When a group of 150 “high valuation” stocks collapsed in April, catching me off guard, the life of the market was damaged. A lot of you trollop types like to say these stocks are nothing more, or less, than trash. But that couldn’t be further from the truth. If you knew anything about investing, you’d know that speculation is the life blood of any bull market. After these stocks dropped by 30-70% inside of 8 weeks, I became convinced that this wasn’t your ordinary run of the mill decline (shocker).

The last time speculation was punished so severely was in April of 2000. The parallels are startling. The difference between then and now was the mega-cap nature of the dot com collapse, which directly affected the major indices. This time around, AAPL, ORCL, MSFT, INTC and CSCO are mature companies, stodgy like utilities. They dominate the NASDAQ weighting–and as a result stymie any dramatic decline.

Understand the dynamics of overvalued stocks collapsing, then rebounding, and try to discern whether or not a large group of widely unprofitable start ups can withstand the test of time, as it relates to a simmering time bomb of bearish sentiment at the precipice of explosion.

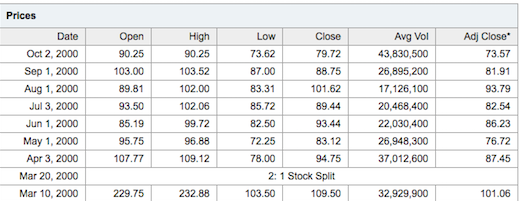

Here is the NASDAQ action from April-Oct of 2000. I do not want you to compare it to our NASDAQ. Instead, compare the price action to stocks like FEYE, WDAY and SPLK.

If I am right, we are about to enter the final phase of high valuation jubilance, followed by the top of tops, which will lead to the complete and indelible destruction of these vagrant stocks.

As discussed earlier, I intend to make a large deposit into my personal account soon for two reasons.

1. Take advantage of the August ramp higher via swing trades.

2. Hopefully get a chance to buy non-high valuation stocks into a trough of over bearish vulgarity.

At the end of the day, profitable businesses will be fine and the indices shouldn’t drop by too much. But the bubble stocks: they are entering the final salvo in what can only be described as the second coming of the dot com crash.

If you enjoy the content at iBankCoin, please follow us on Twitter

Small caps have been sucking wind. I hope we have a nice crescendo here in August, but its so hard to tell with all this QE coming to an end. Seems like a good scenario though.

Small caps are sucking wind, exactly how they sucked in July of 2000. They rallied hard core in August then topped.

Seems like an opportune time to begin accumulating some $TZA, no?

never “accumulate” TZA

go “accumulate” some TVIX while you’re at it.

While the median Russell 2K stock trades at EV/Sales ratio higher than any time in the past 20 years aside from the tech bubble peak there are still stock specific small caps worth looking at under 10x EV/Sales.

How do you see this US market decline in overvalued stock affecting non-US markets? Shanghai and Hong Kong in particular look on the verge of returning to a much more bullish mode even as the US feels toppy.

More burritos for our diet?

Great question. Was thinking the same.

I think it will affect the Dow and S&P similar to 2000: not too much.

Fly

As companies like AAPL have more cash than ever, do you see more buyouts happening than before?

Also, what is your take on companies related to Food sector. Right from fertilizers to the brands?

What is the source of this large deposit of personal money? Not that it’s any of my business, just curious. Where has this money been sitting? Why isn’t it working already?

Budh

A few years ago I took out a lot of money from my accounts to better focus on managed money. I talked about it then. I am now going to place that money, and more, back into the markets.

Sounds like this time is different.

Be careful shorting the market. The largest economy, according to IMF, is going to start a bull market. When China is pulling ahead with its market rising on a daily basis. What will that do to S&P?

fly keep us updated wit dis

u gonna be using ppt signals like last time or strictly picking up random hand grenades?

I got some TZA for the giggles, and COH puts, because F COH, hope it drops 20%, mainly because I have puts.

Merci, Le Fly. (No homo)

somebody is talking out of both sides of his mouth

http://blogs.marketwatch.com/thetell/2014/07/27/this-stock-bubble-is-beyond-1929-and-2007-says-john-hussman/?mod=sfmw

http://www.hussmanfunds.com/wmc/wmc140728.htm

Astute, reasonable observation, especially how the collapse of the SoLoMo (or whatever) stocks will present a huge buying opportunity. These stocks get the press, but unlike 2000 make up a tiny fraction of overall market cap. What do you plan to buy?