Do not worry about anything you’re about to read. In fact, close out your browsers now and go to sleep — since it’s late and you must be really sleepy.

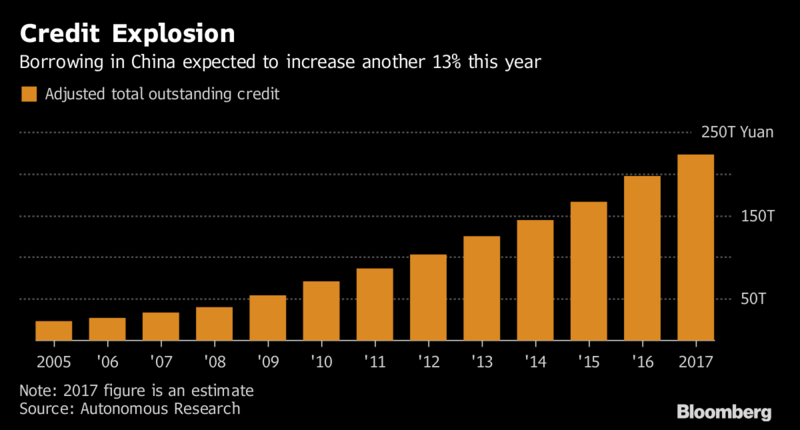

Charlene Chu from Autonomous Research is out with a note warning about Chinese credit expansion. Before we delve into the details, let’s have a gander at said ‘credit expansion.’

Fuckload of credit cards

Total credit is expected to rise to 223t yuan ($33t) from 196t yuan by the end of 2017 — an increase of ~13%, which is down from the 19% gain in 2016.

Progress.

Chu’s estimates are measurably higher than the lies out of Beijing, who offered guidance of 167t yuan, which she says is bereft of local govt bond issuance and off balance sheet lending.

“It’s imperative that they start acting now, rather than continuing to push this to the future,” said the former Fitch Ratings Ltd. analyst, who made her name warning of risks from the country’s debt binge.

By her back of the envelope estimates, institutions stand to lose a potential 38t yuan — implying a nonperforming credit ratio of 25%.

Read that again: twenty five percent.

The Chinese banking regulator, who must be doped up on Mongolian opiates, is estimating just 1.74%. What an arb!

“The overarching issue for China is that there’s a ton of credit that’s not in bank loan portfolios,” said Chu.

Yeah, I’ll say.

Under this doomsday scenario of tumult, Chu is estimating the entirety of the Chinese banking sector to be cracked asunder, drowned in the blood of roguish oriental banksters. She posits a state bailout in the magnitude of 21t yuan will be needed in order to keep the savages at bay and the economy running at minimum efficiency.

In May, Moody’s slashed China’s credit rating, citing a ‘material rise’ in a pan Chinese state debt burden that might just explode.

Over the past few years, Chinese companies have leveraged up, sashaying the globe in search of plunder — making acquisitions worth in excess of $343 billion.

Overall household, corporate and and government debt in China rings in at an astonishing $28 trillion, or 258% of GDP. Of that, $17 trillion is laden on corporate balance sheets — who’ve used said credit to make expensive acquisitions. Due to this unrelenting credit expansion, the IMF is estimating that GDP will contract to +5% from 6.9% by 2021. If the country falls prey to one of those pesky financial meltdowns, analysts feel economic growth could fall below 3%.

Under this scenario, rest assured, all of your left v right bickering will be for nought — as we’ll all be dead — eaten alive by zombie hordes.

The subsequent result of credit expansion growing at 2-3x that of GDP has led to a zombification of the economy — strewn with failed companies kept afloat by cheap credit. A reckoning is coming and there will be little choice but to batten down the hatches and run for cover when the deleveraging begins.

In China, you’re literally not allowed to fail. Credit defaults were just 0.1% last year — compared to 2% in the US. Premier Li Keqiang said China must “ruthlessly bring down the knife” — but they’ve done very little, or anything for that matter, to stop the profligate behavior embedded in the corporate sector.

“We need to see bankruptcies, lots of them,” says Michael Every, head of financial market research at Rabobank Group in Hong Kong.

If matters couldn’t get worse, the Chinese property sector is now frothier as a percentage of GDP than the US housing market in 2006. Similar to the behavior witnessed during the US housing bubble, Chinese investors and flipping homes and buying and selling without even moving in — a blue dream floating amidst unicorns and anime cartoons.

Pan China, there are upwards of 50 million units which have been purchased, but remain unoccupied.

All of this sounds dreadful, and then there’s the unregulated, unwatched, $10 trillion Chinese shadow banking system. I suppose none of this matters when markets are at record highs. Maybe we should just forget about this nonsense and see about that nap now.

The Shanghai is +11.5% over the past 12 months.

If you enjoy the content at iBankCoin, please follow us on Twitter

I am hearing a lot about the decline of America and rise of the Chinese dog eater. Seriously, dog meat festivals guys. Is this inevitable?

Fly, I am loving the good Dr. Michael Savage’s podcast. Very much a trip. SAVAGE. SAVAGE.

While I might be stupider for reading, I do owe this website a debt of gratitude for helping me understand what the fuck is going on… and I’m glad I’m here.

Fly is a vegan now you bitches! He’s better than you in every way.

Move along.

Savage is always entertaining, but his self promotion sometimes makes me want to punch hole through my blue radio.

Self promotion and talk radio, rap music and WWE. Limbaugh, Levin, Savage, Jones etc. They all do it.

John Maynard Keynes died and gone to China.

Oh god, another China bear thesis. Surprised anyone has the balls to put out this drivel still.

They do lie and tell tall tales…I never was comfortable with Chinese stocks …but making big bucks with alibba,and don’t want to give it bAck

1980’s Tokyo real estate was worth more than the entire United States. That didn’t end well.

Does this mean I have too sell all my baba and aaba in the morning,,I am still on my aapl high…but may not be able too sleep after putting the Chinese in my head

You could write that headline every year for the last 15.

There will be plenty of ups and downs, but in the end it’d be pretty weird if the country with the largest population wasn’t the largest economy.

I’d be far more comfortable buying the inevitable inclusion of A shares, or Hong Kong listed equivalents, into global indices, than any kind of bear thesis.

So what happens when the Yuano turns to shit? It is really that “simple”. The only Dudes around who really love it are those Chicoms in the Politburo, and when they run out of so-called “hard currency” reserves to swap for Yuano floating in the off-shore bowls – then the game is flushed. Bass thinks so, Rickards says “end of 2017”. I am not holding my breath, which means I am vulnerable to toxic shock if the wind changes suddenly and I can’t run fast enough.

Here’s my thinking: as long as the US buys mountains of Chinese stuff, then the US is effectively backstopping the Chinese economy – and the US Military, right now, is hopelessly dependent upon the Chinese. But there is a plan to undo this military interdependence – a 270 day program put in place by Trump/Mattis according to reports published by the Atlantic Council.

So I reckon that China’s risks will increase substantially going forward, based upon a new US trade policy, but the risk is still a couple of years away and China may yet find some way to amicably avert this danger to their economy.

Trump admin is said to be going beyond tweets and such to pressure China re N Korea …who knows ..many worries on the wall we’re climbing.

NYTimes “Trump Administration Is Said to Open Broad Inquiry Into China’s Trade Practices”

Chinese banking regulations (lolz) allow for the most egregious credit restructures on the corporate side, hence no defaults. I’ve heard of suspended amort, PIK’d interest and warrants back to the bank. WTF!

As far as personal debt, if you don’t pay, they make you a slave or worse and repo your life.

Nasdaq futures +43. #winning

This China financial crisis thingy is all very nice.

Now, go out and buy more BIDU, BABA, TCEHY, WB, BZUN, etc. I’m banking on more greed to come from all this.