Some of you forgot the credit crisis of 2012, when the Italians and the Spanish and the Greeks were the precipice of disaster. Things got so bad, even the French were at risk, with rapidly ascending bond yields. The only countries in Europe worth anything are the nordic nations, Switzerland, and Germany.

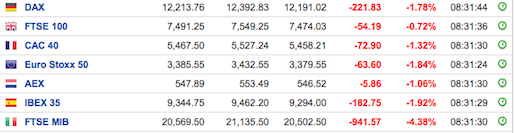

Italian markets are lower by more than 4%, dragging the rest of Europe down with it, due to new government spending, of the socialist nature.

Late on Thursday, Italy’s coalition government approved a budget that set the target for next year’s deficit at 2.4 percent of gross domestic product. That’s more than the 2 percent limit Finance Minister Giovanni Tria was said to be willing to tolerate, and high enough to ensure pushback from the European Commission when the government presents its plan in mid-October.

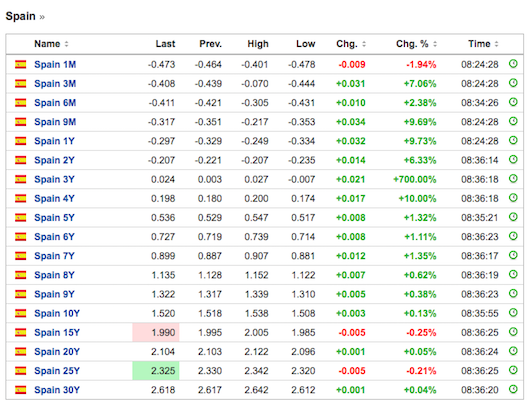

It’s not the headline deficit number itself that’s spooking bondholders. It’s less than the 3 percent level demanded of euro members, though still not low enough to tackle Italy’s debt-to-GDP ratio of more than 130 percent. And the euro’s muted reaction shows that traders don’t see this developing into an existential crisis for the common currency project.

More worrying is the febrile political backdrop to the budget proposal, which includes a basic income for the poor, tax cuts and a reversal of previously announced plans to raise the retirement age. There’s also justified concern that Deputy Premiers Matteo Salvini and Luigi Di Maio will continue to find new populist political projects that will need funding, further testing the patience of their finance minister.

Speculation that Tria will resign from the finance ministry has become something of a daily event. “I won’t quit, for the good of the country,” Repubblica cited him as saying. “There would be the risk of a financial storm. We would throw the country into chaos.”

He’s absolutely correct. Tria’s resignation would prompt another re-rating of Italy’s creditworthiness, and not for the better. Italy’s ratings are already at risk, with both Moody’s Investors Service and Standard & Poor’s slated to update their assessments of the nation’s creditworthiness next month.

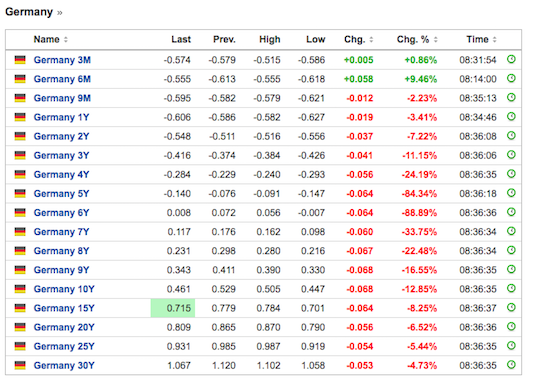

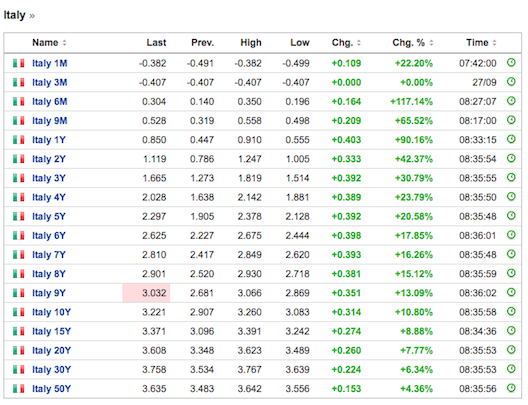

Traders who drove Italian two- and 10-year yields up by 27 basis points on Friday, to 1.05 percent and 3.15 percent respectively, are right to be concerned. Italy’s newfound appetite for increased government spending comes just as the European Central Bank is planning to withdraw some of its support from the government bond market by halting its sovereign debt purchases by the end of the year.

“The fence that protects the prey will soon be lifted,” Claudio Borghi, head of the budget committee in Italy’s lower house, told Bloomberg News in an interview last month.

Moreover, falling government bond prices don’t just hurt bond investors. The so-called doom loop between European banks and their sovereign bond holdings is still very much in effect. The banking sector was the worst-performer in the Stoxx Europe 600 index on Friday.

“We don’t fear the markets,” Stefano Patuanelli, head of the Five Star group of senators, said soon after the budget plans were unveiled. But the markets do fear the next scene in this political and economic drama, and they are correct to be wary.

At current levels, Italy’s 10-year debt yields about 265 basis points more than German bonds. More tussles between the government and its finance minister, or signs that the European Commission will play hardball when the budget plan is presented, and the spread could easily blow through the 290 basis-point high set on Aug. 31.

Basic income for the poor? Good luck with that fucked-faces. You’re living off the German tit, Italy. Your country is insolvent because you’re government is led by criminals. Nothing to see here, other than sharply higher bond prices. We’re to deal with this bullshit again, the violent dance between German, Swiss, and the PIGS — scaring people back into a technocracy.

Our markets are weak in the pre-market, Nasdaq futures off by 26. The dollar is higher by 0.5% v the euro, not bad with all things considered. Since it’s a Friday and ‘who knows what can happen over the weekend’, you should expect markets to remain weak all day.

If you enjoy the content at iBankCoin, please follow us on Twitter