In light of the XIV chicanery, I felt it was my duty to inform others of the full suite of Credit Suisse ETFs, so that you might avoid them and never trade them again.

In a world filled with endless choices in the ETF world, there is little reason to favor an evil organization like Credit Suisse, a company who zeroed out its volatility ETN after just two days of market tumult, done like thieves in the night in the after hours session.

In addition to this list, VIIZ is another one of their bastards from hell.

In meaningless drivel Credit Suisse inspired after-hours trade, upside volatility is +26%, in spite of the fact that futures are -100.

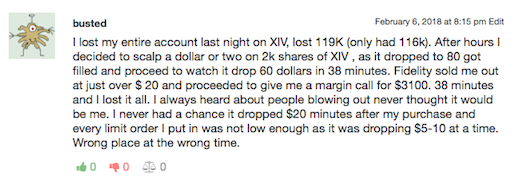

In case you’re wondering why Credit Suisse is evil, here’s a testimonial.

If you enjoy the content at iBankCoin, please follow us on Twitter

aGreed

What did you expect ladies? Credit Suisse is just another everyday classic Nigerian scam. You cannot possibly be surprised:

https://tinyurl.com/ybecrnjd

Right there is the man who should be de-balled, drawn, quartered and burned at the stake.

Spot on, Sac

Thanks for posting this, will boycott them for sure. Mother fuckers. I traded it the same way as Busted, except I averaged down up to 10k shares and ended up losing 36 points before biting the bullet and getting out at 38, knowing fuckery was afoot. Blew up half my year. Feel so stupid because I was actually long the vix through other vehicles and was looking to scalp this piece of shit.

Going long any 2X or 3X etf is best avoided for anything more than a day trade …and is complete insane for anyone that has idle cash even for a day trade.

A lot of traders got in with intention of daytrade, thinking it was overdone

Will the world come to the US for safety or is it different this time? Are we impressed with the dollar bounce and bounce in treasuries?

Which others have termination clauses? Is it only inverse vols? There are literally 1000s of pages of prospectuses

I’m sorry but don’t put your whole fucking account in XIV. JFC…

Most of these instruments have been hawked by various iBC bloggers trying to excite their subs into “getting rich”.

If I had a world of my own, everything would be nonsense. Nothing would be what it is because everything would be what it isn’t. And contrary-wise; what it is it wouldn’t be, and what it wouldn’t be, it would. You see?

What is and what should never be?

Honestly I have no sympathy for the testimonial. He said he bought it at $80, so he apparently watched it drop $19 AH in a heartbeat and thought why not, let me scalp a couple bucks off this falling knife. Maybe next time don’t shoot first and ask questions later. Maybe when something drops 20% in a matter of minutes you should step away from the monitor before jumping in with your entire fucking account. Honestly, he deserved what he got.

I might agree if the long and relatively reliable/stable, history that this instrument had earned was earned in a market where price discovery was permitted to function. That ain’t this market.

Angel of death, actually it was trading 89 when I put order in at 80 never thinking I would get filled but you know I deserved what I got. I should have known they were going to blow up the fund in minutes actually all holders who watched it close at $99 only to lose 95% of their money they deserved it too. Angel of death if, and I only can hope, you are diagnosed with cancer just remember “you got what you deserved” Karma is a bitch.

I like how they claim the liquidation event happened just after the market close……sure.

I’m sure they didn’t use the liquid market during the day to set themselves up and let their friends out of the murder hole before letting it drop to an accurate price in the after hours.

That’s right.

Would put that past them.

Regards

Chuck Bennett

That’s the real fuckery. Someone that got smoked trying to catch a knife AH AFTER a 20% drop in minutes, no sympathy.

A number of clearing firms don’t allow us to B/S any inverse or double/triple leveraged ETP’s…. The reason? E & O insurance wouldn’t allow it…. Good call

Not retard proof. Should have been labeled as such.

Trust the swiss? Haha good one. Didnt anybody watch wolf?

Here’s what Credit Suisse did:

The Astonishing Story Behind What Really Happened to XIV

https://t.co/kBaHAi9r7h

Don’t take my UGAZ away. It’s my pappy.

Fly, your list of Credit Suisse ETFs has no ETFs listed: they are all ETNs. Although the names sound similar they are quite different.

ETF: Exchange Traded Fund. ETFs holds **assets**. When these assets go up or down, the Net Asset Value (NAV) of the ETF changes. An ETF is what is sounds like: a Fund that is Traded on an Exchange.

ETN: Exchange Traded Note. These are nothing more than paper contracts. Their value is set by a formule, usually linked to one or more index. ETNs do not own anything.

To close out an ETF, the assets have to be liquified, which isn’t an easy task. Liquifying tends to have a feedback effect: as you sell, what your selling goes down in value – and everybody knows you’re selling and how much you have. This is the reason that SVXY is still trading and XIV isn’t.

Now, the volatility move we saw was truly record-breaking and the way most of it happened (in AH) was ugly. So from that respect, I do pity the owners. However, a 50% loss would not have been surprising on any given day. Too much complaceny in this market. BTFD.