving extreme gluttony through stock market winship. I will be doing this in stages, with some dollars earmarked for short term opportunities, others for high beta longer term holds and finally a portfolio that is designed to last the test of time–even very cold nuclear winters. It is my belief, very sincerely, that the market is on the verge of going ape to the upside, banana and all. Therefore, virtually anything that I buy now, sans an earnings shortfall, should be profitable within days or weeks of my actions.

For the time being, the hottest short term stocks lies in China (pun intended). Their markets have done very well over the past two months and we are seeing strong momentum to the upside. I have one particular name that I want to buy and will talk about it shortly.

Stay tuned.

Comments »By Any Means Necessary

I sold out of RUBI today for a sizeable loss. It was a bigger loss, when the stock was scuba diving down in the 8’s last week. Nonetheless, whether it was a loss on paper or realized for my p and l, it had to be taken now. Reason being: earnings are coming due tomorrow and I have no idea what they might say. Humans tend to avoid conflict, tuck their heads away in the sand, hoping everything will sort its way out. I embrace it.

RUBI can explode by 30% if they beat and guide higher. If I bought the stock for its fundies, I wouldn’t care about this report and would simply buy any dips. But it was a trade, so I have to be loyal to the mantra. Of course, I should have sold out a few weeks ago; but the stock was knifing lower and the volume was thin. The best thing to do now is to keep moving, pick up where I left off and make the money back elsewhere.

I also sold out of JMEI today. I sold it late afternoon, after the stock had rallied more than 2 points off the session lows. I booked a 7% profit and rolled that money into VNET.

I will not hold onto losers into earnings and will try to avoid any and all earnings plays–because they’re fucking toxic beyond belief. It’s literally like rolling dice at a rigged table. I’d rather play in the Chinese burrito sand pit of hell, than guess on whether some jackass CEO at some loser start up can meet and exceed Wall Street’s retarded estimates.

Comments »LISTEN TO ME

With less than 40% of stocks higher today, most people lost money. There was significant deterioration in biotech and tech stocks, as the small capped melt down continues to take hold without any cause for alarm. The overall indices looked fine. Apple and other mega cap stocks did well, so there is nothing to worry about–yet.

I fully expect this rout to come to an end soon, once earnings are out of the way. In the meantime, you’d be wise to avoid holding stocks through earnings, unless of course you have actionable information–provided to you by insiders at the company you are invested in. If that’s the case, feel free to buy call options and place a large deposit at a securities law firm, as a retainer, for you will be needing it shortly.

One of you savages called into question my purchase of VNET, as if he knew anything at all. It’s unusual for stupid people to cast such wild eyed opinions. Let me help you help yourself: concentrate on your own money and cease offering financial advice to someone who doesn’t need or want it. That’s a life lesson for most of you out there, big mouthed folks trying to save others via advice that is ill tested and sourced from the well of a god damned garrulous road slob.

Comments »

Fly Buy: $VNET

I started a position in VNET.

Comments »Friends Don’t Let Friends Buy Junk

There was a rumor that JMEI was caught selling fake products through its website. Do you realize how abundantly ridiculous it is to sell this stock for that reason? How many times have we heard AMZN or EBAY being accused of selling counterfeits, ripping off Joe Shmoe for the hell of it. Did that stop the upward surge of those stocks? Naturally, because it’s a chinese company, everyone panics out and assumes the worst. People like that should be flayed and roasted over hot coals (no Hannibal).

JMEI is a buy; but the market is heading towards a trough. I believe we will reach an oversold point soon, at which point you’d be wise to start buying aggressively. As always, The PPT will be my guide.

Until then, raising cash on profitable trades might be a good idea.

Comments »My Bearish Scenario

When a group of 150 “high valuation” stocks collapsed in April, catching me off guard, the life of the market was damaged. A lot of you trollop types like to say these stocks are nothing more, or less, than trash. But that couldn’t be further from the truth. If you knew anything about investing, you’d know that speculation is the life blood of any bull market. After these stocks dropped by 30-70% inside of 8 weeks, I became convinced that this wasn’t your ordinary run of the mill decline (shocker).

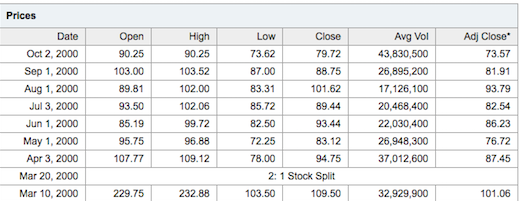

The last time speculation was punished so severely was in April of 2000. The parallels are startling. The difference between then and now was the mega-cap nature of the dot com collapse, which directly affected the major indices. This time around, AAPL, ORCL, MSFT, INTC and CSCO are mature companies, stodgy like utilities. They dominate the NASDAQ weighting–and as a result stymie any dramatic decline.

Understand the dynamics of overvalued stocks collapsing, then rebounding, and try to discern whether or not a large group of widely unprofitable start ups can withstand the test of time, as it relates to a simmering time bomb of bearish sentiment at the precipice of explosion.

Here is the NASDAQ action from April-Oct of 2000. I do not want you to compare it to our NASDAQ. Instead, compare the price action to stocks like FEYE, WDAY and SPLK.

If I am right, we are about to enter the final phase of high valuation jubilance, followed by the top of tops, which will lead to the complete and indelible destruction of these vagrant stocks.

As discussed earlier, I intend to make a large deposit into my personal account soon for two reasons.

1. Take advantage of the August ramp higher via swing trades.

2. Hopefully get a chance to buy non-high valuation stocks into a trough of over bearish vulgarity.

At the end of the day, profitable businesses will be fine and the indices shouldn’t drop by too much. But the bubble stocks: they are entering the final salvo in what can only be described as the second coming of the dot com crash.

Comments »A Unique Opportunity Awaits

I am going to place a large deposit into my personal account soon and will be allocating funds designed for long term capital appreciation. On the blog, you often get to see me lather myself in glorious winship, via swing trading. I do have long term investments that would put you to sleep and aren’t very appealing to my ADD addled audience. Think of the blog as a television channel. In order to retain our powerful ratings, people must be killed, drama must be provided. At times, it’s beneficial to see “The Fly” fail, as that sort of trait resonates with most of you.

However, in this instance, you will get to bear witness to the very nascency of supreme winship, via my personal account holdings. I do not pretend to be able to, or want to for that matter, transform my barmitzvah (sp?) dollars into a multi-million dollar account. Instead, and what I am going to do, I will grow my multi-million dollar account, which was earned the old fashioned way, in a methodical and calculated manner. There will not be much trading involved here and I will not talk about it often.

As for the general market: I find myself up on a weak day, so I have zero complaints. My little Amazonian jungle mobile phone play, IFON, is ripping spines out and committing “Babalities” upon the people who doubted me. IFON should trade to $10 in our lifetime, so help me God.

One quick note: both JMEI and GOGO want to go. And, I really like AG here, and the rest of the gold/silver space. There is money to be made in them hills. Go and get some.

Reminder: All annual members of The PPT, 12631 and After Hours with Option Addict qualify for our 1st annual Labour Day Chinese Lotto Drawing, at which time I will gift two cash prizes–one for 1k and another for $500. If you’ve been on the fence about joining or upgrading your membership, get off the damned fence and do it. If you want further details, contact our customer service rep: [email protected]

Comments »Amazon is Stupid

“Your sturpid American companries make a no monrey–har, har, har.”

Chinese burritos stocks spit in the face of Amazon, while eating fetus soup.

Much to my surprise, most of my stocks are higher today–leading me to believe there is a wave of buying just around the corner.

Stay long.

Top picks: JMEI, GOGO, AG

Comments »