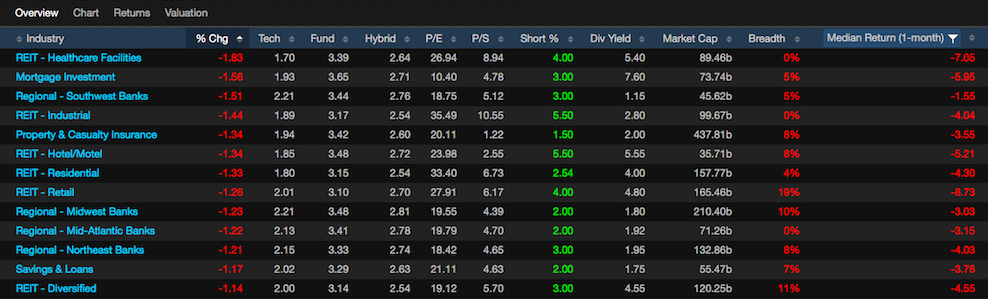

We’re in the process of pricing in a new paradigm, once again. Wall Street is beginning to accept higher rates as a reality and is tossing industries that will be adversely affected by them into the toilet can.

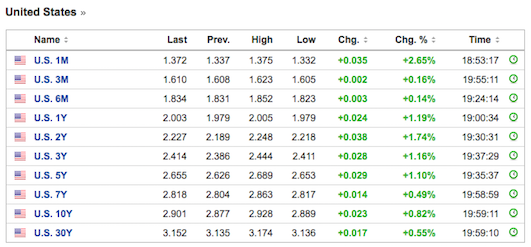

Notice how the 2-10yr spread is tightening? That’s deleterious for banks. We hope they die. When I refer to word “we”, I mean it royally.

So with higher rates, investors are anticipating the annihilation of inflation. This is a little confusing since the whole idea of higher rates is to fend off the beasts of inflation. But the reality is, indelibly, there isn’t any. Ergo, interest rate sensitive sectors are being destroyed. By destroyed, I mean less than -2% for the day.

Do I really need to post a gold chart? At this point, what difference does it make?

Markets are beginning to pick up steam to the downside, making intra-day longs impossible. If you’re looking for overnight trades, perhaps look into crypto proxies, software, semis, or oils. Truth be told, there is a lingering uneasiness to the market and you might be better served keeping some dry powder. At some point, along this very long and tedious narrative, markets will dislocate and plunge lower. Most of you reading will react too slowly to recover, taking advice from perma-bulls who aren’t really smart and only buy markets when they dip. Once upon a time there was a market filled with broken elevators and depraved rapists behind ever bend. In recent years, the country and the rest of the world have gotten fat and spoiled, accustomed to a one directional market and have lost their basic instincts for survival.

“The Fly” has lived through the very worst of markets, dating back to the panic of Kipper and Wipper, purported by Holy Roman faggots. Now we have a wonderful detente, a peaceful and harmonious rigged market that has been buoyed under false pretenses. Well, now with the liquidity being withdrawn from the system and the Federal Reserve revoking its excess money supply, though selling down its balance sheet and hiking rates, one can only assume there will be a renewed interest in the darker side of the market. While I do not think this is the time for panic, I am prepared to accept it.

If you enjoy the content at iBankCoin, please follow us on Twitter

oops

there’s no oops with s&p down 0.75%, djia 1.1%, nsdq 0.28%, gold SMASHED to pieces – 0.8%, etc.,etc.,

up she goes steady as she is next

Fuck dry powder. YELP is safer than cash here.

I’m hoping for a bond rally to get commit more to bond short trades, PST, TMV.

ROKU puts – best overnight play

They want their money back (the federal reserve). They can milk every inflation figure to death so expect same. The tightening is being done asap. My opinion.

Deadcat bounce done. Crash time.