You didn’t need to be a rocket scientist to play this correctly. You only had to listen very quietly, to the rumblings underneath your feet. A gigantic cocked tsunami is barreling towards you — filled with anger and rage for all of the months of complacency — a President who tweeted about stocks is a President who will one day feel its venomous wrath.

The cucks at CNBC have been wasting time, as usual. So I tune them out and drown them in a soundtrack of choice.

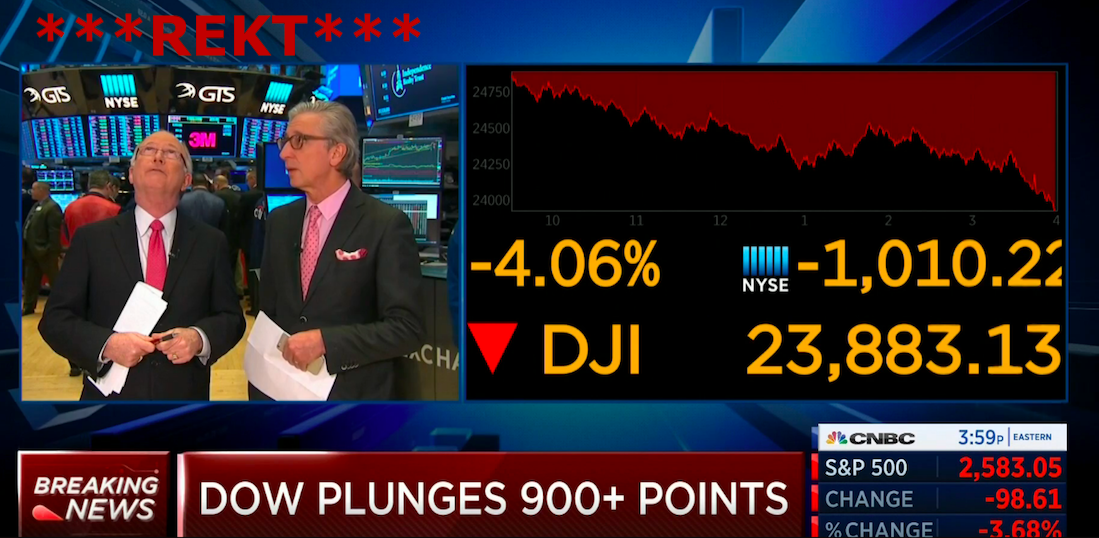

CNBC's coverage is so good. Here, have a listen. pic.twitter.com/k90KH2eegI

— The_Real_Fly (@The_Real_Fly) February 8, 2018

I have an idea where we’re going and it’s lower — rather immediately.

Expect a heart attack drop of 1,000 points tomorrow, closing out the week of hell — setting the stage for true panic Sunday night. A Valentine’s Day massacre is upon you. Fear it, else end up on the losing end of a pork sword.

With my money, I still have some oil stocks and one or two shit stocks — but I am now hedged — long TMV for the black swan failed Fed auction event and of course SOXS — because NVDA is a bitch. My most recent addition is FAZ — because I am hoping for contagion. Why not? After all, it’s a rather good thought and it feels good, so why not bet on it?

From my vantage point, the banks stand to lose largess sums of money from the loss of excess — the perpetual and never-ending stock market incline has caused many to become fat and bloated, narcissistic pigs who should be cleaved.

The XIV was the opening salvo into what will one day be described as “the greatest fuckery to have ever existed.”

Brace yourselves.

If you enjoy the content at iBankCoin, please follow us on Twitter

Alex Jones (2nd HOUR) 2/6/18: Peter Schiff: Stock Market News & Analysis

https://www.youtube.com/watch?v=6UtONN6xAVs

Oh, but he’s been wrong forever too, Right?

So, what are you buying?

NVDA will be up 10% in the morning. Minimum.

WRONG (adjusts microphone)

It will be down 17%, cutting your 2 inch dick off.

Long $MYSZ style!

Told you so.

Too bad you still have a two inch dick

Not for long.

Maybe step back from it for once in your life.

Acehood, you freaking armed chair, NVDA is ALREADY trading up 11%. No need to wait till morning

Easy money.

CONGRATS, YOU’RE UP 2% FROM YESTERDAY’S CLOSE YOU FUCKING LOSER.

Stock will be down by morning

#salt

Damn, would probably be up 20% if market didn’t look like shit.

First bitcoin bubble burst. Now the FED has a choice, the bond market or the stock market? Or both?!

doomsday fag, stop it

Here’s what likely to happen. Blackish Friday down to slightly above recent low. Then, an admirable bounce to suck in the last “it was only a retest” folks.

Then… look out below as people realize the test was just a snowball and an avalanche is coming.

JUST FUCKING CLOSE ALREADY

the fucking HOOKED me

TRUMP SAY SOMETHING!!

He’ll talk about crooked Hillary or inauguration crowds or something useless.

Guys we should be embracing higher rates. In fact I would not mind fed funds at 15%. This will get people off the debt train and force them to start saving again. We will be so much better off in 10 years if they just let it all implode so we can build something that will last. Let’s stop this non-sense of endless debt and start building.

Here here…

The economy is fine.

Today’s auction was a shitshow, but ok.

Assets = Liabilities + Equity

Every liability is someone else’s asset. The two have always grown hand in hand.

But let me know if you figure out how to break that equation.

Do you know the difference between an asset that is priced properly relative to its true value and an asset that’s priced based on what someone needs it to be priced at so they don’t blow the fuck up?

You’re talking about the balance sheet equation and you are correct. We are a heavily indebted nation. We don’t actually own anything. China owns it all. I’d rather own the debt than have to pay it, except it doesn’t really make any sense for China to want to keep buying our debt at 3%. They are going to start requiring higher and higher rates to hold our debt, because they know the only way we ever pay it off is to debase our currency.

China is free to sell at any time and get 0% interest bearing cash. They will still have a trillion in US cash coming in every year, from goods sold, that needs to be invested. Easiest thing to do is buy treasuries as it’s the most liquid market. Also better than sitting on 0% interest bearing cash.

China owns govt debt b/c we tell them it is all that they will be allowed to own. If they don’t like it, tough, they can keep their crappy lawnmower engines. They have no leverage here.

Long GBP short dow short oil.

the weeks events have produced supply and if forced to rebalance by selling that is the very best of circumstances for buyers.

This is exactly the type of market people yearn to be long over the weekend… right?

The Fed auctions are designed to go smoothly, and always have. Of course, this administration may be able to change that. We’ll see. But I think it goes fine.

Treasury auction. Excuse me.

I can’t envision a scenario where banks forgo their primary dealer responsibilities. But I’m open to ideas.

When they don’t want to be left holding a 30 year, 3% bag. One of these days the auction will fail, unless rates keep going up.

Primary dealer is the most prestigious club in the world. To be a part of the club you are obligated to buy whatever is auctioned. In return you get amazing benefits of transacting directly with the fed. If you don’t buy, you get kicked out of the club

A much needed “We the fuck up” call.

Anytime the DOW is down 4% in a day you have to suck it up an buy something in those final minutes.

Got lucky and sold TWTR at the open.

I don’t know shit but me thinks this fuckery is a setup for the companies to do their buy backs from the new tax plan and repatriation.

That 666 point drop last week was meaningful.

That FAZ buy was classic TheFly. HA!

I fucking luv it. Fly gone full bear. The pig market is so fucking retardedly fat from 9 yrs of feeding on fed troft. This slaughter will require multiple cleavers to slash away all fat off the 1 ton pigs.

The funny they don’t even realize how obese they got. Chop chop chop em down.

Preach.

This is a slow motion 1987 redux. Slow motion because of the circuit breakers.

Everything Trump Touches Dies is still as true as ever.

Systematic denial of the XIV situation was a huge indicator. Love being in index funds right now. Hope we cascade to a 30% loss over the next 6 months so I can buy more.

etrade switched free live streaming of cnbc to streaming bloomberg. shows where cnbc has gone. don’t listen to cnbc much anymore other than halftime report and fast money. pretty blah during the day. but no worse than the days of bertha coombs screaming from the oil pits like chicken little about WTI breaking 100 a barrel. they have pretty much always sucked. save for a few then and now.

bitch please…